How the troubled package holiday firm became the latest casualty of a corporate debt bubble that has yet to fully unravel.

Adam Leaver is a senior lecturer in Financial Innovation and Business Analysis at Manchester Business School.

Colin Haslam is Professor of Accounting and Finance at Queen Mary University of London.

Cross-posted from Open Democracy

Image: SOPA Images/SIPA USA/PA Images

On Monday 23 September the package holiday provider Thomas Cook PLC entered compulsory liquidation proceedings after government, shareholders and lenders failed to agree a rescue package.

Whatever initial hope there was that government would stump up a £150m bailout were dashed as Boris Johnson claimed that such a deal would create a ‘moral hazard’, noting that he was unsure ‘whether the directors of these companies are properly incentivised to sort such matters out.’

The question of director incentives and moral hazard is an intriguing one. Moral hazard has always been an ambiguous concept, interpreted on the one hand as a breach of responsible conduct by individuals and on the other in more abstract economic terms as an understandable and rational response to a subsidised price (often provided by government guarantees), implying morality plays no part in these utility maximising decisions.

Although Johnson’s reasons for non-intervention are of the latter interpretation, his comments on director incentives invite us to also consider the former, where the question is not necessarily whether Thomas Cook could have been saved, but whether it needed to fail in the disorderly way that it did.

To answer that question we need to examine two moral hazards: the remuneration incentives that displace alternative strategies and which benefit incumbent management, and the treatment of goodwill, which means that failures are extreme and unmanaged.

Despite running a business that struggled to break-even from 2010 onwards, Thomas Cook CEOs were handsomely remunerated: they received over £35m over the last 12 years. Whilst it would be uncharitable to assume that keeping the company going was entirely self-motivated, it would also be naïve to think that whilst the company remained a going concern, remuneration structures did not benefit them unduly.

Bonuses were understandably not paid in 2018, but in 2017 the CEO, Peter Fankhauser, received 117% of his base salary as bonus.

Thomas Cook’s CEO bonuses were paid according to five main Key Performance Indicators (KPIs): Group underlying Earnings Before Interest and Tax (EBIT) (35%), Group Free Cashflow (35%), Net Promoter Score (15%), Employee Satisfaction (5%) and Strategic Progress on the New Operating Model (10%). But the devil is in the detail, because the KPIs were based on non-standard accounting figures.

The uses and misuses of ‘underlying’ figures in bonus calculations under a fair value regime have been addressed elsewhere. Thomas Cook’s 2017 ‘underlying EBIT’ KPI calculation crucially excluded exceptional items – effectively stripping out £99m of exceptional costs from the bonus calculation.

This figure also handily excluded finance costs, which were large in Thomas Cook’s case because of the amount of debt loaded onto the company as a result of earlier mergers and acquisitions. Thus, the bonus was awarded on the basis of the £312m ‘underlying EBIT’ not the £12m net income they actually realised.

In debt-heavy acquisitive companies with lots of impair-able goodwill, it is unclear why CEO pay is not assessed after the costs of financing and writedowns. If they are excluded, CEOs have a strong incentive to pursue a strategy of debt-led growth, where the upsides of the new income streams bought are included in the bonus payment but the downside costs are either excluded by using EBIT measures or classified as ‘exceptional’ and so are, again, excluded. This is ‘heads I win, tails you lose’ managerial capitalism. It is a moral hazard.

This kind of remuneration structure offers easy answers to managers looking to buy their way out of uncertainty. The lesson of Thomas Cook is that merging with or acquiring an affordable income stream ‘crowds out’ other more nuanced, but difficult to execute, restructuring strategies which require a rare degree of managerial acumen in order to formulate the vision and execute the plan. This has a degenerative effect on the quality of British management: anyone can do it. It facilitates satisficing behaviour.

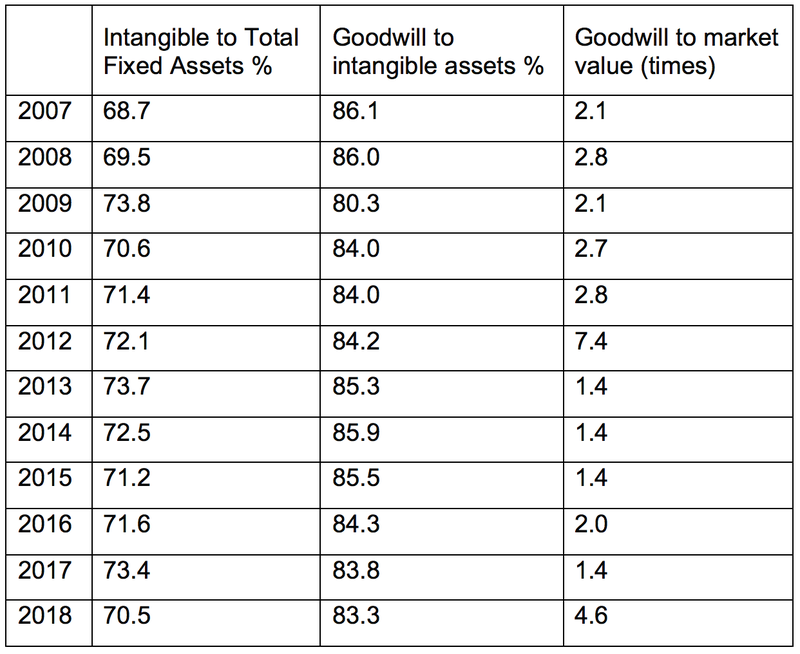

The second moral hazard is related. A central part of keeping the company going was the treatment of the goodwill asset on their balance sheet. Similar to other blow-ups like Carillion, Thomas Cook had intangible assets that were around 70 percent of their reported total fixed assets, with goodwill accounting for around 85% of those intangibles.

Goodwill was consistently two or more times the company’s market valuation for much of the period between 2007-2018, as shown in the table below.

Maintaining that goodwill valuation was central to firm stability. Goodwill values should technically equal the present value of the expected discounted future cashflows that accrue to intangible things like brands, customer loyalty etc. Following changes to the accounting rules in 2003 and 2004, goodwill is not amortized, but is instead subject to periodic ‘impairment assessments’ which reduce the value of goodwill if those expectations are revised.

Those impairment assessments are inherently speculative since they rely on estimates of events that have not yet happened. In a context where impairments depress profit and constrain distributions this could be read as an invitation for managers to maintain optimistic goodwill values for periods longer than is reasonably justifiable from a given trajectory of performance.

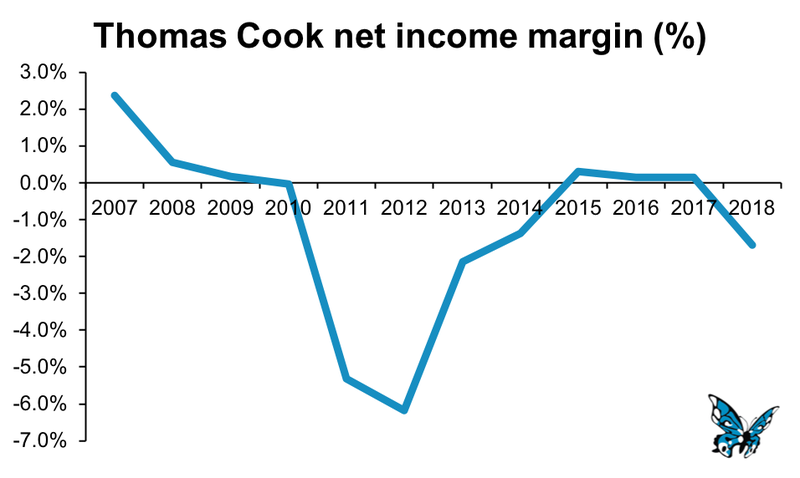

Between 2007 and the first half of 2019, Thomas Cook realised cumulative net income losses of just under £2.8bn, with 7 of those 13 periods negative. This prompts the question of why goodwill values were held at such high levels for so long. That is enough time for expectations to have normalised to the reality of a company in slow decline.

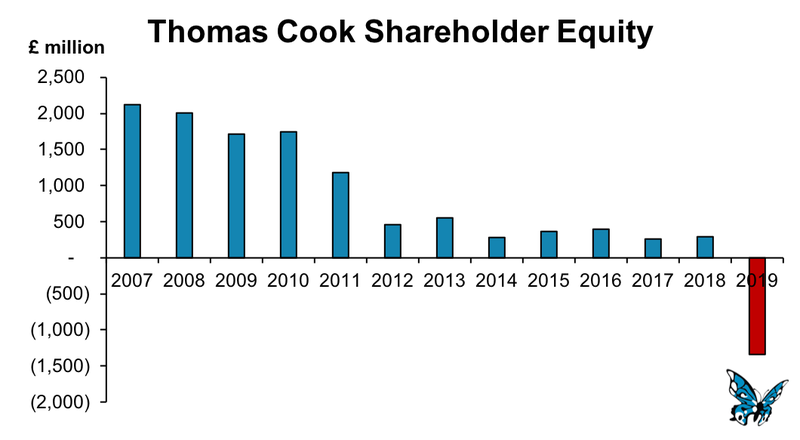

The longer goodwill is left unimpaired, the larger that impairment is when the day of reckoning finally comes. In the first half of 2019 Thomas Cook was finally forced to impair £1.1bn of goodwill, blowing a hole in the company’s balance sheet. The value of its intangible assets fell from £3.06bn in September 2018 to £1.96bn in March 2019, which effectively put the company into £1.35bn of negative equity, as shown in the chart below. This is because of the double-entry effect (when you write down the value asset, you must have a corresponding write down in the value of a liability, because both sides of the balance sheet must ‘balance’).

This turned a company that could have been run down manageably, broken up or even modestly revived, into a liquidation certainty. The firm was kept on life support through this accounting flexibility, which suited management, but was the most disorderly outcome for passengers, the workforce, suppliers and the state.

There is a strong argument that Thomas Cook’s goodwill should have been written down sooner because this would have allowed for a softer landing for many stakeholders. It may not have been rescuable given its cost disadvantage relative to online sellers and the changing holidaying habits of the British public. But its struggle with profitability was not helped by the interest burden of the debt assumed after the MyTravel merger in 2007 and the merger of its retail operations with those of the Co-Operative Group and the Midlands Co-operative Society in 2011, which made it even more difficult to generate positive net income from their operations.

There is thus a more generalisable risk that the Thomas Cook case illuminates – that we will see similar ‘impairment shocks’ when the effects of the corporate debt bubble begin to unravel. Goodwill is the shadow asset of the corporate debt bubble. Cheap debt leads firms to pay higher multiples of annual earnings for their acquisition targets. That in turn leads to a growing dislocation between market and book and consequently a build-up of goodwill on firm balance sheets.

This is paradoxical in this current phase of capitalism: high goodwill valuations should imply that expectations of future cashflows are also high; but those very high valuations of goodwill are now booked at a time when growth rates are secularly low and the risks of global protectionism, trade wars etc are material.

For acquisitive companies with levered balance sheets, that could get very messy if all of a sudden observers begin to question the cashflow expectations that underlie their goodwill valuations.

Be the first to comment