A look at various elements that appear to be relevant in the current wave of inflation

Michael Roberts is an Economist in the City of London and a prolific blogger.

Cross-posted from Michael Roberts’ blog

Last week, the Bank of England’s chief economist, Huw Pill, doubled-down on the argument that the current inflationary spiral affecting the major economies was the result of excessive wage demands. He said that workers should just accept that price rises will hit their living standards. “Somehow in the UK, someone needs to accept that they’re worse off and stop trying to maintain their real spending power by bidding up prices, whether through higher wages or passing energy costs on to customers etc.” Workers asking for more wages just made inflation worse. Pill echoed the previous comments of his boss, the Bank of England governor, Andrew Bailey, who said a year ago that: “I’m not saying nobody gets a pay rise, don’t get me wrong. But what I am saying is, we do need to see restraint in pay bargaining, otherwise it will get out of control”.”

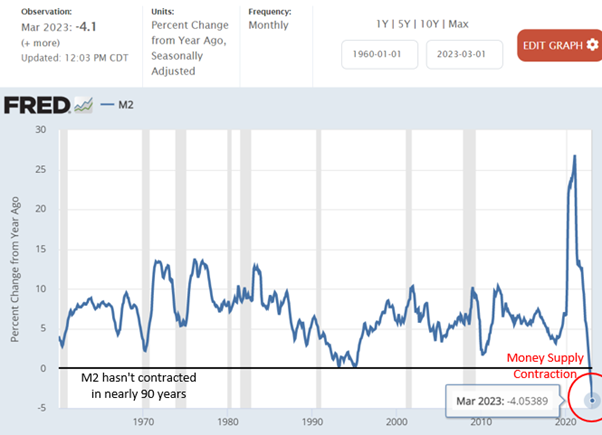

At least this time, Pill vaguely mentioned that firms hiking prices to sustain (or even increase) profitability might also be contributing to inflation. But it remains the orthodox mainstream theory that accelerating inflation is being caused by ‘excessive’ money supply growth over output growth (the monetarist theory) and/or by ‘excessive’ wage demands forcing prices up (the Keynesian theory).

In a similar message, Ben Broadbent, BoE deputy governor, said there was “no getting round the impact on real incomes of . . . jumps in import prices”, which he said had “led to second-round effects on domestic wages and prices”. But how does hiking interest rates stop import price inflation from increased energy and food prices introduced by the multi-nationals that control these necessaries?

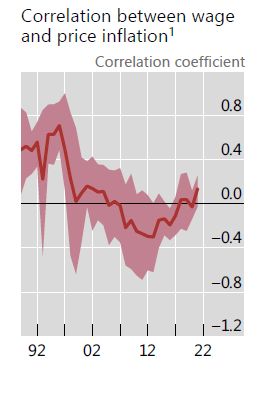

I and others have spent much ink in showing that both these theories do not explain inflation in prices, either now or in the past. And it’s not just leftists. For example, economists at the Bank for International Settlements (BIS), hardly a leftist body, found that: “by some measures, the current environment does not look conducive to such a spiral. After all, the correlation between wage growth and inflation has declined over recent decades and is currently near historical lows.”

But central bankers and mainstream economists ignore the evidence and continue to promote monetarist or wage-push inflation theories. Why is this? Gavyn Davies, former chief economist at Goldman Sachs, once explained why the theory that inflation is caused by wage rises persists even though it has been discredited theoretically and empirically. Davies: “without the Phillips Curve, the whole complicated paraphernalia that underpins central bank policy suddenly looks very shaky. For this reason, the Phillips Curve will not be abandoned lightly by policy makers”. (Davies 2017). Another reason not mentioned, of course, is that the monetary authorities and mainstream economics resolutely refuse to recognize the role of profits in capitalist economies. Profits apparently play no role in investment or in firms hiking prices in order to sustain profitability. And above all, profits must be sustained.

Pill reiterated the policy solution of central banks to get inflation rates down: “Interest rate rises in the US and UK over the past year were designed to cool spending power and the ability of companies and people to pass on the pain of inflation to others”. Exactly who was taking on pain, he did not say; but it is clear that the pain is on workers’ real incomes, not on corporate profits (so far).

In a penetrating paper by Matías Vernengo and Esteban Ramon Perez Caldentey, entitled Price and Prejudice: A Note on the Return of Inflation and Ideology, the authors pose the issues at debate: “there is an ideological divide between those that blame inflation in an incompetent government and central bank reaction to the pandemic versus those that suggest that the real culprits are greedy corporations raising their mark up above their costs.” But “this has deviated the debate from the more important question, which is related to the question of whether the inflationary acceleration originated in temporary supply side disruptions caused by the pandemic or resulted from excess demand in an economy close to full employment.”

The authors go on to say that the dominant view in the profession, and among policy makers is that inflation is caused by excess demand. The main argument against this view is that corporations have taken advantage of supply-side problems during the pandemic to obtain unjustifiable extra gains in an already unequal society.

It’s true that over the past forty years of neoliberal ascendancy, deregulation has allowed corporations to amass pricing power. And it is also the case that that profit margins have increased during the recent inflationary acceleration. And the financial sector has made significant profits during and after the pandemic. But Vernengo and Ramon counter that “it would be wrong to claim as some do on the left that current inflation is ‘greedflation’ ie caused by price-gouging; or that it is the result of monopolistic pricing.”

The empirical evidence shows that it was the sharp rise in the prices of non-labor inputs that were “the likely culprits for the acceleration in inflation”. They rose because of the shutdown of key suppliers during COVID in China and other developing countries and from the loss of electronic components supply that went into the production of consumers goods and because the supply chain system was broken with the collapse of the just in time inventory methods over the last four decades.

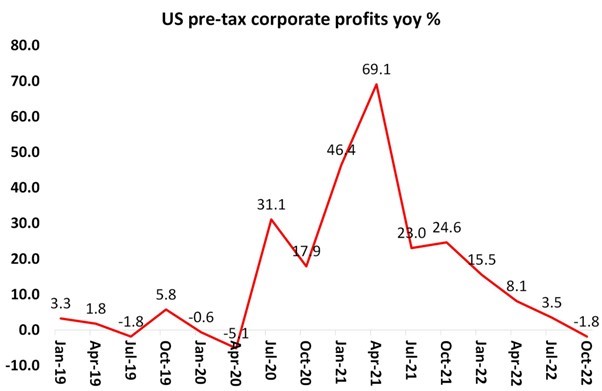

Sure, prices in oligopolistic markets are likely to be higher than in more competitive markets “but it is not the case that this can explain the continuous rise in prices; that would require a change in the competitive conditions, something that is not clearly taken place in the last two years.” Higher inflation can occur both with fairly competitive or oligopolistic market structures. In the late 19th century, the so-called Gilded Age Era was characterized by the rise of cartels, but with deflation in prices; and the 1990s, often seen as a second Gilded Age with increasing market concentration, experienced a so-called Great Moderation in price inflation ie disinflation. Indeed, in the last big inflationary spiral of the 1970s, profits actually fell. According to Sylos-Labini, wiring then: “the decline of the share of profits in several capitalist countries can be attributed primarily to the persistent increase of direct costs in labor, raw materials, and energy”. This contradicts views according to which: “Companies with enough market power can also unilaterally raise prices in a quest for greater and greater profits” as MMT economist, Stephanie Kelton has argued.

In a recently widely acclaimed paper, Isabella Weber and Evan Wasner, Sellers’ inflation, profits and conflict: why can large firms hike prices in an emergency? argue that “To link market power to the sudden increases in profits, it is necessary to examine why large firms have raised prices in the context of the pandemic but kept prices stable in the preceding decades. This implies that market power is not constant but can change dynamically in a changing supply environment.” They point out that that, before the pandemic, there was a long period of relative macroeconomic price stability, with low inflation and generally shared growth in nominal value added between wages and profits.

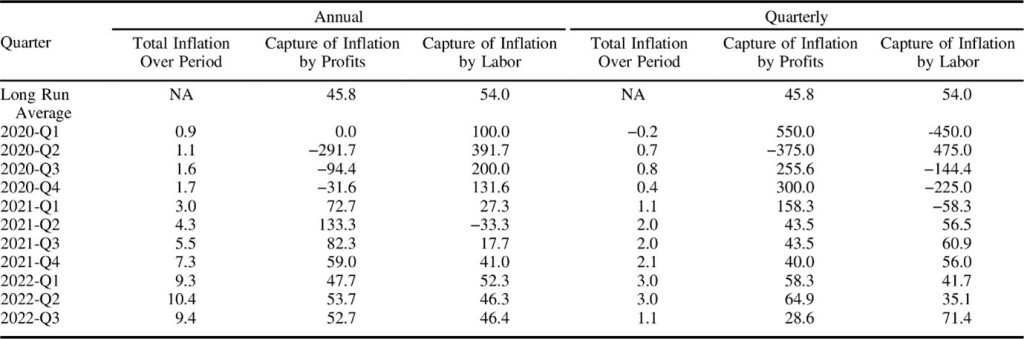

It was only in the post-pandemic period of the last two years that profits have usurped a greater share of the value in price increases per unit of output. But as their table shows, in the first part of 2020, it was wages that gained most from price rises as profits dived in the pandemic slump. Through 2021 those relative shares were gradually reversed and profits reaped the lion’s share. But in 2022, the wage-profit share in the value of price rises was pretty even. Indeed, in Q3 2022, labor’s share in price rises was greater.

So it all depends on the point in the cycle of expansion and contraction that a capitalist economy is undergoing, not on the ability of monopolies to ‘price gouge’ as such. The data suggest that, in the period of supply chain blockages and sharply rising basic commodity prices (food, energy), firms with pricing power hiked prices to sustain and even increase profits (2020-21). But as supply blockages subsided and production picked up in 2021-22, competition increased and further profit mark-ups could not be sustained.

As Vernengo and Ramon conclude: “The persistence of contractionary demand, mostly monetary, policy as the main tool to contain inflation seems to respond more to the prevailing prejudices and the ideological biases of the profession, than to the analysis of the real causes of inflation.” On the other hand,“It is not helpful that the main challenge to this consensus has been to blame corporations for increasing their profit margins, since this view also provides an incorrect explanation for the recent acceleration of inflation. The main culprit for the inflationary acceleration in the U.S. and most advanced economies is related to the supply side snags, and the shock to energy and food prices resulting from the pandemic and the war in the Ukraine.”

Central bankers and the mainstream ignore all this debate and continue with their claims that it is excessive money, or excessive aggregate demand and wage rises that is causing the inflationary spiral. Their policy answer is to raise interest rates and reduce money supply to restrict demand and, as unemployment rises, weaken wage bargaining power.

What should be the policy against accelerating inflation? Weber and other leftists have argued for the introduction of price controls as the alternative to central bank policies. I have argued against price controls as an effective policy to control generalized inflation, especially as current inflation,is being driven by international energy and food prices. Controlling energy prices at the domestic consumer end would not solve price rises at the producer end, but simply drive private energy supplies into bankruptcy. That would force governments to reverse controls or take over companies. Indeed, that poses the best policy answer: public ownership of the international energy and food companies that operate throughout the global supply chain.

In the meantime, price controls or not, the reality is that, as economies go into 2023, headline inflation rates are falling, as energy and food prices fall back. And so are profit margins as the major economies slip into a slump.

Sure, so-called ‘core inflation’ (excluding food and energy) remains ‘sticky’, so that even in a slump, inflation rates are likely to stay above the average rates prior to the pandemic slump. But it’s the slump that will end high inflation (as it did in the early 1980s), not interest-rate hikes or price controls.

Thanks to many generous donors BRAVE NEW EUROPE will be able to continue its work for the rest of 2023 in a reduced form. What we need is a long term solution. So please consider making a monthly recurring donation. It need not be a vast amount as it accumulates in the course of the year. To donate please go HERE.

Be the first to comment