The major economies are still growing at a pitiful pace, if at all, while the poorer economies are trapped in an inescapable debt disaster.

Michael Roberts is an Economist in the City of London and a prolific blogger

Cross-posted from Michael Roberts’ blog

Apparently 85% of economists forecast a recession in the US in 2023 – and they were wrong. My own forecast post for 2023 was headed, “the impending slump”. So I must join the bad forecasting majority.

The US economy looks set to finish the year with an increase in real GDP of about 2%, although, as I explained in a previous post, when measured by gross domestic income (GDI), ie adding up the income accrued in profits, rent and wages in real terms, there has been no growth at all.

But if we stick to GDP as the measure of expansion in the US economy, then 2% is a lot more than forecast by the majority at the beginning of 2023. Also, the US official unemployment rate of about 4% and headline inflation of about 3% is way better than most forecasts at the beginning of 2023.

Thus, the cry now is for a ‘soft landing’ or no landing at all. No wonder investment bank economists at Goldman Sachs are having a ‘victory lap’ in having predicted no recession and a ‘return to normal’ for the US economy – while the stock market is having a record ‘Santa’ rally up to Xmas.

But remember this is the US. The situation in the rest of the G7 is pretty much as forecast at the beginning of 2023. The Eurozone is clearly in recession with real GDP flat at best. The same applies to the UK and Sweden, while Canada has suffered a contraction over several quarters. Japan is basically stagnant. Australia and New Zealand are similarly placed.

In a previous report I discussed why the US economy has done better: it’s partly due to significant fiscal stimulus under Biden in 2022; partly due to increased military spending on all America’s proxy wars (now leading to sizeable government deficits and rising public debt); but mostly due to profits in the corporate sector holding up and thus enabling at least a section of the corporate sector to invest. The other large factor has been better consumer spending in the US, as households run down savings built up during the COVID pandemic lockdowns and now through fast-rising consumer debt. None of these spending forces have been visible in the rest of the G7, particularly Europe, hit hard by the loss of cheap Russian energy imports.

But 2024 may not be so rosy for the US. As I said in a previous post, capitalist economies are, in the last analysis, driven by profits and the profitability of capital.

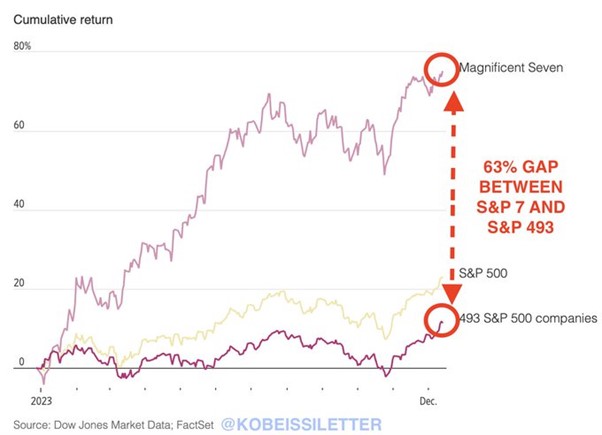

Outside of the ‘magnificent seven’ of mega tech and social media corporations and the energy companies, the rest of the US corporations are experiencing low profitability on their capital.

Profit margins rose sharply after the pandemic slump. The supply chains were broken, the production of manufactured goods faltered and international trade fell. So those companies that had some ‘pricing power’ i.e. with not many competitors and interrupted supply sources, were able to hike margins and boost profits.

Inflation rose sharply and the contribution from profit was considerable. But recent research has confirmed that the rise in corporate profit margins “appears mostly driven by a subset of high-markup firms.” In my view, this is different from what some have called ‘greedflation’ – a rather nebulous term. Markups increased for other reasons than firm ‘greediness’, such as firms recouping pandemic losses or because of the uncertainty about future cost increases. So firms that could hike prices were just being capitalist’ i.e. maximising profits.

The now well-known Weber-Wasner thesis on profit-driven inflation was more nuanced. They suggested that supply chain bottlenecks crimped competition by leaving some firms unable to service demand. And that enabled some firms to hike margins and prices. Other studies were even more doubtful about ‘greedflation’ or ‘price gouging’. Bernardino Palazzo of the Federal Reserve board found that American profits as measured in the national accounts were boosted by plunging interest rate costs during the pandemic, as well as government support for businesses. That muddies any other analysis of whether market power mattered.

A Bank of England study found that yes, profits rose a lot in nominal terms. But so did costs. And so they concluded that other than in oil, gas and mining, profits up to2022 behaved pretty normally. A study from the Bank of Italy estimated that in Germany prices were constant in industry and manufacturing in 2022, but rose in construction, retail, accommodation and transport. And in Italy, they returned to pre-pandemic levels pretty quickly. Another study by the IMF studying the eurozone concluded that “limited available data does not point to a widespread increase in mark-ups”. A paper by Christopher Conlon of New York University and Nathan Miller,Tsolmon Otgon and Yi Yao of Georgetown University found no correlation between mark-ups and price increases between 2018 and the third quarter of 2022 in the US. A different study from the Kansas City Fed found that mark-ups in the US surged in 2021 but then dipped during the first two quarters of 2022 despite high inflation. That looks like companies raised prices in anticipation of their future costs going up, not price gouging.

Indeed, the data show that, in aggregate, the increase in US markups was temporary and, since mid-2022, it has been receding towards pre-pandemic levels. The economy-wide markup increased following the re-opening of the economy in 2021, reaching a peak in 2022 Q2 at around 15% above pre-pandemic levels. Since then, the markup has been receding towards pre-pandemic levels.

Aggregate price markups (indices; 2018 Q1 = 100)

Profit-driven inflation seems to have been are highly concentrated in a small number of firms and a small number of ‘systemic’ sectors, including extractive industries, manufacturing, IT & finance. In the UK 90% of the increase in nominal profits was made by just 11% of firms. One sector that has caught attention recently is food manufacturing. It is very concentrated: four firms have more than 70% market share for some goods.

Inflation rates are now falling sharply. So it appears that inflation was ‘transitory’, driven mainly by supply-side factors, and was not due to ‘excessive monetary injections’ or ‘excessive aggregate demand’ or ‘excessive wage demands’ – the explanations of the monetarists, Keynesians and the central banks.

Keynesian guru, Paul Krugman has taken the opportunity to criticise his Keynesian colleagues: “Economists who were wrongly pessimistic about inflation—most prominently Larry Summers, although he isn’t alone—remain unwilling to accept the obvious. Instead, they argue that the Fed, which began raising interest rates sharply in 2022, deserves the credit for disinflation. The question is, how is that supposed to have worked? The original pessimist argument was… a lot of unemployment…. As best I can tell, the argument now is that by acting tough, the Fed convinced people that inflation would come down, and that this was a self-fulfilling prophecy…”

Krugman makes the point that if the inflationary spike was driven by supply factors, then central banks have played little role in reducing inflation by hiking interest rates – an argument made in this blog on many occasions. Of course, central bank officials will still take the credit for getting inflation down.

Summers responded revealingly in an FT interview. On Keynesian explanations for inflation, Summers commented: “it certainly hasn’t been a glorious period for the Phillips curve theory in any of its forms. But I’m not sure we have a satisfactory alternative theory. The theory to which many economists are gravitating to is that the Phillips curve is basically flat, inflation is set by inflation expectations, and inflation expectations are set by the people who form inflation expectations. And that’s a little bit like the theory that the planets go around the universe because of the orbital force. It’s kind of a naming theory rather than an actual theory. So I think inflation theory is in very substantial disarray, both because of the Phillips curve problems and because we don’t have a hugely convincing successor to monetarist-type theory.”

But Summers reckoned monetarist theory was little better: “Monetarist theory had an idea that the price level had to do with the quantity of paper versus the quantity of goods. But now that money pays interest, what the nominal quantity is, that is divided by a real quantity and sets the price level, is unclear. We know from extreme examples, like the monetary history of Argentina, that in some contexts a theory about the price level and nominal quantity of money becomes the right theory for thinking about inflation. But how one thinks about that in the context of relatively low inflation environments, I think economics is embarrassingly short on clear, operational theories.”

I quote Summers at length here, because it reveals that mainstream inflation theory has been found totally inadequate in explaining the inflationary spike. That also applies to the bogus argument that ‘excessive wages’ caused the rise in inflation – or at the least would cause a ‘wage-price spiral’ unless moderated. Remember the remarks of Bank of England governor Bailey and his current position that he won’t cut the bank’s base rate until wage rises moderate.

The wage rise argument has been wrong from the beginning. Indeed, if we look at the fourth quarter of 2019, which was the last quarter before COVID, the real wage in the US was $362. Now nearly four years later, it sits only $3 higher at $365 – four years of near zero wage growth.

Most American workers saw their real wages decline throughout nearly all of 2021 and 2022. Positive real wage growth only resumed in February of this year.

A caveat here. Inflation rates are coming down, but as argued in a previous post, the major economies are not going to get annual inflation down to the central bank targets of 2% a year any time soon, if ever – short of a slump. Inflation will stay around 3-4% a year because productivity growth is poor and costs of production will remain ‘sticky’. As for the real causes of price inflation in capitalist economies, that will have to be left to another post in 2024. But these posts may help.

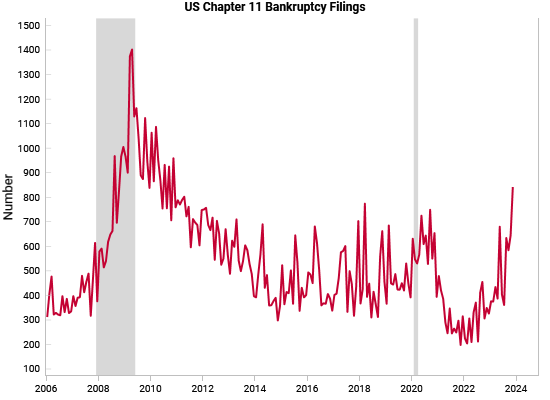

Ok, so the US economy has just about avoided a recession in 2023, although Q4 data will not be pretty. I have argued in previous posts that a slump in the US economy would only happen when profit growth stops and rising interest rates push up borrowing costs for companies that look to invest. Then companies will be squeezed from two directions. Such a squeeze would lead of bankruptcies of the weakest and a reduction in investment and employment by all.

Corporate profits in the US are now falling.

Global non-financial earnings before tax have contracted for three quarters in a row on a year-over-year basis, and fell 4% on an annual basis. All regions have seen a decline, notably Asia-Pacific, where pre-tax earnings are down 7%. Even North America has had two negative quarterly year-over-year declines. This is a profits recession.

When profits fall, business investment follows (with up to a year’s lag).

Then there is debt. As a Federal Reserve paper pointed out earlier this year, lower interest expenses and tax rates explain 40% of the real growth in US corporate profits between 1989 and 2019. But debt servicing costs are now rising significantly.

Goldman Sachs estimates that returns on equity for the S&P 500 companies has shrunk by 69 basis points this year to 23.4% and half of that is because of higher interest payments.

Corporate bankruptcies are increasing at double-digit rates in most advanced economies as borrowing costs rise and governments unwind pandemic-era measures to support business worth trillions of dollars.

And don’t forget the ‘zombies’, companies that are already failing to cover their debt servicing costs from profits and so cannot invest or expand but just carry on like the living dead. They have multiplied and survive by borrowing more.

Defaults on such debt will rise. Rating agency Moody expects the global speculative-grade default rate to continue to increase in 2024 well above the historic average.

Whether the US economy goes into an outright slump in 2024 or just avoids it again, is only an issue to discuss for economists. The major economies are still growing at a pitiful pace, if at all, while the poorer economies are trapped in an inescapable debt disaster. Debt servicing costs in a clutch of the world’s poorest countries are set to soar to “crisis” levels as high interest rates damage already fragile economies, according to the World Bank, in its latest International Debt report.

Twenty-four of the world’s lowest income economies are set to spend a total of $21.5bn on financing their external public debt across this year and next, as bond repayments become due and the impact of higher interest rates feeds through. That represents a rise of almost 40% over the previous two years.

“Record debt levels and high interest rates have set many countries on a path to crisis,” said Indermit Gill, the World Bank Group’s chief economist. “Every quarter that interest rates stay high results in more developing countries becoming distressed — and facing the difficult choice of servicing their public debts or investing in public health, education, and infrastructure….For the poorest countries, debt has become a near paralysing burden,” said Gill.

In the past three years alone, there have been 18 sovereign defaults in 10developing countries including the likes of Zambia, Sri Lanka and Ghana — greater than the number recorded in all of the previous two decades. The World Bank forecasts that by the end of 2024, economic activity in low and middle income countries will be 5% below pre-pandemic levels, with growth over the 2020-24 period projected to be the weakest five-year average since the mid-1990s.

According to IMF forecasts, emerging market and middle-income countries’ average gross government debt burden is heading above 78% of GDP by 2028, compared with just over 53% a decade earlier. Some of the world’s poorest countries also face an additional burden as they repay accumulated debt owed for participating in the G20’s debt service suspension initiative in 2020 and 2021, the exact costs of which, the World Bank said, will not be known until 2024. All this will have dire consequences for the livelihoods of the millions in the Global North and the billions in the Global South next year.

So even if the US economy crawls along next year, the rest of the world’s economies are heading down.

Michael Roberts

“Brave New Europe has made a vital contribution to radical analysis of world events, economic developments and the condition of our planet. It should be supported by all who are striving to make fundamental changes for the better”

Donate: https://braveneweurope.com/donate

Be the first to comment