Despite its recent decision the European Central Bank will keep re-injecting more than 190 billion euros into the financial system in 2019. But the ECB is not making the optimal use of those reinvestments.

Cross-posted from Positve Money Europe

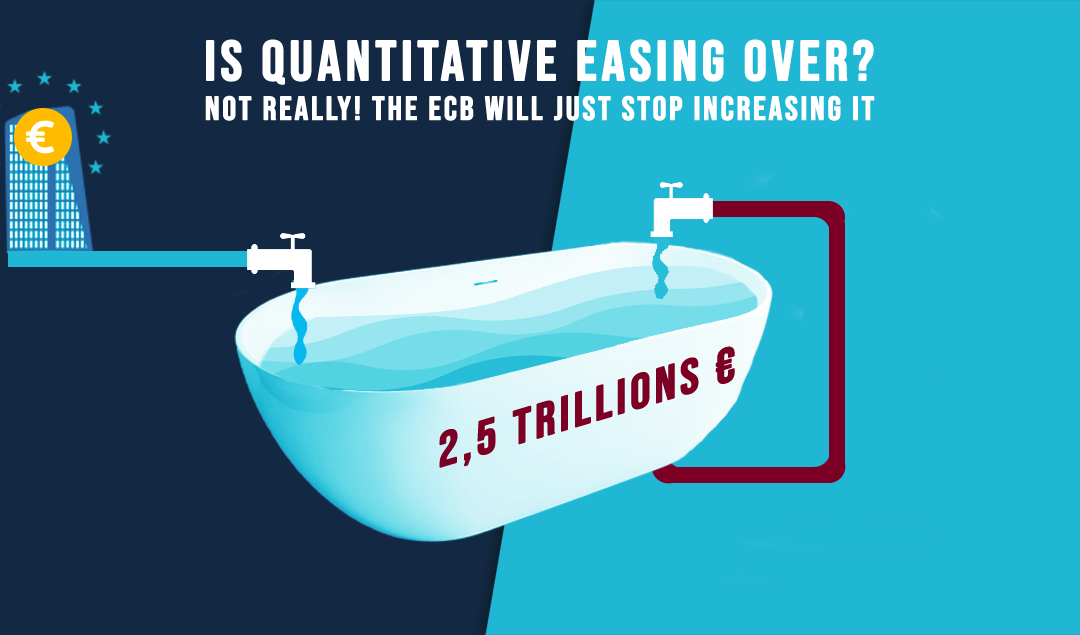

The decision on 13 December by the European Central bank has confirmed a long-awaited decision to stop increasing its asset purchases while reinvesting the repayments received from maturing bonds. This decision mainly reiterates what we wrote in June. In essence, the ECB is not really putting an end to QE, but rather it will stop increasing QE. In practice, the ECB will maintain the current size of its portfolio, by rolling-over the bonds: everytime a government or company reimburses, say, one million euros to the ECB, it will use the money to buy another bond of the same amount.

In fact, those QE “reinvestments” have already started. In 2017, the ECB re-purchased about 47 billion euros this way. This amount has almost tripled to 147 billion in 2018 and is expected to reach 190 billion euros for 2019. Beyond the fuss around the “end of quantitative easing”, the fact is that the ECB’s money creation programme is here to stay for quite a while.

The reinvestment feature of QE means there is still room for making QE work better for the real economy. While the ECB has indicated no significant changes in the way that it will re-inject this liquidity in the market, Positive Money Europe recommends the following strategy for the future:

1. Divest from any privately issued securities which are highly exposed to climate-related risks. The ECB currently holds a lot of corporate bonds which are highly carbon intensive. In order to put into practice the ECB’s recent commitment to deliver its best effort in support to the fight against climate change, the ECB should start excluding bonds that are contributing most to climate change.

2. Re-deploy reinvestments from private securities (ABSPP, CBPP3, and CSPP) towards public bonds. By shifting away from private to public bonds, the ECB can not only reduce its exposure to particularly contentious private companies, but it will also maximize its chances to best support the recovery, by helping governments increase their investment spendings. Stopping reinvestments in privately-issued bonds would also “create room” in the ECB’s balance sheet for finally including Greek bonds into the PSPP programme.

3. Purchase more bonds from supranational entities, beyond the current limit of 33% per bond issuance. Because supranational bonds are not directly connected to one particular member state, the current maximum rule of 33% is not so relevant. For example, allowing a larger share of bond buying from the European Investment Bank could better support the financing of useful social and energy investments than the blunt purchase of private bonds from the market.

4 Flexible alignment with the ECB’s Capital Keys. We see no reason for the ECB to align strictly its portfolio with the ECB’s capital keys (which broadly represent the share of each national economy). As Mario Draghi recently recognized in response to MEPs, capital keys can have a pro-cyclical nature which is counter-productive in the conduct of monetary policy. For example, the fact that Italy’s capital key has recently been reduced (as a consequence of its past five years of stagnation) would in all logic be a reason to increase monetary policy support vis-à-vis Italy, and certainly not a reason to decreasing it. While the ECB should avoid deviating outrageously from capital keys, it shouldn’t use them as a strict anchor either.

Today the European Central Bank has missed an opportunity to make a more sensible use of its reinvestment policy in order to best support the Eurozone economy. However, we are confident that quantitative easing will be around long enough for the ECB to make those changes before it completely disappears – if it ever does.

Be the first to comment