We won’t get fooled again. Already the UK government is talking about massive new state debt. These do not exist. Thus there is no need for a new round of austerity. Richard Murphy explains.

Richard Murphy is a Visiting Professor of Practice in International Political Economy, City University of London. He campaigns on issues of tax avoidance and tax evasion, as well as blogging at Tax Research UK

Cross-posted from Tax Research UK

The post that follows was written as a Twitter thread. As a result no paragraph is more than 280 characters long. But it grew, and grew, and the issue it addresses – the role of quantitative easing (QE) in the economy over the last decade is vital. Breaking it down into a lot of paragraphs does no harm as a result. So, this is my explanation of how QE works and what results. Much of it is new. It also predicts work that is to come. I hope it it useful.

———-

There’s massive misunderstanding about what QE is and what it does. So please forgive a long thread on one of the most important tools used in modern economics, which if used properly might provide real hope for a better future.

Outside Japan QE was unknown until 2009. Since then the UK has done £845 billion of it. This is a big deal as a consequence. But as about half of that has happened this year it’s appropriate to suggest that there have been two stage of QE, so far. And I suggest we need a third.

Stage 1 QE started in 2009 and was last used in 2016. It created £445bn of new money. That was used to buy £435bn of government bonds, or gilts, and £10bn of corporate bonds, which we can ignore. There were three goals to first stage QE.

The first was to keep interest rates down. The Bank of England calls QE monetary policy for a reason. Buying gilts in the financial markets pushes up their price. And since the return paid on them is fixed if their price goes up the effective interest rate paid on them goes down.

The second reasons was to provide liquidity to banks and financial institutions. This liquidity froze in 2008. It was solved because QE created money ends up being held by banks and building societies on the central bank reserve accounts they hold at the Bank of England.

Since 2008 banks and building societies have not trusted each other to not go bust, overnight. After all, Lehman Brothers did. So they don’t give each other credit any more. Instead they have to hold central bank reserve account balances to settle their debts to each other.

QE boosted the balances on central bank reserve accounts. In 2009 these amounted to £42bn. In February 2020, when the last audited figure was published, they were £479bn. They have probably gone up by another £400 billion or more by now as a result of QE this year.

So, QE provided the money to make sure that the banking system could still function. It should not fall over again in the way it almost did in 2008 as a result, although it had a good go at doing so in March this year, which is why the Bank of England intervened so heavily then.

Third, it has to be remembered that QE began in 2009. Back then it was still the official line that banks needed deposits before they could lend. That was not true. It hasn’t been since at least 1971. But this was not acknowledged by the Bank of England until 2014.

Given that this ‘old world’ view on deposits and lending prevailed the BoE thought QE would enable banks to lend more to boost the economy. That was nonsense, and the evidence proved it. Creative lending to promote employment remained as rare as ever within UK banking despite QE.

What QE did instead was two things. First, it released money to buy other assets. Speculation in commodities such as oil and metals increased significantly, and even pushed up inflation. But falling interest rates also did something else. It pushed up share prices.

Just as high gilt prices push down gilt interest rates, so too do low interest rates make shares look more attractive and so push up their prices. A steady increase in share prices followed. By 2019 they had roughly doubled since 2009, although they have fallen since.

It should be added that there is one big problem with all this money going into shares. Little, if any of it actually ends up in the companies that issue the shares in question. It’s just speculative activity in existing shares. It was great for the City, but almost no one else.

The ‘almost’ in that last sentence was deliberate. QE also benefited the government. Despite the claim that it faced a debt crisis that required austerity the QE programme from 2009 to 2012, totalling £375bn, meant that most government debt in that period was funded by QE.

Let’s be clear what ‘funded by QE’ means. The funding is not direct. All government spending is initially paid for by the Bank of England making payment on government command. The overdraft this might create is then by convention cleared by a mix of tax receipts and debt issues.

The debt the government issues to clear a deficit on its account with the Bank of England (which is what the term really means) can last for a few days to more than 50 years. And all of that debt can be traded, or sold, on the City money markets.

People want to own that debt. Banks, building societies, pension funds, life assurance companies, foreign governments, individuals even, all appreciate owning this debt because it’s the safest form of saving available in the UK in sterling. UK debt’s great stuff that people want.

When QE is used to buy this debt back, because that’s what it does, the Bank of England does so using a company called the Bank of England Asset Purchase Facility Fund Limited, or APF for short. This is owned by the Bank of England but, there is a twist.

The APF might be owned by the Bank, but it is effectively controlled by the UK Treasury, which consents in writing to all that it does, including all QE spending. And the Treasury also underwrites all its losses (it has not had many of them) and is entitled to all its profits.

What is more, although the interest on the gilts the APF owns is still paid, the interest actually goes straight back to the Treasury as income, effectively cancelling it, of course. So there are political shenanigans going on here.

The first shenanigan is that the so-called independence of the Bank of England from the Treasury is blown apart by the fact that the Treasury completely controls the APF and the whole QE process. QE is a Treasury operation in practice, not a Bank of England one.

The second shenanigan is that the claim that QE does not cancel debt is blown apart by the fact that repurchased debt is not really owned by the Bank of England but is owned by the Treasury, which gets all the income and profits from it.

Importantly, you can’t, of course, owe yourself money. A debt requires that you owe a third party. But the Treasury does not do that, because the government also owns the Bank of England. But how the mechanics of this works needs explanation.

To undertake QE the BoE lends the APF money. Like all bank loans, this one is created out of thin air. The BoE promises to pay whoever the APF instructs it to make payment to. The APF promises to repay the loan. The two promises create the new money that the debt represents.

The APF then uses its new funds to buy gilts. It uses an auction process, paying the market price as a result. The people selling usually profit, often considerably, as a result. After the repurchase the APF legally owns the repurchased gilts, but the Treasury does in reality.

None of the gilts bought by the APF have ever been sold back to financial markets. Such is the scale of likely deficits in the future it is wholly unrealistic to think that they ever will be. So, once the APF buys these gilts it is now reasonable to think that they are cancelled.

The Bank and government do not agree. They say they could be resold. They do this to pretend the debt still exists. They are included in national debt calculations although no one is owed any money. And the interest on them is still treated as a cost to the gov’t, which it isn’t.

There is only one possible explanation for this pretence, which is that this maintains the austerity narrative. The pretence that there is a debt to repay, and an interest cost to settle, is used as an excuse to cut government spending even though no such excuse exists.

It is appropriate to note what really happens to the money paid by the APF to buy gilts. Even now, when QE is heading to be more than £800 billion, it simply becomes money deposited by the UK’s banks and building societies on central bank reserve accounts with the Bank of England.

So the question is whether or not this is a debt? In a normal bank it would be. Customer deposits in normal banks are liabilities. They are money owing to customers that the bank could have to pay out on and find the money to settle. But the Bank of England is not a normal bank.

The deposits UK banks have with the Bank of England only exist because the Bank of England created that money in the first place. And only they, amongst banks, can create money by lending within their own organisation i.e. within government. So this is different from other money.

That difference has real impact. First, the UK’s banks can’t in effect get rid of these deposits. All they can do is transfer them between them. Only government can cancel these deposits, by charging extra tax or selling new bonds and letting the deposits be used to make payment.

In that case these deposits aren’t debt. They are, instead, money created by the BoE. And just in case there is doubt as to whether money created by the Bank of a England is debt or not, bank notes are not in the ONS national debt figures. So nor should this new money be, either.

Interest is paid on these central bank reserve accounts. It’s settled at BoE base rate. That’s 0.1% right now. But that’s convention. This need not be the case. The Bank of a England could change the rules if interest rates rose and there would be nothing banks could do about it.

So, not only under conventional QE is the debt repurchased effectively cancelled, as is the interest on it, but it’s replaced by newly created money that is not part of the national debt.

Think about it: government created money can’t be part of the national debt because it can only be repaid using more new government created money. That means repayment would create new money exactly equivalent to the amount repaid, so it cannot be debt in any conventional sense.

The result is stage 1 QE benefitted the banks, enormously; lifted asset prices, like shares, considerably; let the government cancel most of its new debt from 2009 to 2012; and left the austerity story completely intact so that most people were economically conned by this.

What has happened in stage 2 of QE, which is the 2020 story? The mechanism is identical is the first thing to say. None of that needs retelling, at all. The figures have just gone up by more than £400 billion all round, that’s all.

But the motivation was different. The first stage of this happened in March. As coronavirus lock down happened that month the banks froze. They were back to 2008 and seemingly unwilling to function. £200 billion of new QE then was intended to simply free up the markets.

That worked. Andrew Bailey claimed he was a super hero as a result. Actually, he just did his job as creator of new money, which is what the markets needed to unblock the jam that was created as banks thought they faced Armageddon.

But the £200 billion also did something else. As it became obvious government deficits would sky rocket new QE provided all the funds required for markets to acquire the new debt the government was issuing, and at the same time still keep interest rates low.

Literally, what the QE process did was pump money into the financial markets as a result of the repurchase of gilts, which money was then available to buy the new gilts the government had to offer because of significant deficit spending.

The difference between stage 1 and stage 2 QE then becomes clear. In stage 1 there could be a pretence that the QE funds were part of monetary policy to control interest rates. They just happened, coincidentally to effectively cancel government debt as well.

In stage 2 QE, for anyone with the willingness to look at what was really happening it was apparent that the Bank of England was actually deliberately creating the funds required to fund government spending in advance of them being needed. It was as simple as that.

With £450 billion of QE planned for 2020/21 and an anticipated deficit of around £400 billion when allowance is made for the profit many gilt owners make in reselling their bonds to the government is taken into account the Bank of England is almost wholly funding the deficit.

So, when the question is asked ‘who is lending money to the government right now?’ The answer is ‘No one’. Instead every penny of the deficit is being paid for with newly created money that is being provided by the Bank of England. And national debt is not in rising as a result.

Of course, the newly created money goes somewhere. It ends up in the central bank reserve accounts held with the Bank of England by the UK’s banks and building societies. These are likely worth more than £800 billion now. All earning interest at 0.1%.

There is a good question to ask about why these banks earn 0.1% on money they did not seek. But that’s for another day. More important is the fact that in net terms in Stage 2 QE there is no money to reinvest elsewhere in the economy.

That’s because the markets effectively sold no gilts back to the government. Unlike Stage 1 QE, in Stage 2 QE the overall impact is that the Bank of England is simply funding new gilt issues. It’s directly funding the government. The markets are almost removed from the equation.

This is not, in that case, monetary policy, even if it does keep interest rates low. This is fiscal policy, in effect. This is about deficit financing. The pretence that the BoE does QE for monetary policy reasons is shattered. It is not. Nor is it in any way independent.

We have reached the point where in reality the claim that the government cannot borrow from its central bank is shown to be a myth. It is doing just that, with the Bank using newly created money that ends up on central bank reserve accounts, to do so.

But this also means that there is no argument for austerity. There is no new debt. And no one is owed anything to repay the central bank reserve account balances, because they are just money. And until there is full employment this new money creation creates no risk of inflation.

So, any claim that we are suffering under a mountain of debt is just wrong. If anything, because of the scale of gilt repurchased national debt is at most stable in amount. It might actually be going down.

Stage 2 QE is not, however, what is prescribed by modern monetary theory. None of the artificial structures that QE uses are in any way required by MMT. It says that the Bank of England should actually just run an overdraft for the government, which is what is really happening.

But whether Stage 2 QE is what modern monetary theory would prescribe is not the point. MMT does explain what is happening. A government in the situation we face in 2020 can fund itself using new money creation. That is exactly what is happening.

Crucially, there is no debt as a result. There is only new money. The amount of that money is wholly under government control. And there is no inflation risk at this moment. Not need there be, external shocks like Brexit apart. This is a completely stable situation.

So, tales that borrowing has reached its limits and that austerity is required, or that we are saddling future generations with debt are all nonsense. No one can, or needs to, repay the new money the government has created.But the government has to understand that.

If the government does not understand this it can do something catastrophic. It can increase overall tax, which would crush demand in the economy, and so increase unemployment. Or it can cut spending, which has the same result.

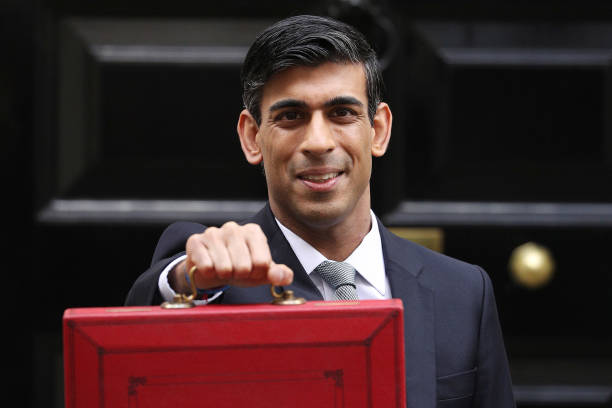

The government can suck the lifeblood out of the economy, in other words. By choosing to believe its own austerity narrative it can deliver an economic disaster. George Osborne had a good go at this. Rishi Sunak might try to do so again.

What should the government do? Stage 3 QE is my answer. This is quite different to stages 1 and 2. In stages 1 and 2 there’s no direct link between government spending and QE. It’s indirect. Spend creates the deficit, requiring bonds to clear it, which requires QE to cancel them.

In Stage 3 QE the link to spending is explicit. In this stage the government plans economic recovery. Call it a Green New Deal. A Green or National Investment Bank funds this programme. It issues bonds to pay for the investment. The Bank of England uses QE to but those bonds.

Now QE is explicitly created in advance to fund spending. It does not mop up after the event. It is used to provide the money need to transform our economy. This does not mean other savers cannot provide funds as well. I have argued that this option should be available.

But, the intention is to show that a lack of private sector and private saver willingness to fund the economic transformation we need to recover and sustain our economy should not prevent that transformation taking place. Government has the power to make this change happen.

That power comes from its ability to create money for social benefit. This has been used so far to save our banks, and to fund COVID created deficits. Now it could be used to fund the transition to a sustainable economy we need if no other sources are available.

The government should try to secure capital required from other sources, by all means. But doing so is not a constraint. For a government in the position of the UK government, a lack of money is not a constraint. How much money there is in the economy is its to decide.

Of course it has to consider inflation. That can be controlled if it is economically rather politically created (the latter being of the sort Brexit will deliver) by additional taxes, bond sales, or cuts in spending. But we have no risk of that type of inflation right now.

So Stage 3 QE could deliver the recovery we so desperately need, if linked to investment, in particular.

What is necessary is that the power of QE be understood. Few have tried to do that. There are few politicians in that number. But it’s time QE – or the the power to create money – was understood. Because this is how we control and deliver the economy of the future.

Be the first to comment