Analysis shows that any progress made is not the result of the Central Bank’s commitment to decarbonising its portfolio

Stanislas Jourdan is Executive Director of Positive Money Europe

Cross-posted from Positive Money Europe

Photo: Chu Huo in Kenting, Taiwan

On March 23, the European Central Bank (ECB) released data about the carbon intensity of its €400 billion corporate bond purchase programmes for the first time. Although the results can be interpreted as evidence of the success of the ECB’s green efforts to fight against climate change, what the analysis actually shows is that the progress made is not the result of the Central Bank’s commitment to decarbonising its portfolio.

Since 2016, the ECB has purchased nearly €400 billion of debt from the largest European firms, through its Corporate Sector Purchase Programme (CSPP). But while the programme was supposed to boost the real economy, it has been more widely known for its disproportionate support to the fossil fuel industry.

This is because the ECB decided to follow a strict “market neutral” approach, meaning it purchased the debt from corporations to the same proportion as the market distribution. However, because fossil fuels are overwhelmingly issuing more bonds than other sectors, the ECB’s pseudo-neutrality resulted in higher subsidies for fossil fuels. Positive Money Europe’s own research showed that more than 60% of the ECB’s corporate portfolio went to the most carbon-intensive industries.

After years of pressure from Positive Money Europe and many other civil society organisations and activists, the Central Bank eventually admitted this problem, and committed to taking action in July 2021 when it adopted an action plan for the climate. More than a year later, it finally operationalised this plan by changing the rules of its corporate bond purchases. Under the new rules, the ECB introduced a scoring system based on climate-related factors to evaluate companies eligible to the programme. As a consequence, since October 2022 it has started to deviate its purchases by buying more bonds from greener companies than from polluting firms.

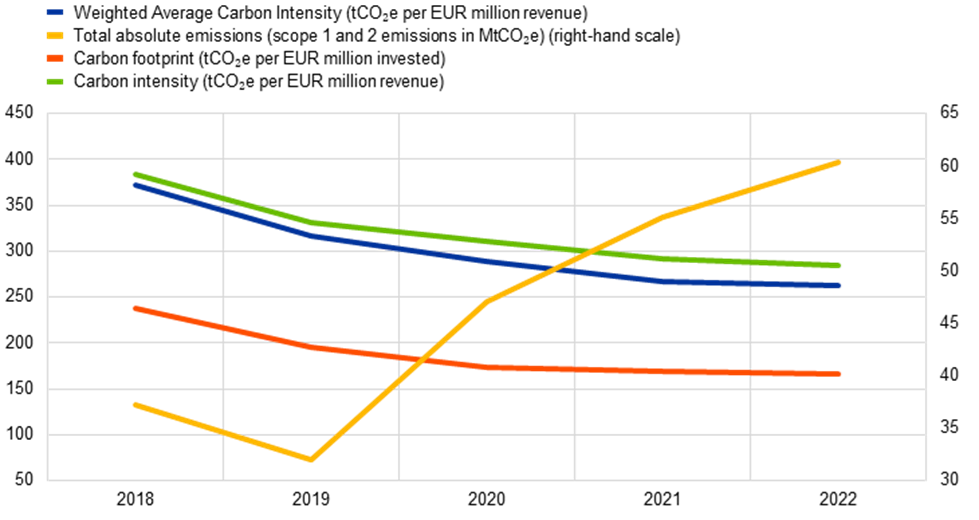

The most prominent result of the ECB’s analysis released last week is shown in this chart:

Three metrics are showing a downward trend, while the yellow line goes on the higher side. How to interpret this? The green, blue and red lines represent metrics for “carbon intensity”, which refers to the measure of carbon emissions being generated per million invested or revenue. The yellow line however represents the absolute amount of carbon emissions. In short, this chart shows that the amount of carbon emissions indirectly supported by the ECB’s bond purchases has continued to increase, for the basic reason that the ECB’s portfolio has increased as a result of more purchases under quantitative easing during the Covid19 crisis. At the same time, the carbon intensity (in proportion to the ECB’s investments) has reduced.

Does this mean that the ECB’s efforts have been so fruitful already? Well, not really. As the ECB’s own analysis shows, the reduction in carbon intensity was due more to the efforts of some corporations themselves, and from the impact of the pandemic on the economy, rather than to the green tilting of ECB purchases.

Moreover, an important caveat to bear in mind when looking at the chart is that these metrics do not fully include so-called “scope 3” emissions, namely the emissions related to the upstream part of the corporation’s activities, such as the purchase of raw materials and other supplies. In a globalised economy, it is well understood that the climate impact of every company is linked to the value chain in which it is embedded, and therefore scope 3 data is essential to really capture the reality of the carbon emissions by a company.

The greening measures on the corporate bond portfolio were only introduced about 6 months ago. The ECB says that since then, the carbon intensity of new purchases has been reduced by 60%, which is the first positive sign of movement in the right direction. However, it is clear that the ECB’s efforts are only just beginning. Before drawing conclusions and celebrating the new approach, it would be wise to wait until the next publication of the ECB’s climate disclosure, which the Central Bank promised will happen every year. By then, the ECB should disclose more detailed data, in particular on the climate scores of each company, in order to enable proper scrutiny on its methodology by civil society organisations and activists, and understand whether the new approach is in line with the EU’s climate objectives.

Overall, while we welcome the initial steps forward on this long standing issue, we do believe that the new economic and geopolitical environment requires a lot more action from the ECB, well beyond the adjustment of the corporate bond purchase rules. The ECB’s current strategy of hiking interest rates is going to disproportionately aggravate the cost of green investments, and result in a slowdown of the ecological transition that clearly cannot wait any longer. As we’ve been pushing for more than one year, to avoid contradicting the EU’s climate strategy, the ECB should adopt a “dual rate” approach by offering a lower interest rate for green investments, which would boost the green transition and help restore price stability.

Be the first to comment