Do not be frightened away by the term NAIRU. It is rather simple to understand and is explained in the article. Although one of the key theoretical pillars of neo-liberalism is has been found to have been wrong.

Stuart Medina Miltimore is an economist. He is a founder of the Spanish Association Red MMT and has contributed to the dissemination of Modern Money Theory in Spain by publishing two books, La Moneda del Pueblo and El Leviatán desencadenado. Siete propuestas para el pleno empleo y la estabilidad de precios. Veintiuna razones para salir del euro.

Last week the young and refreshing congresswoman Alexandria Ocasio-Cortez (AOC) from the 4th District in New York managed to destroy the concept of a Non-Accelerating Inflation Rate of Unemployment or NAIRU in literally less than 5 minutes during a congressional hearing with the new Chairman of the Federal Reserve System, Jerome Powell. NAIRU is one of the many fictions that mainstream economists have created to justify persistent levels of high unemployment. I will delve on the meaning of NAIRU and the strong symbolism of the nail that AOC hammered into mainstream economics’ coffin later in this text. But first let’s take some excerpts from the hearing. You can find a recording of the hearing online. It was knock-out in three counts.

Count 1

AOC asked Powell to confirm that the mandate of the Federal Reserve is to provide price stability with maximum employment, “meaning to aim for the lowest unemployment rate possible without runaway inflation”. Powell had to agree because of course it is.

AOC then digs in into the presumed relationship between unemployment and inflation. “In early 2014 the Federal Reserve believed that the long run unemployment rate was around 5.4%. In early 2018 this was estimated lower at 4.5%; now the estimate is around 4.2%. What is the current unemployment rate?”

Powell responds 3.7%.

Count 2

AOC then retort “but unemployment has fallen about 3 full points since 2014 but inflation is no higher today than it was 5 years ago. Given these facts, do you think that the Fed’s estimates of the lowest sustainable unemployment rate may have been too high?”

Powell responds “absolutely” and chuckles. He then hopelessly fumbles and concedes that “this is something that you cannot identify directly”. Of course! NAIRU is just an estimate that cannot be observed as many other mythological creatures created by neoclassical economics. “We’ve learned that it’s substantially lower than we thought.”

Then AOC gives a climatic masterstroke: “I’ve heard that economists are increasingly worried that the idea of a Philips curve that links unemployment and inflation is no longer describing what is happening in today’s economy.”

Powell admits what central bankers have known now for years: “The connection between slack in the economy –the level of unemployment— was very strong if you go back 50 years and it’s gotten weaker and weaker to the point that it is a faint heartbeat. (…). We’ve learned that the economy can sustain much lower levels of unemployment without troubling levels of inflation.”

AOC has drawn blood and is not letting Powell get away: “Why are we seeing this decoupling in a relationship that we had seen in the economy decades ago.” Powell fumbles again and brings in the inflation expectation narrative, another unicorn of Neoclassical economics. “The expectations are so settled that we think that is what drives inflation expectations. When unemployment went way up you did not see inflation go down.”

Count 3

The congresswoman now gives the final blow: “Do you think that may have implications in terms of policy making; that there is perhaps room for increased tolerance of policies that have historically been thought to drive inflation?”

Powell is now stirring on his chair: “I don’t want to get into the minimum wage discussion directly but I think we’ve learned that (…) downward pressure on inflation around the Globe and here is stronger than we had thought. Central banks are not hitting their inflation targets, they are always below.” Yes! Because governments have refused to use fiscal policy to spur growth and decided to rely on monetary policy instead, which, as Warren Mosler explained is like putting someone to drive a car using a wheel that is not connected to anything. AOC then mentions what Powell is reluctant to talk about: “Earlier you had suggested that in the event of a recession or a contraction we’d like to see more fiscal policy that supports monetary policy. Can you further articulate what those policies and considerations should be?”

Powell responds “I was referring to a severe recession or downturn and if that were to happen then I think that it would be important that fiscal policy come in to play.”

There you go! A central banker just admitted what Modern Money Theory has been saying all along: monetary policy is useless to fix the economy. You need fiscal policy to manage the business cycle. The significance of what Alexandria did last week cannot be emphasized enough.

Now Jerome Powell is no progressive, he wouldn’t have been placed there by Trump otherwise. However, while trying to latch on to his conventional mainstream beliefs he still had to concede that the NAIRU relation doesn’t seem to hold any longer and that there is a role for fiscal policy.

NAIRU was never a meaningful relationship. You can observe a direct relationship between bargaining power and the retaliatory price increase of businessmen. It is common sense to think that a tight labour market will improve the bargaining power of workers who will thus be able to extort better working conditions from their employers. Salaries being a key component of business costs it is self-evident that prices will tend to rise if wages grow. That is called class struggle: the distributional conflict between capital and labour. Inflation, a process for which both workers and business were responsible, was conveniently blamed by mainstream economists on one side only although, in actuality, only firms can raise prices.

While these wage-price spirals could be observed in the 1970s and 1980s they faded away during the Neo-liberal era. Thatcher made it her overriding mission to liquidate the power of trade unions but attacks on workers’ rights were used throughout most advanced nations during the long Neo-liberal half century. That is why we have no inflation today.

The origin of NAIRU can be traced back to the Philips curve, the correlation that the New Zealand economist A.W. Philips identified between unemployment rates and wage rates. The problem is that this statistical observation was not stable throughout time. Never mind. Mainstream economists needed to prove that there was a natural rate of unemployment which could not be trespassed without serious harm to price stability and the economy. They wanted a tool to prove that inflation had to be controlled through mass involuntary unemployment.

In the 1970’s Milton Friedman and Edmund Phelps argued that the erratic shifts in the inverse correlation between unemployment rates and inflation were due to changes in expectations of future price rises. The rational expectations theory not only underpins NAIRU but is also a key argument against the use of fiscal policy. Neoclassical economists purport that fiscal policy is ineffective because agents respond to rises in public spending with an expectation of future tax increases and inflation and cease to invest and create jobs.

NAIRU has been used as a key component of models that systematically underestimate the output gap. An economy growing at its full capacity would be one with full employment and at risk of overheating. If you can fool people into believing that there is no unemployment then you can also pretend that the public deficit is too high and that inflation is around the corner. The concept of NAIRU helped to place the focus of economic policy on controlling inflation rather than employment. NAIRU has thus been the cornerstone of the austerity policies that have destroyed the welfares policies of the postwar era. Moreover, high NAIRU estimates are interpreted as an indication of ‘labour market rigidities’, which can only be confronted by deregulation.

The ideas behind NAIRU were already criticized in 1929 by John Maynard Keynes before the concept was contrived when he famously stated that the “conservative belief that there is some law of nature which prevents men from being employed, that it is ‘rash’ to employ men, and that it is financially ‘sound’ to maintain a tenth of the population in idleness for an indefinite period, is crazily improbable – the sort of thing which no man could believe who had not had his head fuddled with nonsense for years and years.”

Well, lo and behold, forty years later History gave the practitioners of nonsense economics the opportunity to put in practice the folly of unemployment policies. Conveniently, the oil crisis of the 1970s, when Arab oil producing states imposed a fourfold increase in crude prices, provided the perfect excuse to implement the recipes of neoliberal economists. All they needed to do was to put the blame on labour.

Five decades of Neo-liberalism is a long period and the consequences have been dramatic. Many of us have never known a period of full employment.

It is no surprise that AOCs coup received little attention from European media. It astounding that they have not picked up on the significance of AOC’s challenge to one of the most cherished beliefs of mainstream economics. The European media have taken notice of the new generation of young progressive politicians that have recently entered the US Congress, a roll that includes Rashida Tlaib, Ilhan Omar and Alexandria Ocasio-Cortez, females with an ethnic background that is different from President Trump’s but are unabashed in their challenge to the establishment. Modern Money Theory is the theoretical foundation of many proposal put forth by AOC. Sadly, the European media seem to be absolutely clueless about the significance of the challenge to mainstream Economics posed by Modern Money Theory. This paradigm shift, developed by scholars in American and Australian universities, has yet to be felt in economic policies but has already proven mainstream Economics to be morally and intellectually bankrupt.

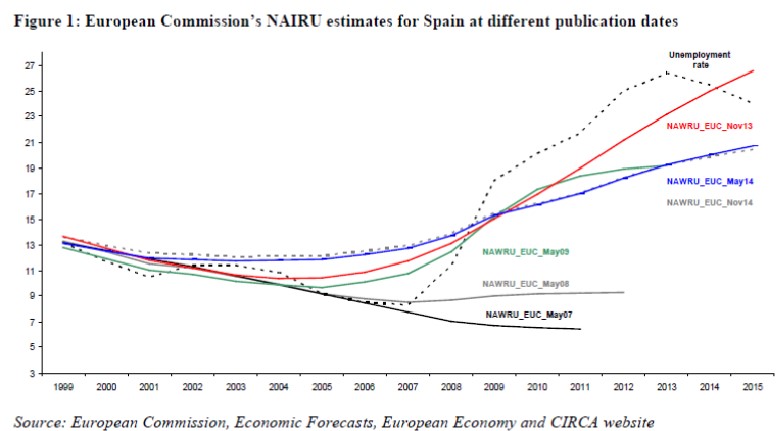

This is the more notorious considering that Economists working for the European Commission and other multilateral organizations have caused incredible damage to the population of Europe with insane estimates of NAIRU and NAWRU (Non-Accelerating Wages Rate of Unemployment, NAIRU’s twin sister). Consider the case of Spain. The Organization for Economic Cooperation and Development (OECD) estimated in 2012 that the sustainable rate of unemployment for Spain was 15.6%. In the midst of Spain’s worst unemployment crisis, which coincided with a long period of deflation, the European Commission experts made estimates of the NAWRU which suspiciously always seemed to trail the actual unemployment number as shown in figure 1 [ CITATION Gec14 \l 3082 ].

Figure 1. European Commission’s NAWRU estimates for Spain at different publication times. Source: European Commission, Economics Forecasts, European Economy and CIRCA website. Taken from Gechert, Tober, & Rietzler, 2014.

The problem with NAWRU and NAIRU is the use of the so called Kalman-filter that leads to revisions of all past estimates whenever new data is entered and assigns a disproportionate impact to the last observations. Hence the estimates tend to trail the actual number, which “raises doubts about the reliability of the underlying statistical filtering procedure” [ CITATION Hub17 \l 3082 ].

A questionable methodology has stubbornly been upheld by European officials to provide fake output potential gaps and structural deficits as a justification to sideline fiscal policies. By assigning the NAWRU a core role, the European econometric models implicitly discount other policy options. In a severe recession like the one suffered by European peripheral countries a traditional Keynesian approach, which would have increased budget deficits to stimulate the economy and create jobs, was evidently in order. Instead, high unemployment rates were not interpreted as a symptom of a weak economy but as a proof of a rigid labor market in need of “structural” reform.

The question begging is: why are European progressive leaders incapable of embarrassing our central bankers and policy makers as effectively as AOC? It should not prove difficult to reveal that Christine Lagarde and Ursula Von der Leyen adhere to a defunct ideology. European parties of the Left: here is an opportunity to redeem yourselves. Prove your worth!

Be the first to comment