Monopolies are mainly associated with the United States. And in Europe?

Jan Eeckhout is the ICREA Research Professor at Pompeu Fabra University in Barcelona

Counterbalance is a newsletter from a new anti-monopoly organisation, the Balanced Economy Project. This interview was conducted by Nick Shaxson.

Cross-posted from Counterbalance

To subscribe to The Counterbalance click Here

NS You have painted quite a stark picture of rising market power at a global level. But if you break it down geographically, patterns emerge. Thomas Philippon’s 2019 book The Great Reversal: How America Gave up on Free Markets argued that while market concentration has increased dramatically in the United States, it had not in Europe. This message doesn’t ring true for us at the Balanced Economy Project, given that European antitrust authorities have almost never blocked a merger, and giant firms now dominate pretty much every sector here.

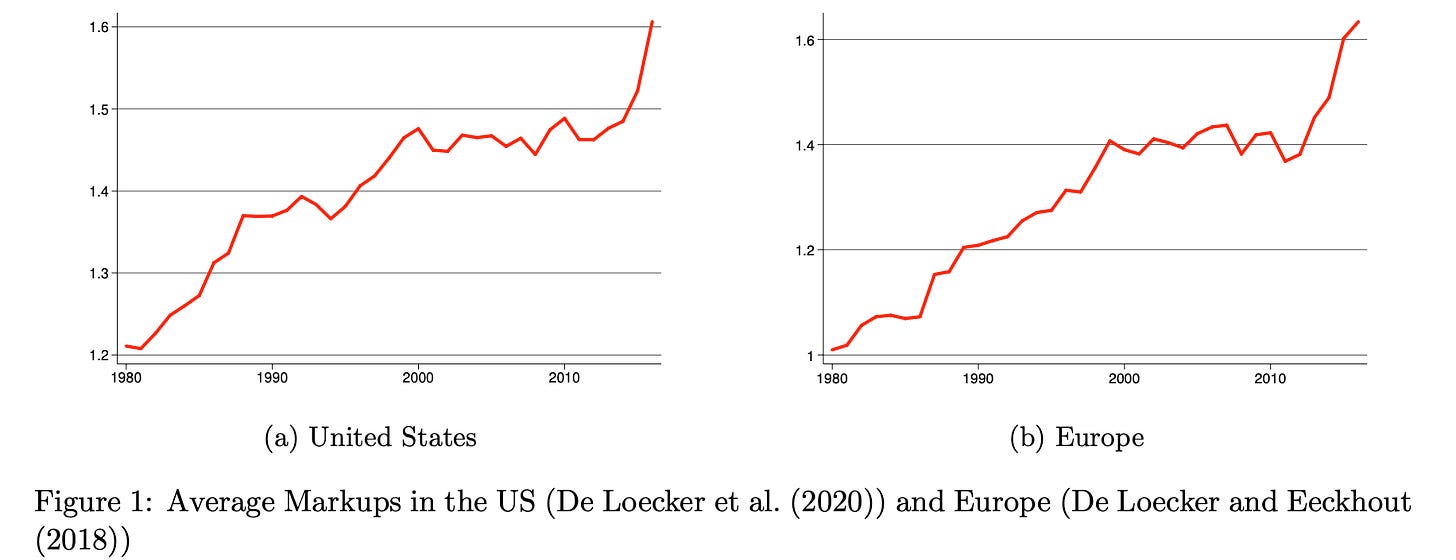

In your recent review of The Great Reversal I found a neat explanation for your difference in opinion about the US versus Europe. For Europe, Philippon used Orbis data from 2000-2014, which coincided roughly with the “China shock” after China entered the WTO in 2001, when its cheap exports pushed down prices (and markups). This flattened the graph for that particular period, giving an impression that Europe has been doing OK. For the US, older data was available, showing a longer trend of rising market power. But there is another dataset from Worldscope which now allows us to look further back in Europe, too, and this changes the picture:

JE Well, as I said in that review, Thomas’ book is a remarkable piece of research and I agree with 99 percent of it.

But you can see that from about 2000-2010, there is a flatness on the [above] graphs, with a sharp increase in markups before and after that time, for both Europe and the United States. We cannot conclude from this that there is a difference between the United States and Europe.

We also have some differences in emphasis, in terms of what has driven these changes. Thomas emphasises lax antitrust as the dominant explanation, whereas I think that technological change has also been important, in addition to lax antitrust. The shift of economic activity towards high markup, ‘superstar’ firms is driven by both factors, in my opinion. Globalisation is also part of that.

NS Some people find it hard to see how big dominant firms push down wages. Google, Facebook, HSBC or Bayer & Monsanto pay employees huge salaries. How can that lower wages? And if someone builds monopoly power in, say, the beer industry and pays workers too little, why can’t they go and work somewhere else, where the pay is better?

The mechanism is subtle. It’s not that these big firms are paying their workers too little. It’s more like an economy-wide effect. This is also happening beyond tech: in textiles, in the beer industry, in publishing, retail, wholesale, anything: you name it, it is dominated by some of these large firms. All these firms set their prices too high relative to costs, so all these firms sell less than what they could in a competitive market, and all these firms are producing less, and demanding less labour. That is where the drop in wages comes from.

Can market power in the beer industry affect the entire labour market? No, because beer is just a small share of people’s consumption. But we see behemoth firms dominating all markets. And there is ample evidence that firms with higher market power spend less on labour.

And this might explain one of the great puzzles in economics of recent years: the decline of what we call the “labour share.” That is the share of income or GDP that goes to workers.

Decades ago, economists including Nicholas Kaldor and Arthur Bowley argued that there were certain so-called “stylised facts,” which in physics we would call universal laws. One of these was that the labour share remained constant, at about two thirds of GDP, with capital and profits taking up one third. This had remained remarkably constant even despite huge changes in the labour force, for example as workers left agriculture over the past century and moved to manufacturing and other jobs. It was as if this had been constant forever.

But then in 1980, around the world, the labour share began to decline, from 65-66 percent of GDP, to about 58-59 percent today. That is a big deal.

In addition, our research shows that GDP now is 9-10 percent lower compared to what it would have been if we had had the competitiveness of 1980.

NS The World Bank currently estimates global GDP at about US$ 87 trilion. So 9-10 percent of GDP is worth eight trillion dollars or so. And the seven percentage point decline in the labour share that you describe would be worth about six trillion. Workers would have six trillion more in their pockets, globally, each year, if the labour share of GDP was what it was back then! The declining labour share distributes the pie more unequally, but the GDP loss shrinks the total pie too. It seems from your work that lax antitrust is a key part of the explanation in both cases.

In my earlier work I am familiar with global estimates of corporate tax avoidance of the order of $5-600 billion in annual global revenue losses. But $6-8 trillion is an order of magnitude bigger. Tax is important, but it amazes me that so little attention is being paid to antitrust outside the United States and outside narrow technocratic circles. Is my back-of-the-envelope calculation a reasonable one?

JE Yes. This is another way of looking at the Profit Paradox. If profits go up as a share of the economy, it must come from somewhere. It means less is spent on labour. More profits, workers are worse off. But also remember: in my opinion lax antitrust is only part of the story. Technological change plays a big role too. So does globalisation.

NS As an economist, how do you untangle market power from technological change, or globalisation in terms of impacts. Can you say it was ‘this factor more than this factor?’ Google is clearly an example of all these factors.

JE It is a very hard problem. Market power in retail is totally different to market power in social networks, or in the biomedical industry where they produce vaccines. And Inditex [the fashion firm that owns Zara and other brands] is as much a technology company as Amazon is, in many ways.

You must study each market, being very specific about each one, and this can only be done by dedicating many more resources to it. And you also have to recognise that these changes have economy-wide consequences, going through the macro economy – whether it is declining start-up rates, declining wage rates, or increases in inequality. These effects are driven by everything going on, in many different ways specific to each market.

Disentangling all this from a policy perspective, you have to look at it on a case by case basis.

NS In our last newsletter about dominant supermarkets and their submissive suppliers, we described a kind of ‘gravitational pull’ effect where the dominant firms take the lion’s share of the rewards, leaving the suppliers (and their employees) dependent on the dominant firms to fight for the scraps. Is this a big part of the story?

JE This is one of several effects. Amazon is a master in doing that. It is not a matter of all businesses doing well, but some doing well and everyone else gets squeezed. Suppliers and workers are getting screwed one way or another – directly like this, but also through this general macro effect on the economy.

NS What does your research tell us in terms of solutions?

JE We have to be careful to understand how firms grew dominant. If they grew dominant because they were so efficient – technology being the hero — then that is different than if they grew through mergers and acquisitions (M&A). Technology is a villain at the same time as it allows firms to become dominant because they are so productive. Being productive is great, but maybe they don’t pass that on to consumers. You don’t want to throw out the hero part: you want to address the villain part.

So if we are talking about splitting firms that have grown through M&A, I can definitely see that, we should split Facebook from Instagram and Whatsapp. But splitting Amazon is different. You could be throwing away some of the good parts, like digging up railway lines. You may have to find cleverer policies. I am not saying that will be easy. But it’s different from just saying “let’s split it up.”

And let me make a clarification here. What we call antitrust at the moment is anything that helps address issues of market power – whether the dominance is due to technological change, or due to M&A. I completely agree that antitrust policy is the solution, using a broad definition of antitrust. We have to deploy antitrust that addresses not just M&A but also the consequences of fast technological change. I believe there is a consensus about this, even if there is no consensus about how to do it.

Be the first to comment