Why Basic Income is more imprtant now than ever.

Guy Standing is a Professorial Research Associate, SOAS University of London and a council member of the Progressive Economy Forum. His new book is The Blue Commons: Rescuing the Economy of the Sea, published by Pelican. He is a technical adviser to the basic income pilot being conducted by the Government of Wales.

Cross-posted from PEF

Photo credit flickr

We are living in an age of chronic uncertainty, in which crises pile into one another, plunging millions of people deeper into insecurity, impoverishment, stress and ill-health. There was the financial crash of 2008, a decade of austerity, a series of six pandemics culminating in Covid, with more to follow, and now the ‘cost-of-living’ crisis as inflation mounts, possibly reaching an incredible 20% by the winter.

Nassim Taleb coined the term ‘black swans’ to designate shocks that were rare, unpredictable and had devastating consequences. Now, they are not rare. But they are uncertain in terms of when, where and why they occur and who will be adversely affected. As such, you and I cannot be confident that we will not be among the victims.

There is something else too. It looks as if a large proportion of the population will be affected. It is predicted, for example, that 45 million people in Britain will be suffering from fuel-related hardship this coming winter, bringing more deaths and ill-health. Natural disasters could hit numerous communities, and being in a job is far from a guarantee of escaping poverty or economic insecurity.

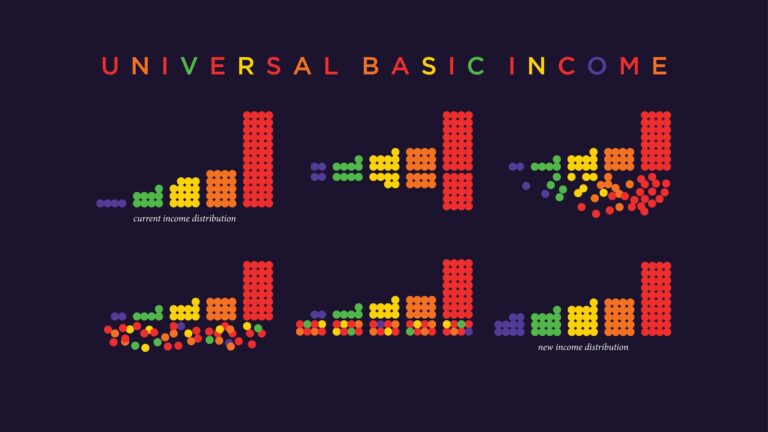

Three deductions should flow from this bleak scenario. First, feasible economic growth will not overcome the threats. Second, old policies are not valid for tackling the new crises. Third, we need to build societal resilience, a new income distribution system and a new social protection system. ‘Targeting’ on a minority would be futile and inequitable.

The post-war welfare state was built on a presumption of Full Employment of men in full-time jobs earning family wages, in which there was a need for compensation for ‘contingency risks’ or ‘temporary interruptions of earnings power’. It was always sexist. But the essence was ex post compensation. This is inappropriate today where the core challenge is chronic uncertainty, for which one cannot devise a social insurance system. What is needed is an ex ante protection system, one which gives everybody guaranteed basic security.

But our politicians are failing to appreciate the nature of the challenge and are resorting to yesterday’s answers to yesterday’s problems. First, the Conservative leadership contenders and the Labour leadership are making overriding commitments to maximising economic growth. Keir Starmer says that the Labour motif for the next General Election will be ‘Growth, Growth and Growth’, and that he will only consider policy proposals from the Shadow Cabinet if they promote growth. Meanwhile, an adviser to several Tory Chancellors says the next Conservative Prime Minister will commit to an ‘absolute priority of maximising growth’.

A phrase that comes to mind is the one used by Michael Gove to characterise Liz Truss: they are taking a holiday from reality. Both the Conservatives and Labour are misdiagnosing the nature of the recurrent crises. Both are chasing the mirage of high GDP growth, wishing away the awful ecological implications. Starmer says the free market has failed. But we do not have a free market. It is rentier capitalism, in which most income flows to the owners of property – financial, physical and ‘intellectual’. Economic growth has to be unrealistically high for the precariat and other low-income groups to gain anything. This is why real wages have stagnated over the past three decades, and why earnings have lagged GDP growth, the difference made up by rising debt.

The income distribution system has broken down. Across all OECD countries, financialisation has accelerated, and is fuelling inflation for its benefit. In the UK, financial assets of financial institutions have risen to over 1,000% of GDP, with most finance used for speculative activity rather than for productive investment.

A rising share of income is going to capital, and more is going in rent, in excess profits. Within the shrinking share going to labour, more has gone to the top, again in forms of rent. The value of wealth has risen sharply relative to income, while wealth inequality is much greater than income inequality.

All the time, the precariat grows. What should exercise progressive politicians is that for a growing proportion of the population income instability and insecurity have grown by more than is revealed by trends in average real wages. A result is that millions of people are living on the edge of unsustainable debt. People lack income resilience. Desirable as that is, raising the minimum wage will not solve that, and nor will trying to be King Canute in banning flexible labour relations.

So what are our politicians proposing in this context of chronic uncertainty, a broken income distribution system and a daunting ecological crisis? What marks all of what they are offering is ad hoc window dressing that seems deliberately intended to avoid the reality that we have a transformation crisis on our hands. Tax cuts would benefit the relatively secure, price freezes would cost the public finances and distort markets, raising the minimum wage would bypass the precariat and those outside the labour market, and targeting more benefits to those receiving Universal Credit would merely bolster an unspeakably punitive and inequitable scheme.

It brings to mind what William Beveridge wrote in supporting his 1942 Report that led to the post-1945 welfare state. ‘It’s a time for revolutions, not for patching.’ So far, our mainstream politicians seem to lack the backbone. The strategy should be one of dismantling rentier capitalism and recycling rental incomes to everybody. Above all, in the foreseeable future of chronic economic, social and ecological uncertainty, the base of social protection should be the provision of ex ante security. People – all of us – must know that, whatever the shock, we will have the wherewithal on which to survive and recover.

This is when politicians should be looking at ways of introducing a basic income for every usual resident. It would not replace all existing benefits, and would have to involve supplements for those with special needs. It would have to start at a modest level, but would be paid to each man and woman, equally and individually, without means-testing or behavioural conditionality. Legal migrants would have to wait for a period, which does not mean they should not be assisted by other means. And to overcome the objection that it should not be paid to the rich, tax rates could be adjusted to make them more progressive.

Before coming to how to pay for it, I want to emphasise the reasons for wanting a basic income for all. The fundamental justification is moral or ethical.

First, it is a matter of common justice. Our income owes far more to the contributions of all our ancestors than to anything we do ourselves. Even Warren Buffet admits that. But as we cannot know whose ancestors created more or less, we should all have an equal ‘dividend’ on the public wealth. After all, if we allow the private inheritance of private wealth, there should be a public equivalent. The Pope has come round to that rationale for his support for basic income. It is also a matter of ecological justice, since the rich cause most of the pollution while the poor pay most of the costs, primarily in diminished health. A basic income would be a form of compensation.

Second, it would enhance personal freedom, including community freedom. Although paid individually, that would not make it individualistic. Experiments have shown that when everybody has basic income, that induces stronger feelings of social solidarity, altruism and tolerance.

Third, it would enhance basic security, in a way that means-tested, conditional benefits cannot possibly do. Politicians seem reluctant to offer ordinary people basic security, which they would always want for themselves and their families. Insecurity corrodes intelligence and induces stress and loss of the capacity to make rational decisions. We are experiencing a pandemic of stress and rising morbidity. None of the existing policy proposals would reduce that.

Finally, there are instrumental reasons. Experiments with basic income around the world have shown it results in improved mental health, less stress, better physical health, more work, not less, and enhanced social and economic status of women and people with disabilities.

Basic income is not a panacea, but it should be part of a transformational strategy, complemented by putting public utilities, most notably water, back in public hands and by rent and energy price controls. There must also be fiscal reform that would help in the fight against the ecological decay while helping to overcome chronic uncertainty. Progressives should accept that taxes on income and consumption should be raised, because they are relatively low in this country and because more revenue is needed to pay for our public services, and in particular reverse the privatisation of our precious health service.

The call for Universal Basic Services is state paternalism and would not help with the nature of the crisis. People need financial resources to overcome the economic uncertainty and lack of resilience. No government can know the particular needs of particular people, and so subsidising some services would be both arbitrary and distortionary.

However, in addition to higher taxes on income to pay for services, we should think of ‘the commons’, that is, all that inherently belongs to every citizen of the UK, beginning with the land, air, water and sea, and the minerals and energy underneath. Over the centuries, they have been taken from us illegitimately, without us or our ancestors being compensated. This includes all the land that has been ‘enclosed’, the forest and public spaces that are being ‘privatised’, the seabed that is being auctioned off, and the oil and gas sold for windfall gains given away in tax cuts for the wealthy.

This line of reasoning leads to the proposal that levies should be put on elements of the commons that we have lost, with the revenue put into a Commons Capital Fund, which would be charged with making ecologically sustainable investments, from which ‘common dividends’ would be paid out equally to every resident citizen.

The initial base for paying for a basic income would be conversion of the personal income tax allowance, which benefits higher-income earners and contradicts the view that in a good society everybody should be a taxpayer. If the revenue from that were put into the Fund, it would provide enough for £48 a week for every adult. Then add a 1% wealth tax, justifiable because wealth has risen from three times GDP to seven times, wealth inequality is much greater than income inequality and over 60% of wealth is inherited, unearned. A 1% wealth tax would be sufficient to pay a modest basic income. And more revenue could be raised by rolling back on many of the 1,190 subsidies and tax breaks given mostly to wealthy people. A modest Land Value Tax, based on size and value of land, is also justifiable on common justice grounds, especially as the value of land has grown from an already high 39% of non-financial assets in 1995 to 56% in 2020.

Then add a Carbon Tax, vital if we are to reduce greenhouse gas emissions and global warming, but which will only be politically popular and feasible if all the revenue from it is recycled as part of Common Dividends. Other levies into the Fund could include a Frequent Flyer Levy and a Dirty Fuel Levy on all those cruise liners and container ships that keep their engines going all the time they are in port, poisoning the atmosphere and causing widespread throat cancer.

Here we have the basis of an income distribution system suited to the era, with supplements for all those with extra needs. It is an approach that would open up a vista of multiple forms of work, unpaid as well as paid, putting care at its centre. It would be an era in which basic security was regarded as a fundamental right, and it would be one in personal freedom would be enhanced while precarity would be reduced, the precarity that comes from dependency on a discretionary state and undignified charity. At this moment of omni-crisis, we need to march in that direction.

Postscript:

In their response to the cost-of-living crisis, the New Economics Foundation proposes ‘free basic energy’ for all households. Besides penalising those outside households, this presumes that all households’ poverty and insecurity is due to high energy prices. For many that will be so, but for some other factors may be more important.

It would also raise moral hazards. Some people may not need the full free allocation, but would be inclined to waste what they did not need, because it was free. The amount given free would have to be based on some ‘average’ household. But many are in non-average households, or are outside them more, for whom the free allocation would be too little or exceed our basic need.

Some people might prefer to cut energy use a little if given the choice of spending on food, debt reduction or extra clothing. Better to enable them to make the choice that suits their particular needs.

The NEF also propose to top-up Universal Credit and legacy benefits. But we know these do not reach many of the poor, due to sanctions, the humiliating application process and long delays. What about the millions in need who would be excluded? Much better than relying on paternalistic measures and behaviour-conditioned targeted benefits would be a basic income, with supplements for those with special needs, coupled with a modest wealth tax and land value tax.

Be the first to comment