Most economists and journalists don’t understand that when companies save rather than borrow and make investments, the state must run a deficit – a lesson that surplus-crazy Austrians and Germans have not learned, yet.

Heiner Flassbeck is an economist, as well as publisher and editor of “Makroskop” and “flassbeck economics international”

Originally posted in German at Makroskop

Translated and edited by BRAVE NEW EUROPE

The ignorance in politics and the inability of politicians to openly discuss the vital issues of society with the electorate seem to grow from day to day. How can it be that modern societies fail so fundamentally to grasp the simplest of insights?

One of our readers and subscribers, a medium-sized entrepreneur from Austria, had had enough of politicians’ slogans and wrote a long letter directly to the party in Austria which sees itself as pro-business, the ÖVP. He began with a simple statement:

“Since we as a nation have an overall surplus of income, we need to think about who has an income deficit (i.e. who is in debt.).

He then explained the crucial context (which I slightly shortened) as follows:

“It may be disturbing for many, but any market economy must solve a problem and this is the saving problem, because “living below one’s means” reduces the exchange of goods. In a functioning market economy, the corporate sector solves the problem of private savings through its own indebtedness. Since the corporate sector in Austria still invests too little, it is still necessary for the state to run a “budget deficit”. If the new ÖVP continues to insist on a balanced public budget, there will inevitably be stagnation, despite the current-account surplus”.

The current leader in Austria wrote back to him:

“You as an entrepreneur know best of all: the boom times should be used to take precautions to have reserves in economically weaker times. With the budget for change that the federal government has decided for 2018/19, sixty-five years of debt policy at the expense of future generations will end – without new or increased taxes! Sustainable savings in the system and for non-Austrians give us the urgently needed leeway to ensure honest relief and make Austria fit for the future. For the first time since 1954, the federal government will spend less in 2019 than it earns. […] With this “common-sense” budget, we are implementing what we were elected to do in October 2017. The new budget policy is not an end in itself, but it creates room for manoeuvre to ensure honest relief and to reduce public debt.”

It must be said, however, that the word “common sense” [Hausverstand] is used in Austria just as “gesunder Menschenverstand” is used in our own country, which is why I steer clear of jokes about the Swabian hausfrau. But where is the common sense in claiming that a debt policy is run at the expense of future generations? And what happens if in Austria and Germany the state really does reduce its debt? Why can’t this be discussed in terms of numbers?

Figure 1 shows Austria’s fiscal balances and it is immediately obvious that in the past ten years companies have not exactly played the role they are supposed to in a market economy – namely to use their investments to fill the demand gap that private households are opening up with their savings.

Figure 1

Financial balances of economic sectors in Austria

[Private Haushalte = Private households, Unternehmen = Corporate, Ausland = Foreign, Staat = Public]

Why are so many laymen in power?

To take another example: last weekend I was invited to speak at a very high-level conference and I gave a short version of what I had said in Mannheim (to be found here in German). If, I began, during times of extremely low interest rates (today the long-term nominal interest rates in Germany are negative and there is even an inverted yield-curve) investment in Germany is not even beginning and companies are running a net savings balance – this in a country that is much better off than most other European countries – there is simply no other way in Europe to stimulate the economy than by fiscal policy.

After me, two people from the highest European economic policy elite spoke on the same topic. One talked about better rules for the WTO, about improving internal competitiveness in Europe and about the production of battery cells. The other put forward the stunning thesis that one only had to redirect the European savings surplus (= current-account surplus, which of course also includes the German surplus) into productive investments, then everything would be alright – and the best way to do this would be the European Capital Market Union. Again and again one heard the age-old argument that all one had to do was “structural reforms” or consistently reform the supply side, and everything would be fine.

A third example comes from the media: Lisa Nienhaus, deputy head of the economics section at the German weekly die ZEIT, who studied economics in Cologne, writes about the debt brake and presents five arguments for maintaining it. The first “argument” already knocks you off your perch, because she actually claims that Germany must have low debts because others in Europe have such high debts. Because then Germany can bail out the others when things get tough. But she does not write that this is explicitly forbidden in the Maastricht Treaty. She should at least have written that everything speaks in favour of abolishing this clause and not, as Germany does, upholding it by force.

But there’s more. Maintaining that the state can get into debt as long as the interest rate is lower than the growth rate, she notes:

“On the other hand, this shows that we are dealing here with a pure cost consideration, which alone makes economic nonsense. Especially in bad times, when companies spend less, the state is poor too. Debt is relatively expensive for them, growth is below the interest rate. Should it therefore take on particularly little debt in bad times? That will not work. And it is even economically dangerous. Because in bad times, it is the state which jumps into the breach and saves the economy.”

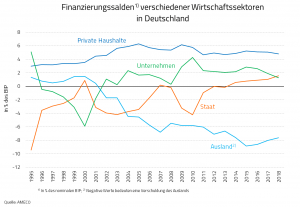

This demolishes an argument that explicitly refers to long periods of no less than ten years, because it cannot be applied to shorter periods. Bravo, that really is a convincing argument. After all, she even understands that the state sometimes has to step into the breach. But when? In bad times? No, exactly when the entrepreneurs don’t want to assume the role of debtor. Such times are actually always with us, as Figure 2 clearly shows for Germany!

Figure 2

Financial balances of economic sectors in Germany

[Private Haushalte = Private households, Unternehmen = Corporate, Ausland = Foreign, Staat = Public]

It is obvious that it is extremely difficult to take note of a simple empirical fact and draw simple conclusions from it. In any case, die ZEIT is not able to do this with its entire economic editorial department. Is this only due to ignorance? Surprisingly, no large editorial office and no well-known columnist in Germany (to my knowledge) has yet managed to draw the simplest of all conclusions from the fact that companies are saving, as our Austrian entrepreneur does. Norbert Häring (also a contributor to Brave New Europe) has just written about this strange phenomenon, referring to certain studies. But, unfortunately, before he could draw the obvious conclusion about government debt, he ran out of ink.

Erring on the other side: MMT

How difficult such simple interrelationships are to explain can be seen on the other side, namely in current discussions in the media on Modern Monetary Theory (MMT). Although the argument about company savings is part of the MMT canon, many of its representatives are so eager to communicate that they can no longer distinguish between what is a compelling and what is a dangerous argument. In an interview with die ZEIT, Stephanie Kelton arrives almost uninvited at the wonderful statement that a state with control of its own money cannot go bankrupt.

That is perfectly correct, but unfortunately also completely irrelevant in a discussion about the national debt of the USA or Europe, which is the issue of the moment. But with that statement right at the beginning of the interview she brings all calmly thinking people up short, because nobody actually asked the question (not even her interviewers at die ZEIT). By emphasising that the USA cannot go bankrupt, she wakes up so many sleeping dogs that even she probably can’t get to sleep afterwards for all the barking. Why not keep silent until the question is specifically asked?

I don’t want to repeat what I have already written about the question of taxes and MMT, which the state either “needs” or “doesn’t need” (to be found here in German), but the argument is a constant communications howler, because you can’t explain at all in public what you mean by it. The worst thing, however, is that the question is also irrelevant, because it is practically always a question of whether and how much the state spends more than it has collected through taxes. You have to teach people and politicians that there is still a lot of wriggle room. Since no one at all says that the state does not need taxes, one should simply leave it at that, instead of going into this communicative nirvana again and again.

Strong arguments must be used

But the fact that there is still wriggle room would not apply if companies were not saving, as shown above. Because they are, the argument is so incredibly compelling, because no reasonable person can deny that one needs a counterpart to the savings of private households. The entire mainstream has absolutely nothing to say about this argument, which is why they are constantly rushing to ask why companies behave in this way, albeit without drawing the consequences for the state.

If you have such a strong argument, you have to consider carefully whether you need any other arguments at all. Any secondary argument you put forward weakens the strong primary argument, because you give the impression that one argument is not enough. But it is enough. If the relationship between savings demand and the underlying movement of aggregate income is first politically recognised, the mainstream argument falls away. Then you can continue to work calmly and question other positions, because then the field is much better prepared.

In Foreign Affairs there was a nice article about MMT and the question of what role theory plays in the markets. Surprisingly, Richard Koo and Jan Hatzius (of Goldman Sachs), who are not part of MMT at all, were mentioned most frequently, but they clearly emphasised the argument between the current-account balance and the role of companies. Richard Koo just told me again last weekend that it took 20 years for Japan to understand his theses and the implications of saving companies.

If important representatives of MMT were more open to cooperation with other economists and not always out to go through the entire canon of their positions, the world might not be so far away from taking a step in the right direction on this crucial issue. Sooner or later, those thick-headed Austrians and Brussels technocrats will have to recognise that “common sense” is going in a new direction.

Be the first to comment