“The reaction to Weber’s case for price controls, in short, is not against ‘Nixonian cynicism or Communist incompetence.’ It is against the truth of modern economic history, which is of an American triumph, long repressed, and of Chinese competence, impossible to ignore but equally impossible to acknowledge.”

James K. Gaöbraotj is Lloyd M. Bentsen Jr. Chair in Government/Business Relations at the LBJ School of Public Affairs at the University of Texas at Austin

This article was first published on the Monetary Policy Institute Blog

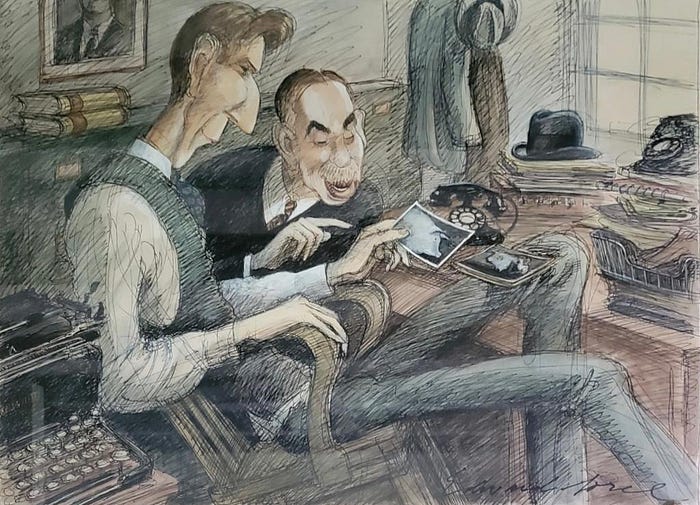

The painting attached, by Edward Sorel, is a fanciful version of a real meeting at the OPA in 1942, between John Maynard Keynes and the deputy director for prices, John Kenneth Galbraith.

Talk about Transitory! So far as one can tell, the great US inflation panic of 2021–2022 has ended. It was replaced briefly by a banking panic, and then, for a few months, by the great debt default panic of 2023. What will come next? Who knows? Since we live from one clickbait crisis to the next, surely they will come up with something.

To reprise, in September, 2022, Professor Jason Furman of Harvard University wrote as follows:

“The scariest economics paper of 2022 argues that labor markets remain extremely tight, underlying inflation is high and possibly rising, and several years of very high unemployment may be necessary to get inflation under control. … To get the inflation rate to the Fed’s target of 2% by then would require an average unemployment rate of about 6.5% in 2023 and 2024.”

It didn’t happen, and it wasn’t needed. The present US unemployment rate is 3.7% but inflation had already peaked, we now know, in June 2022. The annual inflation rate over the six months from November 2022 through April 2023 was down to about 3.4%.

Magical thinkers will credit Jerome Powell and the stalwarts of the Federal Reserve, who began raising interest rates in early 2022. What one cannot do, is credit the Fed with anti-inflationary success, and at the same time credit our high-powered mainstream economists who argued, over many months, that excessive macro stimulus and “tight labor markets” had generated a “persistent” inflation problem, requiring harsh and unrelenting interest rate increases. Either the Fed hit an easy target, or inflation was mainly transitory from the beginning.

To be fair, the Fed’s policies did have some effect. They stalled construction (briefly) and halted a real estate boom, affecting the consumer price index mainly through the exaggerated impact of homeowners’ imputed rent. Since imputed rent is a statistical chimera, why this is sensible public policy is a mystery. Apart from that, there is no channel from interest rates to consumer prices, short of major effects on the dollar or the whole economy — neither of which have yet occurred.

One is therefore forced to the conclusion that the price increases of 2021–2022 were in fact mostly transitory. Apart from the imputed rent component which represented (largely) an asset bubble, popped by rate increases, the other major transitory elements included energy costs — brought back to earth for now by sales from the Strategic Petroleum Reserve — and supply-chain disruptions, notably in semiconductors and affecting the markets for new and used cars.

“Transitory” does not mean “settled and forgotten.” Future energy prices are uncertain. They are subject to both speculation and manipulation, as well as to the unknowns of geology and geopolitics. What will happen this year and next, let alone beyond, is a question mark. However, energy supply depends on investment, so it’s obvious that a high-interest-rate policy does not help.

“Mostly,” also, does not mean “entirely.” There is at least one element of last year’s price surges with the potential to cause persistent trouble. That is profit margins. In normal times, margins generally remain stable, because businesses value good customer relations and a predictable ratio of price to cost. But in disturbed and disrupted moments, increased margins are a hedge against cost uncertainties, and there develops a general climate of “get what you can, while you can.” The result is a dynamic of rising prices, rising costs, rising prices again — with wages always lagging behind.

In this situation, there is a clear role for price controls, as Isabella Weber has forcefully argued since her breakthrough article in The Guardian in December 2021. The main function of controls under these conditions is to break the chain of price/cost/price increases. Their effect, if properly done, is to restore the normal climate of expected stability and good behavior, so that business managers are induced to focus, as they should, on quality and quantity rather than price.

In an excellent article in the current issue of The New Yorker, Zachary Carter tells what happened to Weber when she first surfaced:

“In a matter of hours, Weber, who was thirty-three years old, had transformed from an obscure but respected academic at the University of Massachusetts, Amherst, into the most hated woman in economics — simply for proposing a “serious conversation about strategic price controls.” The uproar was clearly about something much deeper than a policy suggestion. Weber was challenging an article of faith, one that had been emotionally charged during the waning years of the Cold War and rarely disputed in its aftermath. For decades, the notion of a government capping prices had evoked Nixonian cynicism or Communist incompetence.”

Carter is a fine reporter and the author of a superb biography of John Maynard Keynes, but in this case, I fear, his characterization of the historical and political developments is actually too gentle. In the savage dogmas and waves of abuse thrown at Isabella Weber, something even deeper and darker was at play.

Weber is an economic historian. She has written a spectacular book on the emergence of modern China, through gradual reforms, maintained in part through a long tradition of strategic price controls. And what did Chinese experts study, to learn how to implement price controls over modern industry? As she relates, they studied the most successful modern experience, which was that of the Office of Price Administration (OPA) in the administration of Franklin Delano Roosevelt in the United States of America, 1942–1946.

Price controls were abolished, in the US, in 1946, over popular protest — though they were later used in the Korean war and again in the 1970s, with guidelines in force at other times in between — notably for instance in President Kennedy’s 1962 battle with US Steel. It is fair to state that the doctrine of “free markets” and specifically the role of free prices as the principal adjustment mechanism in a market economy emerged, in economic education in the United States — precisely to discredit the government’s role in price management. From this, the entire charade of dumping responsibility for “fighting inflation” on the central bank emerges.

The reaction to Weber’s case for price controls, in short, is not against “Nixonian cynicism or Communist incompetence.” It is against the truth of modern economic history, which is of an American triumph, long repressed, and of Chinese competence, impossible to ignore but equally impossible to acknowledge.

Thanks to many generous donors BRAVE NEW EUROPE will be able to continue its work for the rest of 2023 in a reduced form. What we need is a long term solution. So please consider making a monthly recurring donation. It need not be a vast amount as it accumulates in the course of the year. To donate please go HERE.

Be the first to comment