Central banks have stoked housing inequality, increasing the wealth of those with assets and depriving those without

Cross-posted from Positive Money Europe

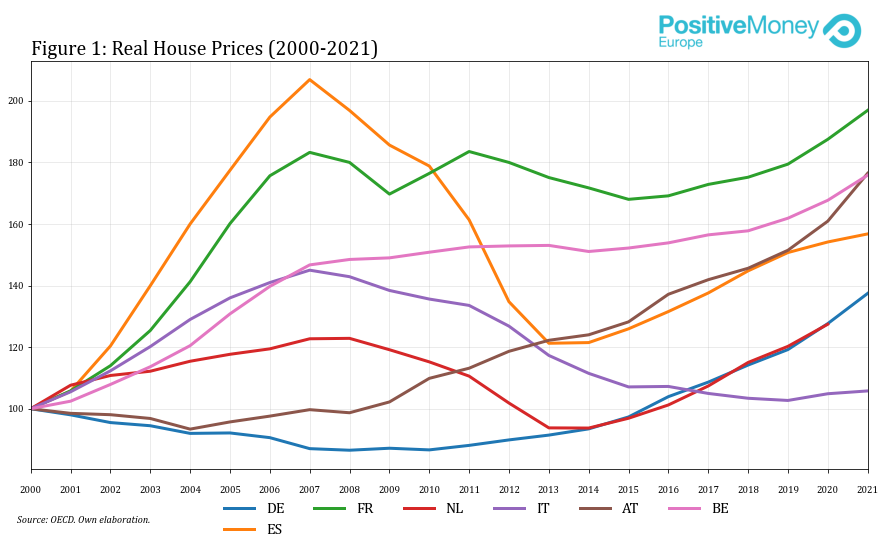

Housing prices plunged during the global financial crisis. A new cycle of increasing house prices started around 2013-2014 (Figure 1). According to Eurostat data, house prices have risen by 45% between 2014-Q1 and 2022-Q1 in the euro area. The pace of growth has been increasing over the last three years.

Expansionary monetary policy has contributed to rising house prices

The research literature has identified two ways in which the past decade of expansionary monetary policy by central banks has contributed to this steady increase in house prices.

First, the interest rate channel. As the ECB lowers its interest rates, mortgage rates fall. The resulting fall in debt servicing costs leads to an increased demand for property purchases, inevitably leading to rising property prices. This inverse relationship between interest rates and house prices has been found to be robust in existing literature. For instance, Shida finds that a 1% increase in the long-term real interest rate decreases house prices by 7%. Nocera & Roma find that a 1% increase in the short-term interest rate reduces house prices by 6.4%. Calza, Monacelli & Stracca find a weaker negative effect of interest rates on house prices. The authors find that the impact of rates depends on specific domestic characteristics: the link is stronger with higher loan-to-value ratios, adjustable interest rates, and higher mortgage debt-to-GDP ratios. Overall, more liberalized mortgage markets lead to a greater impact of interest rate changes on house prices.

Second, the quantitative easing (QE) channel. QE affects house prices through the portfolio rebalancing effect, that is, by shifting investor demand. When central banks purchase safe financial assets (such as government bonds) this provokes a reduction in their yield, making these assets less attractive for investors. This then creates an incentive for investors to “search for yield” by looking for more profitable investments such as in the residential real estate sector, which is seen by investors as a safe and attractive bet, especially in big cities. The resulting flow of money entering the property market leads to appreciating house prices. The evidence of a strong positive impact of QE on house prices has been extensively covered in the literature.

Of course, monetary policy is not the sole factor affecting house prices. Income growth, changes in credit provision, and more recently, pandemic-induced changes in preferences and accumulated savings also affected house prices.

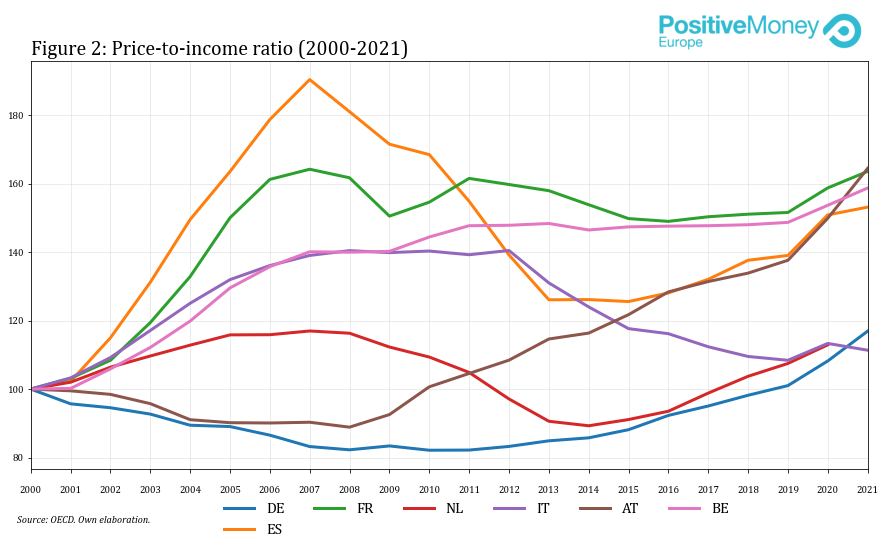

How rising house prices degrade housing affordability

As a consequence of the acceleration of house prices, housing affordability also deteriorated in the years leading up to 2021. Figure 2 shows the rise of the house price-to-income ratio. This means that households need to use a higher share of their income for the purchase of a home. Employment instability combined with more stringent lending conditions further jeopardised access to homeownership. This has shifted the characteristics of new mortgage borrowers in the post-crisis period from young and low-income households to old and affluent ones. This trend is particularly striking in countries most affected by the crisis, like Ireland and Spain.

Unsurprisingly, rising prices created a further socio-economic divide. Older and more affluent households who already owned property have seen their wealth increase as house prices soared. This increased wealth could then be used as collateral to accumulate more property, for example through buy-to-let mortgages, meaning mortgages that landlords use to purchase a home that they will later rent. On the other side, younger and low-income households face even greater difficulties in climbing the housing ladder.

This inherently unequal housing market creates a self-propagating mechanism of wealth inequality, that is then transferred to the next generations as parental wealth becomes a key determinant to access homeownership. This self-propagating mechanism is further fuelled by a tax system that provides incentives to mortgagors –through mortgage interest tax reliefs– while imposing low (or non-existent) inheritance taxes, which further entrenches unequal access to housing.

Will raising rates help the situation?

Since July 2022, The ECB has raised its interest rates by a cumulative 125 basis points. Does that mean the housing situation will improve? Unfortunately not. There are two reasons why restrictive monetary policy is not an adequate policy response to the housing crisis.

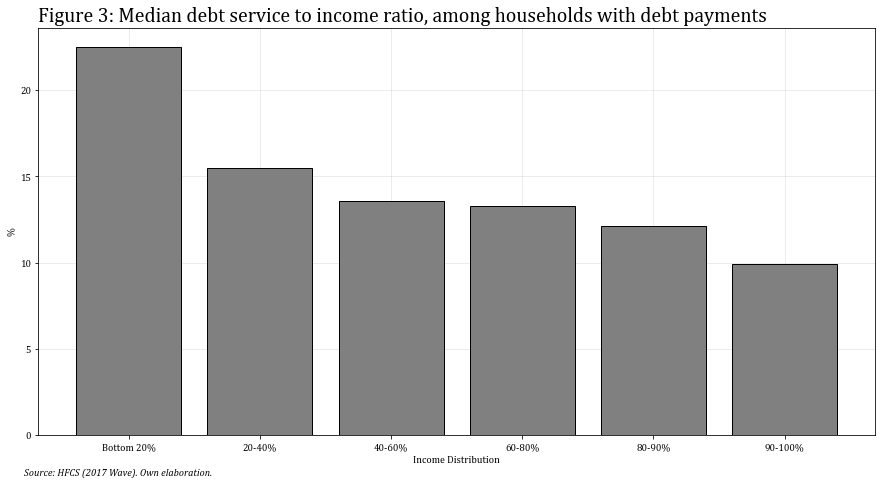

First, interest rate hikes increase debt servicing costs. This will reduce demand for new house purchases, but it will do so by exerting pressure on households’ debt servicing capacity. This is especially true for households at the bottom end of the income distribution, who devote a larger share of their income to interest rate payments (Figure 3).

According to the latest ECB’s Financial Stability Review, households within the lowest income quintile spend 40% of their income on energy and food, whose prices are growing explosively. As a larger part of their income goes towards energy and food prices, interest rate hikes further reduce their income and capacity to pay back their debt. Furthermore, if house prices decrease, the share of households with negative equity (meaning that their remaining mortgage debt is higher than the price of their house) will increase, thus also their likelihood of defaulting on their debt. Byrne, Kelly & O’Toole show that, in Ireland, an increase in the interest rate of 1% increases households’ probability of default by 5.8%. This effect is even stronger when house price fall and households move to a negative equity position.

A hike in interest rates affects house prices, but it also negatively impacts the whole economy, mostly by suppressing labour income. The interest rate is too much of a blunt instrument, as it can only bring house prices down by imposing collateral damage to the rest of the economy. Therefore, the impact of interest rates on house prices does not imply a simple proportional effect on the house price-to-income ratio. The Swedish central bank (Sveriges Riksbank) tried to target house prices but abandoned this practice due to its undesirable effects on employment.

How to fix the housing sector

Low interest rates, by decreasing the cost of liquidity, promote credit creation. There is nothing intrinsically bad in this. Rather, credit creation is essential for our economies. However, instead of promoting lending to socio-economically desirable projects, a low interest rate environment, in our financial system, encourages asset-price bubbles.

In its annual report, the European Systemic Risk Board draws two possible future scenarios for the European real estate sector. In a low growth scenario, the fall in household income will lead to falling house prices, triggering defaults, which would destabilize the financial system. In the optimistic scenario, where the economy continues growing, house prices would continue increasing, and therefore risks will continue to build up in the sector, eventually leading to a market crash.

In other words, we will have a housing crisis either now or later. There must be an alternative. As we saw earlier, low-income groups lose out both when housing prices increase or decrease. Under a new housing policy regime, it would therefore be critical to stabilise housing prices.

Monetary policy, conceived in its narrow sense –meaning an independent central bank that primarily targets inflation using the short-term rate of interest – is ill-prepared to attain such a goal. But there are plenty of policies that we can implement to achieve it. Outside the realm of central banks, we should end fiscal incentives for mortgages, increase the public provision of affordable housing, impose a land-value tax, and promote further measures that limit speculative transactions in the housing sector. Furthermore, we could boost the provision of social housing by enhancing the role that the European Investment Bank has in financing social housing projects). Financial regulators must impose tighter macroprudential policies to dampen indebtedness and hence reduce house prices. Borrower-based macroprudential policies –meaning regulatory measures that limit the capacity of household indebtedness (for example loan-to-value or loan-to-income ratios)– have proven useful for that end. Yet, these should also be implemented with a progressive scope, especially restricting mortgages for second-home purchases and buy-to-let mortgages. As for the ECB, enhancing monetary and fiscal policy coordination is key. The ECB needs to be liable for keeping member states’ government borrowing under control so that fiscal policy can push for a structural transformation of the economy. This would provide more fiscal space for governments to make the housing sector more just and affordable and also respond to negative distributional shocks.

Support us and become part of a media that takes responsibility for society

BRAVE NEW EUROPE is a not-for-profit educational platform for economics, politics, and climate change that brings authors at the cutting edge of progressive thought together with activists and others with articles like this. If you would like to support our work and want to see more writing free of state or corporate media bias and free of charge. To maintain the impetus and impartiality we need fresh funds every month. Three hundred donors, giving £5 or 5 euros a month would bring us close to £1,500 monthly, which is enough to keep us ticking over.

Be the first to comment