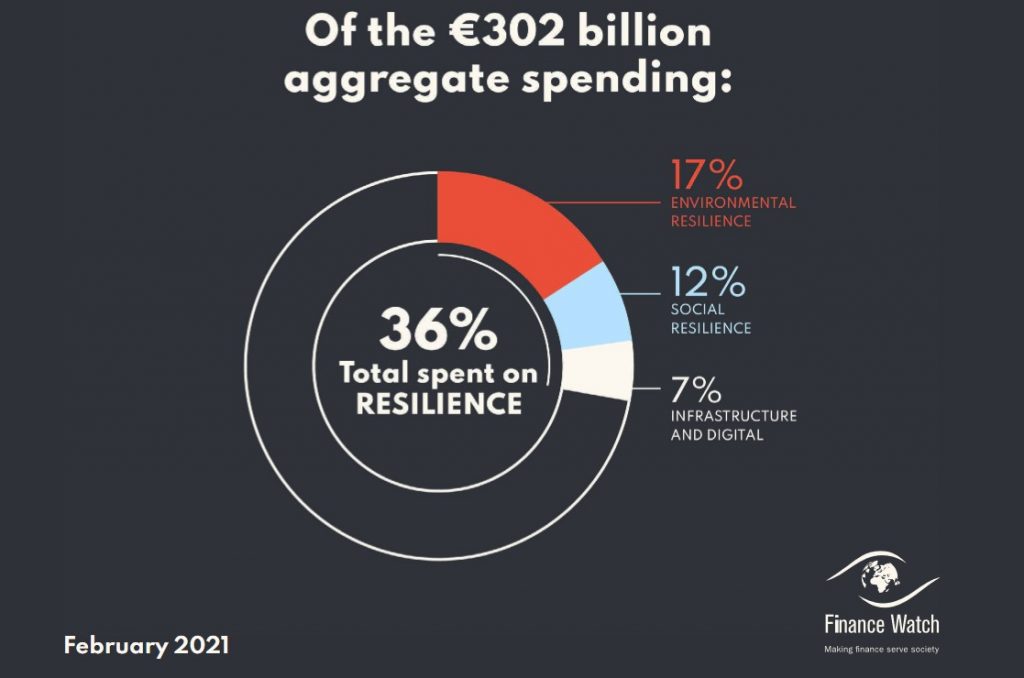

Finance Watch has analysed the fiscal plans put in place by the French, German and Spanish governments. The plans aim to help repair the immediate economic and social damage brought about by the coronavirus pandemic as well as make their respective economies more sustainable and resilient to future shocks. The plans will be partially financed by the funds provided by the Next Generation EU Recovery and Resilience Facility (RRF) in accordance with the criteria defined by the RRF Regulation. The aggregated funding of the three fiscal plans amounts to around €302 billion.

As Senior Research and Advocacy officer at Finance Watch, Julia Symon works, amongst other topics, on Capital Markets Union, MiFID/MiFIR, and fiscal policy

Cross-posted from Finance Watch

Aggregate Spending of 302 billion euros by Germany, France, Spain in response to the COVID crisis

Finance Watch assessed the proposed policy measures of France, Germany and Spain on their environmental and social sustainability as well as contribution to economic recovery vs resilience objectives. For this, the time horizon over which the measures are expected to have their effect (long-term vs short-term), and the alignment with the strategic objectives were taken into account. Such objectives include, among others, the reduction of greenhouse gas emissions, energy transition, digital transformation, social sustainability. Resilience measures were defined as long-term oriented and expected to have transformative economic effects rather than restore the pre-crisis economic situation, which is the main objective of recovery-oriented measures.Based on the analysis, the breakdown of the aggregated fiscal spending of €302 billion can be seen in the graphic above: Expert judgement was used to execute the assessment. No account of the starting conditions in the country was taken, which might accelerate or slow down the transition towards sustainability and resilience.

Summarizing the results of the Finance Watch review:

➜Resilience-oriented measures account for roughly 36% of the aggregate fiscal plan spending across France, Germany and Spain with the remaining 64% of the funds being directed towards recovery objectives.

➜Policy measures, which received the largest budget allocations, are to a large extent driven by short-term considerations such as supporting the demand side of the economy (social benefits in Germany and Spain) or ensuring competitiveness of the national industry (France).

➜The plans offer a weak long-term environmental sustainability component compared to the overall amount of spending (for all countries reviewed); the link of the proposed policy measures to the country’s strategic climate and energy goals has not been established (France, Germany).

➜The cohesion objectives of the plan dominate over economic transformation goals (Spain).

➜Case evidence suggests the funds have already been used to the benefit of powerful industry players rather than transform the overall economic structure and ensure its resilience to future shocks. Noteworthy examples include:

• Air France bailout without legally binding conditions imposed

•Lufthansa bailout with no specific business oversight conditions from the government

• Loan for the multinational conglomerate Thyssen-Krupp

• Luxury cruise shipbuilder MV Werften bailout without receiving guarantees that job cuts will be avoided

• Loan guarantees for the hotel chain NH Hotels

• Loan and loan guarantees for the airline Iberia & Vueling

• Loan for the football club Real Madrid.

The measures put in place as per the plans should be viewed in the broader context of the EU economic governance and fiscal framework. The framework comprises a complex architecture of rules constraining Member States’ fiscal policy, combined with a system of governance and tools aimed at enforcing these rules. The most significant of these rules are the 60% limit on the government debt-to-GDP ratio and the 3% limit on the budget deficit-to-GDP ratio, including the corresponding adjustment mechanisms in case of limit deviations. These limits do not properly account for the economic cycle, quality of spending and impacts that environmental and social imbalances have on long-term debt sustainability. Thus, the existing fiscal framework reinforces policy short-termism and prevents the EU countries from reaching their social and environmental goals. Even though the rules were temporarily suspended due to the pandemic situation, potential return to fiscal austerity could break the recovery.

Be the first to comment