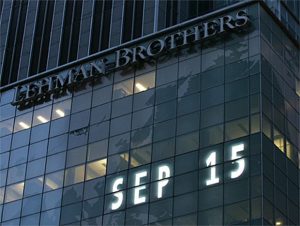

2018 marks the 10th anniversary of the stock market crash of 2008; the current financial malaise is the result of the bank bailouts, not the crash; an over-indebted economy cannot be saved unless the banks fail; debt deflation; the magic of compound interest; how pension funds, state and local governments adversely affected by the bank bailouts; growth of the financial extraction FIRE sector (finance, insurance and real estate); quantitative easing; asset price inflation; wealth concentrated at the top in Roman antiquity led to the Dark Age; Eurozone imposition of austerity Greek style; tariffs, economic sanctions and isolationism.

Listen here

Be the first to comment