After 25 years the ECB has still not been able to fulfil its task

Michael Roberts is an Economist in the City of London and a prolific blogger

Cross-posted from Michael Roberts’s blog

The European Central Bank (ECB) turned 25 years yesterday on 1 June. The ECB is at the centre of the so-called euro experiment that established a single currency for (now) 20 countries in the Eurozone, covering nearly 350m people. The euro is the second-largest reserve currency as well as the second-most traded currency in the world after the United States dollar.

The euro is managed and administered by the European Central Bank (ECB, Frankfurt am Main) and the Eurosystem, composed of the central banks of the eurozone countries. As an independent central bank, the ECB has sole authority to set monetary policy. The Eurosystem participates in the printing, minting and distribution of notes and coins in all member states, and the operation of the eurozone payment systems. While some countries have exemptions, if a European country now wants to join the EU, it must also join the Eurozone and adopt the euro as its currency.

In celebrating the 25 years, current ECB president Christine Lagarde made a speech in which she argued for the success of the ECB in providing three things for Europe. “Stability, because the euro ensured that the Single Market could be insulated from currency fluctuations while making speculative attacks on euro area currencies impossible. Sovereignty, because adopting a single monetary policy at the European level would increase Europe’s policy independence vis-à-vis other large players. And solidarity, because the euro would become the most powerful and tangible symbol of European unity that people would encounter in their day-to-day lives.”

You could argue that the ECB had met these more ‘philosophical’ criteria. But what is missing from Lagarde’s list are other more real criteria for which the ECB is mainly tasked, namely controlling inflation across the EZ and ensuring that there are no banking and debt crises that threaten to split the Eurozone apart. Here the success story is seriously faulty.

On inflation, Lagarde claimed “For the ECB, our immediate and overriding priority is to bring inflation back down to our 2% medium-term target in a timely manner. And we will do so.” So she recognises that the ECB has failed so far in the current inflation spiral. And on debt, Lagarde admits “instability has arisen in other areas that were missing from the original design of the euro area, most painfully during the sovereign debt crisis.”

Back in 2019, when the Eurozone reached 20 years of existence, I published two posts: one on whether the euro had been a success; and another on its future prospects. On the former, I concluded that the real winners were the richer, more technologically advanced members in the northern ‘core’ and the losers were the more debt-ridden, weaker economies of southern Europe. And far from the euro and the ECB helping the latter to make strides towards convergence with the north, the opposite has been the case – the most serious moment being in the euro debt crisis of 2012-15.

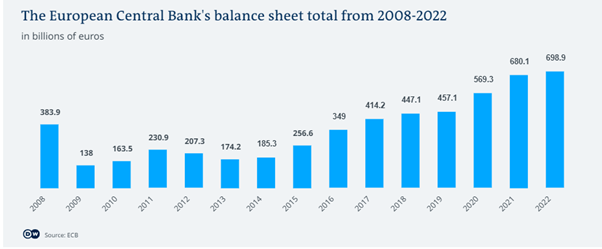

That led to a change of policy by the EZ leaders and ECB then headed up by former Goldman Sachs banker and head of the Italian central bank, Mario Draghi. He launched a new policy of supplying cheap credit with the ECB buying up EZ country government bonds in huge amounts to prop up the likes of Spain, Portugal and Italy (“whatever it takes” was the slogan). In the years between 2010 and 2016, the ECB’s balance sheet of credit rose from €163 billion ($151 billion) to almost €349 billion. Last year it stood at roughly €700 billion.

But that credit support came with harsh fiscal and monetary conditions policed by the ECB, so that any country that opposed them, like Greece in 2015, faced economic suppression by the ECB, the IMF and the EU Commission.

The ECB’s original mandate was to keep inflation in the EZ down to around 2% a year on average and to ensure the financial stability of the EZ banking system. Its success in meeting these mandates has not been great – despite all the supposed monetary powers of the ECB. In the first decade of the 21st century EZ inflation was stubbornly above 2%. Throughout the second decade leading up to the pandemic in 2020, EZ inflation remained well below 2% a year. And then of course, after the pandemic slump, there was the sharp hike in inflation to nearly 10%. The overall average inflation rate for the 25 years was 1.97% a year – so you could say that was close to the ECB target, but this outcome is more from luck than judgement, and certainly had little to do with ECB monetary policy.

Moreover, ECB inflation forecasts have been well out of line. Take the post-pandemic jump in prices. “Recent projections by Eurosystem and ECB staff have substantially underestimated the surge in inflation, largely due to exceptional developments such as unprecedented energy price dynamics and supply bottlenecks.” Forecasting is notoriously difficult, of course, but even so, it does not seem that the great minds and resources of the ECB (the number of employees at the ECB has doubled from around 1,600 in 2010 to around 3,500 today.) has achieved either control of inflation (how could that be possible in a capitalist economy?) or any clear idea of what causes inflation, so that proper forecasting models might be applied.

As for debt and banking crises, the ECB was unable to stop the euro debt crisis of 2012-15 – indeed its policies before that period of raising interest rates only accelerated it. It was a sovereign debt crisis caused by governments having to bail out the banking system in Europe with huge dollops of money and credits that left the public sector irreversibly in debt, squeezing public spending and raising taxes, and driving southern Europe into a debt depression. The ECB reacted with its own flood of credit, this time to governments. But in this sorry saga, the ECB reacted; it did not lead and it could not avoid the debt mess and ensuing slump.

Now in 2023, again it was a bystander to the current banking crisis caused by rising interest rates driven by central banks, including the ECB, attempting vainly to ‘control’ inflation. The collapse of the 167-year old Credit Suisse bank and its forced takeover by UBS with Swiss government funds took place with the ECB uninvolved.

What now for the ECB? Lagarde reckons: “with shifting geopolitics, digital transformations and the threat of a changing climate, there will be more challenges ahead which the ECB will need to address. We must continue to provide stability in a world that is anything but stable.”

In another recent speech Lagarde posed the risk of a fragmenting, multi-polar world: “the single most important factor influencing international currency usage is the “strength of fundamentals.” She meant economic fundamentals. And they are not good for the major economies and for the Eurozone; with poor productivity, investment and profitability. That’s a recipe for global fragmentation and conflict.

The Russian invasion of Ukraine has apparently delivered more political unity within the region against ‘the enemy’, for now. But the economic fissures within the Eurozone between the richer and more advanced and the weaker and less advanced remain and will not be resolved. And if the global economy drops into a new slump in the next year, then those fault-lines will re-open yet again.

Be the first to comment