Another thought-provoking piece by Michael Roberts leaving no economic theories looking terribly convincing. A brilliant weekend read.

Michael Roberts – Economist in the City of London and prolific blogger

Cross-posted from Michael Roberts Blog

Last week, the prestigious Brooking Institution held a conference on the efficacy of monetary policy in stimulating and sustaining economic growth. At the conference, Larry Summers, former US Treasury secretary and professor at Harvard University and Lukasz Rachel of the Bank of England, presented a paper that aimed to revive, yet again, the idea that the major capitalist economies are locked into ‘secular stagnation’: “Our findings support the idea that, absent offsetting policies, mature industrial economies are prone to secular stagnation.”

According this thesis, there is a long-term stagnation in the major capitalist economies. Despite central banks pushing interest rates down to zero or even below (so that bankers and capitalists are paid to borrow!); and despite central banks printing huge amounts of money to buy bonds and other financial assets (quantitative easing), real GDP growth and investment remain weak. Although unemployment rates are officially near cycle lows in many countries, inflation is equally low, confounding the traditional Keynesian view that there is a trade-off between employment and inflation (the so-called Phillips curve).

Central bank monetary stimulation has failed, except to promote ‘credit bubbles’ and speculation in financial assets and property. For example, here are the conclusions of a recent study on the impact of the monetary injections of the ECB in Europe: “the efforts of the ECB to hit its inflation target would be more credible if there was convincing empirical evidence that its balance sheet policies are effective at stimulating output and inflation. Our recent research shows that this macroeconomic evidence is still lacking.”

And there is every prospect of another economic slump approaching in which central banks will be powerless to do anything as interest rates are already near zero and the balance sheets of central banks are already at record highs. “Our findings support the idea that, absent offsetting policies, mature industrial economies are prone to secular stagnation. This raises profound questions about stabilization policy going forward.” (Summers and Rachel)

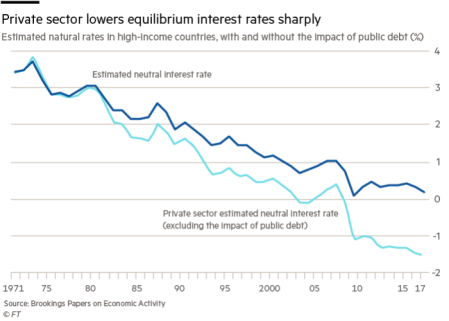

In the FT, Keynesian columnist Martin Wolf echoed the views of Summers and Rachel. Interest rates are near all-time lows and if you follow the Fisher-Wicksell theory of a ‘natural’ rate of interest that enables full employment, then it now seems that the natural ‘private sector’ interest rate needed to achieve jobs for all who want them has be in negative territory.

Of course, this so-called natural rate is a dubious concept at best. But even you accept the theory, as it seems many Keynesians want to do [“That is the root of our problem: the natural nominal rate of interest … today is less than zero, and so the Federal Reserve cannot push the market nominal rate of interest down low enough.” Brad DeLong], it just exposes the problem. Monetary policy has not and will not work in restoring the capitalist economy to a pace of growth that delivers investment and thus sustains jobs at rising real wages.

Indeed, as I have pointed out before, Keynes also realised after the Great Depression continued deep into the 1930s, that his advocacy of low interest rates and even ‘unconventional’ monetary policy (buying government bonds and printing money) was not working: ““I am now somewhat sceptical of the success of a merely monetary policy directed towards influencing the rate of interest… since it seems likely that the fluctuations in the market estimation of the marginal efficiency of different types of capital, calculated on the principles I have described above, will be too great to be offset by any practicable changes in the rate of interest”. In other words, there is no natural rate of interest low enough to persuade capitalists to borrow and invest if they think the return on that investment would be too low. You can take a horse to water, but you cannot make it drink.

This week the Bank of Japan monetary committee met and threw up its hands in despair. After years of central bank ‘unconventional’ monetary easing (buying government bonds to the tune of 100% of GDP!) by printing money, the huge injection of credit into the banks has had no effect in lifting the economy. As Darren Aw, Asia economist with Capital Economics, remarked: “There is a good chance that Japan’s economy will contract again in Q1 2019, for a third time in five quarters”… Given this, the key question for the Bank of Japan is no longer when it might retreat from its ultra-loose policy stance but whether it can do any more to support the economy.” Thus the first of the PM Abe’s three arrows of economic policy (monetary easing, fiscal stimulus and neoliberal de-regulation) has failed.

Now it’s true that per capita GDP growth in Japan since the end of the Great Recession ten years ago is actually faster than in most other major capitalist economies. But that is simply because Japan has a sharply falling population. Real and nominal (before inflation) GDP has been virtually static. National output has remained more or less the same but there are less people that generate and consume it. Japan has the lowest working population as ratio to total population in the top 12 economies of the world.

And yet monetary easing is still pushed by Keynesians, especially the more radical ones from the post-Keynesian school, including those following Modern Monetary Theory (MMT). If the state and/or central bank prints money, it can use that money to stimulate the capitalist economy to get it going. Money is not so much the root of all evil but the genesis of all that is good, it seems. This sentiment reminds me of the earliest exponent of the magic of money – or the ‘money fetish’, namely John Law, who around 300 years ago had a unique opportunity to apply money printing to put an economy on its feet.

Ann Pettifor, the left Keynesian exponent of magic money, has called John Law a “much maligned genius whose 1705 account of the nature of money cannot be bettered”. This proto-Keynesian was the son of a wealthy Scottish goldsmith and banker. Law was born in Edinburgh, proceeding to squander his father’s substantial inheritance on gambling and fast living. Convicted of killing a love rival in a duel in London in 1694, Law bribed his way out of prison and escaped to the Continent. There Law concentrated on developing and publishing his monetary theory cum scheme, which he presented to the Scottish Parliament in 1705, publishing the memorandum the same year in a tract, Money and Trade Considered, with a Proposal for Supplying the Nation with Money (1705).

Law argued for a central bank to issue paper money backed by ‘the land of the nation’. Echoing the MMT (or is it the other way round?), Law proposed to “supply the nation” with a sufficiency of money. This would vivify trade and increase employment and production. Like MMT, Law stressed money is a mere government creation which had no intrinsic value. Its only function is to be a medium of exchange and not any store of value for the future.

Law was sure that any increased money supply and bank credit would not raise prices and expanding bank credit and bank money would push down the rate of interest (MMT again). To Law, as to Keynes after him, the main enemy of his scheme was the menace of “hoarding,” a practice that would defeat the purpose of greater spending. So, like the late 19th-century German money fetisher Silvio Gesell, Law proposed a statute that would prohibit the hoarding of money.

Amazingly Law found a supporter for his theories in the regent of France. The regent, the Duke of Orléans, set up Law as head of the Banque Générale in 1716, a central bank with a grant of the monopoly of the issue of bank notes in France. He was made the head of the new Mississippi Company, as well as director-general of French finances. The Mississippi Company issued bonds that were allegedly “backed” by the vast, undeveloped land that the French government owned in the Louisiana territory in North America.

This scheme eventually led, not to a booming economy, but instead to a speculative financial bubble where bonds, bank credit, prices, and monetary values skyrocketed from 1717 to 1720. Finally, in 1720, the bubble collapsed and Law ended up as a pauper heavily in debt, forced once again to flee the country. Law was not so much a ‘much maligned genius’ but more “a pleasant character mixture of swindler and prophet” Karl Marx (1894: p.441). What the Law debacle showed was that the state just issuing money cannot replace the ‘real economy’ of production and trade. Money alone does not create investment or production.

Of course, modern Keynesians (unless they are of the MMT variety) do not promote unending printing of money for governments and the private sector to spend. That’s because they have been forced to recognise; as John Law found in 1719-20; and as Keynes found in 1933; and as Abe in Japan has found now; and the secular stagnationists also accept, printing money does not work if capitalists and bankers hoard that money or switch it into speculative investments in financial assets.

So what’s the answer? Well, as Martin Wolf puts it: “The credibility of the “secular stagnation” thesis and our unhappy experience with the impact of monetary policy prove that we have come to rely far too heavily on central banks. But they cannot manage secular stagnation successfully. If anything, they make the problem worse, in the long run. We need other instruments. Fiscal policy is the place to start.” Yes, it’s back to fiscal stimulus. But will that work either?

Last year President Trump launched a fiscal stimulus of sorts by cutting taxes for the rich and the big corporations. It boosted after-tax profits in 2017 sharply and real GDP growth ticked up a little towards 3% a year. But that boost has been all too fleeting. US real GDP growth is heading back down to below a 1% rate in this quarter and business investment is also turning down.

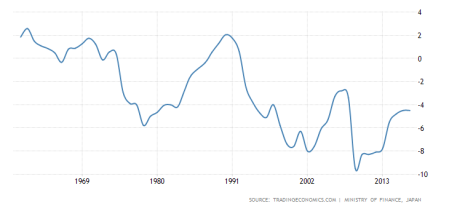

One of the policy arrows of Abenomics in Japan was fiscal stimulus. Indeed, there is no major economy that can match Japan for its government running permanent budget deficits (MMT-style).

Japan: annual budget deficits to GDP (%)

This should be the policy dream of MMT and other post-Keynesians. But it has not worked in Japan. Japan has ‘full employment’, but at low wages and with temporary and part-time contracts for many (particularly women). Real household consumption has risen at only 0.4% a year since 2007, less than half the rate before. So fiscal stimulus has not worked in Japan which remains in ‘secular stagnation’.

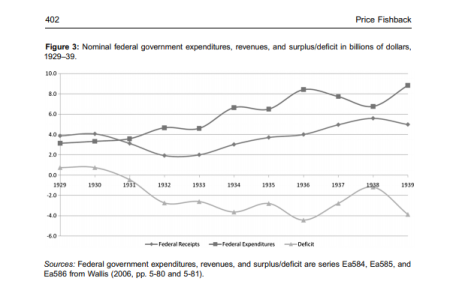

And it did not work in the Great Depression of the 1930s. After dropping monetary easing as the policy answer to the depression, in the Los Angeles Times on 31 December 1933, Keynes wrote: ‘Thus, as the prime mover in the first stage of the technique of recovery, I lay overwhelming emphasis on the increase of national purchasing power resulting from governmental expenditure which is financed by loans and is not merely a transfer through taxation from existing incomes. Nothing else counts in comparison with this.’ Deficit-financing was the answer.

The Roosevelt regime ran consistent budget deficits of around 5% of GDP from 1931 onwards, spending twice as much as tax revenue. And the government took on lots more workers on jobs programmes (MMT-style) – but all to little effect. The New Deal under Roosevelt did not end the Great Depression. Keynes summed it up “It is, it seems, politically impossible for a capitalistic democracy to organize expenditure on the scale necessary to make the grand experiments which would prove my case — except in war conditions,” (from The New Republic (quoted from P. Renshaw, Journal of Contemporary History 1999 vol. 34 (3) p. 377 -364).

Wolf recognises that fiscal policy may also not work. “It is of course essential to ask how best to use those deficits productively. If the private sector does not wish to invest, the government should decide to do so.” So if the ‘private sector’ (ie the capitalist sector) won’t increase investment rates to boost growth despite negative interest rates and despite huge government money injections funded by money printing, the government will have to step in do the job itself, apparently.

Thus, the Keynesian/MMT answer is to act as a backstop to capitalist failure. But the capitalist sector dominates investment decisions and it makes those on the basis of potential profitability, not on the cost of borrowing. Keynes saw it as politically impossible to ensure sufficient investment through government spending – and he was right in a way. Only complete control of the capitalist sector could enable governments to ensure full employment at decent wages. At this point, I’m tempted to repeat the comment of left Keynesian Joan Robinson to MMT/Keynesians: “Any government which had both the power and will to remedy the major defects of the capitalist system would have the will and power to abolish it altogether”.

Be the first to comment