“The State of Capitalism is an exercise in hard analysis and there is much to learn and debate. In that sense, the book is a must read…”

Michael Roberts is an Economist in the City of London and a prolific blogger.

Cross-posted from Michael Roberts’ blog

The book, The State of Capitalism, is an ambitious work. Written by the NAMe Collective with the lead from Professor Costas Lapavitsas from SOAS University, London, it seeks to analyse all aspects of capitalism in the 21st century from a Marxist perspective. It has been widely praised by the likes of Yanis Varoufakis and Grace Blakeley, leading rock stars of leftist economics.

According to the authors, the book “is the outcome of collective writing that combines different types of knowledge and experience, while still finding a common voice. For several years, the European Research Network on Social and Economic Policy (EReNSEP) has sustained itself through the voluntary efforts of its members…. the outcome of collective writing that combines different types of knowledge and experience, while still finding a common voice.”

In this review, I cannot possibly cover all parts of the book’s analysis of modern capitalism. So I shall concentrate on where I agree or disagree with what I shall call ‘the Collective’ and its analysis and conclusions.

The book starts with an overview of capitalism in this century. The Collective argues that capitalism is much weaker than in the 20th century. And the roots of this weakness lie in a slower accumulation of capital, particularly since the ‘interregnum’ of the Great Recession of 2007-9. “Core economies across the world are marked by weak production and predatory finance. Financialisation is entrenched, and finance remains the chief beneficiary of government policies as well as the source of fabulous wealth for an oligarchic sliver of society. At the historic sites of advanced capitalism, growth is feeble, employment is precarious and poverty endemic, while income differentials continue to widen, creating vast social fractures. Neoliberal financialised capitalism, dominant for more than four decades, is showing signs of exhaustion.”

Immediately, we can see that the Collective designates the main (new) feature of modern capitalism: financialisation. This is a dominant theme throughout the book. For the Collective, the main cause of the growing weakness in capitalist development in this century can be found in financialisation: “At the root of this lay the weakness of capitalist accumulation in core countries, exacerbated by the advance of financialisation for several decades; the writing had been on the wall since the Great Crisis of 2007–09.”

Now as regular readers of this blog will know, I find the term ‘financialisation’ either too generalised and/or problematic. In particular, see the excellent paper by Stavros Mavroudeas. As the Collective admits: “The vast literature on financialisation in the social sciences has not produced an agreed meaning for the term.” The authors define it as “a historical transformation of mature capitalism reflecting, first, the extraordinary growth of the financial sector relative to the rest of the economy and, second, the spread of financial practices and concerns amid non-financial enterprises and other fundamental agents of capitalist accumulation.”

If by this, the Collective means that the financial sector in capitalist economies has grown in size and in influence over the productive sectors and as such there has been a rise in the share of total profits going towards financial activities as opposed to productive activities, then this is undoubtedly true. But I think the Collective means more than that. Now in modern capitalism: “Wealth accrual took advantage of proliferating financial expropriation, a characteristic feature of predatory financialised capitalism.” And in particular, the gigantic shock of the 2008-9 Great Recession “sprang out of the aggressive financialisation of core countries during the preceding two decades.” So the crisis in capitalism in the 21st century is mainly due to the “unravelling of financialised capitalism that began in the late 2000s.” It is not primarily due to any deterioration in the accumulation of productive capital.

Indeed, the Collective reject Marx’s law of declining profitability as being relevant to the crises of modern capitalism. Their rejection is shrouded in a contradictory and confusing analysis of the law and its impact on capital accumulation. First, we get an electic view: “The anaemic performance of accumulation in the 2010s was partly due to the suppression of aggregate demand as core states implemented austerity policies, but even more significant (my emphasis) was the underlying weakness on the side of production.” So it’s both.

According to this eclectic view, in considering aggregate demand and supply, for Marxist political economy, “the two sides cannot be strictly separated”. But the process of capitalist accumulation is presented as one where production takes place “by forming expectations of demand and produce output based on costs deriving heavily from real wages and technology. Enterprise plans help determine aggregate demand in the form of both investment and consumption, but if expected demand does not materialise, production is curtailed. Moreover, the drive to innovate and adopt new technologies is negatively affected when demand is weak over a long period of time.” In this analysis, there is no mention of the possibility that a decline in supply, investment or profit might cause a decline in aggregate demand. And yet, the Collective goes on to say that “capitalist economies rest primarily on production, where value and surplus value are generated. The side of production is ultimately the determining factor in the overall performance of capitalist accumulation”(again my emphasis). Confusing.

The Collective then tackles Marx’s law of the tendency of the rate of profit to fall and its relevance to crises of accumulation and production in modern capitalism. On the one hand, they say that “the variable that most usefully sums up the underlying condition of aggregate supply is the average rate of profit, particularly that of non-financial enterprises. The point of departure for the analysis of accumulation weakness in the 2010s is the conduct of profitability before and after the Great Crisis of 2007–09.”

But then the Collective tells us that Marx’s law analysing the rate of profit is actually “ambiguous”. You see, “the rise in the rate of exploitation would boost the rate of profit, and the impact might be even bigger if the value composition fell. If, on the other hand, the value composition rose, it would give a downward push to the rate of profit that could potentially exceed the boost from the rising rate of exploitation, thus bringing the rate of profit down. Once again, however, within reasonable assumptions about magnitudes, a rise in productivity would probably raise the average rate of profit.” So the Collective accepts the usual theoretical dismissal of Marx’s law that it is ‘indeterminate’.

Again, those of you who are regular readers of this blog, know that this is nonsense. Simply put, Marx argues that over time capitalist accumulation takes the form of a rising organic composition of capital (ie rising investment in means of production relative to investment in employing labour). If that is right, then there will be a tendency for the average rate of profit to fall. Yes, there are counteracting factors like a rising rate of exploitation of workers, or possibly falling costs of the means of production; and in the national context, better profitability from trade and investment abroad or from the financial sector speculation (what Marx called fictitious capital). BUT these counteracting factors are not sufficient over time to reverse the downward pressure on the rate of profit. This is all well explained by Marx in Capital Volume 3, Chapters 13-15 and developed by many Marxist authors since.

Indeed, if you accept that the law is ‘ambiguous’ or ‘indeterminate’, then Marx’s law is useless as a tool for analysing capitalist accumulation and crises of production. That’s why, in essence, the Collective resorts to alternative theories. First, they argue that the rate of profit only falls because of rising wages (this is the classic neo-Ricardian view); and second, it only falls when the growth in productivity of labour slows or falls.

And here we get yet another confused position by the Collective. They argue that “labour productivity is the driving engine of capitalism, the means through which profits rise and enterprises win the battle of competition in the medium to long run.” Really? Is not the driving engine of capitalism profits, not productivity? The Collective’s analysis has reversed Marx. Marx’s theory of accumulation and crises reckons that the profitability of capital ultimately decides the rate of accumulation in the means of production and employment, and the rate of accumulation (or investment) then drives the productivity of labour. The key contradiction for Marx is that the drive for higher profitability through mechanization may lead to higher productivity, but it also leads to falling profitability. So the accumulation process founders. For Collective, it’s the other way round: “the trajectory of the average rate of profit, which reflects (my emphasis again) the underlying strength of accumulation” and “could be usefully analysed through the movement of real wages and the productivity of labour.” So profit and profitability depend on the productivity of labour, not vice versa as in Marx.

This leads the Collective to argue that while the growth in capital accumulation (investment in means of production) has slowed over the last four decades, this has not been due to any fall in profitability, a la Marx. Indeed, they claim that there has been a ‘rather level trend’ in profitability “– perhaps rising gently – while following a cyclical path, broadly in line with the overall fluctuations of the economy.” So Marx’s law is both faulty theoretically and disproven empirically.

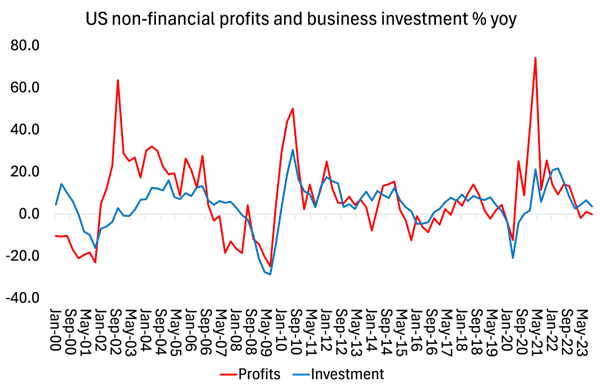

I could spend some time arguing that this is wrong. But consider the Collective’s graph above in the book on the profitability of the US non-financial sector. It starts in 1980, thus leaving out the huge drop in profitability from the mid 1960s to the early 1980s. It’s not quite clear what method and sources have been used but even so, the graph does show a peak in profitability in 2006 before the Great Recession and a downward trend since. But if we extend the data further back, using the US Federal Reserve’s own measure of non-financial profitability, they tell a clearer story.

For more on useful measures on profitablity, see https://fredaccount.stlouisfed.org/public/dashboard/53250 and also see the work of Basu-Wasner on the rate of profit. https://dbasu.shinyapps.io/Profitability/

Having rejected (reversed) Marx’s law of profitability, the Collective resumes its argument that it was low productivity not low profitability that was the key to the weakness of capitalism in the 21st century. “During the decades of financialisation, flimsy productivity growth attenuated the ‘internal mechanism’ in core countries.” Swinging away from profitability, the Collective focuses on aggregate demand as being the problem. “Aggregate demand in core countries was persistently weak throughout the 2010s as the private sector registered poor results in both investment and consumption, and as several governments pursued policies of fiscal austerity.” This is classic Keynesianism.

Aggregate demand is composed of both investment and consumption demand. The Collective argues that the perceived weakness of aggregate demand is shown in the fall in investment as a percentage of gross domestic product (GDP) .

But was this decline in investment to GDP and for that matter, slowing investment growth over the last four decades due to inadequate demand and/or slowing productivity growth, or was it due to weakening profitability, particularly since the late 1990s and particularly in productive sectors? – as the Fed’s graph above shows. The evidence from many Marxist scholars would argue that it is profitability that was key. Note in the graph below how close the correlation is between movements in the rate of profit and movements in business investment.

The Collective goes on to argue that “the deficiency of private aggregate demand was also visible in consumption as a proportion of GDP”. But look at the chart they provide for this.

In the chart, there is no significant fall in consumer demand from the 1980s, unlike in investment. US consumption to GDP rises throughout, and all the other countries (except Germany) have a steady ratio until the Great Recession. And I have shown that in every crisis of capitalism since 1945, it is investment that collapses first, not consumption, which generally stays flat. So ‘inadequate demand’ comes from investment, not consumption, in the capitalist business cycle; and investment is driven by profitability (previous and expected).

For the Collective, the recent weakness of capitalism is to be explained mainly by “the relative retreat of financialisation in the 2010s.” But again, the chart of non-financial sector debt to GDP offered as evidence does not confirm this feature.

Over the period 2002-2020, US NFC debt to GDP rises. Germany and Japan’s ratio in 2020 is the same as in 2002. France’s rockets. Only the UK shows a significant decline. The Collective says that “Financial speculation involving the working class of the USA – often its poorest metropolitan layers – and pivoting on shadow finance, was the prime culprit of the huge bubble that led to the collapse of 2007–09 and the ensuing global crisis. The uniqueness of this development in the history of capitalism cannot be overstressed.” Well, just maybe it is being overstressed.

In my view, the Collective’s claim that the current weakness of capitalist accumulation and economic growth; and the recent major crises are the result of low productivity growth, inadequate aggregate demand and the collapse of financialisation is superficial at best, confusing and just wrong (at least in Marxist terms).

The Collective devotes a lot of space and chapters to exploring the rise of the financial sector, ‘shadow finance’, state-backed fiat money (QE), and the propping up of overindebted ‘zombie companies’ with yet more debt. This is a valuable account. But the question for me remains: why have these components of ‘financialisation’ expanded so much in the last four decades? For me, the answer lies in the growing weakness of productive investment as driven by the long-term decline in profitability. This has forced the monetary authorities and the state to intervene to try and prop up capitalist accumulation and ameliorate the impact of slumps in production by ‘printing’ money and increasing credit/debt.

On this question, the Collective heavily criticises Modern Monetary Theory, correctly in my view, for arguing that the expansion of money and credit by the state will not be harmful to the capitalist economy. “First, MMT underestimates the risk of financial asset speculation inherent to expansionary monetary policy.” And “most significant, MMT largely ignores the importance of transformative interventions by governments on the side of aggregate supply and focuses primarily on aggregate demand (!). MMT proposals aim at changing the distribution of income without fundamentally changing the structure of production.” Indeed. And yet, the implication of the Collective’s own analysis that crises in modern capitalism are mainly a result of weakness in aggregate demand would also suggest that fiscal spending and printing money to boost aggregate demand could avoid or solve crises under capitalism.

The Collective’s analysis also leads to a confused explanation of the post-pandemic inflationary spike. The Collective starts by saying that “the return of inflation was clearly due to the support of aggregate demand delivered by core states in 2020–21.” But then adds “At a deeper level, however, it reflected the underlying weakness of the supply side and the entrenched malaise of accumulation discussed in previous chapters.” Which is it? The Collective eventually makes a choice. “Rising inflation indicated that the poor performance of capitalist accumulation in core countries after the Great Crisis of 2007–09 was not simply due to persistent austerity compressing aggregate demand. The problem had to do with the underlying weakness of aggregate supply – it was structural and deep.” Indeed, but how does that square with the earlier argument that it was a lack of aggregate demand that was the underlying cause of capitalist crises and not any problem with the supply side?

The Collective concludes (correctly) that “The real issue, however, was the inability of aggregate supply to respond commensurately, and in this regard the Quantity Theory of Money has little to offer.” But then the Collective swings back: “Inflation in the 2020s was spurred by the boost to aggregate demand, particularly as the expansionary policies of core states were compounded by the lifting of Covid-19 restrictions in 2021, which facilitated the recovery of private expenditure.” But hold your horses; actually it was not that so much. Instead, “Rising inflation primarily reflected the inability of aggregate supply adequately to respond to recovering demand. In part, this was due to the disturbance of production networks across the world.” And guess what? “It was also due to the deep – and related – malaise of the production side in core countries manifested in poor profitability, low productivity growth, and the prevalence of zombie firms, as was discussed.” Indeed. But just in case readers do not remember the ultimate factor, “the inability of supply to respond was due to the underlying malaise of financialised capitalism.” Thus, we reach full circle, with no indication of where to start.

The question of imperialism and its nature in the 21st century is essential to understand. The Collective tackles this task vigorously. “The distinguishing feature of the classical Marxist theory of imperialism is that it connects the form and content of imperialism to the underlying economic interests of capital.” In analysing imperialism, the Collective revises its earlier view of financialisation. “The conduct of monopolistic non-financial enterprises is a pillar of contemporary financialization, but must be approached with caution. It is misleading, for instance, to think of the giant monopolies as constantly choosing between the sphere of production and the sphere of finance while seeking profits. There is no systematic evidence that the profits of non-financial enterprises are significantly skewed toward financial activities, even if financial skills and activities have grown among industrial and commercial enterprises.” Exactly. The evidence elsewhere shows that non-financial multi-nationals do not make most of their profits from financial activities but from traditional productive investment and the exploitation of their labour forces, at home and aboard.

In my view, the Collective is correct to reject the old notion of a ‘labour aristocracy’ in the core countries as it “has little persuasiveness in a world of rampant neoliberalism, with precarious employment and tremendous inequality within core countries.” But in turn, the Collective is dismissive of structuralist or ‘dependency’ theories to explain how the exploitation of the people in the peripheral economies by the multi-national of the imperialist countries is being accomplished. I have my own criticisms of those theories of imperialist exploitation.

But the Collective goes further. Marx’s theory of unequal exchange as applied to international trade is rejected as explaining the exploitation of the rich over the poor economies. “It is deeply problematic to attempt to analyse foreign trade and investment by deploying Marx’s schema of domestic profit-rate equalisation.” Apparently, “Dependency theorists struggled to provide a theoretically and empirically coherent explanation of the economic mechanisms through which resources are drained from the periphery. Perhaps the most popular accounts were ‘unequal exchange’ and the ‘super-exploitation of the labour power’, but neither is theoretically persuasive.” This rejection is not explained and yet there is plenty of recent work to show the relevance of Marx’s theory.

The Collective reckons that those old classical Marxist theories are out of date. There have been “significant changes in the development of capitalism since the time when Marx produced his theoretical work. In particular, the links between the circuits of industrial and financial enterprises were closely analysed by classical Marxists, for whom bank capital was even capable of dominating industrial capital, thus creating the novel form of ‘finance capital’. Financialisation again.

“During this period, which also witnessed the expansion of financialisation globally, the world economy was permeated by worldwide production networks or, as they are widely referred to in the literature, ‘global value chains’ or ‘global production networks’.” Yes, global value chains within companies have been an important route for transferring value or profit from the poor countries to the rich. But it is still the case that the bulk (two-thirds according to UNCTAD) of profit transference is through international trade and profit repatriation from FDI and portfolio investment, not through value chains within multi-nationals.

The Collective’s analysis of the rise of China is distinctly refreshing compared to the views of mainstream economics and compared to the majority of Marxist views. They argue that China is just another rising capitalist power with no distinctive features. I have critiqued these arguments about China ad nauseam in posts on this blog, so I won’t go over the points again here. But the Collective delivers an interesting angle on the nature of China: “both the mode and the extent of state intervention in China are profoundly different from those adopted by the USA. The US state provides support to financialised capitalism by drawing chiefly on command over fiat money, while also mobilising its intimate links with private corporations. The Chinese state has certainly catalysed the meteoric rise of China during the last four decades, but its interventions are based on direct ownership and command over both productive resources and finance. The difference is of great importance for the emerging hegemonic contest.”

Indeed, as I have argued, China’s economic success is not the product of capitalist accumulation for profit through markets, but of state-led investment for growth and social needs. Capitalists do not rule the development process in China: “There is no independent private capitalist class in China capable of directly challenging the command of the state over the core of the Chinese economy.” The Collective identifies where China is now. “For the time being, the Chinese ruling bloc appears to have decided to continue with public control over strategic productive forces, marshalled by the Communist Party. However, the pressure to move toward private ownership and control has far from disappeared. … If privatisation somehow prevailed within the ranks of the ruling bloc and a profit-driven bourgeois class emerged at the helm, it is hard to see how the Chinese challenge to US hegemony would be sustained.”

The Collective sees the profitability of capital in China as a key indicator – surprising given its rejection of profitability as relevant for the major capitalist economies. “An important factor is the changed outlook of non-financial enterprises, including the leading SOEs, in the period since the Great Crisis of 2007–09. The supply side of the Chinese economy has begun to exhibit symptoms of weakness, which are reflected in low profitability.” However, the Collective says this falling profitability is again due to slowing growth in labour productivity, not vice versa.

To conclude, the Collective reminds the reader of the aim of the book: to develop a clear analysis of capitalism today in order to see the way towards replacing it with socialism. What do they advocate? Democratic planning “with the state and the broader public sector taking a commanding role in production, consumption, and distribution. The balance of power in economic decision making must be altered accordingly, creating social foundations to confront the ecological crisis in a coherent and socially aware way, something that private capital is incapable of doing.”

The State of Capitalism is an exercise in hard analysis and there is much to learn and debate. In that sense, the book is a must read, even if I have disagreements on the Collective’s view on the causes of crises in capitalism, the nature of imperialist exploitation and the role of finance.

Are profits the driving engine of Capitalism? Or is productivity the driving engine? This is a fruitless argument, because we are dealing with a ‘system’ of movement with feedback. So, whereas profits are an outcome of prior drivers like productivity. profits then feed back into the systema and drive change themselves. Chicken and egg stuff. I think we need Steve Keen and his Minsky systems engineeing approach to tell us the real story.