The US economic crisis will probably decide today’s election

Michael Roberts is an Economist in the City of London and a prolific blogger

Cross-posted from Michael’s Blog

Americans go to the polls today to vote in the so-called mid-term elections for the US Congress. All the seats in the lower House of Representatives are up for grabs, while a portion of the upper house, the Senate, is being voted on. Currently, the Democrats hold a majority of just eight in the lower house and have a majority in the Senate only through the vote of the Chair, who is the Democrat vice president.

Current opinion polls suggest that the Republicans will gain control of the lower house with a majority of 20-30 seats while the Senate is much closer. If that result is about right, it will mean the Democrat Biden administration will be pretty much blocked from carrying out any of its proposed measures over the next two years up to the next presidential election in November 2024.

Perhaps it makes no difference who is calling the shots over the next two years, as neither Democrats nor the Republicans have any useful policies to improve the lot of most Americans, particularly when it comes to the cost of living, better jobs, more investment in public services and infrastructure.

And let there be no doubt that it is the economy (stupid!) that matters for most of those likely to vote over any other issue. According to the polls, the economy and inflation is seen as the top issue by 51% of likely voters, much higher than the tortuous issue of abortion (15%) where the rights of women to choose have been emasculated by a right-wing Supreme Court and various Republican states. And the so-called conspiracy over vote rigging that the Trumpist right reckons is the key issue is only important to just 9% of voters; followed by gun policy 7% and immigration 7%. Climate change, the issue for the whole planet’s future, is most important to only 4% of voters.

And we can see why the economy and living standards are so dominant an issue. The economy is nearly always the leading issue, but with inflation rocketing up to over 8% a year and mortgage rates chasing after inflation, average real incomes (as in all the major economies) have been plummeting.

Living standards for the average American have now been flat for nearly three years.

The so-called ‘misery index’ is often used as a gauge of the well-being of households. It’s a simple addition of the official unemployment rate and the consumer price inflation rate. The misery index is at its highest since the Great Recession, and before that, since the cost of living crisis of the 1970s and early 1980s. Interestingly, quite often (but not always) the incumbent administration loses the mid-term elections when the misery index is high or rising fast (1958, 1974, 1982, 2010). Even though the official unemployment rate is near all-time lows, the rise in income earned from these jobs nowhere near covers rocketing inflation in food, fuel and rents.

The prospect ahead for the US economy over the next two years to the 2024 presidential election increasingly appears to be one of a new slump or contraction in national output in 2023 and a further fall in living standards for most Americans.

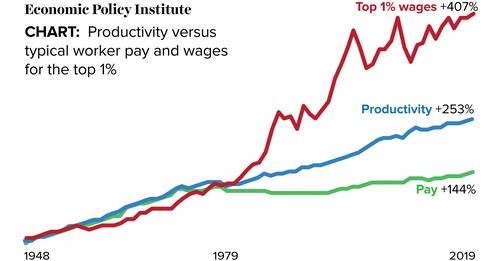

Of course, this decline in living standards only applies to most Americans. The top 1% of income earners are doing very nicely, thank you.

Indeed, inequality of income and wealth has never been so extreme in modern US history. The top 1% of American wealth holders now take 31.8% of all household wealth compared with 23.5% in 1989, while the bottom 50% of wealth holders have just 2.8% – down from 3.7% in 1989. According to the Federal Reserve, inequality of household wealth in the US has never been higher during and since the COVID slump.

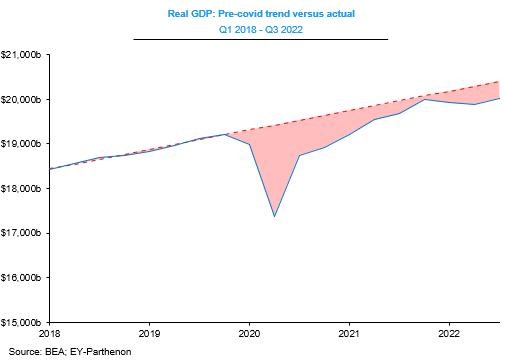

It’s true that US real GDP increased at an annual rate of 2.6% in Q3 2022, up from a decline of 0.5% in Q2 – so officially there is no ‘technical recession’ ie two consecutive quarters of contraction – yet. But year on year growth (compared to Q3 2021) was just 1.8%, the same as in Q2. And excluding inventories and government, sales to domestic consumers rose only 0.1% on the quarter and slowed to 1.3% yoy. Most significant, looking ahead, the PMI business activity indicator came in at 47.3, which indicates the second fastest pace of contraction since the Great Recession of 2009.

The US Conference Board’s index of the US Top 10 Leading Indicators has had a 100% success rate in anticipating every recession over the last 40+ years. And the indicators are now on the cusp of forecasting a new slump.

The US economic recovery since the pandemic slump year of 2020 still has not got back to pre-pandemic trend growth and that was weak enough compared to pre-Great Recession. And next year the US economy will grow even more slowly (at best) or more likely go into recession.

And the US economy is supposed to be the better performing of major economies; with Eurozone already in recession, Japan crawling along (as usual) and the UK heading for a deep two-year slump according to the Bank of England. In the drive to reduce inflation, the Federal Reserve continues to hike its interest policy rate, forcing up the cost of borrowing both for households and companies. And this is at a time when business debt by any measure is at highest historically.

No wonder the incumbent Democrats face defeat in the mid-terms, despite the lunacy of the Trumpist Republicans. But the Republicans also have no answer to the long-term relative demise of the US capitalist economy.

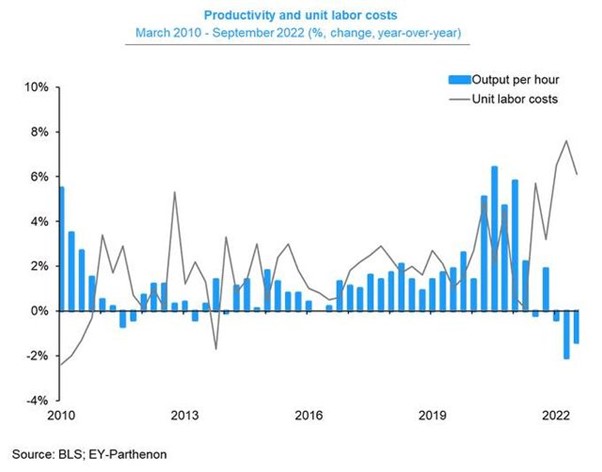

Economic growth depends on two factors: more employment and more output per worker. And right now it is the latter that matters. But the productivity of labour is falling in the US. In Q3 2022 there was a -1.4% yoy fall, making three consecutive quarters of yoy decline, the first such instance since the deep slump of 1982. So even though wages are rising at only just over 3% compared to US inflation of 8% plus, falling productivity is squeezing company profits as labour costs per unit of output rose by over 6% yoy.

The fall in productivity is a major factor in inflation because production is not responding sufficiently to consumer and business demand. The productivity slump could only be reversed by a sharp increase in productive investment in new technology and in human skill training. But US business investment is in a long-term slowdown.

Government investment, even after the limited Biden infrastructure program is nowhere near enough to compensate for slowing capitalist sector investment.

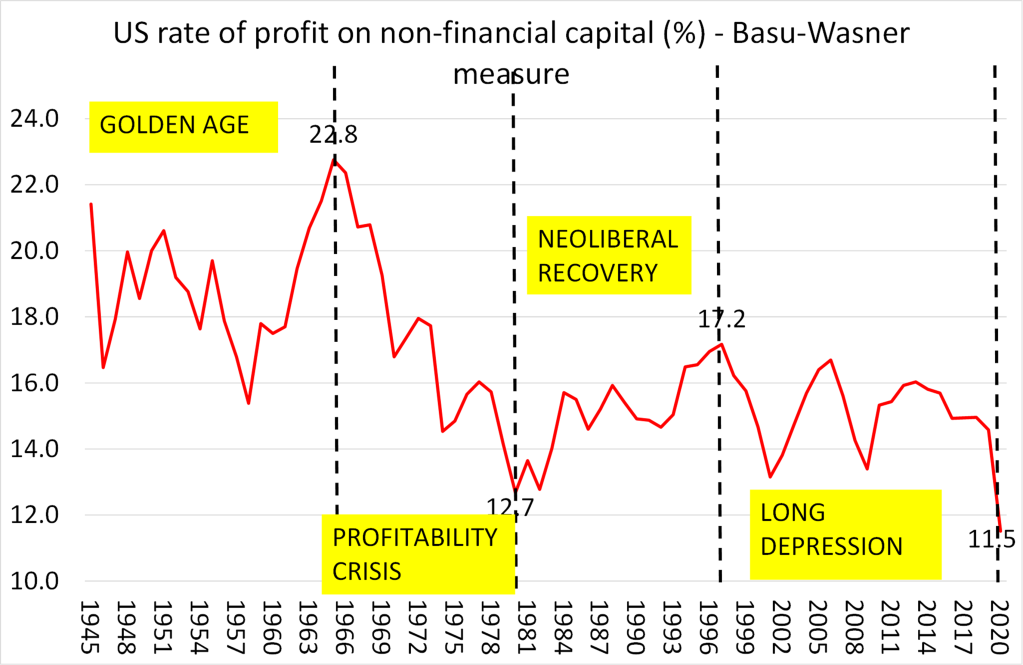

Businesses do not invest productively unless the profitability of such investment is high and/or rising. And that has not been the case in the 21st century. Even the big media companies that have led the profit bonanza since COVID are now seeing falls in profits. For most US companies the profitability on capital investment has been falling.

The only way to restore a sustained rise in profitability is through what Marx called the destruction of capital values, namely a major slump that clears out the weaker sections of the corporate sector and recreates a ‘reserve army of labour’, with unemployment rising by double digits. The Fed’s policy of increasing the cost of borrowing may well double the current unemployment rate over the next two years, but even that may not be enough to create new conditions for profitable investment. So the US economy is likely to totter towards the 2024 presidential election with the prospect of the return of the Donald.

Be the first to comment