The Finance Curse is a concept first developed by the Tax Justice Network. It is a relatively simple idea — and also an original and powerful multi-level critique of the modern global economy.

Here we frame it in a number of different ways.

Nick Shaxson is an Investigative Journalist and author of “Treasure Islands”. His new book, The Finance Curse, was published in October. He is an editor at BRAVE NEW EUROPE.

Cross-posted from Tax Justice Network

1. Shrink Finance

We all need good finance. A financial sector has a useful core surrounded by a toxic, predatory part. This should be entirely uncontroversial, especially following the global financial crisis.

It seems sensible, then, to shrink finance down to its useful core. A fast-growing strand of academic research, known as Too Much Finance, backs this up. Here’s a startling picture from the real world, illustrating the excess bloat (source.)

2. Wealth Extraction vs. Wealth creation

This is closely related to Point 1. The bad part of finance is engaged in predatory wealth extraction, as opposed to the good part, which supports wealth creation (and other socially useful ends.)

This has geographical dimensions, as well as racial, gender, disability-based, and others. The most privileged interests profit from wealth extraction, while the least privileged tend to be those being extracted from.

Other terms that have often been used in this context: Makers vs Takers; Producers vs. Predators; there are various other terms, some less pleasant.

This framing provides exceptionally rich research material, into the many different mechanisms of financial wealth extraction.

3. Cuckoo in the nest

“The City of London likes to portray itself as the goose that lays the golden eggs. In reality it is a different bird: a cuckoo in the nest, crowding out and killing other sectors that could have made Britain more prosperous.”

(The quote is from The Finance Curse book, which lays out some of the many ways in which this happens.)

This highlights the damage that oversized, extractive finance inflicts on other parts of the economy, crowding out other sectors. This, too, has geographical, racial, gender, and disability-based implications, as laid out here.

Studies have sought to quantify the damage. Here’s one, estimating that the excess size of Britain’s financial sector inflicted a massive £4.5 trillion cumulative hit to British GDP from 1995-2015, which includes the period of the great financial crisis. It explains:

A similar calculation for the United States estimated a $13-23 trillion hit to the United States from 1990-2023. These costs are due to misallocation of resources, excess “rents” due to the financial sector, and financial crisis.

4. The tax haven comparison

Tax havens are financial centres that transmit harm outwards, elsewhere, offshore, to other countries. It harms foreigners: “This hurts them.” The Finance Curse, by contrast, transmits harm inwards, to one’s own country. “This hurts us.”

If we’re worried about helping low income countries, this is an especially useful frame, because it’s relatively hard to get governments or citizens to support (apparently) altruistic actions to help foreigners, or to engage in complex international collaborations to counter a race to the bottom.

It’s far more powerful to rally people behind a platform that caters to national self-interest. Shrink predatory global finance, not only to ‘help them’, but to ‘help ourselves.’ (In the process, this will help victims in other countries too.)

This also helps clarify the boundaries of the finance curse concept. Tax havens certainly hurt or ‘curse’ people elsewhere, but that’s an extension of the core “this hurts us” concept.

5. The Resource Curse comparison

The Finance Curse concept originally emerged from discussions between John Christensen, a former Economic Adviser to the British tax haven of Jersey, and Nicholas Shaxson, then an expert on the “Resource Curse” afflicting many countries whose economies are dominated by oil or minerals or natural resources. Likewise, the Finance Curse afflicts countries with a dominant financial centre.

The key misunderstanding around the Resource Curse is that these countries are poor because elites are stealing all the money. That does happen, of course, but the deeper understanding is that many of these countries are even poorer than if they’d never discovered any natural resources. It also leads to what’s known as “path dependence,” as other sectors wither, leading to a problem known as ‘putting all your eggs in one basket.’

As the “too much finance” literature shows, finance has similar effects.

There is a large overlap between the two “curses,” both in terms of the causes, and the effects: a similar “brain drain,” a “Dutch Disease,” recurring volatility and crises, rent-seeking (or wealth-extraction) dynamics, state capture by private interests, and plenty more. To understand more, see Section 1.0 here.

6. The Telephone Comparison

We need finance, but the measure of its contribution to our economy isn’t whether it creates billionaires and big profits, but whether it provides useful services to us at a reasonable cost.

Imagine if telephone companies suddenly became insanely profitable and began churning out lots of billionaires, and telephony grew to dwarf every other economic sector—yet our phone calls were still crackly and expensive and the service unreliable.

We’d soon smell a rat. All that wealth, and all those telephone billionaires, would be a sign of sickness, not health. (This analogy comes from here.)

7. The Paradox

Another way to frame the finance curse is to couch it in terms of an apparent paradox, which is is that more money or “too much finance” makes you poorer. This again overlaps with the Resource Curse above, sometimes known as the Paradox of Poverty from Plenty.

This also connects with the point that a large portion of finance is wealth-extracting rather than wealth-creating, as Point 2 outlines.

8. Financialisation

This is a term preferred by academics, which overlaps heavily with the Finance Curse. Different people offer different definitions: perhaps the best-known comes from Prof. Gerald Epstein:

“the increasing importance of financial markets, financial motives, financial institutions, and financial elites in the operation of the economy and its governing institutions, both at the national and international levels.”

Financialisation essentially involves two trends, particularly marked since the 1970s. First, the growth in size in the financial sector. Second, the increasing penetration of financial techniques, tools, and especially debt into different parts of industry, agriculture, caring professions, and many other parts of the non-financial economy, so that they increasingly resemble financial actors. This involves wealth extraction and is justified by the shareholder value revolution.

This infographic gives just one example of what the second aspect of financialisation looks like. A wealth-extraction pipeline.

9. Shareholder value.

From the 1970s, intellectuals led by Milton Friedman and Michael Jensen argued for that corporations should no longer be run for the benefit of a range of stakeholders (owners, employees, communities, taxpayers etc.,) but instead should have a single-minded focus on maximising wealth for owners.

This way of thinking encapsulates the ideology behind the giant shift towards wealth extraction since the 1970s. (The shift is described and illustrated in the Private Equity chapter here.)

10. Mafia

The supporters of “more finance” say that the financial sector creates large numbers of jobs, tax revenues, trade surplus, and so on. (For example, here.) For many if not most people, that’s the end of the story.

But one could make the same fallacious argument about organised crime. Mafia-owned businesses create jobs, pay taxes, contribute to exports, and so on. But that is not to say that the Mafia is a good thing. Ideally we want to keep the businesses, but take the Mafia out of them. Similarly, we want to de-financialise our economies.

(We’re not saying here that the financial sector is necessarily like the mafia, though parts of it may be. We’re merely making an analogy, to aid understanding.)

11. Net versus gross

This is another way to challenge the false claims about a financial sector’s alleged contribution to the economy that hosts it (such as those published by TheCityUK). These figures they like to put about represent the sector’s gross contribution to the economy.

But the gross benefits are meaningless when it comes to making sensible policy. We need the net contribution. That is, the benefits minus the costs of oversized finance. Here’s one publication that lays out the net contribution.

12. Optimal financial sector size

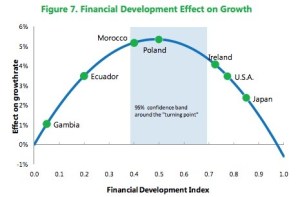

This is one of several graphs published by the IMF, the Bank for International Settlements, and others. The basic relationship is that a country’s financial sector has an optimal, growth-maximising size.

They recognise that if a country’s financial sector gets too big, it turns predatory and further growth in finance reduces that country’s economic growth. (For more such graphs, see here.)

This graphic, from finance Prof. Gerald Epstein conceptualises the difference another way.

Point D is where an economy would be if there wasn’t a financial sector: little more than subsistence farming. Point A is the optimal point where growth would be maximised, with an optimally sized financial sector serving its useful roles. Point C is where the economy currently is. (Point B is merely an effort to separate out the effects of crisis from other effects.)

For more on this, see here.

13. There is no trade off: it is not democracy versus growth

Many people labour under a misguided belief that there is a trade off between democracy and prosperity. As in: “If we tax and regulate finance and big business too much, we’ll lose jobs in the City of London and Wall Street.” Better give the capitalists freedom to do what they do best.

The Finance Curse shows us that there is no trade-off. If we tax and regulate the financial sector as democracy demands to curb predatory activities, the finance curse tells us that this shrinkage of the financial sector will make us more, not less, prosperous, as those studies in Section 3 suggest. This is especially true in larger economies. It’s a win-win.

This means that the Finance Curse carries an enormously hopeful, positive message.

14. The pie

This is closely related to the “No Trade Off” point above. Many people think that if we redistribute the pie more fairly, we’ll shrink the overall size of the pie, and it will discourage or frighten away investment.

The finance curse shows that this is incorrect. If we redistribute the pie more fairly by curbing wealth extraction and shrinking finance back to its useful core, we’ll grow the pie. This is the ultimate win-win.

The finance curse helps show why.

This links the finance curse to debates about inequality, and to another strand of research showing that more unequal countries grow more slowly.

15. Race to the bottom

When one country enacts a secrecy law, a tax or financial regulatory loophole, or an environmental free pass, to stay ‘competitive,’ others may follow suit, to “stay in the global race.” A race to the bottom ensues. The result is ever lower taxes and rules and regulations on mobile billionaires and corporations, leaving the rest of us to pick up the consequences. This hurts both ‘us’ and ‘others’, overseas).

This is closely related to questions of “national competitiveness,” below.

16. The Competitiveness Agenda

This is a way to talk about the Finance Curse’s global dimensions, and how they hurt the country hosting oversized finance. It’s perhaps the most complicated concept to convey. We’re told our countries must ‘compete’ and be ‘competitive.’ We need a ‘competitive’ tax system and a ‘competitive’ financial centre. It sounds great! Motherhood and apple pie! Who wants to be ‘uncompetitive.’? This is a potent ideology.

But what do these c-words mean? Countries aren’t anything like companies, and the two forms of competition are utterly different beasts (to get a first sense of this, ponder the difference between a failed company, like Enron, and a failed state, like war-wracked Syria or Venezuela.)

National competitiveness can have many meanings, but the finance curse unpacks the most virulent strain: the Competitiveness Agenda, heavily associated with the now-discredited political movement known as the Third Way. In a nutshell, this agenda tells us to hand tax cuts, deregulation, tolerance for monopolies, subsidies, too-big-to-fail banks and big multinationals so they can compete on a global stage. In short, we must extract wealth from society, from ordinary people, and hand it to big banks and multinationals, so as to be “competitive.” The finance curse shows that this is insane. A more ‘competitive’ economy in this sense will increase the role and size of finance, which the finance curse tells us will reduce growth and cause other harms.

The whole Competitiveness Agenda is an intellectual house of cards, ready to fall. Understanding the Finance Curse and how to tackle it provides great hope and vision for the future.

Note: other c-terms include “Open for business” (which means ‘favouring handouts to multinationals.’) “We are in a global race.”

Further reading: the chapter on Charles Tiebout, here.

17. Unilateral action is possible

A lot of people who want to “do something” about the race to the bottom focus on setting up international agreements to stem it.

In this context, collaboration is good, if you can get it. But this is hard: like “herding squirrels on a trampoline,” especially when certain countries behave as if they have the incentive to cheat. People feel conflicted, as in ‘we hate undermining poor countries, but (whisper it softly) we like the dirty money coming in.” It’s also hard to get large numbers of people onto the streets to support complex collaborative schemes to help foreigners. So the pushback is feeble.

The Finance Curse, however, offers a completely different approach, because it appeals to selfish national self-interest: “this hurts us.” Once we understand this, then the brakes are off, and we can start really cracking down on this stuff.

And this changes everything.

Conclusion

The Finance Curse is a deep, rich and powerful tool, not just for analysing and understanding many of the most pressing complex economic issues of our time, but also for presenting these to a wide public in a simple way, and providing pointers for deep and widespread reform.

Be the first to comment