Richard Murphy on what he thinks MMT does and what it doesn’t do

Richard Murphy is an economic justice campaigner. Professor of Accounting, Sheffield University Management School. Chartered accountant. Co-founder of the Green New Deal as well as blogging at Tax Research UK

Cross-posted from Tax Research UK

I have promoted the ideas implicit in Modern Monetary Theory (MMT) for some time. Indeed, I think I have done more than most to promote this idea in the UK. However, I am now quite worried that some who think that they advocate MMT are actually going to do significant harm to economic understanding and the necessary political embrace of the ideas implicit within it.

If you want to understand what I think MMT is then please read this blog post. It is still a pretty accurate summary of what I think, including the fact that MMT does not result in policy prescriptions like job guarantees whatever those who promote it might say.

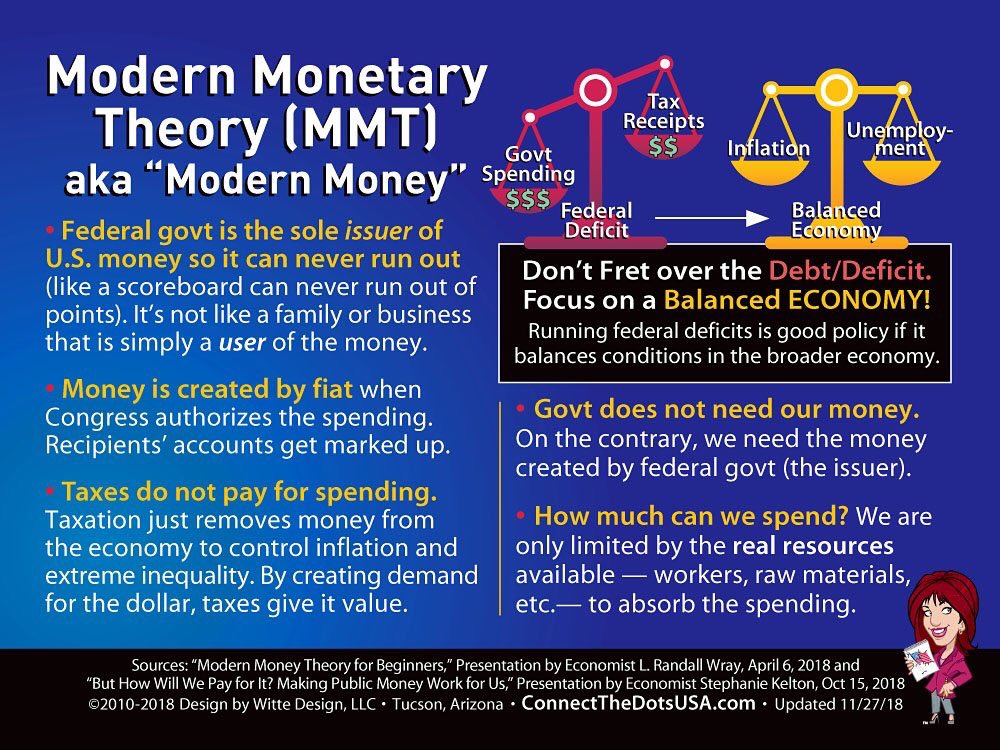

There is good reason for this. MMT is neither modern nor a theory. It was, in fact, completely misnamed . All MMT does Is describe how money works in an economy with its own fiat currency. A fiat currency is one that is issued by the government through its own central bank without any asset backing, meaning that it is nothing more than a promise to pay.

There are some obvious consequences from the understanding that MMT provides. The first is that fiscal policy is always more powerful the monetary policy, and that is most especially the case when interest rates are at or close to zero, as they are now and as they are likely to be for some considerable time to come.

Second, MMT makes clear there is no requirement for a government to balance its budget and that seeking to do so can be positively harmful to the well-being of a country because significant unemployment is likely as a consequence.

Third, MMT makes clear that the idea that the government taxes and then spends is very obviously wrong. It actually has to spend in the first instance to create the currency that is used to settle tax liabilities when it demands that they only be paid in the currency that the government itself creates.

Fourth, this then liberates a government to use tax, fiscal policy and its power to create money to deliver its other social, economic and industrial policies. These might, for example, seek to deliver full employment, reduce inequality, or promote certain activities such as those described as a Green New Deal, and so on. However, MMT does not dictate what those policies are. To claim otherwise is simply incorrect. I will go so far as to say that such a claim is a category error. Because MMT suggest that something is possible does not mean that it has to happen, or be done. Political choice always remains in operation.

Despite these facts there are now those who think that they are promoting MMT when what they are actually doing is ignoring political economic realities. Let me be quite blunt about that. In my opinion MMT does not permit that possibility. So let me note some economic realities that MMT does not let us ignore, whatever some might like to think.

First, governments that understand MMT will still need to issue bonds. I am well aware that in principle MMT suggests that this is not necessary, because a government that is able to follow the principles of MMT could instead simply borrow directly from its central bank on overdraft. However, that ignores some essential economic fundamentals that are at present embedded in our economies which MMT will not alter.

One of these is that people need to save. Another is that when people want to save they seek security. What is certain, and which MMT confirms, is that no one can deliver that security better than the government because it cannot default on its debt, and most saving (rather than investment) is debt. There is nothing contentious about that claim: what MMT makes clear is that every bank deposit account is no more than a debtor/creditor relationship. In that case if a government wants to provide a secure mechanism for people to save, and in every country there is a demand for that facility, then it must issue bonds for this reason. To pretend otherwise is to suggest that either there is no reason for private saving, which is absurd, or that private saving must be subject to high degrees of risk, which is a negation of the responsibility of government. So, let’s stop pretending that governments do not need to issue debt. They do. There is a social purpose for doing so. MMT advocates ignore social purpose at their own peril.

Second, let’s also stop pretending that there are no other uses for this debt. There are. For example, the overnight bank repo markets would cease to exist if there wasn’t government debt. For some bizarre reason some MMT proponents may wish to create massive instability in the banking system, but I don’t. In that case we need that to provide security for large-scale overnight deposit taking and that requires that there be significant quantities of government debt in issue. Saying that MMT would let us get rid of this debt is an act of recklessness as a consequence.

Third, let’s also note that MMT teaches that there is very good reason why a government should want to have its own debt in issue, and over a wide range of time periods. If the government is able to set interest rates by issuing debt and as such take control of these rates to hold them to the lowest possible level that can be achieved then it is delivering sound economic policy by doing so. Ignoring this possibility for controlling the unnecessary interest that might otherwise arise within an economy would be a recklessly irresponsible act by a government saying that it prescribed to MMT. MMT enthusiast should not encourage that.

Fourth, let us also stop the pretence that there is no connection between taxation and government spending. It is emphatically true that government spending is not funded by taxation. It is just as true, and MMT teaches it, that without taxation there are massive adverse consequences within an economy.

One of these is that government created money will lose its claim to value. Any other currency might be used instead. An immediate, disastrous, consequence might be that the government could lose control of the macroeconomy. Tax is an essential component of MMT as a result.

Another use for taxation is the control of inflation, which would have to be a priority for any government that prescribed to MMT, just as it is for any other government.

And, since, we know that the scales of deficit that can be sustained without significant inflation risk arising, most especially when full employment is reached (as I hope it would be) are very small, it follows that at the point where MMT delivers on its promises there will appear to be a direct relationship between government spending and taxation, even though we will still have to emphasise that spend comes before tax.

Finally, using MMT jargon does not change reality. So, for example, MMT is inclined to discuss matters like asset swaps. It does so, for example, when discussing quantitative easing. The claim is that bond issues, where cash (on which interest is not paid) is replaced by bonds on which interest is paid are just ‘asset swaps’. The reverse is then claimed to be the case for quantitative easing. The claim is made by some within the MMT community that this is inconsequential. Politely, that is absurd.

What has been described is, of course, an asset swap. But then, there is also an asset swap on every occasion when money is exchanged. This is true without exception. Double entry requires it. But double entry is not neutral. Double entry records changes in obligations and the nature of assets and liabilities that are in existence so to pretend that an asset swap has no consequence is to quite literally to seek to suspend reality. MMT should not be doing that. It should be describing reality.

When QE takes place Government bonds in issue are replaced in the hands of their owners with money. That money was created for the purpose, like all money created by loan transactions is. The government debt is cancelled. There is more government created money in the economy as a consequence. The profile of savings opportunities available within the economy changes as a result. Indisputably the risk profile of saving is increased. The outcome of that has been increased inequality resulting from substantial increases in speculative asset trading as a result of which their prices have risen with substantial socially significant consequences arising.

To pretend that this is without consequence, as some in MMT are doing, is to behave as irresponsibly as do those who promote the operation of free markets as if they are without social consequence, which neoliberals do. The claim that this asset swap can be ignored is as far removed from reality as is the theory driven dogma of those neoliberals that has done so much harm to our society over the last 40 or so years.

Any MMT group is, of course, at liberty to promote myths unrelated to what MMT actually explains as to economic reality, but they should then know that if they do I will criticise them as strongly as I do the fantasists who pursue other economic falsehoods. As far as I am concerned MMT is simply a tool that assists understanding in some areas. And that is it. It does not mean that I have to suspend my judgement. And it does not answer political questions. It does not prescribe policy. It does not let you pursue economic fantasies. It just explains how money works. To those who think otherwise I have one simple message: get real.

Richard Murphy

Be the first to comment