We have been trying to introduce Modern Monetary Theory to our readers. There is no one who explains it better and clearer than Richard Murphy. It is really not that difficult or esoteric. It is supported by many of our authors. We can only recommend taking the time to familiarise yourselves with it. It could well be a major influence in financial policy in the future.

Richard Murphy is Professor of Practice in International Political Economy, City University of London. He campaigns on issues of tax avoidance and tax evasion, as well as blogging at Tax Research UK

Cross-posted from Tax Research UK

David Howdle posted a comment on this blog in which he said:

Professor Murphy, thank you for your thoughts which I find most interesting. I share a lot of your blogs on pro Scottish independence Facebook group. I find that MMT resonates with many supporters. However, not with all by any means.

In response to sharing this blog someone has said “Check his blog. Murphy is peddling a new-ish economic fad called Modern Monetary Theory. This controversial and untested approach is evangelised by small clique of left-leaning economists and intellectuals mostly in the US who are looking for an unsuspecting guinea pig. Step forward Scotland”.

Are you able to point me to something robust to show that MMT is not as he labels it? That is “untested”. I’d be most grateful.

I take the comment seriously. Modern Monetary Theory does suffer from being called a theory. It also suffers on occasion from being a little too dogmatic (I include myself in that criticism, perhaps). And sometimes it just needs to be explained for what it is.

The truth is that modern monetary theory is as much a theory about money creation as sexual intercourse is a theory of how procreation in humans happens. In other words, it’s a description of what happens and not an explanation of what might be.

Modern monetary theory says money can be created in three ways. First, it recognises that notes and coin can be printed or minted and they have value so long as the government promises to accept them as legal tender in payment of tax. That is what the ‘promise to pay’ printed on a note now means, and has done since gold ceased to underpin the pound. But modern monetary theory also recognises that note and coin represent a tiny proportion of what we use as money. It is less than 3% in the UK at present.

What modern monetary theory does, however, then recognise (I say recognise because it is a truth, not really open to debate) is that in the modern economy we have what is called ‘fiat money’. Charles Adam has provided a good explanation of what fiat money is on the Progressive Pulse blog: I won’t replicate it here. Suffice to say that fiat money is based solely on a promise to pay and nothing else. There is no gold or anything else to back up the value of this money. It is simply debt.

The question as to why we accept that this debt has value is where modern monetary theory breaks ground. Remarkably recently (2014, to be precise) the Bank of England finally recognised the reality of banking in a fiat money system. This is that, as it says:

Most of the money in the economy is created, not by printing presses at the central bank, but by banks when they provide loans.

This is, then the second way in which modern monetary theory says money is created. To add a little more detail, the Bank say:

Money is more than banknotes and coins. If you have a bank account, you can use what’s in it to buy things, typically with a debit card. Because you can buy things with your bank account, we think of this as money even though it’s not cash

Therefore, if you borrow £100 from the bank, and it credits your account with the amount, ‘new money’ has been created. It didn’t exist until it was credited to your account.

This also means as you pay off the loan, the electronic money your bank created is “deleted” – it no longer exists. You haven’t got richer or poorer. You might have less money in your bank account but your debts have gone down too. So essentially, banks create money, not wealth.

Banks create around 80% of money in the economy as electronic deposits in this way.

We can debate the number and proportion, but that’s not the point at issue. What is clear is that the Bank of England agree as, modern monetary theory suggests, that money is debt and can be destroyed when debt is repaid.

There is a third type of money according to the Bank of England. As they say:

This is called electronic central bank money, or reserves.

This, in the Bank’s estimation, is about 17% of the money supply. They describe its use as:

[M]ost banks have accounts with us at the Bank of England, allowing them to transfer money back and forth.

The reserves are funds held in these accounts to ensure that banks can meet their obligations to each other.

Given that I have used Bank of England sources to this point (whilst noting that they agreed most of this under pressure from economists who in varying ways subscribe to ideas like modern monetary theory) it’s hard to argue with the ideas being unconventional.

What MMT has done is go further. First it has pointed out that the third type of money that the BoE notes exist has increased dramatically in quantity since 2008: it now exceeds £350 billion (note 21, here). And at the same time it so happens that the BoE has been creating very large quantities of money on its own account. As they say of quantitative easing, which is how they have done this:

Quantitative easing involves us creating digital money. We then use it to buy things like government debt in the form of bonds. You may also hear it called ‘QE’ or ‘asset purchases’ – these are the same thing.

As they stress, this is not a cost to taxpayers: the money is made out of thin air. Technically it is done by the BoE lending the new money to a company that the Bank itself owns which both agrees to repay it whilst using it to buy bonds that the government itself has issued: the rule that money has to be debt has to be followed, even if in this case the Bank technically owes itself the money it creates and uses it to then buy the debt of the government, which itself owns the Bank.

This might seem convoluted. It is. But the net effect is that the Bank of England issues new money to fund government spending and does so by cancelling government debt that would otherwise have funded it. £435 billion of cash has been created in this way – which has cancelled about 25% of all UK government debt. This is proved by the Whole of Government Accounts, which show government debt net of QE. Page 84 of those accounts says:

Gilts held by public sector entities are eliminated on consolidation and removed from the balance above.

It so happens that this sum seems to be remarkably similar to the increase in reserve funds noted by the Bank of England: this is not a coincidence. The latest Whole of Government Accounts are likely to show these now exceed £400 billion as QE has now exceeded that sum.

But this means that the Bank of England really should be saying that the third type of money is government created, because it is. Modern monetary theory is explicit about that. MMT recognises that both government created and bank created money exist. Here I will borrow from another post by Charles Adam on Progressive Pulse. As he says:

Money is created either when the government spends, or when a bank makes a loan. We can think of government spending and bank loans as the beginning of two interconnected money circuits. The government and bank circuits form the duopoly of money creation.

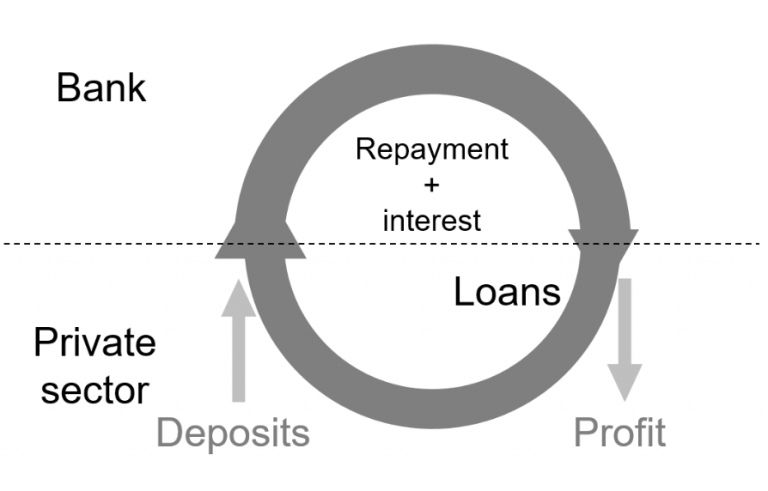

The Bank of England acknowledges the bank money circuit, which Charles draws as follows:

The bank lends money into existence. That creates private debt that is cancelled on repayment. I stress the point: repayment of loans does not provide new money for lending. It just cancels debt.

The money lent does not exist before it is lent. It is created by double-entry book-keeping and not by a printing press. Simply recording the debt in the books of the bank and customer creates the money because that is what is required to record the promise which gives fiat money its value. And repaying it reverse the entry and cancels the money. The promise has been fulfilled and is at an end.

And that’s it, although interest does create another circuit, part of which leaks into bank profit. But the point is that there is public debt until the loan is repaid matched by public wealth – the deposits held at banks created by the people who receive the lent funds when they are spent by the borrower.

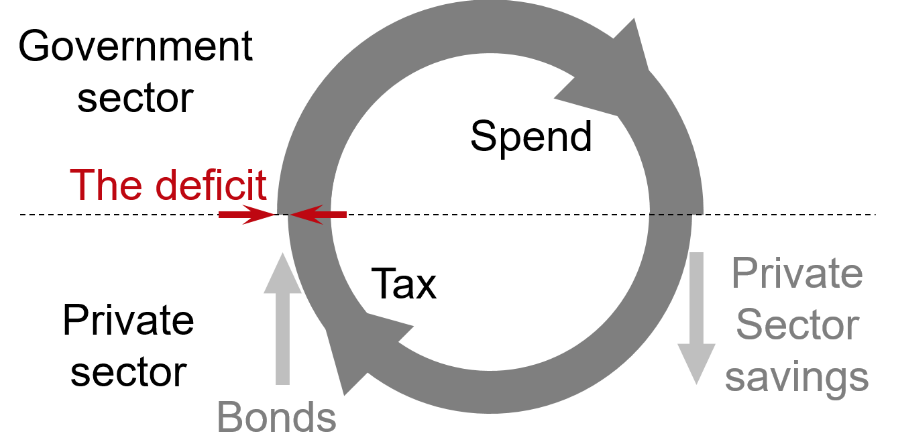

The government circuit is actually remarkably similar to this, and the logic is identical. This is the diagram:

Just as a bank does not wait for someone to deposit money to lend (and could not in the first instance, because until banks lent there would be no money to deposit) so governments don’t wait to collect tax before they spend. Instead they tell their own bank (the Bank of England in the UK) to spend for them. And then when they have spent they have created the money that can be paid in tax. And they have also created the money that can be used to buy the bonds the government issues if tax receipts are less than the total spend.

Let me absolutely clear: what this says is that government spending actually creates the money to enable the apparent payment of tax that appears, in popular imagination, to fund that spend. It also creates the money to buy government bonds – which are private wealth.

In other words we don’t have tax and spend. We have spend and tax.

And any shortfall in tax revenue compared to spend is either funded by the public lending the money the government has created back to it in the form of bonds, or is funded by government created money permanent as part of bank reserves – which is what QE does.

So MMT does not say anything except what happens to this point. As I noted earlier: this is not a theory of money creation, it is a description of what happens. And it has to be this way: if the government insists on being paid tax in its own currency (and it does) then it has to create that currency in the first place or tax could not be paid. The proverbial chicken and egg problem says spend has to proceed tax.

The bank money cycle does not change this. In principle, banks could create money debts for customers in any currency they and the customer likes and it would not matter. And of course, they do in fact do that for some customers. But in the UK (or any other country) the vast majority of loans will be created in the domestic currency. And that is precisely because the government does insist on having tax paid in its currency. When at least a third of all income is paid in some form of tax or other this means that receiving income in any other currency makes almost no sense for most people: they will not take the exchange risk of trading in one currency when they owe tax in another. This logic is core to modern monetary theory: it is tax that provides value to a state’s money. nIt is the government’s promise to accept its own currency in payment of tax that gives its money its worth.

And it is its promise to regulate banks in their issue of that currency by way of loans that ensures that the value is maintained.

And that regulation means that the bank money creation circuit is, in fact, a subsidiary one to the government money creation circuit: bank money would be worth very much less (or nothing at all) but for the fact that government regulates them and gives value through tax to the money that they create.

So money has value because the government endows it with that quality. And then, and only then, is the supposed left-wing quality added to this whole issue, because modern monetary theory then notes that when markets do not create full employment (and they usually do not, as Keynes first pointed out 80 years ago) then the government can create its own money to just to indirectly boost economic activity (which is exactly what QE was supposed to do, but was not very good at, to put it kindly), but to do it directly by investing itself.

And modern monetary theory says that this can be done until we reach full employment. Then, and only then, will we have inflation because of money creation (although we could have it for other reasons, such as a Brexit devaluation, but that’s something quite different). Because we have not had effective full employment for a long time (bogus stats on self-employment levels do not indicate full employment really exists) we have also not had this type of inflation for a long time.

So, to answer the question, who has used modern monetary theory? And who believes in it?

First, proper Keynesian economists believe in it. We had it for thirty years post WW2.

And the Bank of England and the government have believed in a form of it, and done it through QE since 2009.

All they have not been willing to do is direct the funds to good use, instead letting the money boost house and share prices.

But that does not mean they have not done it.

There is then nothing faddish or outlandish, let alone cultish about this. The only twist most explicit modern monetary theorists add is that we could use this power of the government to create money out of thin air – which the Band of England says exists – for the good of everyone by trying to boost employment, investment, productivity and median wages by direct government activity or investment. If that’s cultish, faddish, or left wing, then so be it, I say. Or rather, I actually say that those who say that this is cultish simply reveal their prejudice against those who might benefit from such policies.

Modern monetary theory describes the way money is created. And modern monetary theory says that if properly understood the power of government to create money could be used to create an economy focussed on benefit for the majority in any society where it can be used.

To return to the original question, does Scotland want that? As far as I can see it does. But it would not be an experiment as David Howdle’s critics suggest. The sad fact is that we’ve done the experimenting with everything that does not work for the last decade or more. Now we need to do what can work, and that’s modern monetary theory.

Be the first to comment