Interest rates were attached to Quantitative Easing, so that banks get interest on money created by the BoE, in which they have done nothing to earn. Now interest rates are rising, and those banks are going to benefit to the tune of £136 billion over the next five years, which is the cost of the NHS for a year

Cross-posted from Richard Murphy’s blog

Forgive me if what follows is a little technical. It relates to an issue of massively important concern, which is the amount of interest that will be paid by the UK government to our commercial banks because they were the recipients of the money created by the Bank of England to fund the quantitative easing programmes and some other loan programmes e.g. that for SMEs advanced during the Covid crisis.

The bottom line of this blog is that give or take a bit (and all economic forecasting is open to uncertainty) it is likely that those commercial banks will benefit by £136 billion over the next five years as a result of the projected Bank of England base rates included in the latest Office for Budget Responsibility forecast for the UK economy. That is almost enough to pay for the NHS for a year or to pay for education for 2.4 years.

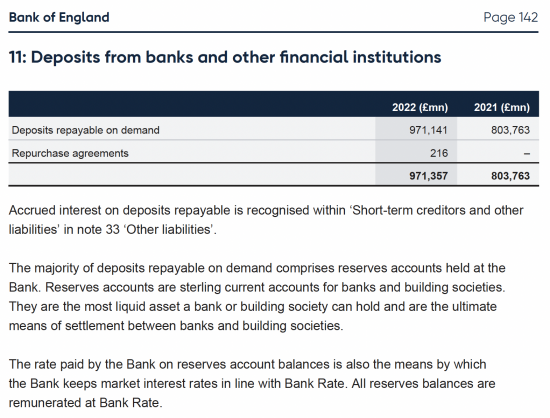

First, let’s be clear what we’re talking about. It is this sum on the Bank of England’s accounts in February this year:

There was £971 billion on deposit with the Bank of England at that time, placed with them by our commercial banks in what are called central bank reserve accounts.

Of this sum approximately £875 billion at that time was due to quantitative easing. The rest was due to additional loan programmes for SMEs and other organisations advanced by the Bank of England to commercial banks for them to lend. I explain how these balances arise here and here and so I will not repeat myself. They are, in summary, the inevitable consequence of the government injecting new money into the economy via the commercial banks using the quantitative easing process. What is absurd is that we pay those banks interest for the privilege of the government doing this.

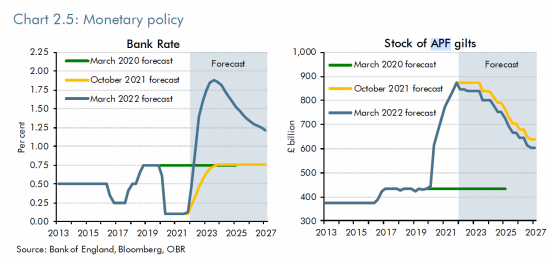

Until mid-2021 that was not an issue of concern: the interest paid was at 0.1%. It was insignificant. And then interest rates began to rise. This was the forecast of rates from the March 2022 Office for Budget Responsibility forecast:

You will note that rates were expected to rise to 1.8% and then fall back to 1.25% over time.

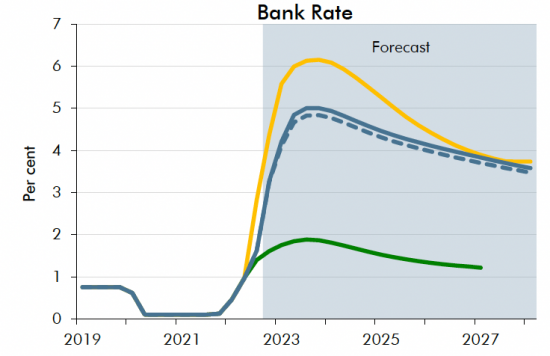

This is the forecast from the latest OBR forecast:

The forecast is for rates to rise to 5% and then fall to maybe 4% by 2027.

There is no equivalent chart for the APF – which is a shame. The Asset Purchase Facility is the fund maintained to hold the government bonds purchased using QE. This began unwinding in March this year. The net value is now around £835bn and the plan is to reduce it, although how realistic that might be is anyone’s guess. I will accept for the purposes of projection, however, that from 2023 until 2027 this facility reduces in stages to £600 billion meaning in turn that the sums held by commercial banks with the Bank of England might fall from £971 billion in February 2022 to maybe £700 billion in 2027.

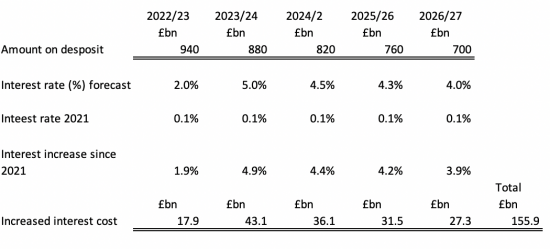

To look at the additional cost of the extra interest due as a result of forecast increases in bank base rates I prepared the following table. It is, of course, approximate. I assume a steady reduction in the sums on deposit assuming the Bank of England will keep redeeming its bonds as forecast in March. I have taken an average interest rate for each year based on the data supplied by the OBR. This is approximate but more than good enough for illustration purposes:

Let me put this in context. What this calculation shows is that additional interest of £155.9 billion will be paid to these commercial banks over five years.

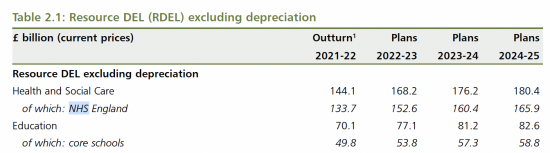

This is from the Autumn Statement and shows the sums given to the NHS to manage the health service. Capital budgets are about £12 billion a year on top:

So, we are, over the next five years, going to give the commercial banks enough to pay for the NHS last year.

I stress: we are giving them this money because the funds they have on deposit were created by the government and not by those banks: the commercial banks did nothing to earn these sums, at all.

And yesterday the tax rate on banks was reduced by 5%.

And let’s also be clear that this interest paid on these accounts is paid voluntarily: there is no law that requires it. What is more, it could be cut. For example, a balance of £100 billion would be more than enough to achieve the Bank of England’s goal of communicating its base rate into the economy via the commercial banks. 0.1% could then be paid on the rest. Doing this would save £136 billion over five years – and I strongly suspect rather more as I really cannot see the Bank of England successfully selling its bonds over the next few years given the scale of HM Treasury bond sales that are also planned.

In other words, education and the NHS could have an average of £27bn a year more to provide essential services simply by cutting the money paid to UK banks on deposits gifted to them by the government in the first instance.

And note – that is exactly the amount of spending cuts planned next year.

Or the amount of tax increases planned next year.

And what is clear is that these sums are being used to enrich our banks for no good reason.

How important is this issue? I would describe it as vital.

I just hope some politicians pick this up: it is vital that the interest paid on these accounts for no blood reason be changed and that our banks are not enriched unfairly at cost to us all. We cannot afford what the Treasury is planning. We do not need austerity to enrich our banks.

Be the first to comment