This is the first part of a series about how finance concentrates economic power.

By Nicholas Shaxson

Subscribe to The Counterbalance now

Wikimedia Commons Creative Commons Attribution-Share Alike 4.0 International

In July Darren Jones, the Chair of the UK’s Business, Energy and Industrial Strategy Committee, wrote to the head of the Competition and Markets Authority (CMA), the monopolies regulator, asking if it could investigate or intervene when debt-fueled private equity (PE) firms start buying out (or hoovering up) companies across the economy.

“There is concern,” Jones said, “that regulatory bodies have insufficient oversight or powers to intervene when new owners act irresponsibly.” He was focused on supermarkets but the PE buying spree ranges widely, from funeral parlours to dentists to sports to media to music to care homes to veterinary practices to children’s social care, and far beyond – in many countries.

“Private equity is rampant,” leading UK businessman Martin Sorrell said. “They are the dominant force now.”

|

We aren’t the first to point out the dangers from this wave of buyouts.

In our recent submission to the CMA on children’s social care, we showed how PE buys out healthy companies then, typically, loads them with debt. (We found that on average PE-owned firms in this sector had far higher leverage and far lower interest cover than non-PE firms, and strongly negative net tangible assets.)

This finance-led model is especially inappropriate for a sector like care for vulnerable children. But when it happens economy-wide — in the UK alone, private equity-owned firms employ some 850,000 people — the economy becomes more fragile, less resilient, slower-growing and more unequal. It is leading to the rise of “hollow firms” and makes bailouts more likely, as we saw in the pandemic.

We’ll make three big points here, alongside the usual (mostly accurate) “locust” criticisms of PE. All three apply up to a point to some non-PE firms, though PE is at the leading edge.

First, PE use its privileged access to finance, and its heightened willingness to use harmful financial engineering, to wring out extra profits from firms they buy. So PE firms can justify higher acquisition firms than less aggresive firms can. Bad actors have a finance-fueled competitive advantages over good ones, and this is contagious: non-PE firms feel the need to use PE tools and techniques, to stay in the race. When a PE firm buys one pet food company at 58 times earnings, and another at 69 percent above the listed share price, markets are clearly, violently, distorted. That is a competition issue.

|

Second, private equity firms are deliberately monopolising sections of our economies via mass acquisitions or “roll-ups“. That’s a competition and monopolies issue too.

Third, competition regulators could fix but aren’t fixing these distortions, because they are operating without the mandate, the paradigm, the tools, the resources or the political backing to meet the challenge. Indeed, the CMA’s boss Andrea Coscelli replied to Jones that the CMA can’t do much about blocking the PE shopping spree because of its core legal mandate “to promote competition in the interests of consumers.”

Our emphasis added: as we have often explained, our regulators’ obsessive focus on consumers, at the expense of other stakeholders like workers or taxpayers or the environment, has blinded and distracted them from the core issue: economic power, and the power structures that distort our economies. Competition rules were not designed with private equity in mind, and they are not fit to respond to the threat.

All this must urgently change. We recently made a submission to the UK government on this, which provides a template for change. (We’ll describe it in another edition of The Counterbalance, very soon.)

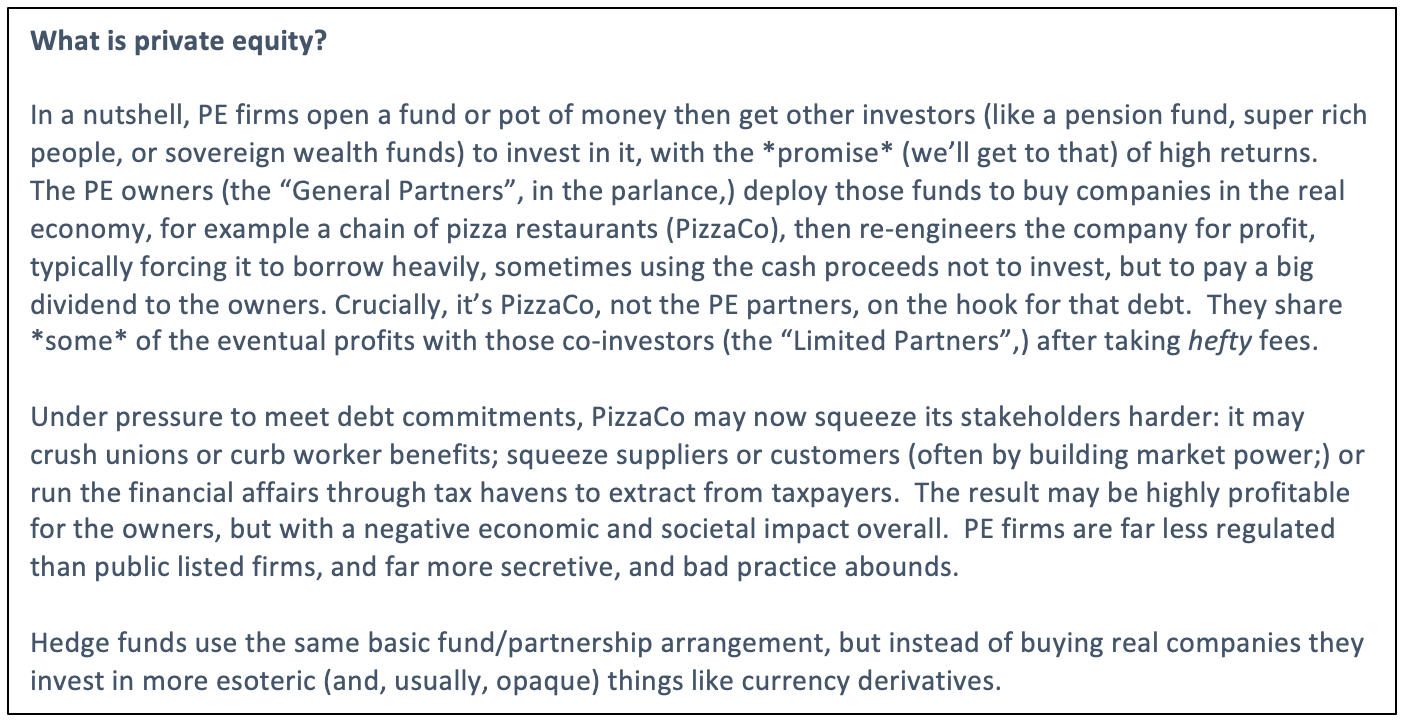

How do PE firms re-engineer the companies they buy, and how do PE owners get so rich? Those are trillion-dollar questions. As I recently wrote in The Guardian:

“To their critics, private equity firms are blood-suckers that load healthy companies with debt then asset-strip them, leaving lifeless husks. The private equity titans counter with the opposite tale: they buy underperforming firms, install whizzy IT systems and inject far-sighted management, borrow money to juice up performance, and turn them into roaring engines of capitalism, making everyone rich. As ever, the reality is a mix of the two.”

It’s true that PE firms do many useful things. If they buy care homes, they deliver care. If they buy funeral parlours, they bury the dead, hopefully with dignity. And so on. They can also add value by upgrading computer systems, doing staff training, or getting a promising startup access to world markets. And so on.

But these useful things are what any normal company boss seeks to do. It is what sets PE apart from the rest that is so troubling.

PE has pioneered a toolbox – a set of techniques, typically using heavy borrowing, that enables large-scale mining or extraction of wealth from underlying businesses on behalf of the PE owners (as well as, perhaps more surprisingly, from those that invest in PE). PE is under-regulated, under-taxed and opaque — and bad practices abound.

To put it crudely, this wave of buyouts by private capital is dragging a rising share of our economies out of the sunlight and into the shadows: “going dark,” as the US regulator Allison Herren Lee put it recently, risking “massive misallocation of capital, widespread fraud and the build-up of systemic risks.” (This is why, for example, residents of some Scottish care homes have been unaware that they are living in institutions run by the Chinese ministry of finance.)

Do PE firms employ excellent managers? Of course they do – because the money is so good! But that’s a bad thing – because it is sucking our best and brightest out of well-regulated sectors into this “dark” under-regulated world where the incentives are so skewed against a balanced and healthy economy. (This brain drain into finance is part of a broader “finance curse” – known to academics as “Too Much Finance.”)

And to the long charge sheet, we must add monopolisation. Here’s a first way it happens.

Roll-ups and market power

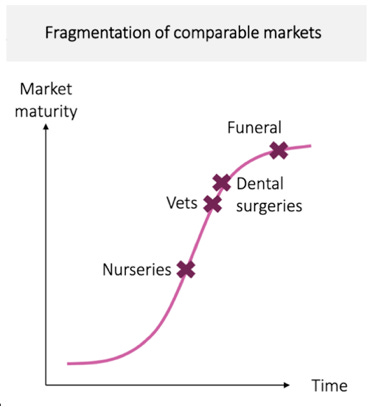

A common (and super-profitable) technique in PE-land is “Roll-Ups” — where someone buys up lots of companies in the same sector. This is not just about monopolisation. It can be done to reap economies of scale, and if you assemble lots of small firms into a larger one and call it a platform, financial markets value it more than the sum of its parts and you get “multiple arbitrage,” realised on ‘exit’ or sale.

Roll-ups can also be, of course, a monopolisation play. This image, from an industry presentation last year, shows UK sectors becoming more consolidated over time.

|

‘Market fragmentation’, of course, is (kind of) the opposite of ‘monopoly’. Take funerals, which this graph suggest is furthest along the consolidation road. An official from the French PE firm Antin, which had just bought a crematorium company, told the Financial Times in 2016 that

“the asset fitted their investment strategy because it was an infrastructure with high barriers to entry with a near monopoly.”

A CMA investigation into the sector found “serious concerns” about sketchy practices, exploitation of bereaved and vulnerable people, funeral firms getting hospitals and care services to funnel dying people into their welcoming arms, and high prices – “persistent” excess profits” leading to rising “funeral poverty” affecting over 100,000 people per year, with some having to take vicious payday loans or using food banks to cope. (The CMA’s remedies were half-hearted.)

Once again, this harm to consumers is a result of the devastating and self-defeating “consumer welfare” paradigm that dominates competition policy and reinforces monopoly.

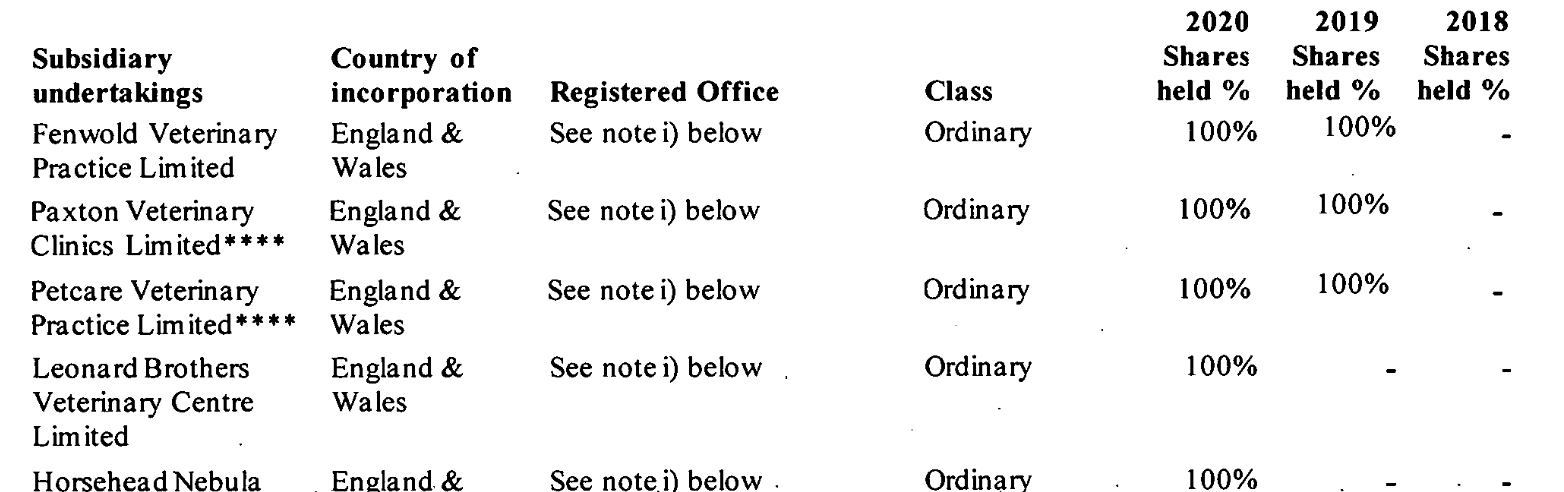

Another recent buyout wave concerns vets. Below is another visual sketch of a roll-up, this time from the 2020 accounts of IVC Acquisition Pikco Ltd., a subsidiary of the PE-owned vet giant IVC Evidensia. In the left hand column you see vet practices, and on the three columns on the right, you see when IVC took them over. These ones were rolled up in 2019 or 2020.

|

This list runs for a full 30 pages, with acquisitions in Belgium, Denmark, England & Wales, Finland, France, Germany, Ireland, Isle of Man, Netherlands, Northern Ireland, Norway, Scotland, Sweden, and Switzerland: IVC now owns more than 1,700 clinics and hospitals¹.

A Financial Times story this year focusing on IVC Evidensia notes:

“It’s a giant acquisition machine,” says a former employee. . . . A vet who sold his practice to the group says he “almost fell off his chair” on hearing how much it was offering. The vet, who requested anonymity, says IVC mistook his shock for hesitation — and increased its offer.

Once again, that debt-fueled, PE-led market distortion. (There has been some slackening of UK vet acquisitions recently, we’re told, amid Covid and Brexit.) Other big vet firms in the UK include CVS (a large non-PE firm,) VetPartners, (owned by PE firm BC Partners: it calls itself “the fastest growing consolidator of the UK veterinary practices market”) and Linnaeus, owned by the chocolate maker Mars Inc. in the US.

We spoke to two British vets for this article. One, Ian Bellis, an equine vet and co-founder and clinical director of an equine out-of-hours business called Equicall, now owned by CVS, said he was happy working for a large corporate. He saw benefits in terms of work-life balance, collaboration, salaries and opportunities for promotion, expansion, and diversification. These insider benefits illustrate the ‘scale’ and ‘efficiency’ justification routinely made for large corporations, which forms a basis for pro-merger competition regimes around the world.

But those are internal efficiencies. The economy-wide effects of consolidation are a different matter. Another vet, a co-owner of an independent practice in Yorkshire who did not want to be identified, told a different story.

Since graduating in 2004, she said, “almost everyone I know has had their practice bought by a corporate group.”

Historically, retiring owners of vet practices would sell their stakes to younger employees, keeping vets in charge of vet practices. (Before a 1999 UK law change, non-vets weren’t allowed to own veterinary practices.) Now corporates pay prices (and multiples of earnings) far higher than what employees can afford or borrow to pay. Her practice stayed independent, she said, only because the retiring owner “had set it up from scratch and felt he would struggle to hold his head up in the community if he sold out.”

“Initially [after a takeover,] nothing will change,” she said. But “gradually, over 1-2 years, it will become more expensive. There will be branding, a pricing structure, different uniforms.”

“They will say ‘the deceased pets need to go to this crematorium, because we own it.’ If you take a blood test the corporate will send it to a lab they own. They have a contract for washing machines, phones, computer systems, fuel: everything is done on scale, and for every little thing, the price [paid to suppliers] is pushed down.” [See here how supermarkets wield their market power, and the knock-on effects on local businesses.]

Prices could go up dramatically. “They are very clever: the things people compare prices on, like vaccinations, or consultations, are cheap, but everything else is very expensive. A friend of mine [working for a large corporate] said “I had to make an estimate for a treatment for a broken leg, and I am cringing.”

“The vets [working for a large corporate] get a bit deflated: they haven’t got the same respect for who they work for.” They’d turn extra jobs down, because “nobody would thank them . . . a lot of clients come to us because the corporate won’t squeeze them in.”

The CMA, in fact, has just launched a mini-merger inquiry involving CVS and Quality Pet Care, a provider operating in a small area on the southeast edge of London. “Why that one triggered the enquiry, I don’t understand,” she said, adding that there were local near-monopolies all over the shop. “In a single area, there might be six vets with different names, all owned by the same corporate. . . . In York the two biggest practices have different names but are owned by [the same corporate.] If you live in York but don’t want to work for them, it’s a bit rubbish.”

“For a long time, people have been saying ‘surely, there has to be regulation.’ Whether this troubles the general public, I don’t know.”

A good question, indeed. And where, indeed, are the competition regulators? They could, and in our opinion should, intervene to ensure a balance, diverse, resilient and thriving economy. Instead, under the consumer-first paradigm, they are promoting the opposite – and consumers are getting screwed.

Where did PE come from?

In history, several Americans stand out as guiding lights for PE.

One is Milton Friedman (see our co-founder Michelle Meagher writing about him in the Financial Times) who argued that business leaders should not worry about public-interest goals such as creating jobs, curbing pollution or stopping discrimination, and instead focus on just one thing: delivering profits for shareholders. That is one recipe for monopoly. We’ve also written about the pro-monopoly US jurist Robert Bork, who also argued that antitrust regulators should ignore public-interest goals, power, and democracy, and narrow everything down to the concerns of consumers, and of internal corporate ‘efficiencies.’ This cheer-led a “tsunami” of mergers and the march towards monopoly.

Matt Stoller has more on the cast of characters in PE history, but we’d single out Michael Jensen, an advocate for what the private equity expert Peter Morris calls “capitalism on steroids.” Jensen thought Friedman was too soft, and that corporate bosses needed their incentives juiced up. First, give them ownership stakes in the companies they ran, so they’d work harder to boost share prices, to get bigger bonuses. Second, make companies borrow heavily, and the “discipline of debt” would force bosses to focus more intensely on squeezing out those “efficiencies”. Third, as noted elsewhere:

“relax laws to allow for the development of a full-blooded “market for corporate control,” where financial players would buy and sell companies across the global economy as if they were cartons of orange juice. The free market, thus unleashed from above onto the corporate landscape, would magically dismantle and rearrange the corporate world in a blur of dealmaking to deliver a great surge of efficiency.”

Financiers, including PE firms, would be in the driver’s seat in this new economy: this was a power grab. These ideas (supposedly) justified private equity’s secret money sauce: debt, or borrowing. Bork’s ideas removed the anti-monopoly brakes, and Jensen’s put a brick on the accelerator.

Debt, debt, debt

To misquote a famous economist, the process by which PE firms use debt to make money is so brazen and simple that the mind is repelled.

We won’t get into the squirrelly details of the debt-laden tricks – our Children’s Social Care submission gives plenty of examples (see the outrageous “dividend recapitalisation” ploy, for instance, or the “Opco-Propco” manoeuvre.)

But generally, when PE buys a firm they load it with large debts, which cranks up the rewards – and the risks. But they set it all up so that if the risks turn out well, the PE owners make a killing — and they can spend the cash on — to use a real example — parties with acrobats, Mongolian soldiers, Rod Stewart, camels, and Donald and Melania Trump.) If things turn out badly, it’s the underlying company and its employees and other stakeholders that pay the price. All that debt makes the whole economy more fragile, as the financial sector grows bigger. (That’s a financial version of the “Profit Paradox“, or the finance curse in action.)

Why do bankers lend so much to fragile companies? The first short answer is that it isn’t their own personal money they’re lending — they get bonuses from sealing each lending ‘deal’ so have incentives for doing as many as possible; second, there’s a “wall of money” out there, much of it puffed out by central banks, looking for a home. Lenders are so eager to lend that, as one lawyer put it:

“There used to be a sense that private equity firms needed to take care of the lenders that funded their LBOs . . . Now, they don’t seem to care at all and they have no qualms about burning [them].”

Alongside this leverage, consider this. An average of only 1-2% of the money in a PE fund comes from the owners, with the rest coming from those hapless co-investors, like pension funds. If I flip a coin and get £100 every time it lands heads, but only lose a pound or two if it lands on tails – well, I’ll flip as many as I can. With multiple acquisitions, I can’t lose.

So PE separates risk from reward. This is a recipe for recklessness, and it makes a mockery of Jensen’s ideas. This is not how capitalism was supposed to work.

Solutions – and PE’s big dirty secret

How do we tackle this, for a healthy (and balanced) economy?

Answers come in two main varieties: upstream and downstream.

The upstream answers look at the sources of money flooding into PE firms. Much of this is outside our scope, in the realms of monetary policy and so on. But here, it is worth mentioning PE’s big dirty secret.

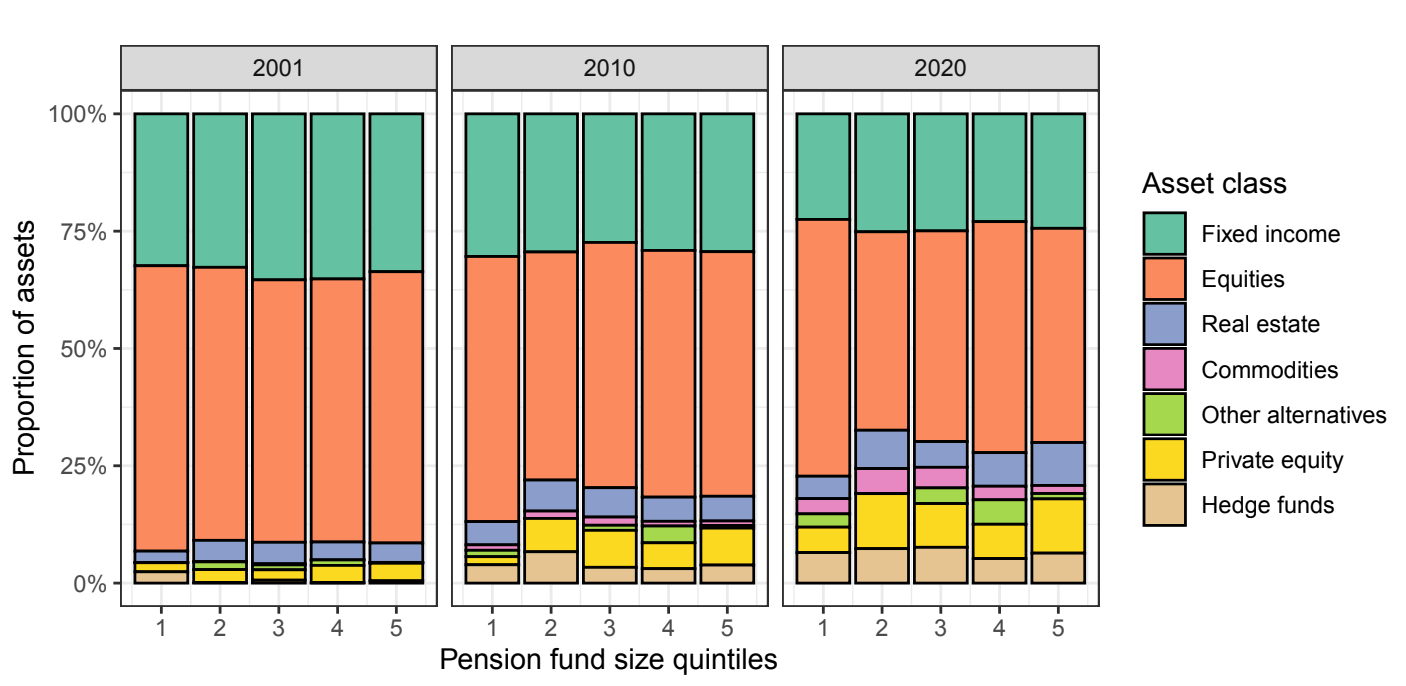

Investors in aggressive PE funds tend to know that they are investing in predatory practices — but they think they’ll get to share in that predation, and get high returns. So they have invested increasing amounts in it.

|

Source: Fueling Financialization: The Economic Consequences of Funded Pensions, Ben Braun, New Labor Forum (forthcoming.)

The dirty secret is this: PE firms on average produce hopeless returns for their investors! (See here, here and here, for instance.) This is the “Real Money Heist.” Through a litany of visible and hidden fees — averaging around seven percent a year (compared to 0.2 percent, say, for a tracker fund) — PE firms do often make a killing from their operations, internally, but the PE owners take nearly all of those extracted winnings for themselves before those hapless co-investors – perhaps your pension fund – get a look-in.

Why do fund managers invest, then?

The reasons are rather sad. Many are beguiled by an industry of bamboozlement, storytelling and sponsored ‘academic’ studies generating the “opaque informational soup that private equity firms squirt out like cuttlefish ink.” There are other reasons too – some of which are just pitiful.

Competition authorities could impose a blast of transparency upstream to expose fund managers’ folly. But their main contribution probably lies downstream, dealing with where investors’ money goes and how it gets spent. On children’s care, we made numerous recommendations. (Another admirably fierce package, not enacted, is Elizabeth Warren’t Stop Wall Street Looting Act.)

But for the bits competition authorities can do, like block harmful PE takeovers, we must change the paradigm under which they operate. We have made a submission to the UK government on this, too: we’ll cover that in a future Counterbalance.

Geographically, all this plays out in unhealthy ways. Each unproductive PE trick in each vet practice, each children’s nursery, each dental surgery, each squeezed customer or employee or supplier, creates a little teardrop, or trickle, of money. These trickles collect in rivulets, then streams, then large rivers, all flowing in one direction: out from every part of the nation, into the pockets of a small number of PE owners, usually located in rich parts of London, overseas or offshore. PE and financialisation will counteract and undermine any efforts to ‘level up’ the left-behind regions. And all this debt poses systemic risks threatening the “metropolitanisation of gains, the nationalisation of losses” when the next crisis hits.

Finance is re-making the structure of our economies. As Herren Lee recently put it, “What happens in capital markets, doesn’t stay in capital markets. Faultlines on Wall Street can crack and spread across the entire country upending the lives of all.”

Private equity is one of finance’s sharpest tools, monopoly is a core goal, and a key regulator that ought to step in, can’t or won’t. We need to change the paradigm. This is a winnable fight.

BRAVE NEW EUROPE has begun its Fundraising Campaign 2021

Support us and become part of a media that takes responsibility for society

BRAVE NEW EUROPE is a not-for-profit educational platform for economics, politics, and climate change that brings authors at the cutting edge of progressive thought together with activists and others with articles like this. If you would like to support our work and want to see more writing free of state or corporate media bias and free of charge. To maintain the impetus and impartiality we need fresh funds every month. Three hundred donors, giving £5 or 5 euros a month would bring us close to £1,500 monthly, which is enough to keep us ticking over. Please donate here

Be the first to comment