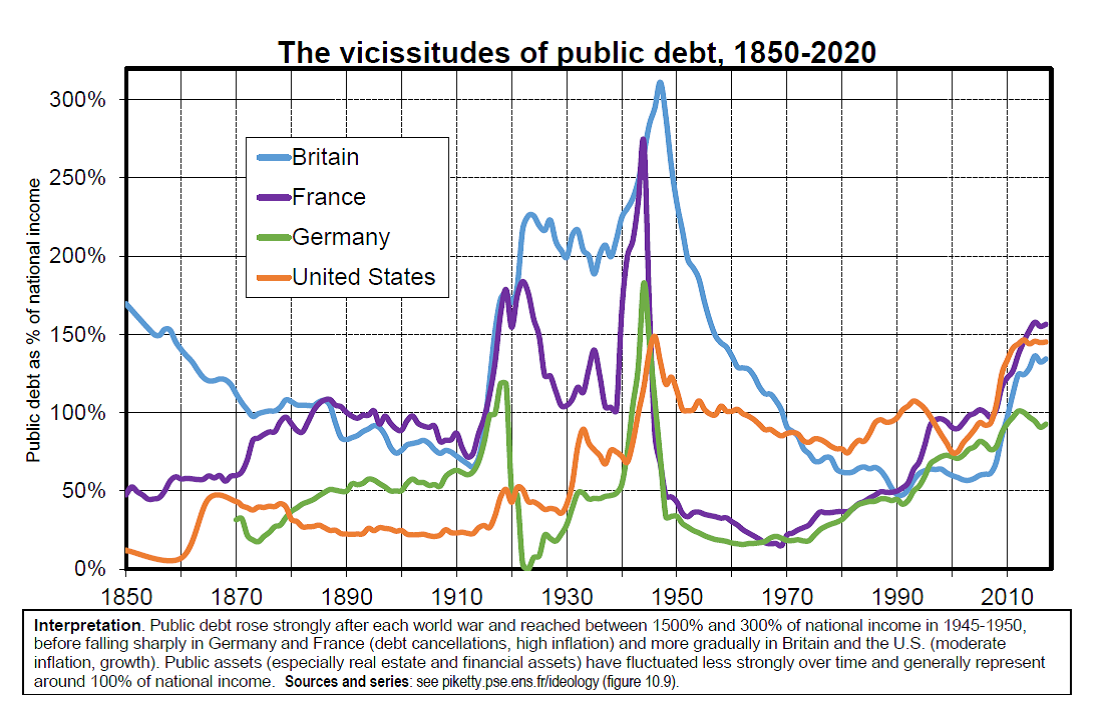

How are States going to deal with the accumulation of public debt generated by the Covid crisis? For many, the answer is clear: central banks will take on their balance sheets a growing share of the debts, and everything will be settled. In reality, things are more complex. Money is part of the solution but will not be enough. Sooner or later, the wealthiest will have to be called upon.

Read here

Be the first to comment