In Germany investments are at an all-time low despite negative debt rates and huge foreign account surpluses. Yet, according to think tanks such as Bruegel and Centre for European Reform, there is a need for investment in German infrastructure and in the education system. This would also appease German voters, who punished the government parties in recent EU elections, showing their displeasure at the resulting increasing number of low-paid workers.

Carlo Clericetti is an Italian journalist. In the past he has directed “Affari & Finanza”, a weekly supplement published by “La Repubblica”, and web portals. Currently he blogs for “La Repubblica”, for his personal website “Blogging in the wind”, and writes for other websites on economy and politics.(published on Repubblica.it on 10 June 2019)

Translated and edited by BRAVE NEW EUROPE

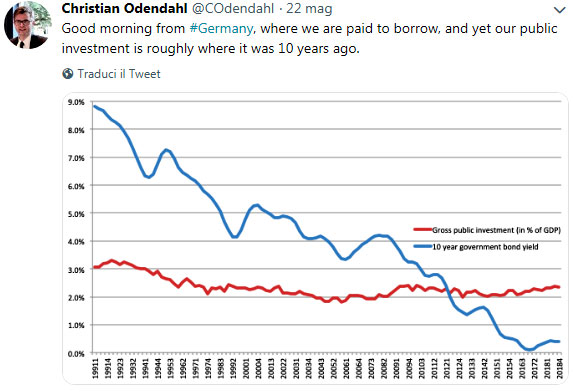

The graph below is very simple – just two lines. It was published on Twitter by Christian Odendahl, chief economist of the Centre for European Reform, accompanied by the few words characteristic of the medium. But it is enough to make us understand the absurdity of German economic policy, which Berlin and its allies have in fact imposed on the entire European Union.

Before talking about this, it is good to know that this British think-tank, in its presentation, defines itself as “pro-European but not uncritical”. It considers European integration “largely beneficial”, but believes that “in many ways the Union does not work well”. It follows that the think tank’s intentions are to make constructive criticism, thus one cannot see it as an enemy of the EU.

Now let’s return to the graph, which shows trends in interest rates of the Bund, the ten-year-old German government bond, and public investment in Germany.

“Good morning from Germany” – writes Odendahl ironically – “where we are paid to borrow money and yet our public investments are at about the same level as ten years ago.” He could have said twenty years ago, and also added that even earlier, in 1991, when interest rates were almost 9%, public investment had been about a percentage point of GDP higher than today.

The latest economic data from Germany are very bad. In April, industrial production fell by 1.9% on the previous month and by 1.8% on an annual basis, but that of industry in the strict sense (i.e. excluding energy and construction) was -2.5%. The Bundesbank cut its growth estimates by a full point, from 1.6 to 0.6%, reducing also those for next year. If you rely only on exports to grow, when something happens in the rest of the world economy – as is now the case due to the trade wars the US is waging – you suffer a heavy backlash. Together with these data, in fact, comes the export data, which fell by 3.7% compared to the previous month.

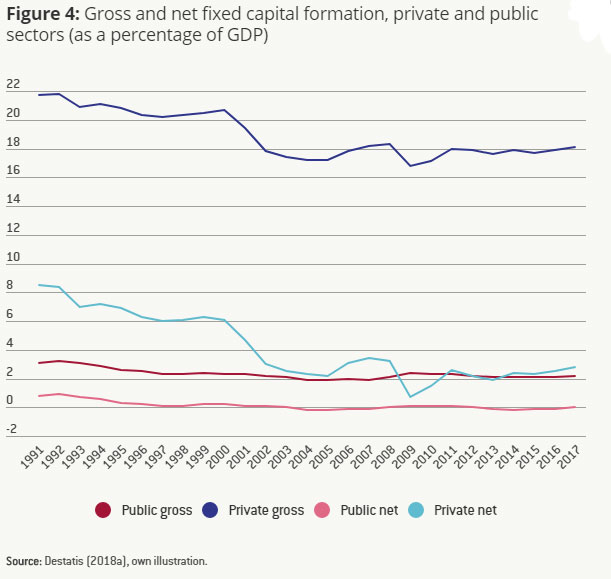

Oh, but perhaps the public sector invests little because there is no need, because there is a boom in private investment. Is that so? Another graph helps us to understand this. This is by Bruegel, another authoritative think-tank, and is in an article (by Alexander Roth and Guntram B. Wolff) with the significant title: “Understanding the lack of German public investment”.

Private investments, as we can see, have more or less the same trend as public investments, and were higher when interest rates were higher.

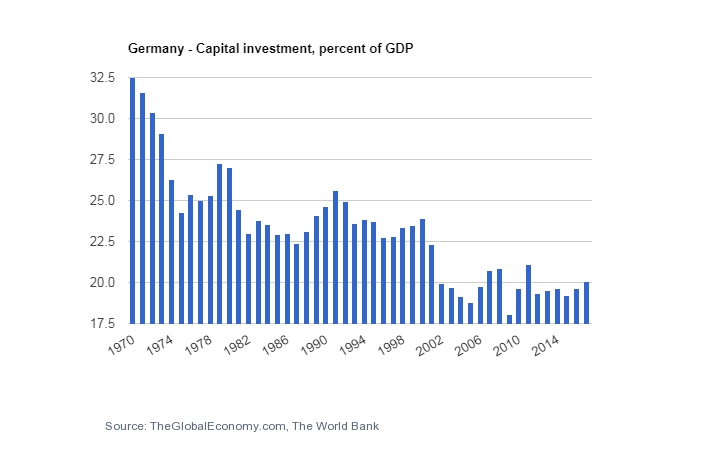

But nowadays, perhaps everything is in an optimal condition in Germany, it does not need to make many investments. What does Bruegel’s paper say? The authors do not think so. Not only do they write about “under investment in the corporate sector”, but they also believe that “the decreasing quality of public infrastructure – such as education and digital services, but also roads – will obviously have negative implications for private economic activity and could in turn further reduce corporate investment”. Also because the decline in German investment is not something recent: as this graph shows, in the last half century the trend has been that of a progressive reduction.

And yes, the resources are there in abundance for Germany to invest more today. Since 2014 its budget has closed not with a deficit, but with a surplus: in 2018 it was 1.7% of GDP, or 58 billion euros, the highest in 30 years. And the enormous assets of foreign accounts – in recent years more than 8% of GDP, while European rules set an already generous maximum of 6 – which also equates to unused savings. Some might say that they do so to reduce public debt, but as is well known, what counts is the ratio of debt to GDP: and if investment were to increase growth, the ratio would decrease itself, and German citizens would be richer overall.

Why is Germany behaving in this way? The explanation can be found in the combination of dominant economic theories, applied according to a theoretical orientation characteristic of a strand of German scholars – the famous ordoliberalism – and approaches that have their roots both in events in the history of the nation and in the culture of this people. The maniacal attention to price control certainly derives from the indelible memory of the catastrophic hyper-inflation at the beginning of the 1920s, while the aversion to debt appears to be a pre-rational attitude. This sediment has generated a specific interpretation of economic liberalism, precisely ordoliberalism, not by chance elaborated in the 1930s. Its main pillars are that the task of the State is to keep the accounts in order and to intervene in the economy only to ensure that the rules of the market are respected, above all protecting competition. Instead, it must refrain from directing industrial policy, because it is up to the private sector to decide whether, how, and where to invest.

This was recently confirmed by a document of the German Council of Economic Experts (the so-called “Five Wise Men”) in response to the “2030 Strategy for National Industry” of the Minister of Economy, Peter Altmaier of Merkel’s Christian Democratic Party (CDU), decrying it as unusually interventionist. Altmaier, while using expressions such as “exceptionally” and “in exceptional situations”, affirms that no country bases its success by relying only on market forces and demands that the State take an active role in the creation of “national champions” (i.e. companies large enough to be able to compete with the American and Chinese giants), in favouring innovation and in protecting companies considered strategic from foreign acquisitions, if necessary with nationalisation. Out of step policy for the Wise Men, guardians of traditional orthodoxy: “To be successful in the long term, an innovation project should refrain from an industrial policy orientation, which considers it a state task to identify future markets and technologies as strategically important … Policy makers are unlikely to have sufficient knowledge and understanding of future technological developments and changes in demand to develop this strategy effectively in the long term.” If the government is concerned about making progress, it should rather rely on the decentralised knowledge and individual actions of various actors in the national economy.” The only dissenting voice was Peter Bofinger, the sole Keynesian among the five and who in recent years has led a solitary battle against these approaches. He disagreed as usual with these conclusions: but it was his last minority report, because his third term in the Council terminated last February and he is no longer a member. In a recent speech, Mr Bofinger called for a Europe-wide debate on industrial policy. Otherwise, he foresees, despite the fact that Annegret Kramp-Karrenbauer, current president of the CDU and potential successor as Chancellor of Angela Merkel, also spoke in an interview about the need for a “real paradigm shift” in industrial policy, “it is to be feared that this impulse could be anchored into the German mainstream thought”.

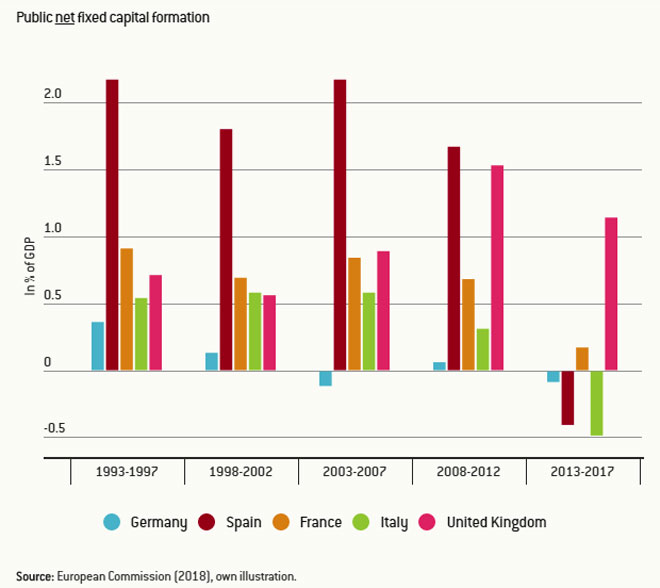

The intentions expressed by Altmaier and Kramp-Karrenbauer have been flanked with concrete policies. Public investments have been set at150 billion – but over four years – which is a fiscal stimulus of 0.4% of GDP with the reduction of taxes and contributions. But it is still too little to recover the inertia of the past. Bruegel again shows us how Germany has invested so little that it can be compared to the countries that have suffered the most from the crisis, such as Italy.

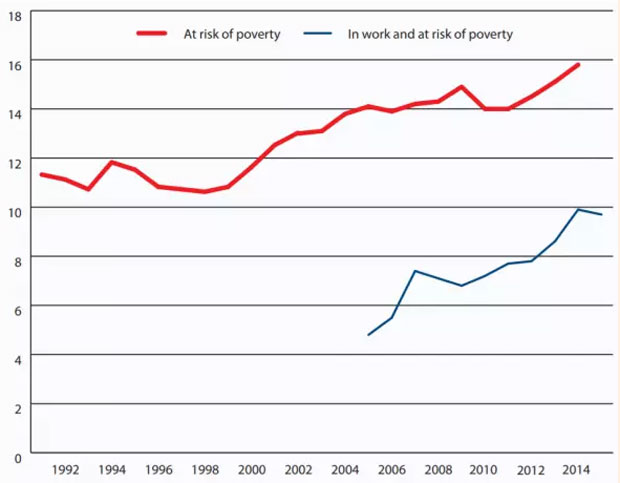

All this rigour would have little effect on the situation of normal German citizens. It is Odendahl again who points out the deterioration in the living conditions of a large number of people. This is the increase in those at risk of poverty, an increase that, as you can see, also affects those who have jobs.

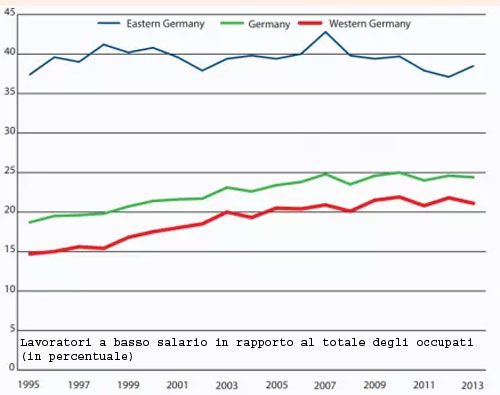

“Poor workers” are also on the rise. Those who earn less than two-thirds of the median wage are considered to be at risk of poverty. They have gone from about 15% in the mid-1990s to almost a quarter of the total, mainly because of the situation in the East, where they are close to 40%.

If you want an explanation of why the people are abandoning Merkel’s party and the social democrats of the SPD in droves, it is because the two big parties that have alternated to lead Germany since the war, and are currently in government as a “Grand Coalition”, cannot find a convincing answer to these graphs.

But if it is true that Germany is badly governed, why does it have such a strong economy and has become the world’s leading exporter? First of all, as we have seen from the graphs, this has not always been the case. In the past the country has generated a powerful and technologically advanced industrial system, with high quality products very competitive on international markets. It is also true, however, that the balance of trade surplus records date back to the last decade. And this is due to another factor: the euro. In a paper by the International Monetary Fund, quoted in an article by Marcello Minenna, it is estimated that the real effective exchange rate (REER) of Germany is undervalued between 10 and 20%. If there were still the deutsch mark, that would be its quotation on the foreign exchange market, and the prices of German products would be higher by a similar percentage. Moreover, Minenna adds, the inflow of capital into German government bonds, which are considered to be a secure investment, means that German companies can be financed at zero interest rates, further increasing their competitiveness. In short, thanks in part to the euro, the Germans are now living off an annuity.

Incidentally, the German situation is helping to demolish fundamental aspects of the dominant economic theory. That, for example, that investments depend on the level of interest rates and that the issuance of public debt, by raising rates, “displaces” private investment. As we have seen, the private sector is not investing either, despite the zero interest rates. The idea that has prevailed in Germany so far, according to which the budget deficit is a bad thing anyway, even if it serves to invest, receives from these data a sharp denial.

Finally, it should be stressed that if Germany is misgoverned, it is not just “their business”, for two reasons. The first is that its policy is of the beggar-thy-neighbour type, i.e. “do business at the expense of your neighbour”. By squeezing its domestic demand, Berlin weakens the entire economy of the European Union (and also the international economy: it’s no coincidence that Trump is not only upset about China, and in this case he can’t be wronged). The second is that Germany wants the same policy to be applied by all the EU countries, forcing them to compete by making the living conditions of its citizens worse. Once upon a time, there was talk of a “European model”, characterized – compared to the Anglo-Saxon model – by a fairer distribution of wealth in a society that sought to offer well-being to as many of its citizens as possible. Germany has long forgotten that model.

Be the first to comment