As governments struggle to reimpose austerity we shall be confronted with some noteworthy intellectual contortions, as here in Britain

Jo Michell is associate professor in economics. Bristol Business School, UWE

Cross-posted from Critical Macro Finance

We are entering fiscal silly season. As the budget approaches, we should brace for impact with breathless reporting of context-free statistics about inflation, interest rates and government debt.

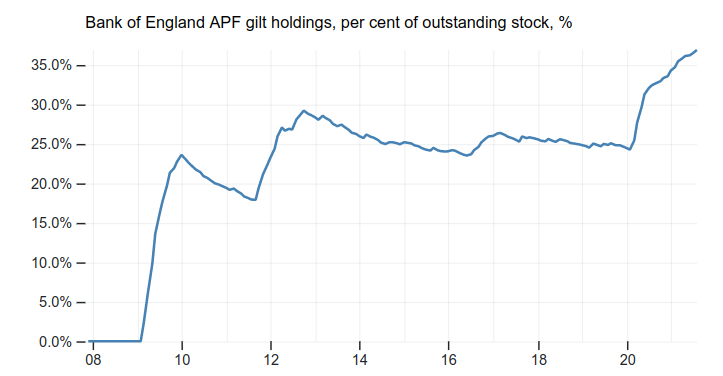

The story is likely to go something like this. Inflation is rising. This raises costs on government debt because some of it (index-linked bonds) pays an interest rate linked to inflation. Costs associated with quantitative easing (QE) will also increase because QE is financed by central bank reserves which pay Bank Rate (the Bank of England’s policy rate of interest). Since inflation is rising the Bank will have to raise interest rates to control it. This will increase the financing costs of QE and the cost of issuing new debt for the Treasury.

The conclusion — sometimes implied, sometimes explicit — is usually some version of “the situation is unsustainable therefore the government will have to make cuts”.

While each part of the story is technically correct in isolation, the overall narrative — debt is out of control and the situation is going to get worse because of inflation — doesn’t stand up to scrutiny.

These stories are rarely presented with sufficient context. Instead, journalists tend to rely on statistical soundbites such as “public debt is the highest since … ”. This is rarely if ever accompanied by the fact that debt/GDP is a fairly meaningless number.

The problems associated with government debt essentially boil down to the fact that debt involves redistribution. In the case of the government this means redistribution in the form of transfers from tax payers to bond holders. This is politically difficult. (This is also why “but currency issuer …” responses to these issues are largely beside the point — the problems of debt management are ultimately political not technical).

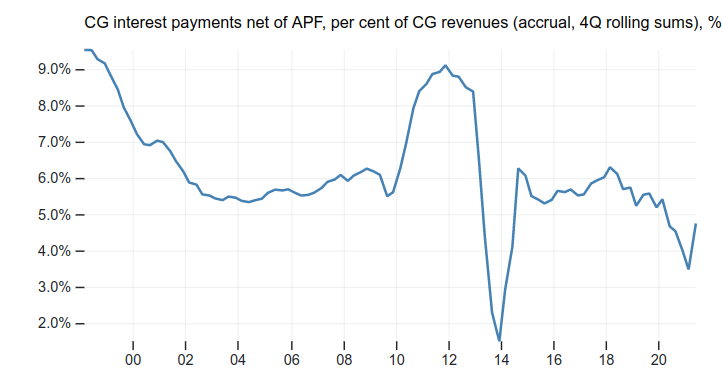

The ratio of debt to GDP tells us very little about the current political difficulties arising from debt servicing. Instead, the relevant magnitudes are total interest payments and tax revenues.

Total interest payments are equal to the debt stock multiplied by the effective interest rate on government debt. Focusing on the debt stock in isolation is thus equivalent to representing the area of a rectangle by the length of one side.

A better indicator of the risks associated with public debt is the ratio of government interest payments to tax revenues, as plotted in the figure below.

Interest payments on government debt have indeed risen recently. A spike in June triggered media articles about the highest interest payments on record. In context, such statistics are shown to be meaningless. Interest payment have risen to around 6% of taxation over a four quarter period, compared with all-time lows of about 5.3%. (Calculated on a 12 monthly basis this rises to around 6.5%). It is hard to see signs that the sky is falling.

Adjusting for this reduction in interest payments produces the figure below: net interest payments sum to around 4.7% of tax revenues over the last four quarters (or 5.2% on a rolling 12 monthly basis).

What of the dangers ahead? It is true that if inflation rises, then interest costs will rise, all else equal. But the scale of these rises is not predetermined, and will be affected by policy.

First, persistent inflation is far from a certainty. If if inflation does persist in the short term, the Bank does not need to raise interest rates. Hikes in response to price pressures due to pandemic reopening and supply side bottlenecks will do more harm than good — instead the Bank should wait until the economic recovery is clearly underway. In this context, interest rate increases would likely be a good sign, and would be offset by rising tax revenues. Further, the Bank could introduce a “tiered reserve” system which would serve to hold down the rate paid on a substantial proportion of outstanding debt. Short term and index-linked debt can be rolled over at longer maturities, delaying the point at which higher rates would feed into higher interest payments.

In summary, simple claims such as “a one percentage point rise in interest rates and inflation could cost the Treasury about £25bn a year” are not useful without context and explanation of the long list of assumptions required to produce such a figure. The policy conclusions derived from such claims should be taken with a large pinch of salt.

Be the first to comment