The European Central Bank has raised interest rates again, despite the alarming signs that a financial crisis is looming.

Jordi Schröder Bosch is a researcher at Positive Money Europe.

Cross-posted from Positive Money Europe

Prices do not simply decrease when central banks raise interest rates. Instead, the ECB raises the interest rate on interbank lending, which then goes on to influence financial conditions, demand, and finally, prices. This journey, from the short-term interest rate to prices, takes time to materialise. Or, as economists would say, the transmission of monetary policy operates with long and variable lags.

According to a recent analysis in the IMF’s World Economic Outlook, it takes up to three years for interest rate hikes to have their maximum effect on prices in advanced economies [1]. This means that if the ECB were to raise interest rates today, the full effects of this decision would not be felt until 2026. Ultimately, this means that the ECB, by putting most of the weight of their policy decisions on today’s inflation, faces the risk of overdoing it in its current response to inflation, as when the current hikes take effect, we may be in a completely different macroeconomic context.

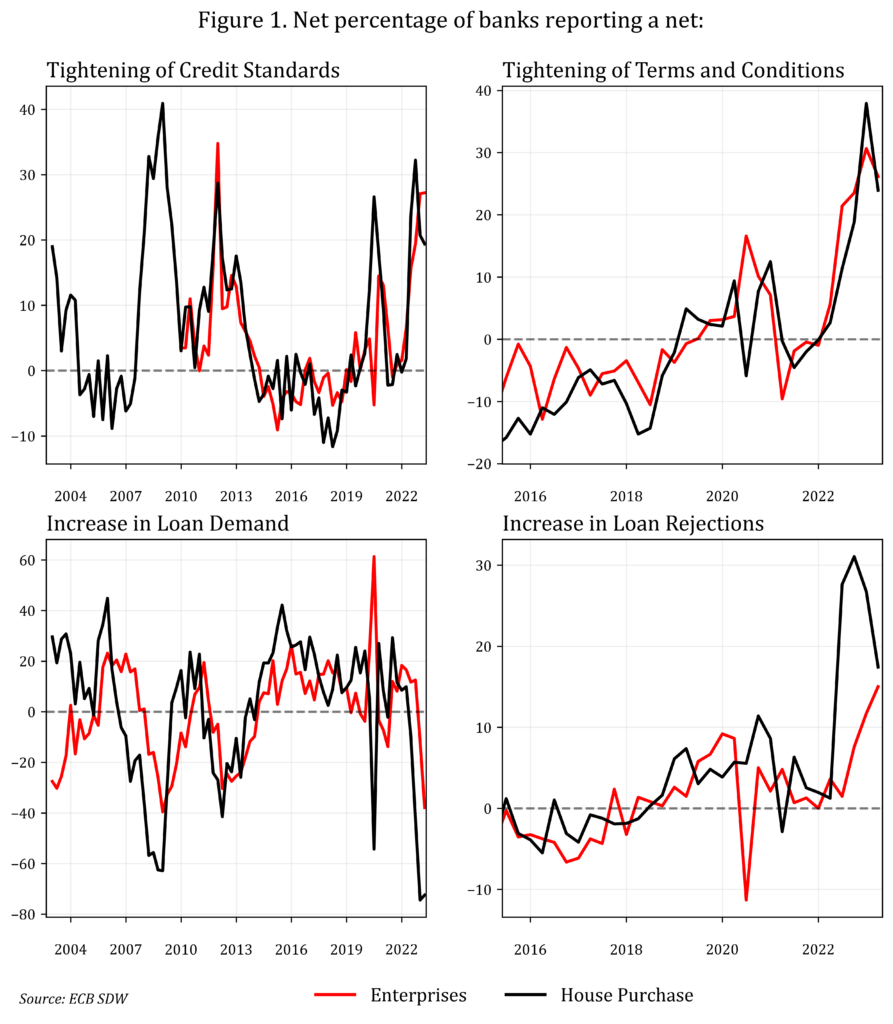

The data in the Bank Lending Survey can act as a canary in the coal mine to help us observe the strength by which the tightening of monetary policy is being passed on. In the latest round of the survey (2023-Q1), banks reported a worrying tightening of credit. The tightening in banks’ terms and conditions is the most severe since the Eurozone crisis (Figure 1, top left quadrant). The contraction in loan demand by enterprises is the largest since the global financial crisis in 2007, while loan demand for house purchases has experienced its sharpest fall since the survey began in 2003. This should indicate that instead of continuing to raise the interest rate, ECB officials should rather wait and see what the consequences of their past policy decisions end up being.

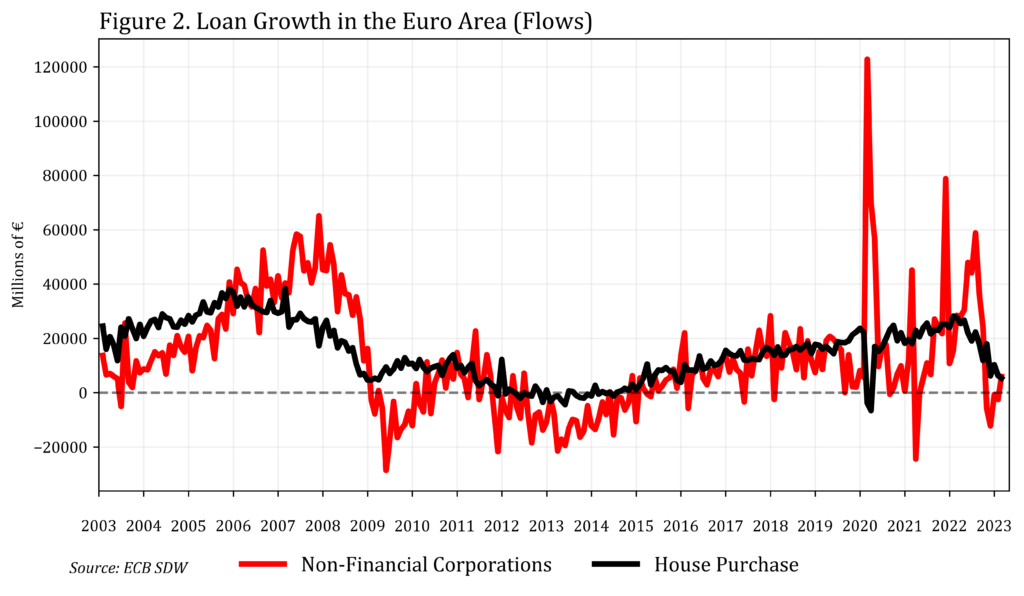

This tightening of credit shows us that the initial steps of the monetary transmission mechanism are taking place with force. This is resulting in a decline in loan growth for both house purchases and financial companies (Figure 2).

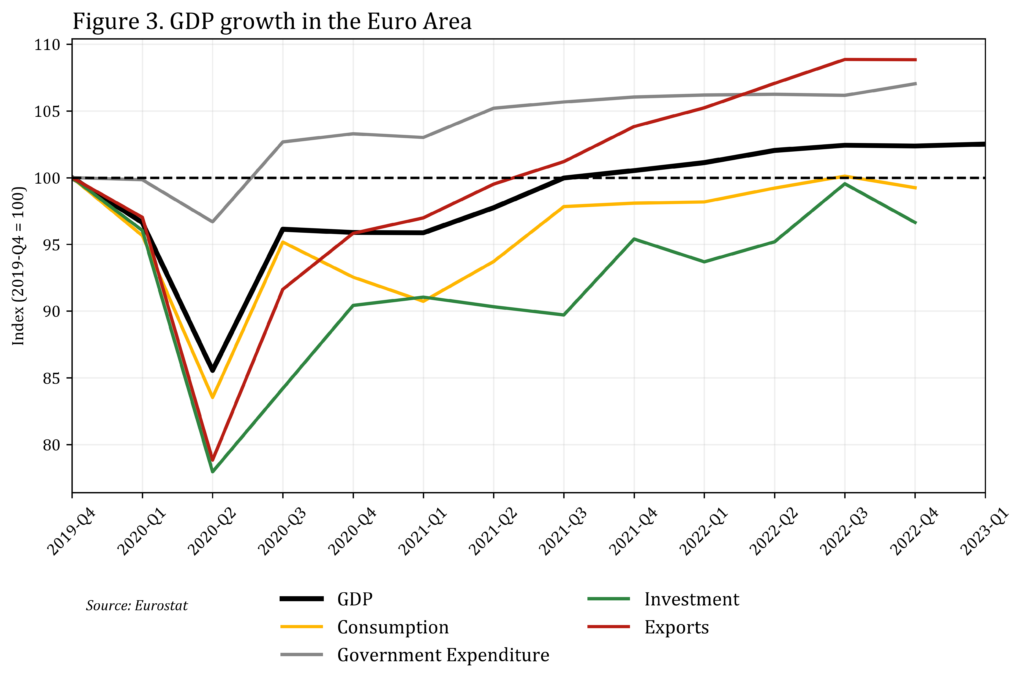

Another important finding from the IMF’s World Economic Outlook is that while falling interest rates have a significant impact on prices, they only have a small impact on output. The post-Covid recovery in the Euro Area has been bleak, and it has come off the back of exports and government spending, as private investment and consumption have remained weak (Figure 3).

As the transmission from higher rates to the rest of the economy takes time to come into being, the ECB should pause. A credit crunch in the making should indicate to the ECB that the canary is dead, and that there is a danger that gas is nearby.

[1] Based on Havraneka & Rusnak (2013): Transmission Lags of Monetary Policy: A Meta-Analysis

Thanks to many generous donors BRAVE NEW EUROPE will be able to continue its work for the rest of 2023 in a reduced form. What we need is a long term solution. So please consider making a monthly recurring donation. It need not be a vast amount as it accumulates in the course of the year. To donate please go HERE.

Be the first to comment