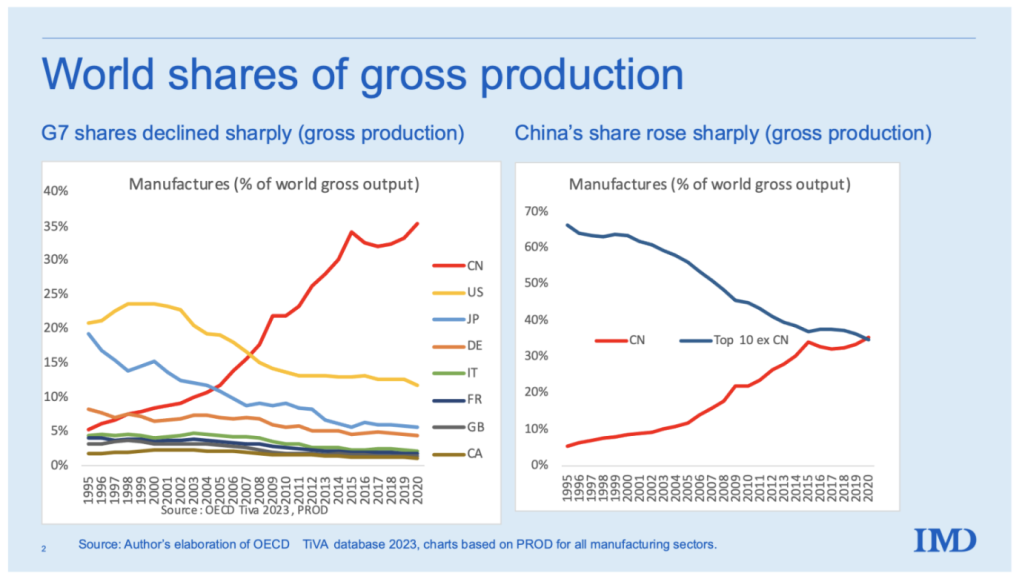

China is now the world’s sole manufacturing superpower. Its production exceeds that of the nine next largest manufacturers combined.

Michael Roberts is an Economist in the City of London and a prolific blogger

Cross-posted from Michael Roberts’ blog

The US economy grew 2.5% in 2023 over 2022, according to the first estimate of real GDP for Q4 released this week. This was greeted with rapture by Western mainstream economists – the US is motoring and the ‘recession forecasters’ have been proved badly wrong. Earlier in the week, it was announced that the Chinese economy grew 5.2% in 2023. In contrast to the US, this was condemned by Western mainstream economists as a total failure (with China using probably faked data anyway) and demonstrated that China is in deep trouble. So China grows at double the rate of the US, the best performing G7 economy by a long way, but it is China that is ‘failing’, while the US is ‘booming’.

Western economists continue to argue that the Chinese economy is heading down the drain. I have rejected this familiar refrain on numerous occasions on my blog. This is not because I have unquestioning support for the so-called ‘Communist’ party regime – on the contrary. It is because the Western critique is not factually correct – and also because the aim of that critique is to trash the predominant role of China’s state sector and its ability to sustain investment and production. The critique aims to distract attention from the reality that the Western capitalist economies (apart from the US it seems) are floundering in stagnation and near slump.

Take this as an example of the Western view of China: “the Chinese economic model has well and truly run out of juice and that a painful restructuring is required.” Actually, if we look at the growth rate of the US from 2020-23 and compare it with the average growth rate between 2010-19, even the US economy is underperforming. In the 2010s, the US average annual real GDP growth rate was 2.25%; in the 2020s so far, the average is 1.9% a year.

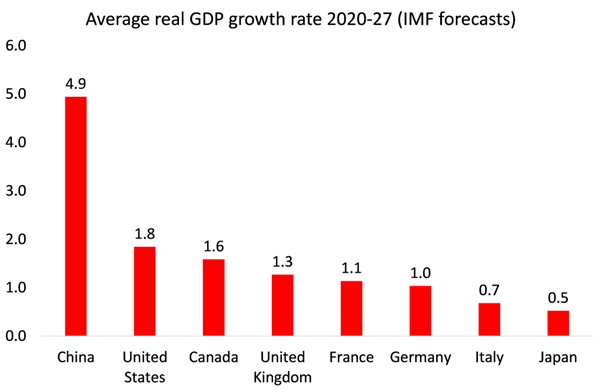

If we compare China’s 5.2% growth rate with the rest of the major economies, the gap is even greater than with the US. Japan grew 1.5% in 2023; France 0.6%, Canada 0.4%, the UK 0.3%, Italy 0.1%, and Germany fell -0.4%. Even compared to most of the large so-called emerging economies, China’s growth rate was much higher. Brazil’s growth rate is currently 2% yoy, Mexico 3.3%, Indonesia 4.9%, Taiwan 2.3% and Korea at 1.4%. Only India at 7.6% and the war economy of Russia at 5.5% is higher (of the large economies).

There is a continual attempt to trash the official statistics offered by the Chinese authorities, especially the growth figure. I have discussed the validity of this critique in posts before, but the current argument is that the Chinese GDP figures are faked and if you look at other ways of measuring economic activity like electricity or steel generation or traffic on the roads and ports, then we get a much lower growth figure. But even if you reduced the growth rate by say one-third, it would still mean a rate that is twice that of most advanced capitalist economies and above most others. And we are talking about an economic giant, not some tiny island like Hong Kong or Taiwan.

And India’s figures are to be disputed just as much as China’s are by Western economists. Back in 2015, India’s statistical office suddenly announced revised figures for GDP. That boosted GDP growth by over 2% pts a year overnight. Nominal growth in national output was being ‘deflated’ into real terms by a price deflator based on wholesale production prices and not on consumer prices in the shops, so that the real GDP figure rose by some way. Also the GDP figures were not ‘seasonally adjusted’ to take into account any changes in the number of days in a month or quarter or weather etc. Seasonal adjustment would have shown India’s real GDP growth well below the official figure. A better gauge of growth may be found in the industrial production data. And that is just 2.4% yoy in India, while China’s rate is 6.8%.

Indeed, the IMF reckons that China will grow by 4.6% this year, while the G7 capitalist economies will be lucky to manage 1.5%, with probably several going into outright recession. And if the IMF forecasts through to 2027 are accurate, the gap in growth will widen.

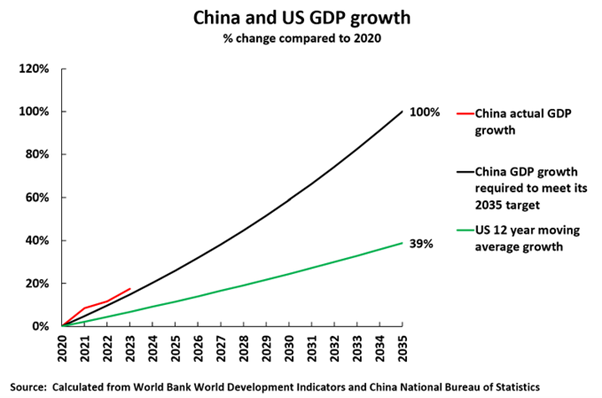

As John Ross has pointed out, if the Chinese economy continues to grow 4-5% a year over the next ten years, then it will double its GDP – and with a falling population, raise its GDP per person even more. “To achieve China’s target of doubling GDP between 2020 and 2035 it had to achieve a 4.7% annual average growth rate. So far since 2020 China has achieved an annual average 5.5% growth rate – with a per capita GDP annual average increase of 5.6%. To be on target for achieving its 2035 goal, China’s total GDP increase from 2020 had to be 15.5% and in fact it achieved 17.7%. The U.S. Congressional Budget Office, which makes the official economic projections for the U.S. government policy making, projects that the U.S. economy will grow at 1.8% a year until 2033 and 1.4% year from then onwards. Even if the higher rate of annual growth was achieved the U.S. economy would only grow by 39% between 2020 and 2035 whereas China would grow by 100%. That is China’s growth would be more than two and half times as fast as the US.”

But Western economists reckon that this target will not be met. First, they argue that China’s working population is falling fast and so there will not be enough cheap labour to boost output. But more output does not just depend on a rising labour force but even more on the increased productivity of that labour force. And as I have shown in previous posts, there is good reason to assume that China’s productivity of labour will rise enough to compensate for any decline in the number of workers.

Second, the Western consensus is that China is mired in huge debt, particularly in local governments and real estate developers. This will eventually lead to bankruptcies and a debt meltdown or, at best, force the central government to squeeze the savings of Chinese households to pay for these losses and thus destroy growth. A debt meltdown seems to be forecast every year by these economists, but there has been no systemic collapse in banking or in the non-financial sector.

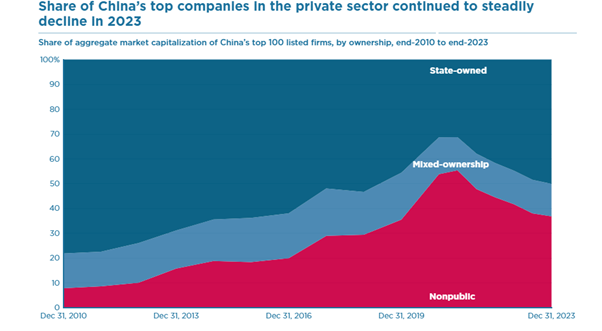

Instead, the state-owned sector has increased investment and the government has expanded infrastructure to compensate for any downturn in the over-indebted property market. Indeed, it is China’s capitalist sector (based mostly in unproductive areas) that is in trouble, while China’s massive state sector takes the lead in economic recovery.

The reality is that China is continuing to lead the world’s productive sectors, like manufacturing. China is now the world’s sole manufacturing superpower. Its production exceeds that of the nine next largest manufacturers combined. It took the US the better part of a century to rise to the top; China took about 15 or 20 years.

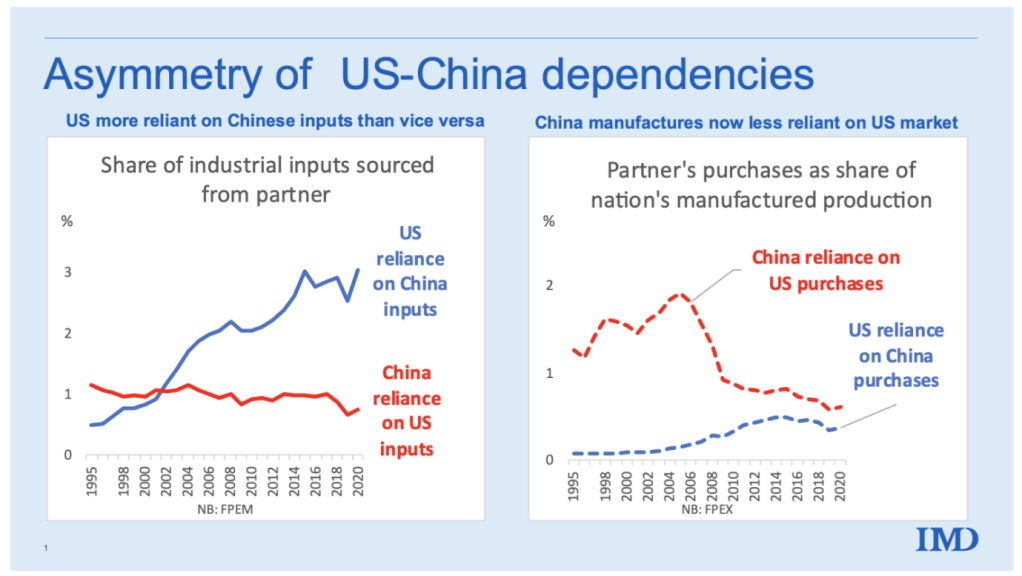

In 1995 China had just 3% of world manufacturing exports, By 2020, its share had risen to 20%. Far from China being forced into a corner by the US ‘decoupling’ its investment into and demand for Chinese goods, the US is more dependent on Chinese exports than vice versa.

And China is closing the gap with the US in hi-tech products including semi-conductors and chips.

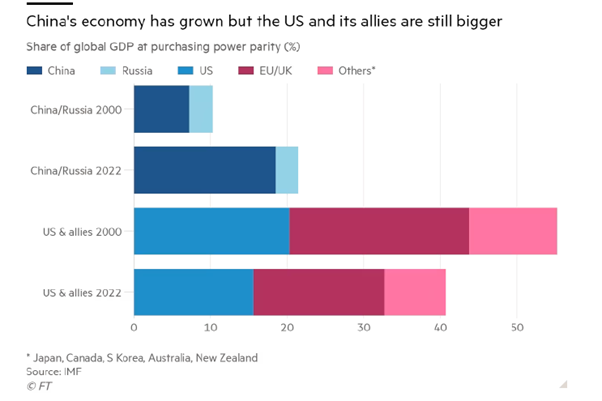

China has still some way to go to surpass the combined economic power of the imperialist economies, but it is closing the gap. This is what worries the US and its allies.

But you see, say the Western economists, China’s emphasis on manufacturing production and investment in infrastructure and technology over increasing household consumption is the wrong model for development. According to neoclassical (and Keynesian) theory, it’s consumption that leads growth, not investment. So China needs to break up its too large state sector, cut taxes for private enterprises and deregulate to allow the private sector to expand sales of consumer goods.

But has the large consumption share in the Western economies led to faster real GDP and productivity growth, or instead to real estate busts and banking crises? And is it not really the case that more productive investment boosts economic growth and employment, and thus wages and spending, not vice versa? That is the experience in China over the last 30 years, with high growth and investment delivering rising wages and consumer spending.

We shall see who is right about China during this year.

Be the first to comment