And what the progressive economists at the American Economics Association (ASSA) are thinking

Michael Roberts is an Economist in the City of London and a prolific blogger

Cross-posted from Michael Roberts’ Blog

To read the first part of this article, “Economics: The Mainstream Dilemma”, click here

At the annual conference of the American Economics Association (ASSA), there are sessions hosted by the Union for Radical Political Economics (URPE) for Marxist and other heterodox economists to present papers.

At this year’s ASSA 2021, many of the URPE sessions were concerned with the economic impact of COVID-19 and climate change, as did the mainstream sessions, but, of course, from a different perspective. But before I look at those sessions, let me start with the annual David Gordon lecture presented by a different radical economist each year.

This year it was Michael Hudson who gave the lecture. Hudson is a longstanding radical economist with a wide reputation. He considers himself a classical’ economist. His theme for the lecture was Has Finance Capitalism Destroyed Industrial Capitalism? Hudson argued that capitalism started as a progressive force in developing the productive forces because it was industrial capitalism. But since the 1980s, ‘financial capitalism’ had superseded industrial capitalism. And this was really a return to feudalism where the surplus in an economy was extracted by landlords (rent) and financiers (interest and capital gains), not by exploitation of labour power (profits).

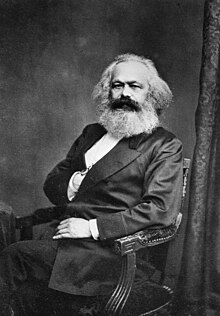

Feudalism had originally been critiqued by the great classical economists like Adam Smith and David Ricardo who reckoned that the landlords and financiers held back the productivity of labour by reducing the surplus going to the industrial capitalists. Hudson argued that Marx also supported industrial capitalism as progressive, being he was “the last of the great classical economists.”

Hudson argued that Marx had a vision that capitalism will eventually create the objective conditions for a transition to socialism. Instead, in the last 50 years finance capital has blocked that vision with a form of ‘neo-feudalism’ represented by monopolies extracting ‘rents’ and bankers extracting interest and capital gains. And now the main enemy of workers was not the capitalist owners of industrial companies, but rentier capitalists who exploit us through mortgages, loan rates, housing rents etc. And now it was rising debt that was the cause of capitalist crises and not the falling rate of profit of productive capital. This was where David Harvey and Hyman Minsky had taken us forward from Marx.

I disagree. This classic financialisation’ thesis by Hudson has many holes, in my opinion. First, modern capitalism can hardly be described as ‘neo-feudalism’ because feudalism was never a mode of production based on monopoly rents or usury. Under feudalism, the surplus created by the serfs and peasants was appropriated by landed aristocracy directly from the produce of the land. Commercial and financial activity was an adjunct, not the dominant activity of feudalism.

Yes, the classical economists opposed the landlords and monopolies and supported industrial capitalism, but the whole point of the Marxist critique was to reveal the new form of exploitation under the capitalist mode of production, namely the exploitation of labour power for profit by capitalists (industrial capitalists). Indeed, Marx’s Capital has a subtitle: A critique of political economy; and back in 1842, Engels wrote a piece entitled An outline of a critique of political economy. Both attacked the position of classical political economy because it backed markets and the exploitation of workers for profit in industry.

At no time did Marx or Engels suggest that ‘industrial capitalism’ could move smoothly to socialism without first ending the contradiction between labour and capital through class struggle. The idea of a seamless progression to socialism was that of the later revisionists like Eduard Bernstein. Yet Hudson seemed to suggest that the gains that workers made in public services, wages and welfare in the ‘golden age’ after WW2 were made possible because it was in the interests of the ‘progressive’ industrial capitalists. Tell that to the workers who had to fight hard for these gains! These gains were only possible because the industrial capitalists were forced to concede them by labour action; and they were able to do so only because profitability of capital was relatively high. But when profitability started to fall in the 1970s, ushering in the era of ‘neo-liberalism’, that was when there was a reversal of those gains and the relative rise of financial capital.

Indeed, the idea that we can divide capitalism into progressive industrial capitalism and reactionary monopoly financial capitalism is not only not the Marxist view, it is also empirically invalid. There is a very high integration between financial and industrial functions in modern capitalist companies – they are not separate. And most important, the industrial surplus value-creating function is still the largest section of capital by any measure.

Josh Mason from John Jay College was the discussant on the Hudson’s lecture and he made some telling points. He queried Hudson’s claim that industrial capitalists supported better public services because it raised the quality of the labour force. Mason argued that industrial capitalists’ main aim is always to lower wage costs and, for them, public services are a cost not a saving. In the neo-liberal period, industry supported austerity, crushed trade unions and demanded public spending cuts just as much as bankers. And monopolies are found in industrial sectors just as much as in finance. Moreover, is Jeff Bezos just a rent extractor? Surely Amazon exploits workers for profit in its distribution and web services like an industrial capitalist, not like a ‘neo-feudal’ financier?

For me, the Hudson ‘financialisation’ thesis not only weakens and distorts Marx’s critique of capitalism by ditching his law of value for post-Keynesian monopoly rent extraction theory. It is also empirically incorrect. And it leaves the door open for a reformist policy: that if we regulate or control the finance sector and monopolies and return to ‘competitive industrial capitalism’ (something that never really existed), then we can gradually move onto socialism.

But let’s move on here too. There were some important papers on China in the URPE sessions. Minqi Li of the University of Utah made a compelling empirical case that China was not an imperialist country in Marxist terms. Li argued that, although China had developed an exploitative relationship with South Asia, Africa, and other raw material exporters, China continued to transfer a greater amount of surplus value to the core countries in the capitalist world system than it receives from the periphery. Just handful of countries are rentier imperialist economies getting super profits from working people in global south and China is not one of them.

China has a net stock of financial investment of around $2trn, but this is mainly FX reserves held in US T-bonds ($3.5trn). Gross FDI stock is $1.7trn, but only a tiny share is invested in Africa or Lat Am. It’s mostly in tax havens! So 90% has not been invested for imperial super-profits. Indeed, the profitability of China’s FDI is lower than profitability for foreigners on inward investment into China ie China’s net investment income from abroad is negative.

Zhonglin Li and David Kotz reach a similar conclusion in their paper. IsChinaImperialist_EconomyStateAnd_preview (1) China is ruled by a Communist Party that came to power through a socialist revolution. China still has a significant sector of large state-owned enterprises and the party and state exercise considerable control over the economy. China’s role in other parts of the world does not fit the Marxist concept of imperialism. China does not operate a free market economy, as the CP is still directing investment and employment to a great degree.

Li and Kotz argued that the pro-market faction has not triumphed in China. Indeed, this is also the conclusion of another paper by Isabelle Weber of UMA. HowChinaEscapedShockTherapy_TheMar_preview (2) She reckoned the direction of ‘more market’ was dominant among Chinese reformers very early in the reform process in the 1980s, but the question of how to introduce market mechanisms into China’s command economy remained highly contested and is still unresolved.

Two other Chinese scholars provided further empirical support for the view that China is not imperialist. UnderstandingChina’sNew“DualCirc_preview Using the world input-output database, Su from Nanking University and Liang from UMA reckon China transfers up to 10% of its value added through trade to the US and other imperialist economies. Indeed, there is an asymmetrical trade relationship with the US, so that if the US and China were to completely halt and transfer their bilateral merchandise trade to elsewhere, the Chinese economy would lose 2.5 percentage points in its growth rate and over ten million jobs, while the United States would gain 1.3 percentage points in growth and some 700 thousand jobs. That is why President Xi is looking to adopt a ‘dual circulation’ strategy of switching more to the domestic market.

All these studies confirm the empirical work that G Carchedi and I first presented to the Historical Materialism conference in 2019. China is not an imperialist country in the Marxist definition. But two questions on China were still unanswered for me. All the contributors reckoned that China was a capitalist state in some form, if not imperialist. In which case 1) how did this capitalist economy perform so unprecedently well during the neo-liberal period when the imperialist economies and other peripheral capitalist economies did so poorly?; and 2) if China is capitalist and yet so huge, will it eventually become imperialist? But that’s for another day.

There were also several good papers on the impact of COVID and the economics of climate change. Ron Baiman of Benedictine University highlighted the huge loss in Arctic ice in the recent period that had now become a tipping point in its impact on global warming. InSupportOfARenewableEnergyAndMat_powerpoint (1) Stopping emissions rising was not enough. We need to reduce the existing carbon stock. If we could reduce the stock already in Arctic, we could give the planet an extra 17 years to turn things round. It was utopian to solve the crises by looking to achieve zero emissions alone. He reckoned that there were technical solutions that could lower stock levels including Arctic Sea-Ice climate triage and carbon cycle climate restoration “that would rapidly move us toward avoiding increasingly catastrophic climate impacts.” Strangely, he did not mention to need to phase out fossil fuel production as well.

Robert Williams of Guilford College gave us chapter and version on how the COVID pandemic would increase the already high levels of inequality of wealth and income in the major capitalist economies. Even before the COVID, Federal Reserve policies “have lavished hundreds of billions of dollars annually on the rich. Despite an unemployment rate trumpeted by many for its 50-year low, these structural forces and policies have left the vast majority of US households were wholly unprepared for sudden onslaught of the coronavirus.”

Chyrs Esseau, Tomar Galaragga and Sherif Khalifa in their papers showed how previous epidemics have affected income inequality. They found that an epidemic/pandemic shock increased income inequality by 4.6 points (gini coefficient). “We conclude that the epidemics and pandemics of the early 21st century contributed to the stagnation, and even worsening, of the otherwise slightly decreasing trends in global income inequality.”

Sergio Camara from the Autonomous Metropolitan University of Mexico provided an overall Marxian framework for the COVID pandemic, breaking the crisis down into its cyclical, structural and systemic parts. Cyclically, the world economy was already “on the verge of falling into a new cyclical crisis because of the imbalances accumulated after the 2007-2009 cyclical crisis.” Structurally, the major capitalist economies were not equipped to handle the pandemic because they had run down the health, medical and public services needed to cope. And systemically, the pandemic had shown that capitalism’s drive for profit over need leads to recurring crises in humanity, the climate and nature.

Finally, there was a session on ‘post-capitalist futures’ which, I think, exposed how market economies cannot cope with pandemics and reinforced the need for democratic socialist planning of economies. Robin Hahnel and Mitchell Szczepanczyk presented the results of their innovative attempt to model democratic annual planning in a post-capitalist economy. ComputerSimulationExperimentsOfParti_powerpoint Through iterative computer simulations of the planning process from local to central level and back, using a new computer coding technique, they found that it would not take a long at all to reach a feasible and practical annual plan to meet social needs with available resources which involved the participation and democratic decisions of people.

This was another compelling refutation of the critique made by neoclassical pro-market theorists like Von Mises and Hayek; and Keynesian pro-market social democrats like Alec Nove who argued that socialist planning was infeasible because there were just too many calculations to make. Only the invisible hand of the market and market pricing could do this. This paper showed that this was not true, especially now with the advances in computer programming. Democratic socialist planning can work and can replace market chaos.

Be the first to comment