Is the US losing its hegemonic power or not? Are the BRICS+ in a position to replace US hegemony in the next decade or so?

Michael Roberts is an Economist in the City of London and a prolific blogger

Cross-posted from Michael Roberts’ blog

The annual conference of the International Initiative for the Promotion of Political Economy (IIPPE) took place last week in Madrid. The IIPPE conference brings together leftist economists, mainly post-Keynesians and Marxists, from around the world to present papers and panels on a range of subjects. Most of this year’s near 400 attendees are academics, students, researchers or lecturers. Given that the conference was in Madrid, there was a large turnout of Spanish and Portuguese speakers and papers on issues in Latin America.

I was unable to attend at the last minute. Nevertheless, I did participate by zoom in a session and have compiled a number of papers that looked interesting and important to me. So I think there is much that I can convey from the debates on many subjects of interest to readers.

Let me start first with the subject and debate in the session that I participated in. The session was called Imperialism, hegemony and the next war – a grand and ambitious title. I was first in with short slide presentation entitled, Profitability and waves of globalisation.

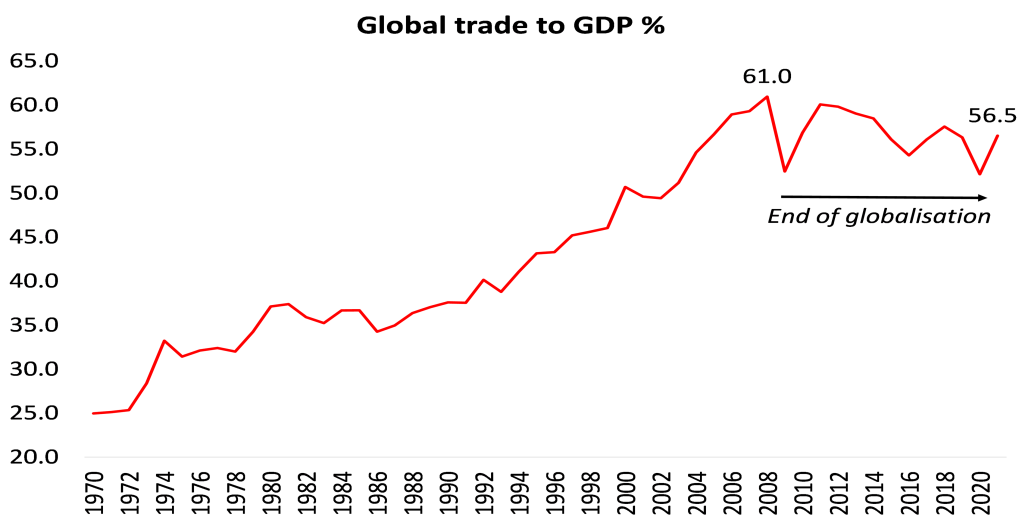

I argued that globalisation, defined as the expansion of trade and capital flows globally, took place in waves i.e periods of fast expanding trade and capital globally and then periods where trade and capital flows fall off and countries revert to trade and capital barriers. I reckoned that we could distinguish three waves of globalisation, from about 1850-80; from about 1944-70; and the largest from the mid-1980s to end of the 20th century.

What drives these waves? I argued that they could be tied to a change in the profitability of capital. In each of the periods before these waves, the profitability of capital in the major economies fell significantly. In order to counteract this fall in national profit rates, the leading capitalist economies looked to expand foreign trade and capital exports in order to gain extra profit from the less technologically developed and cheaper labour economies of what we now call, in shorthand, the ‘Global South’.

Marx had included foreign trade as one of the counteracting factors to his law of the tendency of the rate of profit to fall in capitalist production. And as Henryk Grossman accurately showed, the fall in profitability during the late 19th century depression was one reason why the major capitalist economies began a significant expansion of capital exports. This boosted the rate of profit, but only for a while because Marx’s law would eventually override the counteracting factors (as Al Campbell at the session prompted me to explain). So, in the decades leading up to WW1, inter-imperialist rivalry hotted up.

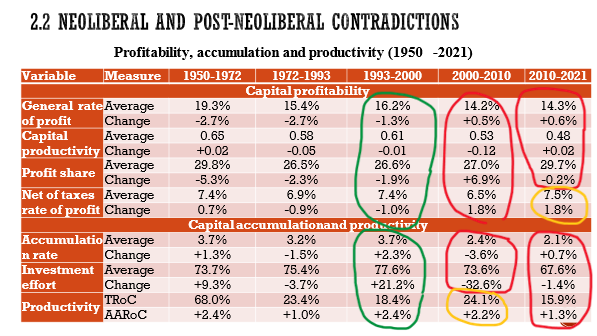

This is also the situation in the late 20th century. The wave of globalisation from the mid-1980s was in response to the big fall in the profitability of capital in the major economies from the late 1960s to the early 1980s. Globalisation (among other factors) boosted profitability through the decades of the 1980s and 1990s. But (especially after the Great Recession of 2008-9), the globalisation wave eventually petered out as profitability fell back. Now we have entered a period of trade barriers, protectionism and dangerous rivalry between the major economic powers especially the US and China.

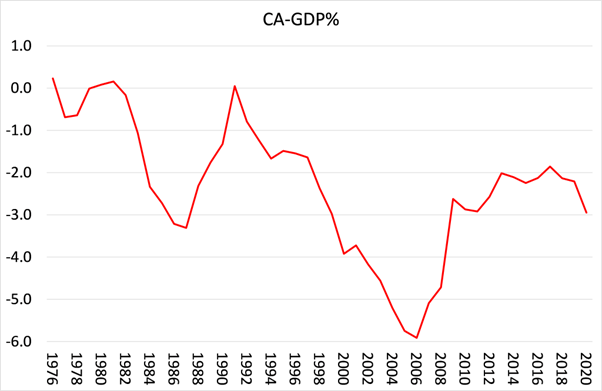

And the decline of the hegemonic US economy relative to the rising economies of China, India and East Asia has increased. This relative decline was taken up in the next paper by Maria Ivanova (Goldsmiths University). She pointed out that the US runs a significant and long-lasting trade deficit with the rest of the world. It is only able to pay for this because of its monopoly issuance of the US dollar, which is the major transaction and reserve currency in the world. However, the dollar’s hegemony is gradually weakening and now there are attempts by other economic powers, like the BRICS group (increasing in size), to reduce their reliance on the dollar and replace it with alternatives.

US current account to GDP %

Sergio Camera from UAM Mexico presented us with a battery of data and analysis to show that the US economy is in a structural crisis, still gradual maybe, but nevertheless showing clear signs that US capital’s ability to expand the productive resources and to sustain profitability is declining. This explains its intensified effort to strangle and contain China’s rising economic strength and so maintain its hegemony in the world economic order.

Sergio’s data showed “a prolonged stagnation” of the US rate of profit in the 21st century. The general rate of profit was 19.3% in the ‘golden age’ of US supremacy in the 1950s and 1960s; but then fell to an average 15.4% in the 1970s; the neoliberal recovery (coinciding with a new globalisation wave – MR), pushed that rate back up to 16.2% in the 1990s. But in the two decades of this century the average rate dropped to just 14.3% – an historic low. That has led to lower investment and productivity growth (especially in the decade of what I have called the Long Depression of the 2010s) so that, to use Sergio’s words, the US “economic base has been seriously debilitated”. This is weakening the hegemonic position of US capitalism in the world.

Sean Starrs from Kings College, London then provided a refreshing counter-balance to the hype that US imperialism and the dollar is soon about to lose its dominance in the world economy. In his presentation, he pointed out that most of China’s key exports were made by foreign companies (70%), not Chinese companies; and that most of the profits from China’s exports were realized in the imperialist bloc, not in China (this is something that G Carchedi and I also found in our work on the economics of modern imperialism).

Moreover, China is not yet a serious contender to the US in the technology industries globally, despite the hype. The US remains the dominant techno power and also holds most of the personal wealth in the world (45% unchanged in the last two decades).

The discussion in the session revolved round how to balance these trends. Is the US losing its hegemonic power or not? Are the BRICS+ in a position to replace US hegemony in the next decade or so? Will these rivalries lead to major military conflicts?

In my view, while there has been a relative decline in US economic and political hegemony since the golden days of the 1950s and 1960s, from the 1970s onwards that decline has been gradual and possible challenges to US hegemony eg: Japan in the 1970s; Europe in the 1990s; and now China (+BRICS); have not and will not succeed in replacing it.

I likened the situation using the analogy of the decline and collapse of the ancient Roman Empire in the 3rd century ACE. Some scholars argue that the Roman Empire collapsed because of outside forces ie invasions and rising contender states (ie BRICS?). But others argue, rightly in my view, that the real cause was the economic disintegration of the dominant slave economy within Rome. Roman conquests had ended in the late 2nd century ACE and there were not enough slaves to sustain the economy so that productivity dropped off and eventually weakened financial support for the military. Rising and extreme inequality in Rome was a symptom of this decline and eventual collapse.

In the 21st century, globalisation has fallen away and regionalisation is emerging. Inequality of wealth and income in the US and the G7 is at extremes. But above all, the profitability of capital in the imperialist bloc is near all-time lows. The collapse of the Roman Empire also ended the dominance of the slave-owning mode of production, to be eventually replaced by a feudal system. The increased internal disintegration of the US economy could not only end its global hegemony, but also usher in a new mode of production.

In the second part of my account of IIPPE 2023, I shall cover many of the papers I collected from presenters at the conference.

Be the first to comment