Is Marx’s theory of the falling rate of profit still a compelling explanation for economic crises?

Michael Roberts is an Economist in the City of London and a prolific blogger.

Cross-posted from Michael Roberts’ blog

In the first part of my coverage of this year’s IIPPE annual conference, I outlined the discussion from just one session in which I participated on whether the dominance of US imperialism will last. But of course, there were many other sessions on different topics at IIPPE. In this second part, I shall single out some sessions/papers that I found interesting and where I was able to obtain the presentations from the authors.

Let’s start with China. Before the conference proper, the China Working Group within IIPPE organized a special series of sessions on China. Professor Dic Lo at SOAS London reflected on how China coped with the COVID pandemic and what lessons could be drawn from that.

Elias Jabbour, now special advisor to former president of Brazil, Dilma Rousseff, now head of the New Development Bank in Beijing, discussed the possibilities of greater trade and investment integration between Brazil and China.

And Salam Alshareef from the University of Grenoble discussed whether China’s Belt & Road initiative to fund and build projects in countries across the globe has been successful; whether it increased alternatives to traditional Western funding sources like the World Bank; and whether it represented a shift in the global balance of power from the US-to ‘contender states’. The China WG has released a series of You Tube videos on these sessions, so I’ll leave comments on these presentations for now.

In the main IIPPE conference there were other presentations on China. I’ll single out just two. The first was again by Prof Dic Lo, called The Political Economy of China’s “New Normal”. This dealt with a key question being posed in the Western media – namely is China’s recent economic slowdown permanent, or even worse is it a signal of China’s imminent demise? Prof Lo considers whether the slowdown is due to a lack of domestic demand, as many Keynesian experts on China like Michael Pettis claim, or is it due to falling profitability of capital in China, as Marxists might suggest? Lo tends to argue for the latter as the main cause (indeed I find the same in my own study of this – see the book, Capitalism in the 21st century, pp213-14).

But Lo points out that industrial sector profitability remains high; it is the profitability of unproductive sectors like real estate and the stock market that has fallen back – and we know that China is facing a real estate crisis. Also, profitability has fallen because of a rising share of wages in value added (unlike in the West) and a rise in the organic composition of capital, following Marxist theory.

For me, Lo’s paper poses the major contradiction in China’s weird, hybrid economy. If the profitability of capital falls, that reduces investment and productivity growth in the capitalist sector. For me, that increases the need for China to expand its state sector to make the economy not so dependent on profitability, particularly in technology, education and housing.

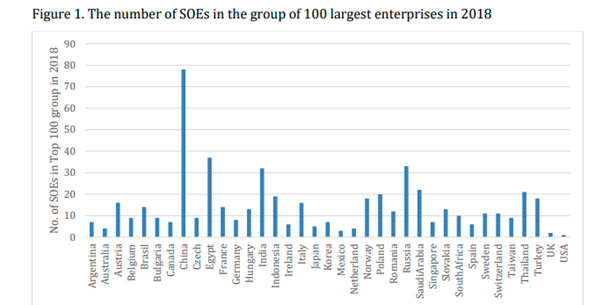

In another session, Grzegorz Kwiatkowski and David Luebeck of the Berlin School of Economics looked at the degree of state control over companies in China. Of the 100 largest Chinese enterprises, there are 78 state-owned companies. The dominance of state-owned enterprises in the Chinese economy is much greater than in most other countries, reflecting the unique role they play in China’s economic system.

Again, this is something that I have outlined in my own work (see Capitalism in the 21st century p214). Using the IMF data on the size of the public sector for all countries, I found that, in 2017, China had a public investment to GDP ratio more than three times any other comparable economy, with the others averaging around 3% of GDP. China had a public capital stock to GDP ratio that was 30% higher than Japan and close to three times more than the others. And China had a public/private stock ratio nearly double that of India and Japan and three times that of the UK and US. But the private sector had been getting larger in China up to 2017 which, in my view, if continued, was a risk to China’s state-run economy – indeed as the recent real estate crisis shows.

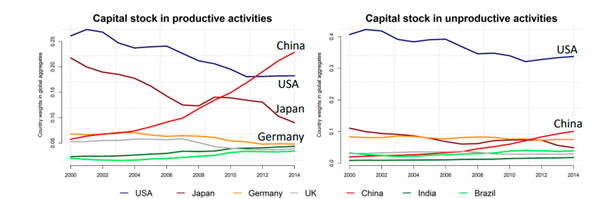

You can see that I often revert to considering movements in the profitability of capital as a key indicator of trends in an economy, even in one like China where state investment dominates. There were two papers at IIPPE that provide support for the validity of Marx’s law of profitability and its relevance to crises in capitalist economies. The first is a ground-breaking analysis by Tomas Rotta of Goldsmiths, London and Rishi Kumar from University of Massachusetts, called Was Marx Right? Rotta and Kumar analyse the profitability of capital in 43 countries from 2000-14 using the World Input-Output Database (WIOD) for defined productive and unproductive sectors.

They show the high ratio of productive capital stock in China compared to other countries and conversely the high ratio of unproductive capital in the US. And they compile a world profit rate, which declined over the period, mainly because the organic composition of capital rose faster than the rise in the rate of surplus value – as forecast by Marx’s law. Profit rates declined at the aggregate global level, between countries and within countries. They found that rich countries have lower profit rates because of the rise in the capital stock tied up in unproductive activity.

The problem with this data is that only covers a short period in the 21st century and also is based on input-output tables which are not dynamic but snapshots of economic categories. But even so, their analysis gives further support to Marx’s law. And there is more to come on this from the authors.

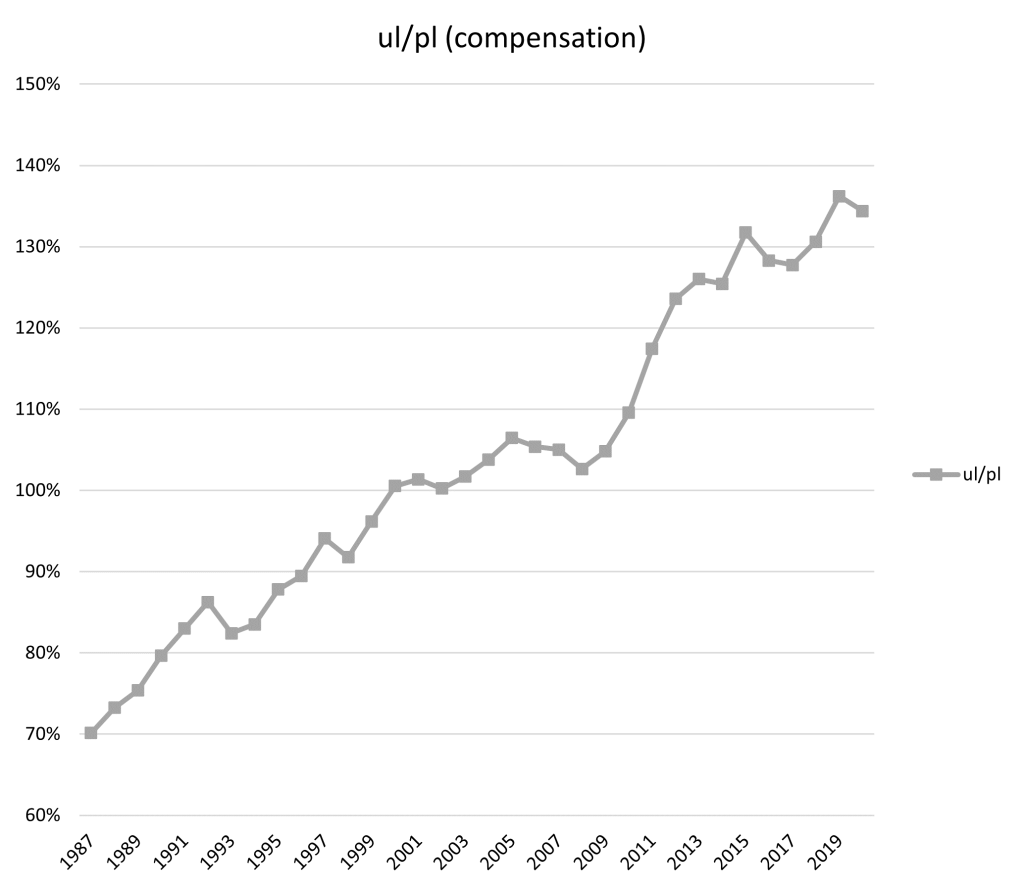

The question of what constitutes productive and unproductive labour and sectors in capitalist economies is continually debated among Marxists. Costas Passas, Senior Fellow at the Centre of Planning and Economic Research (KEPE), in Greece provided a clear explanation in his presentation.

According to Adam Smith, productive labour produces a profit and produces just tangible commodities. For Marx, the first part of this definition, the production of a profit, is correct, whereas the second is wrong. “Marx explicitly criticizes Smith for mixing up a definition of productive labour based on (surplus) value with a definition based on the physical attributes of the commodity.” Servants are unproductive because they are not employed by capital, not because they do not produce external objects. And labour that supervises workers is unproductive. Unproductive sectors are those that do not produce new value but instead get value and surplus value from new value-creating sectors. The former includes finance, real estate and government. As you might expect, in mature advanced capitalist economies, the share of value going to unproductive sectors rises. Passas found this for Greece.

The other paper on profitability was by Carlos Alberto and Duque Garcia from AUM Mexico on the Distribution of profit rates in Colombia. The authors have already done great work on profit rates in Colombia. Their new paper estimated the distribution of profit rates among and within industries in Colombia by employing firm-level data. It’s very technical, but they found that there was a significant dispersion in the firm-level profit rates as well as in the average profit rates across industries. And around 15% of firms did not achieve a profit rate above the average cost of debt – in effect they were zombie firms.

Alberto and Garcia point out that the dispersion of profit rates is in line with Marx’s law of the tendency of profit rates to equalize due to competition. If you take a snapshot of profit rates in sectors and firms and find a wide range, it should not be concluded that the tendency of profit rates to equalize is not taking place, as some Marxist have argued (see Farjoun and Machover). As Marx put it, the equalization tendency of average profit rates across industries is, in itself, a dynamic, turbulent and stochastic process in which “with the whole of capitalist production, it is always only in a very intricate and approximate way, as an average of perpetual fluctuations which can never be firmly fixed, that the general law prevails as the dominant tendency” (Marx, 1991, p. 261)

Despite increasing evidence that Marx’s law of profitability is valid both theoretically and empirically and very relevant to explaining regular and recurring crises under capitalism, this is still denied by many. Indeed, the post-Keynesians thesis of financial crises continues to hold sway among many. The ‘financialisation hypothesis’ is that the cause of modern capitalist crises is to be found in the ‘financialisation’ of what used to be industrial capitalism; and this has caused rising inequality and capitalist crises, not falling profitability or increased exploitation in investment and production.

At IIPPE we had one paper that lent further doubt to this view. Niall Reddy of the University of Witwatersrand, Johannesburg, South Africa argued the evidence dd not show that that non-financial firms were engaged increasingly in financial investment over productive investment. Increases in cash holdings by such firms were more driven by tax advantages and the need to build funds for research. “Neither of these implies a substitution of financial for real investment, which calls into question an important mechanism thought to connect financialisation to secular stagnation and rising nequality.”

I have written extensively on the financialization thesis. But the most devastating refutation of the financialization hypothesis (FH), both theoretically and empirically comes from a new paper not presented at IIPPE, by Stavros Mavroudeas and Turan Subasat.

On the theory, the authors say: “The Marxisant versions of the FH ultimately concur with the mainstreamers and the post-Keynesians that the unproductive-capital dominates productive-capital, and that the former acquires autonomous (from surplus-value) sources of profit. Consequently, they converge to a great extent with the Keynesian theory of classes and consider industrialists and financiers as separate classes. For Keynesian analysis, this is not a problem as it posits that different factors affect savings and investment. However, Marxism conceives interest is part of surplus-value and financial profits depend upon the general rate of profit, Marxism does not elevate the distinctiveness of money-capital and productive-capital to the point of being separate classes. Finally, the Marxisant FH currents have a problematic crisis theory. Instead of a general theory of capitalist crisis, they opt for a conjunctural one… the FH eventually ascribes to a Keynesian possibility theory of the crisis which has well-known shortcomings. In conclusion, the FH variants fail to offer a realistic account of the rise of fictitious-capital activities during the recent period of weak profitability and increased over-accumulation of capital. Marxist theory “does so by realistically keeping the primacy of the production sphere over circulation and also the notion that interest is part of surplus-value extraction.”

And empirically: First, the claim that most of the largest multinational companies are financial is not true. Over the last 30 years the financial sector share in GDP has declined by 51.2% and the financial sector share in services declined by 65.9% of the countries in our study. “Although the rapid expansion in the financial sector observed in some countries before the 2008 crisis suggests that the financial sector may have played an important role in deindustrialization, this situation seems to be cyclical when it comes to a wider time frame.”

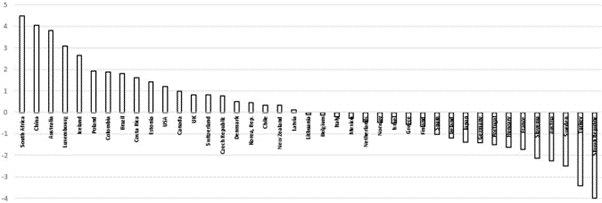

Ranking of Countries according to the Share of the Financial Sector in Total Value Added (% in 2015)

Rather than look for crises based on too much debt, financial recklessness or Minsky-type financial instability, Marx’s law of profitability is still the most compelling explanation of crises.

Thanks to many generous donors BRAVE NEW EUROPE will be able to continue its work for the rest of 2023 in a reduced form. What we need is a long term solution. So please consider making a monthly recurring donation. It need not be a vast amount as it accumulates in the course of the year. To donate please go HERE.

Be the first to comment