The rate of price inflation first depends on the growth rate of value creation

Michael Roberts is an Economist in the City of London and a prolific blogger

Cross-posted from Michael’s Blog

Photo: TSGT MICHAEL AMMONS, USAF via wikimedia commons

The inflation debate among mainstream economists rages on. Is the accelerating and high inflation rate of commodities here to stay for some time and or is ‘transitory’ and will soon subside? Do central banks need to act fast and firmly to ‘tighten’ monetary policy (ie cut back on injection credit into banks through purchases of government bonds (QE) and start hiking policy interest rates sharply? Or is such tightening an overkill and will cause a slump?

I have covered these issues in several previous posts in some detail. But it is worth going over some of the arguments and the evidence again because high and rising inflation is severely damaging to the livelihoods and prosperity of most households in the advanced capitalist economies and even a matter of life and death for hundreds of millions in the so-called Global South of poor countries. Being made unemployed is devastating for those who lose their jobs and for their families. But unemployment affects usually only a minority of working people at any one time. Inflation, on the other hand, affects the majority, particularly those on low incomes where basic commodities like energy, food, transport and housing matter even more.

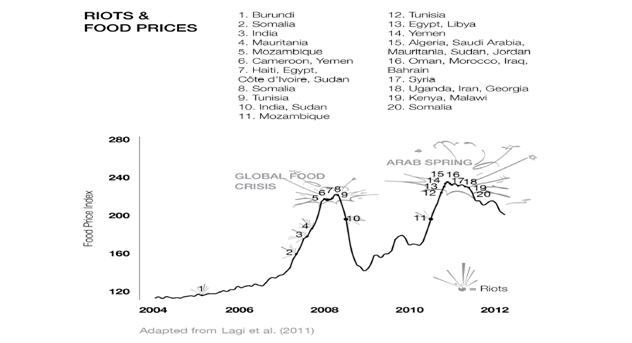

In a recent book, Rupert Russell pointed out that the price of food has often been decisive historically. Currently the global food price index is at its highest ever recorded. This hits people living in the Middle East and North Africa, a region which imports more wheat than any other, with Egypt the world’s largest importer. The price of these imports is set by the international commodity exchanges in Chicago, Atlanta and London. Even with the government subsidies, people in Egypt, Tunisia, Syria, Algeria and Morocco spend between 35 and 55 per cent of their income on food. They’re living on the edge: small price rises bring poverty and hunger. Russell reminds us that grain was key to almost every stage of World War I. Fearing the threat to its grain exports, imperial Russia helped provoke that global conflict. As the conflict dragged on, Germany, also suffered from a dearth of cheap bread and looked to seize Russia’s bountiful harvest. “Peace, Land, and Bread” was the Bolshevik slogan, and success had much to do with bread and the control of the new grain pathways inside Russia. Now the Russian invasion of Ukraine puts the harvest of these two leading grain exporters in jeopardy.

Indeed, when you consider food prices, one of the key contributors, along with energy prices, to the current inflationary spiral, it exposes the inadequacies of mainstream explanations of inflation and their policy remedies. Current inflation is not the product of ‘excessive demand’ (Keynesian) or ‘excessive monetary injections’ (monetarist). It is the result of a ‘supply shock’ – a dearth of production and supply chain breakdown, induced by the COVID pandemic and then by the Russia-Ukraine conflict. The recovery after the COVID slump in the major economies has been faltering – every major international agency and analytical research consultancy has been lowering its forecast of economic growth and industrial production for 2022. At the same time, these agencies and central banks have revised up their forecasts for inflation and for the length of time it will stay high.

Central banks have little control over the ‘real economy’ in capitalist economies and that includes any inflation of prices in goods or services. For the 30 years of general price disinflation (where price rises slow or even deflate), central banks struggled to meet their usual 2% annual inflation target with their usual weapons of interest rates and monetary injections. And it will be the same story in trying this time to reduce inflation rates. As I have argued before, all the central banks were caught napping as inflation rates soared. And why was this? In general, because the capitalist mode of production does not move in a steady, harmonious and planned way but instead in a jerky, uneven and anarchic manner, of booms and slumps. But also, they misread the nature of the inflationary spiral, relying as they do on the incorrect theories of inflation.

I would argue that this supply-side ‘shock’ is really a continuation of the slowdown in industrial output, international trade, business investment and real GDP growth that had already happened in 2019 before the pandemic broke. That was happening because the profitability of capitalist investment in the major economies had dropped to near historic lows, and as readers of this blog know, it is profitability that ultimately drives investment and growth in capitalist economies. If rising inflation is being driven by a weak supply-side rather than an excessively strong demand side, monetary policy won’t work.

The hardline monetarists call for sharp rises in interest rates to curb demand while the Keynesians worry about wage-push inflation as rising wages ‘force’ companies to raise prices. But inflation rates did not rise when central banks pumped trillions into the banking system to avoid a meltdown during the global financial crash of 2008-9 or during the COVID pandemic. All that money credit from ‘quantitative easing’ ended up as near-zero cost funding for financial and property speculation. ‘Inflation’ took place in stock and housing markets, not in the shops. What that means is that US Federal Reserve’s ‘pivot’ towards interest rate rises and reverse QE will not control inflation rates.

The other mainstream theory is that of the Keynesians. They argue that inflation arises from ‘full employment’ driving up wages and from ‘excessive demand’ when governments spend ‘too much’ in trying to revive the economy. If there is full employment, then supply cannot be increased and workers can drive up wages, forcing companies to raise prices in a wage-price spiral. So there is trade-off between the level of unemployment and prices. This trade-off can be characterised in a graphic curve, named after AW Phillips.

But the evidence of history runs against the Phillips curve as an explanation of the degree of inflation. In the 1970s, price inflation reached post-war highs, but economic growth slowed and unemployment rose. Most major economies experienced ‘stagflation’. And since the end of the Great Recession, unemployment rates in the major economies have dropped to post-war lows, but inflation has also slowed to lows.

Keynesian Larry Summers takes the ‘excessive demand’ approach. His view of inflation is that government spending is driving price hikes by giving Americans too much purchasing power. So it’s the Biden administration’s fault; the answer being to re-impose ‘austerity’ ie cutting government spending and raising taxes. Again, you could ask Summers why there was no high inflation when governments spent huge amounts to avoid a banking collapse in the Great Recession, but only now.

Following the Keynesian cost-push inflation theory inevitably comes the policy call for ‘wage restraint’ and even higher unemployment. For example, Keynesian guru, Paul Krugman now advocates raising unemployment to tame inflation in his New York Times column. So much for the claim that capitalism can sustain ‘full employment’ with judicious macro-management of the economy, Keynesian-style. It seems that the capitalist economy is caught between the Scylla of unemployment and the Charybdis of inflation after all.

As for wage restraint, both Keynesians and central bankers have been quick to launch into such calls. A Keynesian FT columnist call for monetary policy to be “tight enough to … create/preserve some slack in the labour market.” In other words, the task must be to create unemployment to reduce the bargaining power of workers. Bank of England governor Bailey made the same call in order, he said, to stop runaway inflation. But there is no evidence that wage rises lead to higher inflation. We are back to the chicken and the egg. Rising inflation (chicken) forces workers to seek higher wages (egg). Indeed, over the last 20 years until the year of the COVID, US real weekly wages rose just 0.4% a year on average, less even that the average annual real GDP growth of around 2%+. It’s the share of GDP growth going to profits that rose (as Marx argued way back in 1865).

US inflation is much higher than wages which are only growing at between 3-4%, that means real wages are going down for most Americans. Financial assets are rising even faster. Housing prices are up by roughly 20% on an annualized basis. Just before the pandemic, in 2019, American non-financial corporations made about a trillion dollars a year in profit, give or take. This amount had remained constant since 2012. But in 2021, these same firms made about $1.73 trillion a year. That means that for every American man, woman and child in the US, corporate America used to make about $3,081, but today makes about $5,207. That’s an increase of $2,126 per person. It means that increased profits from corporate America comprise 44% of the inflationary increase in costs. Corporate profits alone are contributing to a 3% inflation rate on all goods and services in America.

Then there is the ‘psychological’ explanation of inflation. Inflation gets ‘out of control’ when ‘expectations’ of rising prices by consumers takes hold and inflation becomes self-fulfilling. But this theory removes any objective analysis of price formation. Why should ‘expectations’ rise or fall in the first place? And as I mentioned before, the evidence supporting the role of ‘expectations’ is weak. As a paper by Jeremy Rudd at the Federal Reserve concludes; “Economists and economic policymakers believe that households’ and firms’ expectations of future inflation are a key determinant of actual inflation. A review of the relevant theoretical and empirical literature suggests that this belief rests on extremely shaky foundations, and a case is made that adhering to it uncritically could easily lead to serious policy errors.”

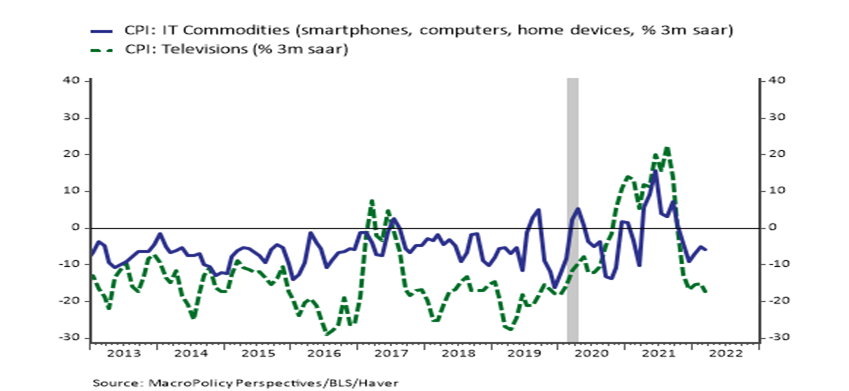

All these mainstream theories deny that it is the failure of capitalist production to supply enough that is causing accelerating and high inflation. And yet, evidence for the ‘supply shock‘ story remains convincing. Take used car prices. They rocketed over the last year and were a major contributor to US and UK inflation rises. Used car prices rose because new car production and delivery was stymied by COVID and the loss of key components. Global auto production and sales slumped. But production is now recovering and used car prices have dropped back. Indeed, prices of home electronics are now falling.

A Marxist theory of inflation looks first to what is happening to supply and, in particular, whether there is sufficient value creation (exploitation of labour) to stimulate investment and production. Guglielmo Carchedi and I have been working on a Marxist inflation model, which we hope to publish soon. But the key points are that the rate of price inflation first depends on the growth rate of value creation. Employing human labour creates new value and using technology reduces the labour time involved in the production of goods and services. So more output can be produced in less labour time. Therefore prices over time will tend to fall, other things being equal. Capitalist production is based on a rise in investment in fixed assets and raw materials relative to investment in human labour, and this rising organic composition of capital, as Marx called it, will lead to a fall in general profitability and an eventual slowdown in production itself. This contradiction also means price deflation is the tendency in capitalist production, other things being equal.

But other things are not always equal. There is the role of money in inflation. When money was a (universal) physical commodity like gold, the value of commodities depended partly on the value of gold production. In modern ‘fiat’ economies, where money is a unit of account (without value) created by governments and central banks, money becomes a counteracting factor to the tendency for falling prices in value creating production. The combination of new value production and money supply creation will ultimately affect the inflation rate in the prices of commodities.

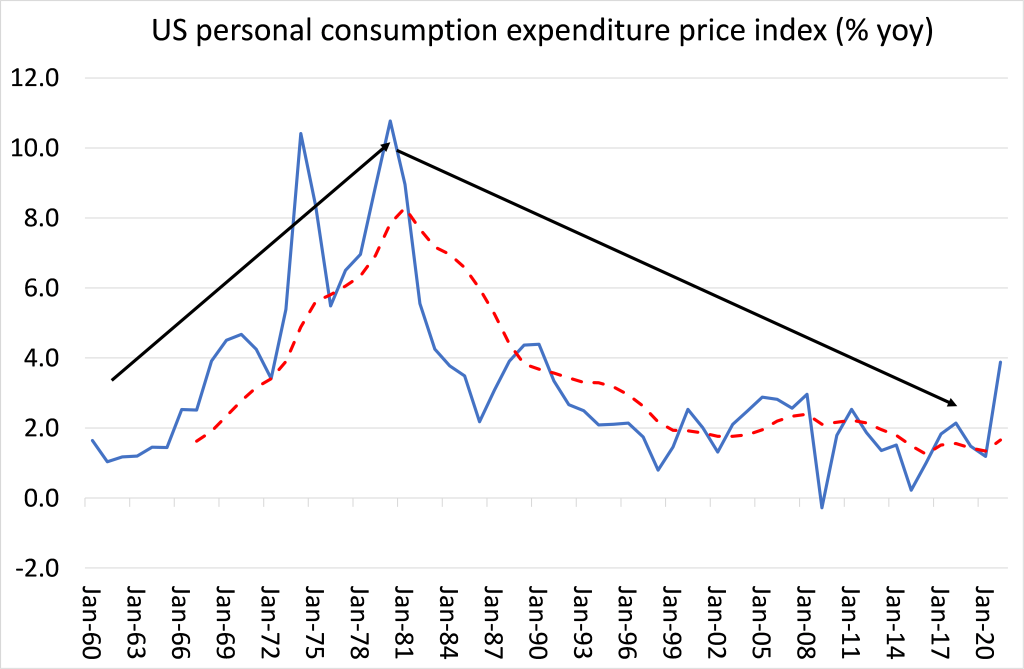

In our initial research, we showed that when money growth was moderate, but value creation was strong, inflation rates were high and rising (1963-81); but when value creation weakened, money creation avoided deflation but was not enough to stop price inflation from subsiding (1981-2019). This tells you that if the major economies slow down sharply or even enter a slump by the end of this year, inflation too will eventually subside – to be replaced by rising unemployment and falling real wages.

There is an alternative to monetary or wage restraint, these policy proposals of the mainstream, acting in the interests of bankers and corporations to preserve profitability. It is to boost investment and production through public investment. That would solve the supply shock. But sufficient public investment to do that would require significant control of the major sectors of the economy, particularly energy and agriculture; and coordinated action globally. That is currently a pipedream. Instead, ‘Western’ governments are looking to cut back investment in productive sectors and boost military spending to fight the war against Russia (and China next).

Support us and become part of a medium that takes responsibility for society

BRAVE NEW EUROPE is a not-for-profit educational platform for economics, politics, and climate change that brings authors at the cutting edge of progressive thought together with activists and others with articles like this. If you would like to support our work and want to see more writing free of state or corporate media bias and free of charge. To maintain the impetus and impartiality we need fresh funds every month. Three hundred donors, giving £5 or 5 euros a month would bring us close to £1,500 monthly, which is enough to keep us ticking over.

Be the first to comment