What comes next and what can be done to prevent a further redistribution of wealth to international corporations responsible for inequality and environmental destruction, without conditions, as we are already witnessing?

Sergi Cutillas is an Economist Researcher at the Ekona Economic Innovation Center and Member of the European Research Network on Social and Economic Policy (EReNSEP)

Pablo Cotarelo is a Spanish engineer. He works in the development of energy and industrial policies at different levels, including remunicipalisation and nationalisation. He is member of the EReNSEP

The use of conditionality in the Covid-19 crisis

On 15 April the Presidents of the EU Commission and the European Council presented, as a first step, a Joint European Roadmap towards lifting Covid-191 containment measures including the European Green Deal as part of the EU’s recovery strategy. Following this roadmap, on 27 May the European Commission proposed a major recovery plan2 that endorses the following policy elements:

-

-

Renovating buildings and infrastructure and creating a more circular economy, bringing back local jobs

-

Rolling out renewable energy; contributing to cleaner transport and logistics; and strengthening the Just Transition Fund

-

Adapting to the digital age and investing in digital education and infrastructure

-

Ensuring Fair minimum wages and binding pay transparency measures

-

Stepping up the fight against tax evasion

-

The EU recovery package of measures contains a number of conditions related to the transfer of public resources. This practice is neither new nor exclusive to the EU, and has been used for a long time both by the European institutions and mechanisms, and by the member states themselves.

Recent events have however shown the destructive policies integrated in EU conditionality. The debt crisis of 2010-15, managed by the Eurogroup, imposed conditions through the Memoranda of Understanding (MoU) to countries receiving bail-outs, especially Greece. However, the effectiveness of these mechanisms has been proven egregiously wrong. Today the discussion about the type of conditionality that should be attached to the recovery plans goes well beyond the framework of the Stability and Growth Pact.

Paradoxically, another remarkable feature of the European crisis policies after 2008 was that conditionality was omitted in the transfer of public money to the ‘too-big-to-fail’ agents (mainly Financial, Insurance and Real Estate corporations). The asset prices of the FIRE sector were supported through new indebtedness assumed by the states, which imposed few to no constraints related to goals that would have served the common good. This has had a large negative impact in the increase of inequality, environmental crises, corruption, lack of public control and accountability, and in turn, major damage to democratic legitimacy within the EU.

Luckily, things are evolving and initiatives are already being employed by most member states to counter the Covid-19 crisis. For instance, in some EU nations (for instance, Spain) temporary basic incomes are being implemented to protect the most vulnerable groups affected by the lock-down. Such provision of income will have two objectives: first, ensuring material living conditions; and second, sustaining internal consumption. However, accessing this basic income is subject to a series of conditions such as: being part of the active population, the level and period of income loss, personal wealth, family structure, and other social variables. This is an example of how the main discussion and the key elements in relation to the use of public resources for the recovery, across the world, and in the EU even more, conditionality will likely be managed.

Conditionality based on ESG criteria

In the recent years a new framework for assessing corporate responsibility called ESG has been gaining prevalence. This acronym stands for Environmental, Social, and Governance criteria. This model is playing an important role in the evolution of Corporate Social Responsibility and is promoted internationally by major rating agencies and banks in the private sector, like JP Morgan Chase3. In fact, two months ago, the European Commission announced that it would collaborate with BlackRock to develop tools and mechanisms to integrate ESG in banking regulation4.

There is a major danger regarding the misuse of a system of conditionality. While ESG conditionality could lead to a responsible use of public resources in the context of the Covid-19 crisis, it could also be misused by major corporations as a greenwashing tool to attain public funding.

In the context of dire economic prospects in the coming months, governments should aim at reactivating the supply of goods and services, at avoiding the destruction of the productive fabric, and laying the foundations for a new and more resilient production model. The consequences of this crisis will favour a re-localisation and re-industrialization of the European economies to reduce their dependence on global supply chains, especially in the sectors most sensitive to domestic security (health, food, energy, etc.).

As has been mentioned before, generally, nation-states will attach conditionality to public aid within their borders, either in their direct income provision to the population or other different types of aid to enterprises and banks. The sums of this expenditure are and will be very high. Thus, the degree of responsibility demanded to agents receiving this money, especially the most powerful, must also be very high. Responsibility should not only be demanded as a short-term condition until the crisis has been overcome, but as a permanent set of conditions that allows for a generation of more resilient and sustainable production-consumption models.

In this context of mandatory conditionality, if we want to increase the effectiveness of public resources and promote a responsible and sustainable economy for Europe based on democratic values, a public and bottom-up approach to ESG criteria would be a good means to accomplish responsible conditionality, if it takes into account the following aspects:

-

It must avoid conflict of interest. Self-declarative systems of “responsibility” and private actors rating their partners in business and interests have to be excluded.

-

It must have public accountability. The system of certification must be run by a publicly accountable and transparent regulation agency, preferably publicly owned and operated, that should define the accreditation requirements for certified enterprises and the ESG standards.

In the same spirit, the ESG Certification system needs to target the real economy, including the Small and Medium Enterprises (SME) System5. Its aim should be to assess the commitment of enterprises to responsibility. The certification should provide an objective measurement of a representative set of variables associated to the environmental, social, and governance policies of companies, which would produce a composite indicator. The certification would make it possible, on the one hand, to measure current performance in responsibility, and on the other hand, the detection of possibilities for strategic development regarding ESG. The advantage of a model of conditionality like this compared to self-declarative Corporate Social Responsibility (CSR) reporting lies on its objective measurement and absence of conflict of interests.

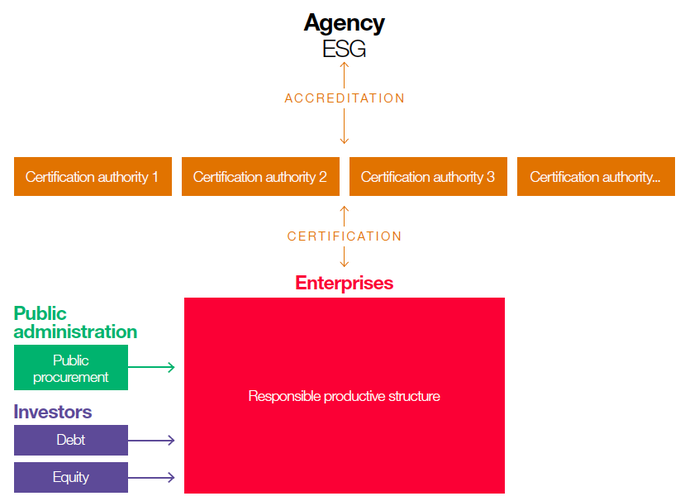

As is shown in Figure 1, this model would allow public and private fund providers to identify responsible enterprises through the ratings obtained by them in the process of certification. With this information, public administrations could direct their effort through public procurement, subsidies, or investments, placing them in a very good position to manage economic policy6 effectively.

Figure 1. ESG Certification system

Source: own elaboration

This approach to the ESG criteria responds to social, environmental, and governance concerns, but also to concerns related to an efficient distribution of scarce resources, a reasonable investment return, and an orderly re-localisation of the economy. The European Union and its member states should follow its Action Plan for Sustainable Finance7, which will serve as the basis for integrating ESG criteria in the evaluation of financial risks, as well as the United Nations Working Group on Transnational Corporations and Human Rights8. These principles will be especially valued in a scenario in which there is a need for guidance for large public investment initiatives that are responsible, efficient, local, sustainable over time and which generate endogenous development processes. As such, we believe that we need to apply this type of tool to the productive economy of small and medium size enterprises, which are predominant in the European Union, fundamental in sustaining employment and one of the most important social stabilisers.

Recovery based on ESG criteria

By the time we reach the phase in which public money begins to flow as established by the recovery plans, the conditions for the use of that money will have to be defined. The success of the recovery plans will depend on the nature of those conditions. The use of the ESG certification model with public accountability allows for the design of an incentive system necessary to efficiently allocate resources, and also to correctly assess the social, environmental, and governance returns of public investments. The effectiveness of the ESG criteria is based on the following main pillars:

-

Public procurement: the recovery plans will take into account the potential that procurement policy has for its effectiveness as an engine for directing public investment and expenditure. The economic volume of public procurement amounts to 2 trillion euros in the EU, 14% of the EU GDP. Such major investments will play a key role in the process of improving the business fabric associated with recovery. In this sense, the inclusion of prerequisites related to ESG criteria constitutes an efficient tool to achieve the greatest possible harmony between the different programmes included in the recovery plans.

-

Pre-conditionality: companies may be considered eligible for public funding in relation to their relative degree of responsibility in their economic sectors, measured using ESG criteria. Such assessment of eligibility for public funding must occur prior to the launching of the recovery plans and independently of it. It will provide guidance for efficient resource allocation processes and incentives to entrepreneurs to enhance the quality and responsibility of their projects under ESG criteria, which in turn will help re-localize supply chains. Thus, the introduction of this new tool within the framework of the recovery plans will facilitate its management.

-

Continuous certification: there is a need to establish a harmonized responsibility accounting system that can interact or even integrate within current accounting methodologies. The system hereby proposed, based on ESG criteria, entails a periodic certification of companies. The introduction of these proposed ESG certifications as an official method to assess eligibility throughout the realisation of the recovery plan will expand the number of companies using the proposed ESG accounting system, consequently, improving the responsibility and resilience of the public investments during recovery.

-

Institutional granularity: the recovery plan needs depth and width, which means that it needs wide extension with a high degree of institutional granularity. To be successful in this regard the effort of the recovery plan must be distributed among the different levels of public administrations, with a special emphasis in local administrations, which should see their funding and policy-capacity increased. For that, applying our proposed ESG model would substantially improve the probability of success. The new model would give incentives to enterprises to make strategic bets for the fulfilment of the sustainable development goals coherent with our proposal. In the short run, we would see that local responsible enterprises benefit from this new procurement approach. In the medium term we would see that new enterprises have been created from their inception in coherence with ESG principles. Long established firms will have to adapt to the new conditions or cease to provide services to the public administrations.

This model could be adjusted and reinforced through complementary policies coherent with local needs and resources. In this sense, local policy could be even more successful to the extent that supporting services were provided by public institutions to entrepreneurs that wanted to use this kind of ESG model, such as those related to credit provision, community-building between local stakeholders, and education and business support. In this way, possible obstacles could be overcome during the introduction to the ESG model along the implementation of the recovery plan.

1 https://ec.europa.eu/info/live-work-travel-eu/health/coronavirus-response/european-roadmap-lifting-coronavirus-containment-measures_en

2 https://ec.europa.eu/info/live-work-travel-eu/health/coronavirus-response/recovery-plan-europe_en#financing-the-recovery-plan-for-europe

4 https://braveneweurope.com/daniela-gabor-is-the-eu-really-going-to-put-blackrock-the-arch-purveyors-of-greenwash-in-charge-of-eu-green-accounting

5 The authors of this piece, co-founders of Ekona Center of Economic Innovation, have developed an ESG certification model with public accountability.

6 A wider explanation is available at: http://www.esgaequum.com/certification/?lang=en

Be the first to comment