Patrick Kaczmarczyk’s book in German “Kampf der Nationen” (“Clash of Nations) appeared this week in Westend-Verlag . This is a short introduction by Patrick that vividly shows that competition of nations is a truly absurd idea. But it is precisely this idea on which German and large parts of European economic policy have been based for several decades.

Doctoral Researcher at Sheffield Political Economy Research Institute

Cross-posted from Heiner Flassbeck’s website Relevante Ökonomik

Translated by BRAVE NEW EUROPE

Competitiveness has been the favourite topic of politics for the last 20 years. Across the political parties and throughout Europe, there have been calls for “all” nations to increase their competitiveness. Even the objection that such a project must fail for logical reasons alone, because competitiveness is not an absolute but a relative concept, has not been successful. Politicians have repeatedly tried to push through wage cuts and structural reforms under the mantra of competitiveness. Especially in Southern Europe, this policy was considered to have no alternative after the outbreak of the euro crisis. Since then, every country has been desperately trying to outbid its trading partners in terms of competitiveness – and Germany is the gold standard in this – after 20 years of wage restraint.

If the neoclassical theory underlying this policy were even remotely correct, the reforms – above all the massive wage cuts in Greece – should have been followed by an unparalleled employment boom. Lower wages, according to the prevailing theory, should have eventually led to more demand for labour. But instead, the policy resulted in higher unemployment and economic stagnation, which spilled over into widespread populism.

What kind of competition do we want?

Competitiveness for all and maximum price flexibility are not the basic prerequisites for a functioning market. Yet in Brussels and in most capitals, the thinking that “competition” must be as “perfect” as possible in order to increase prosperity and create more jobs still prevails. The basis of this model is neoclassical theory, in which perfect competition must be the goal because only then does every producer use the input factors efficiently and thus maximise the economic opportunities of a society.

Whoever allows himself even the slightest inefficiency in such a market will have to offer his goods at a price that is higher than in the market price – and is thus threatened with insolvency. In such a market, producers have no market power whatsoever, because they have to adjust their production methods at any time to the relative prices of labour and capital determined in other markets in order to survive in the market. Those who are less productive than the market average cannot survive economically.

However, the theory cannot explain where the productivity comes from to which everyone is supposed to adapt. How do new inventions and new production processes come about if no one can break out of the efficient market? Joseph Alois Schumpeter asked himself this question more than a hundred years ago, and he gave an answer that summed up the matter He stated that the static equilibrium theorem of neoclassics cannot explain what is actually interesting, namely the dynamic economic development of capitalism. For him, neoclassical theory was “empty and meaningless” and represented at most an early stage of a science of the economy that had to be overcome. Technological and overall social development, according to Schumpeter, is impossible if perfect competition prevails all the time.

Competition that promotes development

Competition per se does not lead to development. It depends on the right kind of competition. If companies increase their competitiveness by simply combining existing production methods with lower wages, which they enforce with power, then – quite apart from the consequences in the form of higher unemployment – there is precisely no renewal of production structures and thus no development.

A renewal of production structures that goes hand in hand with higher overall productivity only comes about through innovation, i.e. through a new combination of labour and capital – in which, as a rule, less labour is used than before. If the pioneer passes on his higher productivity in the form of decreasing prices, he gains a cost advantage over his competitors, but at the same time the purchasing power of all consumers increases and consequently their demand. In order to satisfy this demand, the labour saved by the pioneer enterprise must be re-employed elsewhere. Everyone has benefited in the form of higher incomes and the number of jobs has remained unchanged.

The pioneer achieves exactly the monopoly-like advantage that is not foreseen in the perfect market. If the other entrepreneurs emulate him, he loses this advantage over time and has to try again to outdo the other companies – again through a technical innovation in production processes or a new product. While in neoclassical competition all firms survive that manage to adapt to the technological standard – which has fallen from the sky – once and for all, the Schumpeterian pioneer and innovator forces them again and again to change and also to act dynamically. The simple question arises: what kind of competition does politics strive for? Static or dynamic?

Economic policy dogmatism in Europe

The competitive dynamics in Europe are shaped by the model of perfect competition. The institutional framework is designed to ensure that all input factors are as flexible as possible. Free movement of persons, free movement of capital, free movement of goods and services, restrictions on government spending and so on. In such an environment, there is an incentive for firms to adjust their costs downwards, but not the crucial incentive to innovate.

Perhaps the most illustrative example is provided by the automobile industry. Admittedly, it is often and readily presented as a paradigm industry to show that it is precisely not costs but innovations that drive German exports. But this view does not stand up to a sober examination of the sector.

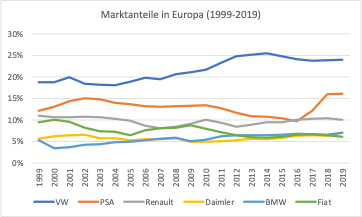

If one looks at how market shares have shifted in Europe, it is obvious that German expansion picked up speed especially from the mid-’00s onwards (Daimler was still merged with Chrysler until 2007). The undisputed frontrunner here was Volkswagen, occupying about a quarter of the entire market as of 2012. As the market as a whole stagnated, the growth of the German manufacturers came directly at the expense of the other players in the market.

Figure 1

Market Share in Europe (1999 – 2019)

Apart from Fiat, it is particularly noticeable that Peugeot and Renault also experienced a continuous decline from 2004 onwards. Renault held its own after a brief slump following the financial crisis, but all the growth came from the low-cost brand Dacia, which is produced in Romania. What had happened?

As recently as the early 2000s, France stood out brilliantly as a car manufacturing country. The German press praised it for its high productivity. But then in Germany the red-green government under Schröder tightened the thumbscrews on labour market reforms. Under heavy political pressure, the trade unions had to be browbeaten into giving in to almost all of the employers’ demands in order to keep production in the country. Wages were cut, labour markets made more flexible and collective bargaining increasingly eroded. In addition, there was the pressure of eastward expansion, where significantly lower nominal wages were waiting to be exploited. In the end, it was the supplier industry in particular that moved to the East and thus increased the price competitiveness of German factories – after all, it was possible to buy labour there at outstandingly favourable conditions. As a result, the margins of German producers improved due to lower labour costs and the resulting higher sales.

The opposite happened with the competition: for example, as companies in France lost markets, their profit margins came under pressure because fixed costs in the industry are enormous. Under the pressure of the financial markets and after two huge crises (financial and euro crisis), French companies had no choice but to follow the German model to increase competitiveness. This meant radical wage reductions, flexibilisation of the labour market and great efforts to outsource production to low-wage countries.

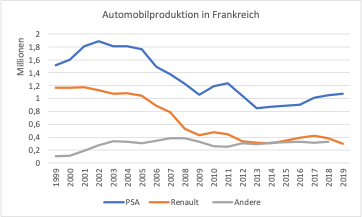

In contrast to Germany, which was able to use its proximity to Eastern Europe to integrate cheap labour into its own value-added processes, French manufacturers had to outsource their production completely, because the just-in-time model does not work over such large distances. It is true that France tried to promote an entry into electromobility through an industrial strategy in order to follow the Schumpeterian path and increase competitiveness through higher productivity. But this was not nearly enough to cushion the collapse of production. Peugeot-Citroen (PSA) and Renault together account for about 80 per cent of French production. Figure 2 shows how production has evolved: the industry in France is now only a shadow of its former self.

Figure 2

Car Production in France

In the wrong competition model, everyone is a loser

France thus copied Germany’s policy and companies optimised for all they were worth. Due to the loss of market share and pressure on margins, French companies were forced to combine their high productivity with lower wages – either by cutting wages in France or by massively outsourcing production to low-wage countries. And the reforms did not fail to have an effect from the companies’ point of view. Renault and PSA have caught up with the German manufacturers in terms of profitability.

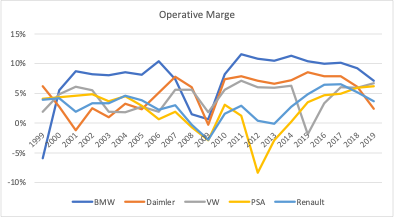

The operating profit margin, i.e. the margin that puts operating profit in relation to sales (before taxes and interest), shows that Renault’s and PSA’s profitability plummeted at the time when the German manufacturers started to take market share from them (Figure 3). The financial and euro crisis hit the French groups just as they were going downhill, so that access to the capital market also dried up. Only with the radical restructuring did the two carmakers recover. Before Corona, PSA was almost as profitable as BMW, Renault was more profitable than Daimler. VW was somewhere in between.

Figure 3

Operative Margins

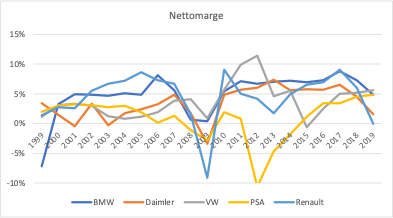

In terms of net margins, which put profit in relation to total sales after all expenses have been deducted, there was little difference between the German and French groups over time (Figure 4). However, between the years 2005 and 2014, Peugeot-Citroen in particular drops massively and Renault is also unable to maintain its previous position.

Figure 4

NET Margins

The automotive industry as a whole is where it was 20 years ago in terms of profitability. However, conditions for workers have deteriorated. They are paid less and are often employed in precarious conditions. The expansion of German corporations based on wage repression was a major driver of the decline of French industry, so that not only cars were exported to the rest of Europe, but also unemployment.

In the overall economy, a competitive strategy in which each country tries to outdo the others in competitiveness through wage compression ensures high unemployment and economic slack throughout the region in the long run. Germany may have been able to temporarily reduce its unemployment more than the others, but now at the latest the entire continent is blocked because wage pressure hampers domestic demand everywhere. Since low demand weakens investment activity, Europe is also falling behind technologically in the long run. If one considers in the automobile industry, for example, how great the backwardness is compared to the pioneers from the USA and China, one can only conclude that no one is emerging as a winner from this economic dogmatism that Europe has installed in the internal market.

What do we need in Europe?

If we want a competition of innovation and not of wage dumping, we must fundamentally rethink the type of competition that has been imposed in Europe. If we follow Schumpeter, the top priority for policy must be to create a form of competition in which investment and productivity increases remain the only means of increasing competitiveness. Indeed, wage cuts without changing production structures hinder the process of creative destruction and allow “zombie firms” that are actually no longer competitive to continue to survive in the market by simply lowering their wages.

For Schumpeterian competition, therefore, three things are needed: First, firms must be granted stable investment framework conditions. For this, the central bank must guarantee a low level of interest rates and stabilise the prices of government bonds, the latter being the reference point for all corporate bonds. Secondly, companies need to know that investment is the basic condition for their long-term survival in the market. Thirdly, the state must push for a forward-looking wage policy that follows the golden wage rule (nominal wages must rise in line with expected productivity and the target inflation rate) and relies on high collective bargaining coverage.

Only if the starting conditions for companies are equal in terms of their wage and capital costs will differences in productivity alone determine differences in competitiveness. In an international economy with capital mobility, it is thus a matter of course that direct investments are accompanied by wage conditionality that obliges the foreign investor to raise local wages in accordance with the golden wage rule. In this way, companies could increase their competitiveness in the short to medium term by outsourcing production to developing countries. In the long run, however, they would lose their absolute advantages if they cannot increase their overall productivity with their own innovations.

All these measures go hand in hand with far-reaching state intervention in the market. However, even liberals and conservatives should slowly realise that there is no market without the state. The sooner we in Europe start drawing the right conclusions from this, the better – because we have been asleep at the wheel for the last 30 years.

Be the first to comment