Are EU economic instruments fit for purpose?

Philipp Heimberger is Economist at the Vienna Institute for International Economic Studies (wiiw)

Cross-posted from Philipp’s blog

To subscribe to Philipp’s blog please click here

Last week on April 21st, there was the 75th anniversary of the death of John Maynard Keynes, one of the 20th century’s most formidable public intellectuals, who made highly influential contributions to economics. I take this anniversary as an occasion to write about something I think Keynes would be very vocal about were he still alive: the role of economic models in current policy-making. I will focus on fiscal policy in Europe.

Understanding current and upcoming discussions about whether and how to reform the EU’s fiscal rules requires us to come to terms with the power of economic models. The reason is that the current set of rules is based on model-based estimates, which restrict the fiscal space of EU countries due to their importance in the EU’s fiscal rules.

In this post, I will talk about a paper I co-authored with Jakob Kapeller und Jakob Huber: “The power of economic models: The case of the EU’s fiscal regulation framework” – recently published in the journal Socio-Economic Review. The paper provides an in-depth analysis of the underlying estimation approach of “structural” deficits. I will try to relate our study to some important elements of Keynesian thinking. I will also provide cross-references to current fiscal policy debates in Germany and Europe.

We will see that political processes in Europe have been characterised by feedback loops where political decisions are coined by technicalities and, as a consequence, seemingly innocent technical assumptions become objects of political demands.

The issue of how to estimate output gaps and “structural balances” is currently important in the debates over when and how the EU’s fiscal rules and national “debt brakes” should be reintroduced and reformed.

Keynes and the role of economic ideas

At the end of his book “The General Theory of Employment, Interest and Money,” Keynes wrote:

These reflections by Keynes on the role of economic ideas are a central starting point for our study.

In recent decades, research on economic ideas and their influence on policy and political programs has focused on the level of abstract theories – such as explaining the economic policy paradigm shift from Keynesianism to monetarism in the 1980s. We take a new approach because we are interested in the role of concrete economic models that play an important role in policy processes.

We argue that economic models can serve as a transmission device between economic paradigms and policy programs, which allow actors drawing on the model to exercise power in political processes. From this perspective, models translate paradigmatic assumptions into political action, but this is usually hidden from public discourse.

In this context, we claim that models can mediate between economic paradigms and political programs by providing simplified representations of complex economic processes that specify causes and quantify effects, as they emphasise the influence of certain variables while downplaying the importance of other factors. In doing so, a relevant economic model draws on a paradigm in such a way that makes it possible to operationalise the paradigm for specific policy programs.

Under what conditions can economic models act as such a transmission device between paradigmatic assumptions and policy programs? We tackle this question by looking at the important case study of the EU’s fiscal rules.

The output gap in the EU’s fiscal framework

What is special about the EU fiscal rules is that there is a legal basis for employing a specific model as its technical backbone. The EU Commission uses the so-called potential output model to estimate the output gap – the difference between actual output (as measured by gross domestic product) and a model-based estimate of potential output –, where the output gap is interpreted as an indicator of an economy’s position in the business cycle. Output gap estimates are an important basis for the EU Commission’s assessment of how much of the actual fiscal deficit (or surplus) in a given EU country is “structural” in the sense that it is not due to the impact of the fluctuations of the business cycle on tax revenues and government spending.

Model calculations of the output gap are, however, just as relevant for calculating “structural” deficits in the context of “debt brakes” at the national level. For example, the European Commission’s model is used in the context of the German “debt brake” to estimate whether the state adheres to the restrictions on government borrowing in the form of the “structural” fiscal deficit limit of 0.35% of Gross Domestic Product per year for the federal government and of the zero “structural” deficit limit for the federal states.

Our study shows that the theoretical and technical foundations of estimating output gaps are of high political importance. If, e.g., the output gap is estimated to be small in an economic downturn, this means that an economy’s production factors are almost fully utilised; the fiscal room for manoeuvring of the government decreases as the achievement of model-based budgetary objectives is estimated to be at risk. As a consequence, EU fiscal rules give countries in an unfavourable economic situation only limited scope for higher fiscal deficits to combat the downturn. This results from the use of statistical filtering techniques to calculate subcomponents of potential output, which are subject to a procyclical bias because they are disproportionately driven by the last data points to enter the estimation procedure.

The mechanism is at follows: procyclical model estimates – implying a downsizing of the output gap – increase fiscal consolidation requirements for the affected government during economic downturns. Fiscal consolidation in an adverse economic situation then reduces economic growth and employment, and leads to further fiscal consolidation requirements based on the fiscal rules. Such a vicious circle was at play in several member states in the context of the Euro crisis.

In-depth analysis of output gap estimates after the onset of the Corona crisis shows: there is still a procyclical bias due to the underlying estimation problems, which will directly affect EU member states as soon as the fiscal rules – currently suspended due to the crisis – are reactivated. From a Keynesian perspective, revisions of the model estimates threaten to put counterproductive fiscal consolidation pressure on national governments, which could undermine fiscal stabilisation policies after the COVID19 crisis and make it more difficult to increase public investment.

Output gap estimates in European fiscal policy-making

The EU Commission’s model estimates have gained importance in European fiscal policy-making due to the reforms of the EU’s fiscal rules after the financial and economic crisis of 2008/2009. Our study examines the basic assumptions and technical developments of the potential output model mentioned above, which underlies the calculation of the output gap. Generally speaking, the model is based on a neoclassical production function approach, and further assumptions are incorporated at the level of modelling and estimating the factors of production. In recent years, the technical details of the model have been adapted in several steps.

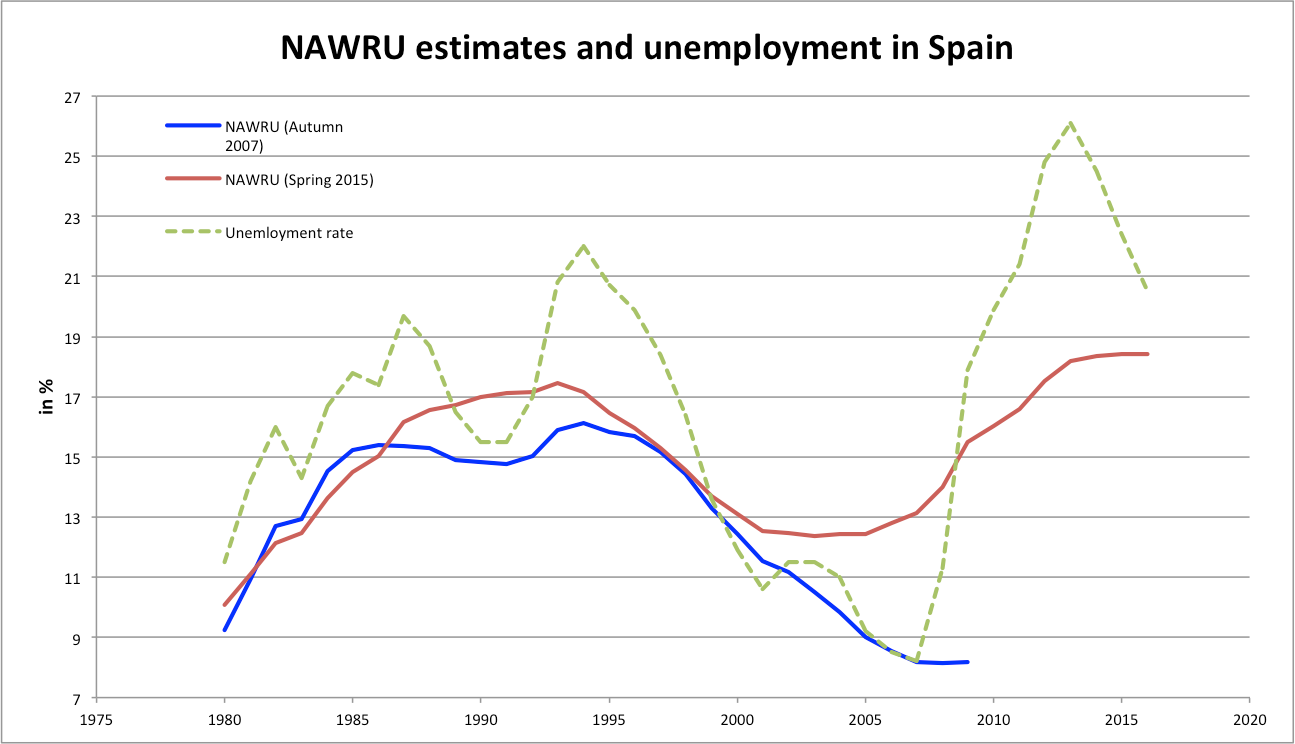

Several governments of individual EU member states have expressed dissatisfaction with the model estimates and their implications for fiscal policy-making; as a consequence, they pushed for model adaptions. Over the course of the euro crisis, for example, Spain criticized the European Commission’s estimates of the “structural” unemployment rate (proxied by the so-called NAWRU; Non-Accelerating Wage inflation Rate of Unemployment), which essentially determine the contribution of labour as a production factor in the Commission’s model, for being implausibly high. According to the Commission’s real-time model estimates, Spain’s “structural” unemployment rate stood at around 20% in 2012 and 2013 – almost as high as the actual unemployment rate. As a consequence, the output gap was estimated to be small, which put additional fiscal consolidation pressure on the Spanish government in the context of the EU’s fiscal rules, because a large part of the fiscal deficit was considered “structural.” The Spanish government, with the support of other countries, pushed for changes in the estimations of “structural” unemployment. After major political conflicts in the background, a compromise on adaptation of the underlying model was finally reached in 2014, which somewhat reduced the fiscal consolidation pressure for Spain and some other countries.

Source: European Commission.

This anecdote points to the fact that fiscal policy decisions in the EU in the pre-Corona era were often shaped by technical details, and as a result seemingly innocent technical assumptions in the context of calculating the “output gap” became the subject of political conflicts and demands.

What would Keynes say about these output gap estimates?

Our study results suggest that the prevailing European Commission model for estimating output gaps helps translate paradigmatic priors into policy action. Paradigmatic priors of supply-side economics are translated into economic policy programs through the application of these model estimates in political processes; demand-side Keynesian arguments are side-lined or suppressed. The procyclical bias that the potential output model promotes in conducting fiscal policy of EU member states contrasts with a Keynesian view in which discretionary fiscal policy should be countercyclical, i.e. expansionary in recessions and restrictive in cyclical upswings.

We cannot, of course, know exactly what Keynes – were he alive today – would say about the role of output gap estimates in fiscal rules. But with recourse to Keynesian thinking, the theoretical and technical orientation in modelling potential output can at any rate be criticised on the basis of our study. The procyclicality of the underlying model estimates is particularly problematic because it undermines effective countercyclical stabilisation policy. Economists and policy-makers should discuss this publicly and seek improvements as part of the upcoming reform efforts concerning the fiscal rules after the Corona crisis.

Should democratic economic policy-making depend heavily on such model estimates? How can the underlying model estimates be improved? These questions are of great importance for the future of fiscal policy in Germany and Europe, and I will talk more about it in future posts.

Be the first to comment