You can prove most anything wrong if you fabricate the facts. The Guardian is a specialist in this.

Richard Murphy is an economic justice campaigner. Professor of Accounting, Sheffield University Management School. Chartered accountant. Co-founder of the Green New Deal as well as blogging at Tax Research UK

Cross-posted from Tax Research UK

The Australian edition of the Guardian (available via the UK website) had an article yesterday that was headlined as follows:

The author is described as ‘a financier and author’. His Wikipedia page makes clear he has a fairly conventional finance background.

The article might fairly be described as an attack on modern monetary theory (MMT). He describes MMT in this way:

A state, MMT argues, finances its spending by creating money, not from taxes or borrowing. As nations cannot go bankrupt when they can print their own currency, deficits and debt don’t matter. Accordingly, governments should spend to ensure full employment, guaranteeing a job for everyone willing to work. Alternatively, though not formally part of MMT, governments can fund universal basic income (UBI) schemes, providing every individual an unconditional flat-rate payment irrespective of circumstances.

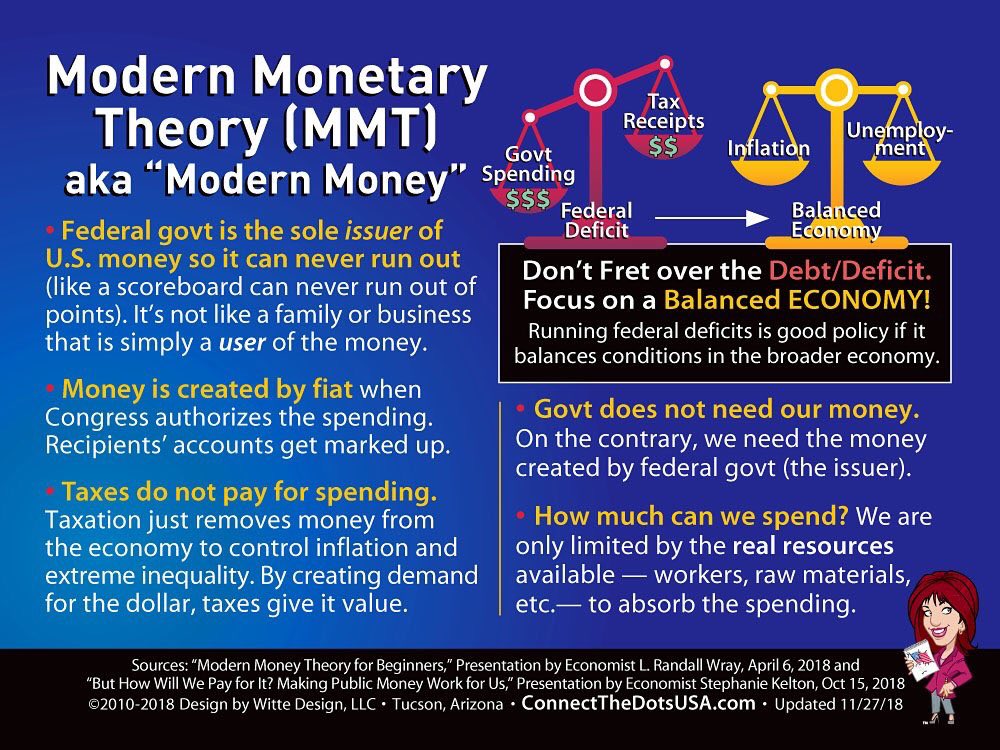

These claims are wrong. They are either not what MMT says or the telling is distorted. For the record, MMT actually says is quite different.

First it is true that MMT argues that all government expenditure is funded by money creation. In the UK it can reasonably be said that this has happened since 1866 when the Exchequer and Audit Departments Act was first passed. This does not, however, mean, as the author implies, that there is no role for taxation or borrowing within modern monetary theory. In fact, the exact opposite is the case. Taxation has a fundamental role, to control inflation and, I would argue, to provide a delivery mechanism for a whole range of government social and economic policy.

Collecting taxes also fulfils the fundamental task of completing the government’s promise to pay that is both printed on every banknote and is implicit within the existence of the fiat currency, where all money is simply a debt. Only accepting its own currency in settlement of tax liabilities is what provides a country’s currency with its value, and so the naive presentation made by this author is completely false.

In addition, borrowing also has a very clear function, although it is entirely unnecessary for a government to borrow in theory because the government can always create money of its own instead. In practice, a government will want to borrow to provide a safe place of deposit for people within the society for which it is responsible, and it will wish to issue bonds of varying ages because these provide it with the mechanism to control interest rates within their economy.

Secondly, whilst it is technically true that any government that issues its own currency and which, most importantly, only borrows in that currency (conditions the author did not note) cannot go bankrupt it is entirely untrue to say as a consequence that governments are quite indifferent to the level of their deficit or debt. The only reason why a government would wish to run a deficit is if it had the desire to stimulate its economy because it believed that the private sector activity within it was either not delivering full employment, or was alternatively delivering outcomes that were not as socially beneficial as those which the state could deliver instead. Tax basically restricts the role of the private sector to make the more useful or socially desirable activity possible in that case. Running deficits that could, for example, lead to inflation is something that any government following the principles of MMT would wish to avoid. The author’s representation is, again, then entirely false.

Third, Das is then right to suggest that a government following the principles of MMT can then pursue a policy of full employment as its primary economic goal. In fact, the only reasonable question to be asked of a government that did not understand this is why it would not wish to pursue that goal on behalf of the people of the country for which it is responsible?

Fourth, the alternative claim that Das makes that MMT says that a universal basic income can be run instead is completely false: he could search long and hard for this to be recommended within MMT literature and not find it, because most MMT academics do not think that the job guarantees that delivers full employment and universal basic income are in any way alternatives to each other. Again, then, his argument is false.

I make these points for one good reason. If you’re going to criticise something you have to fairly state what that thing that you are criticising says. Das does not do that. As a consequence all that he says thereafter within his article is bound to be wrong. He is not arguing with MMT. Instead he is arguing with a straw man that he set up in place of MMT. Most of those who take argument with MMT do this, and Das is stereotypical in doing so.

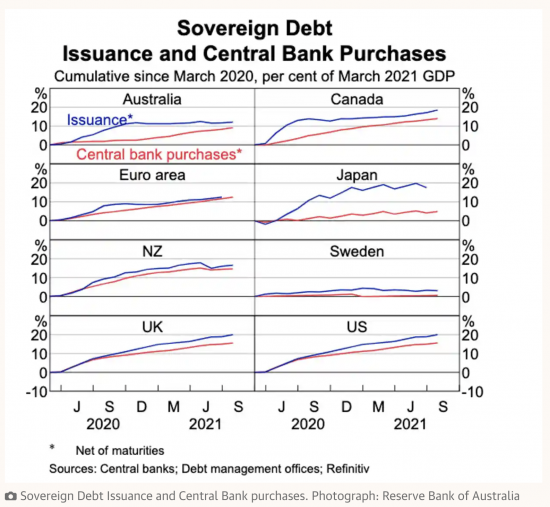

What Das then argues is that it whilst no government, according to him, follows the principles of MMT (about which is also wrong, because every fiat currency government does, as a matter of fact, do so) a great many of them have been increasing their deficit and debt since 2008. He supplies this chart to illustrate the point:

What Das implies is that this means MMT is being followed. He straightforwardly confuses it with QE. I comment further on this below. They are not the same thing.

Das then delivers another trope, suggesting:

MMT is actually a melange of old ideas: Keynesian deficit spending; the post gold standard ability of nations to create money at will; and quantitative easing (central bank financed government spending) pioneered by Japan.

If it was nothing new, what is he worried about? The fact is that MMT is new understanding but like so many others, Das wants to deny the fact. To understand why this is the case we have to look next at the claims that he makes about what he describes as the uses of MMT.

The first such use is, he claims, to direct the creation of new employment. He does however dispute that government is able to direct the private sector in this task, which makes something of a mockery of 70 years of tax-related fiscal policy, which is the actual policy most commonly used for this purpose. As for governments directly employing people to facilitate this, the opinion of Das on this is best summarised in his own words:

The woeful record of postwar centrally planned economies, where people pretended to work and the government pretended to pay them, highlights the issues.

Again using his own words, it would seem that he thinks that a government’s role in employment creation is:

Getting one person to dig a hole and another to fill it in creates employment, but it is of doubtful economic and social value.

In that single throwaway casual sentence he dismisses all the value created by teachers, universities, health and social care, the justice system, environmental protection, the regulation and protection of fair competition, and so much more on which society depends, to none of which he apparently attributes are value.

Das then turns to the old trope of inflation, saying:

Second, excess government spending and large deficits financed by money creation risk creating inflation.

Of course that is true. MMT wholly recognises the fact. That is why it discusses so many mechanisms to control inflation. The only reason why he can make this claim is because he denies what MMT actually says.

Next Das claims that MMT may weaken the currency and increase the expense of servicing foreign currency debt. There are many reasons for dismissing this ridiculous claim. The first is that as we know that almost every major economy and currency has been engaged in a similar process of using quantitative easing, which Das falsely equates with MMT, there have been no major currency movements against each other as a consequence, because every government is pursuing a similar policy. To suggest that there is any currency threat is, as a consequence, ridiculous, using his own evidence. But, the fact that worldwide interest rates are now at a record low, and that this only happened during the period when QE has been in prevalent use, which happens to coincide with what he thinks is MMT, completely undermines his argument about the cost of servicing debt: if anything it is very apparent that QE has delivered the means to control the cost of debt into the hands of government, and it has no desire to let go of it. Das is, yet again, completely wrong.

Das then moves into the realms of the surreal when suggesting that whilst it is within the power of nation states to issue their own fiat currencies this is unavailable to state government, private businesses or households as if there is something wrong with that. His inability to spot the difference between macro and microeconomics is quite staggering. He is also wrong. Anyone can issue a currency. The problem is in getting it accepted. He does not understand currencies.

His complaints go on though. His next is that:

Who decides the target employment rate or UBI payment level?

Answering his own question he says:

The theory delegates management of MMT operations to politicians, rather than unelected economic mandarins. But financially challenged elected representatives may be poorly equipped for the task. Political considerations and cronyism may influence decisions.

Das is obviously quite horrified by the idea of democracy and clearly believes that corruption is something only found in the state sector. I think he should go out a little more.

Next, he complains that:

MMT may encourage hoarding of commodities. This exacerbates inequality and increases the cost of essentials such as food, fuel and shelter. Fear of debasement of the value of paper money, in part, is behind unproductive speculation in gold and cryptocurrencies.

Das is deeply confused because he equates MMT with QE. The above consequences could arise from QE, I agree. However, that is because QE injects money into the financial system without putting any control over how it might be used resulting in it being directed towards wholly unproductive speculative activity rather than into productive use. MMT is entirely different. If MMT were in active rather than passive use the government would not inject funds through the financial system but would instead take directly responsibility for the use of those funds within the economy. Consequently the claims that Das makes would not arise. The money would not be available for speculation.

He still goes on. The seventh claim Das makes is:

MMT might undermine trust in the currency. Instead of spending the payments, citizens may question a world where governments print money and throw it out of helicopters.

Once again, the simple fact is that Das has not done his research. No one associated with MMT suggests that helicopter money should be used. Milton Friedman did. Marton Wolf has done so in the Financial Times. But MMT has not. Yet again, the claim made is completely false

Finally, Das says just because Japan has used QE2 for decades without any apparent risk arising does not prove that MMT will work. I agree, it does not, because what Japan has done is not pure MMT. On the other hand it is pretty persuasive evidence and cannot be ignored, although Das would like to do so.

What does Das conclude from all this? His first conclusion is:

MMT’s allure is the irresistible promise of freebies; full employment, unlimited higher education, healthcare and government services, state-of-the-art infrastructure, green energy and “the colonisation of Mars”.

How wrong can he be? MMT offers full employment for sure, because it is possible. The rest is simply made up. There is a full employment constraint, after all. That is what really limits us. MMT consistently says so. It never says anything of the sort that Das claims. I am left wondering if he has ever read anything about MMT.

Then he claims:

But monetary manipulation cannot change the supply of real goods and services or overcome resource constraints, otherwise prosperity and utopia would be guaranteed.

This one is quite fantastic. I think he will find that cutting off money supply can most definitely change resource allocation. So too can inflation; he has already said so. What MMT says as a consequence is that in that case the supply of money must be carefully managed for social purposes. Das would not seem to realise that social purposes exist.

Finally he says:

While the current game can and will continue for a time, the bill will eventually arrive. The borrowings will have to be paid for out of disposable income, higher taxes or through inflation, which reduces purchasing power, especially of the most vulnerable, and destroys savings. Other than nature’s free bounty, everything has a cost.

I agree that QE has a cost. That is from the inequality and pointless speculation it induces. That is why I have argued its use is wrong since 2010. That is what led me to what I realised was MMT. That is why I argue for Green QE, which is what might be called applied MMT.

But even with regard to QE he is hopelessly wrong. QE never has to be repaid. QE has not created higher taxes or inflation, despite all the claims. And all that can destroy savings is the cancellation of QE, which literally destroys money. It is he who is the threat to savings.

What do I conclude? It is that Das is a typical underread neoliberal commentator who would appear to be driven by loathing of government, democracy, public goods and social worth, all of which radiates from what he has said. Worse though, the Guardian has given him space to discuss something about which he has little knowledge, and which he totally falsely portrays, whilst offering opinion that would be deeply detrimental to society if acted upon. What I hope is that they will publish a full rebuttal. They have a duty to do so.

Richard Murphy

Be the first to comment