Why are people currently buying bonds? Because they want safety. And they do not believe equity markets can provide that.

Richard Murphy is Professor of Practice in International Political Economy, City University of London. He campaigns on issues of tax avoidance and tax evasion, as well as blogging at Tax Research UK

We would like especially to thank Richard who expanded his original article on his website Tax Research UK for BRAVE NEW EUROPE

I have been much criticised in recent times by supposed investment specialists for suggesting that there might be any merit in investing in government bonds. In that context I note this morning that the FT reports that:

The global bond market rally accelerated on Wednesday, as New Zealand’s central bank became the latest to sound a gloomy note on economic growth and traders ratcheted up bets that the Federal Reserve will start cutting interest rates this year. The 10-year Treasury yield slipped another 6 basis points to 2.37 per cent, the lowest since 2017, as the US bond market heads towards its second-best monthly performance in more than a decade. The yield fell further in Asia trading on Thursday, slipping to a near 16-month low of 2.34 per cent.

As they add:

Traders are now betting that there is almost an 80 per cent probability of the Fed trimming rates at least once this year — and a meaningful chance of several cuts.

And why are people buying bonds? Because they want safety. And they do not believe equity markets can provide that.

Why can’t equity markets do that? First, because of a shortage of demand: some of that is down to low pay. Second, it’s also partly because people do not want to buy what is on offer (think new phones, diesel cars and planes that don’t work). Third, because markets have stopped working out what people want because i) most of the people that markets serve have all they reasonably need and ii) advertising appears not to be working any more. Fourth, because what people want (jobs, a pay rise, security, action on climate change, affordable health care) can only be supplied by the state. And fifth, because those things are not being delivered by market ideologues in legislatures.

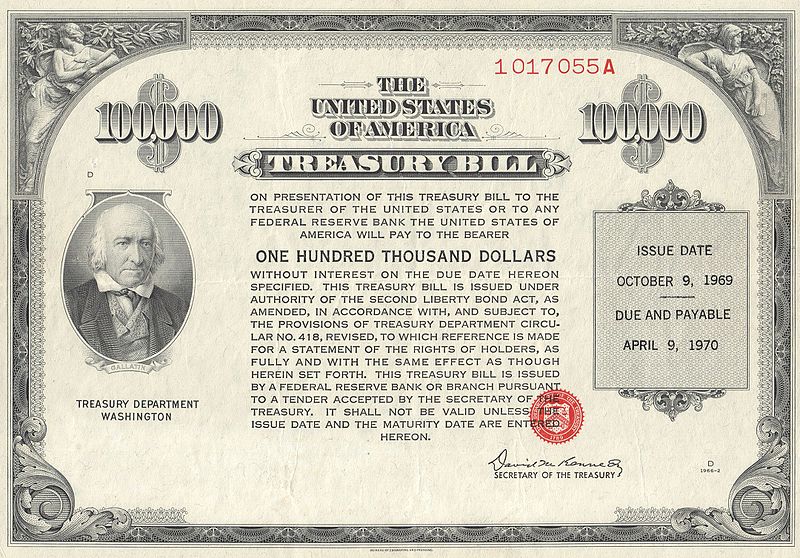

So bonds make sense, to the extent that there are $10 trillion of negative yielding government bonds in issue right now, and people willingly own them. https://www.bloomberg.com/news/articles/2019-03-25/the-10-trillion-pool-of-negative-debt-is-a-late-cycle-reckoning

So here’s an answer. It’s a Green New Deal. I hate to point out the obvious. But it’s also the only answer I know of. Or that anyone else knows of at present. And if there’s one thing the Green New Deal will do it is that it will meet the demand for bonds.

It will do that in three ways. First, the National Development Banks who will have to co-ordinate the Green New Deal will largely be financed by bonds. Prof Stephany Griffith Jones, who is an expert in such things believes that for every euro, pound, yen or dollar the government has to put into such a bank at least nine can be raised by borrowing through the issue of bonds. Given the scale of the investment required, which is at least £50 billion a year in the UK alone, this is going to help meet the demand for security within the financial markets.

Second, it has long been my suggestion that tax relief on savings products should in the future be targeted at those which support the Green New Deal. Given that most savings products owned by most households are tax incentivised, whether as pension fund savings or as ISA savings in the UK, and the bonds issued by a National Development Bank for Green New Deal purposes would be assets meeting this criteria is not too hard to imagine that there will be demand for them.

And third? When people realise that their savings turned into hope for their children’s future, and that it is the government that has enabled this process then money will naturally move in this direction.

I am aware of the counter argument, which is that bonds do not provide the rate of return on equities do, and as a result people will not be able to afford to live in their retirements. My point is simple. Bonds invested in the Green New Deal will guarantee that people might live to a retirement. Equities, on the other hand, will have sunk below the tidal wave unleashed by global warming before many will ever have such an opportunity to give up work. The rate of return on an investment will not in the future reflect past trends. It’s a lesson that markets need to learn now.

If you like this kind of article and want to see more writing free of state or corporate media bias and free of charge, please donate here. We welcome your support.

Be the first to comment