The decline in the ECB’s purchases of Italian government bonds has generated unprecedented scrutiny in Europe of the nature of such interventions.

Sergi Cutillas is an economist and worked in the financial sector before taking up his work as a financial justice activist in early 2012. He is a member of the European Research Network on Social and Economic Policy. He is now Secretary of Economy and Work in Podemos Catalonia.

Cross-posted from CTXT

Translated by BRAVE NEW EUROPE

In its bond purchase programme, called Public Sector Purchase Programme (PSPP), the European Central Bank (ECB) is obliged to purchase sovereign debt bonds of the various member states participating in the capital of the ECB in a proportion equivalent to their share of the capital of the institution, which is called the ”Capital Key”.

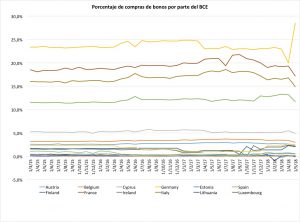

The purchase of bonds from Italy and Spain in such a programme should therefore correspond to their capital key of 17.5% and 12.6% respectively. However, in May of this year, these proportions were 14.9% for Italy and 11.7% for Spain. In the case of Italy, this is the lowest percentage since the start of the ECB’s bond purchase programme.

The percentage of bonds purchased by the ECB

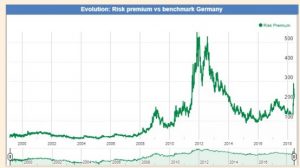

The same month saw rises in the risk premium of the sovereign debt of Italy and Spain compared to Germany’s Bunds, but mainly in Italy, as it rose almost 300 basis points (3%) at the end of May, levels only reached during the euro crisis between 2011-13 (see chart below). This coincided with the negotiations for the formation of a new government in Italy, in which the President of the Republic, Sergio Mattarella, vetoed the proposal of the newly elected coalition of 5 Star Movement and Lega to appoint Paolo Savona as Minister of Economy and Finance, an economist critical of the European single currency policy.

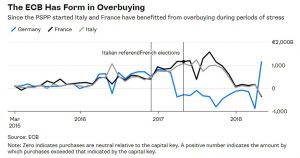

This coincidence has led the public to wonder whether there has been any political motivation for the ECB buying the smallest proportion of Italian bonds in May since the programme was launched in early 2015. It should be noted that the ECB has always increased the proportion of bond purchases during periods of financial stress (see chart below) since the start of the PSPP programme, so what happened this time is even more anomalous.

Since the PSPP began, Italy and France have benefited from increased purchases during periods of financial stress.

Note: Zero indicates that bond purchases are neutral relative to capital key. A positive number indicates the amount by which purchases exceed the amount indicated by the capital key.

The ECB’s response to such suspicion and public debate was that there had been no political motivation for reducing bond purchases from Italy and other countries. The explanation given by the central bank’s press department is that this occurred for technical reasons, given that large amounts of German debt maturing in the same month were to be refinanced, which would explain why German debt purchases have increased while those of the rest had fallen.

However, as analyst Marcus Ashworth explained in an article in Bloomberg on June 5, this argument is not convincing. In the same month, Italy was also facing the maturity of large amounts of its debt. In addition, the refinancing rules for bonds maturing under the PSPP programme make it clear that this process must be carried out (see the History of the ECB´S Asset Purchase Programme redemptions):

“In a flexible and timely manner in the month in which they mature, at best, or in the following two months, if justified by market liquidity conditions. Monthly net purchase volumes published by jurisdiction may therefore fluctuate due to the timing of these rollovers.”

The ECB, which is required by Article 127(5) and Article 282(4) of the Treaty on the Functioning of the European Union to contribute to the stability of the European financial system, had sufficient room for manoeuvre to facilitate the refinancing of German bonds without affecting the interest rates on debt on the secondary market and thus without influencing the formation of the Italian government. Their action was therefore a clear violation of Article 127(5) of the Treaty on the Functioning of the European Union in the light of the evidence, as well as a political interference by their management, requiring it to resign if it does not provide a credible justification for such action. This has not yet happened.

It is therefore necessary to know whether the ECB can justify its action, especially since the technical arguments put forward so far have proven unjustified. Is there an explanation for changing the criteria and buying fewer bonds during a market pressure situation where the opposite has been done before? Actions such as this adulterate the course of democracy, influencing public opinion and the actions of politicians elected by citizens. Was this its intention? If this were the case, we would be talking about a serious attempt to alter a process of government formation resulting from a democratic election. If it was not, and was it simply casual negligence, should the EU institutions not dismiss the ECB’s management for its serious incompetence?

Statements by the European Commissioner for Budget and Human Resources, Günther Oettinger, who said that the capital markets would teach Italians how to vote correctly in the event that the formation of a government failed and new elections were to be called, point to a clear awareness on the part of the European institutions of the pressure and influence that market action can have on electoral, legislative, and governance processes. Are not European institutions such as the ECB, the institution with full power to tackle speculative dynamics against debt bonds, and the European Commission promoting instability in the markets and fear among voters by giving them signals that the institutions will not intervene to ensure stability if a mass selloff of sovereign bonds is initiated?

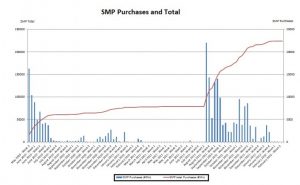

It is not the first time that the ECB has sabotaged sovereign bonds in the periphery by allowing risk premiums to soar, using them as a mechanism for extortion. During the first phase of the euro crisis, the three periods in which tensions over the euro reached unbearable levels, between November 2009 and May 2010, as well as between March and August 2011, and May and August 2012, were periods in which the ECB refused to intervene in the public debt markets, thus exerting pressure to impose the various adjustment programmes they dictated to the European periphery nations (see chart below).

Purchases of government bonds by the ECB under the Securities Markets Programme (SMP) programme

The ECB had at its disposal the Securities Market Programme, which stated in its recital number 4 of the Decision to adopt the programme that (see here):

“The Governing Council will decide on the scope of the interventions. The Governing Council has taken note of the statement of the euro area Member State governments that they ‘will take all measures needed to meet their fiscal targets this year and the years ahead in line with excessive deficit procedures’ and the precise additional commitments taken by some euro area Member State governments to accelerate fiscal consolidation and ensure the sustainability of their public finances.”

This ‘taken note’ has de facto materialised in the extortion of the ECB through the lack of protection (non-intervention by not purchasing bonds) of peripheral public debt in secondary markets if their governments did not implement austerity measures and other neoliberal reforms. It was this coercive mechanism that Trichet, the former President of the ECB, used to put pressure on the prime ministers of Italy and Spain in August 2011 to impose neoliberal reforms. This pressure led to the fall of the Berlusconi government and the imposition of the pro-austerity government of Mario Monti in Italy, and to the modification of Article 135 of the Spanish Constitution and the beginning of the end of Zapatero’s government followed by a Rajoy government fully committed to the EU’s neoliberal reforms. This event would therefore initiate the period of austerity in both countries. That such reforms are prescribed by the European institutions, with the ECB as the armed wing, is made clear in the letters Trichet sent to Berlusconi and Zapatero in August 2011:

“At the current juncture, we consider the following measures as essential: […]

- a) A comprehensive, far-reaching and credible reform strategy, including the full liberalisation of local public services and of professional services is needed. This should apply particularly to the provision of local services through large scale privatizations.

- b) There is also a need to further reform the collective wage bargaining system allowing firm-level agreements to tailor wages and working conditions to firms’ specific needs and increasing their relevance with respect to other layers of negotiations. […].

- c) A thorough review of the rules regulating the hiring and dismissal of employees should be adopted in conjunction with the establishment of an unemployment insurance system and a set of active labour market policies capable of easing the reallocation of resources towards the more competitive firms and sectors”.

It is paradoxical that at that time Mario Monti himself, an economist who would shortly after succeed Berlusconi as technocratic prime minister, was also a member of various elitist forums such as the Trilateral Commission and the Bilderberg Group, admitted that important domestic policy decisions were being made “by a supranational market-oriented government” and compared the ECB to a “podestà forestiero”” an authoritarian figure appointed by the central government during the fascist regime to replace democratically elected mayors (see here). In the same vein, Harvard historian Adam Tooze has characterized public bond investors as paramilitaries who have engaged in punishing their state victims by beating them under the auspice and with the consent of the ECB and the German government, dominant in the Eurozone (see here). In this sense, it should also not be forgotten that in 2015 the ECB and this same German government used similar torture techniques in Greece, consisting of reducing (and finally cutting off) liquidity to the banking system to generate a flight of deposits and thus a financial strangulation that ended up sinking the country’s banking system causing a new recession, and forced its government, a coalition of Syriza and Anel, to abandon its progressive programme and adopt the third neoliberal programme in 5 years, which currently keeps the country in a deep economic depression with almost a third of its population living in poverty.

In short, and in view of the events described, and others not discussed here for lack of space, would it be possible for a progressive government to carry out policies in favour of the working and popular classes in the Eurozone when it knows that if it does so it will face the possibility of the ECB contributing to the collapse of its finances? What is more, is it possible to call the political regime of the euro a democracy?

The answers to these questions become even more urgent and necessary as the PSPP programme comes to an end next December and the markets will be able to take advantage of any political disagreements between state governments and the EU directorate to generate financial turbulence. We will see whether the ECB extends its procurement programmes or deploys new tools to regulate such pressure, or whether this is done through the new (yet to be created) European Monetary Fund and the mechanisms deployed around it, or most likely whether it will be a mix of all these. However, the first step in proposing strategic alternatives to such a domination of financial interests begins with finding these answers.

Be the first to comment