This week the Dutch government blocked a proposal to activate a special credit line for countries who need financial support to fight the Covid19 crisis. But the logic behind the Dutch position is backward-looking and lacks diplomatic tact and political leadership.

See also our recent article on this topic: “Sergi Cutillas, Albert Medina, Pablo Cotarelo, Marc Lascorz – Corona Bonds: Administer with Caution” here

Stanislas Jourdan is head of Positive Money Europe

Cross-posted from Positive Money Europe

As the Coronavirus crisis intensifies, EU institutions and governments are proving themselves unprepared in the face of crisis. Yesterday, the Eurogroup failed – once again – to agree on any decision regarding the possible use of the European Stability Mechanism (ESM) in order to lend money at low cost to the countries most affected by the crisis.

The ESM is the crisis-fighting fund created by EU member states to bail out countries – previously conditioned by harsh austerity measures – during the last Eurozone debt crisis. When it was created in 2012, the ESM’s role was to provide liquidity for countries who had lost access to financial markets. If this happens, the ESM can leverage on its strong EU state guarantees to borrow money on financial markets at a very cheap price. In turn, the ESM can then lend money to individual countries.

Ahead of a Eurogroup meeting yesterday, many voices (from trade unions, MEPs, experts, and even us at Positive Money Europe) raised support for the idea that the ESM should be mobilized to provide liquidity support against the Coronavirus crisis.

Among the several proposals on the table, most revolve around the idea of offering a special credit line to all EU countries, at zero interest rate, and without any restrictive conditions.

Klaus Regling, the ESM’s Managing Director, proposed using the precautionary credit line ECCL (Enhanced Conditions Credit Line), under which countries are free to draw money from it without obligation.

In the past, using the ESM was framed as a choice between bailouts and austerity, but these proposals clearly go beyond that, giving the ESM a new function in a time of crisis. The only purpose of this new credit line would be to make sure that those countries can spend without facing punitive costs imposed by markets to finance their urgent healthcare spending and to limit the negative economic impact of the coming recession. As the case of Spain shows, the use of the ESM could significantly improve the debt sustainability of countries.

The aggressive opposition of the Dutch Government on ESM

Some countries, however, do not agree with this idea and are blocking it from the outset. The Eurogroup was not even able to come up with a joint statement. The Dutch government, in particular, was among countries vehemently disagreeing with the proposal (which will nevertheless be considered again at a European Council meeting at the end of this week).

The Dutch Finance Minister Wopke Hoekstra explained his position in a letter addressed to the Dutch parliament. “The Netherlands is committed to ensuring that an appropriate form of conditionality is observed for each instrument,” Hoekstra said, insisting the ESM should only be used “as a last resort”.

The Dutch position – which is aligned with other countries as well – is based on a narrow technical and legal understanding of the ESM’s role which is incredibly lacking in political foresight, diplomatic tact, and European leadership.

Firstly, the Dutch government’s insistence on the implementation of conditionalities over concern for moral hazard demonstrates an embarrassing lack of solidarity. The current crisis clearly stems from an exogenous factor – a virus – and not because of any fiscal profligacy. Therefore, raising concerns over a moral hazard and the need for conditionalities in the current situation is totally inappropriate and is, to some degree, quite insulting to the citizens who are suffering from a lack of resources in their national healthcare systems.

Second, Hoekstra implicitly argues that the ESM cannot be used for coping with a pandemic crisis, (or only as a last resort). We argue instead that the current situation is an opportunity to update the ESM’s role and scope to make it fit for a variety of different economic shocks, and not just extreme and hypothetical cases of government bankruptcies.

Transforming the ESM before it dies

The transformation of the ESM is not just wishful thinking. Now, more than ever, it is necessary as its initial purpose of bailing out countries is becoming increasingly redundant. Indeed, by announcing their 750bn euros Pandemic Emergency Purchase Programme (PEPP) last week, the ECB has effectively bypassed the need for an ESM programme to activate unlimited and targeted sovereign bonds purchases. By doing this the ECB has preemptively reduced the risk of any country losing market access to basically zero, thus making the ESM effectively useless.

Added to the fact that no country wants to resort to the ESM because of the humiliating stigma of having to request ESM bailout, one can clearly see that the ESM is at risk of becoming a tool that only exists in theory. Today, no country is under an ESM programme, and no country even wants to contemplate using it.

Ultimately, the idea that the ESM should remain a “last resort” tool is misguided. The Eurozone’s unpreparedness during the last crisis hugely aggravated its total cost. The medical principle that prevention is always better than a cure also applies to macroeconomic policy. The EU should consider itself lucky that today the ESM already exists, as using this tool would allow member states to regain their strength more immediately than if they had to create one from scratch.

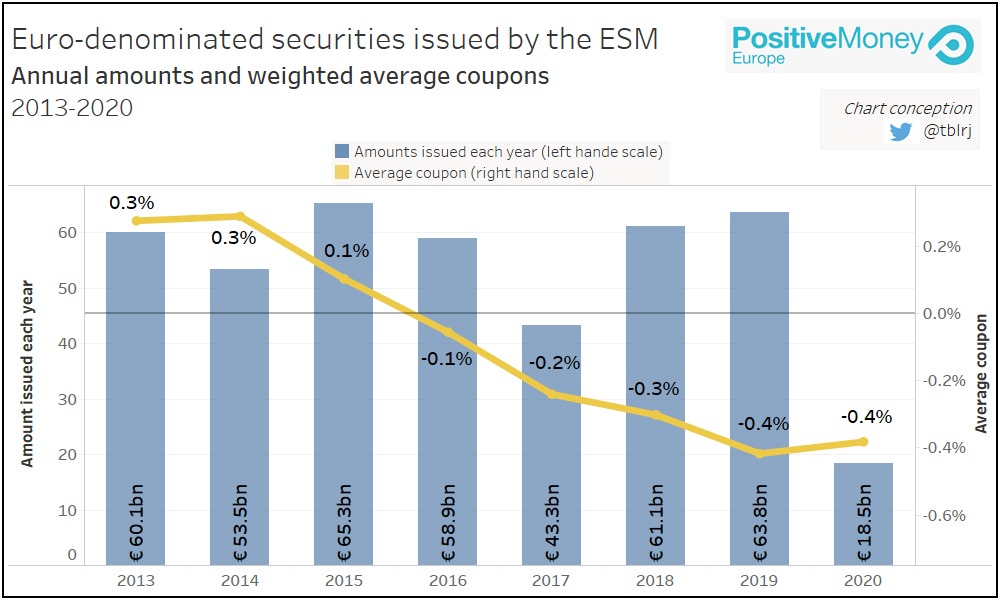

As our research shows, the ESM is able to finance itself at negative interest rates (see chart below), meaning that investors are paying to finance the ESM. This firepower will be guaranteed for a long time as the ECB is committed to purchasing up to 50% of bonds issued by supranational institutions such as the ESM or the EIB under quantitative easing and the new PEPP programme. This presents an incredible opportunity for the EU to use this potential firepower for the greater good of the EU, at no extra cost for any taxpayers.

Instead of sticking with backwards-looking reflexes, EU leaders should show leadership by seizing this opportunity and build up the EU architecture by transforming the ESM into a true solidarity mechanism for Europe.

BRAVE NEW EUROPE brings authors at the cutting edge of progressive thought together with activists and others with articles like this. If you would like to support our work and want to see more writing free of state or corporate media bias and free of charge, please donate here.