Fiat Money vs. Gold and why Elon Musk is wrong

Steve Keen is a Distinguished Research Fellow, Institute for Strategy, Resilience & Security, UCL

Cross-posted from Steve’s website Building A New Economics

I guessed that most people would think that industrialists like Ford and Edison were opposed to fiat money, and in favour of “sound money”—money backed by gold or some other commodity. As this post will show, that is a false belief. These two industrialists were outright fans of fiat money—money created by the government—and critics of both the gold standard and, to some degree, private bank-created money as well.

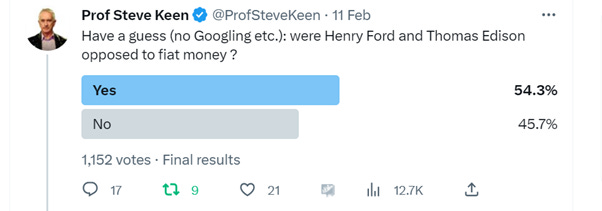

I decided to find out what the public thought that Ford and Edison would think the best way I could—via a Twitter poll.

It’s hardly a representative sample. Twitter itself is a minority of the public, and people who follow me—and therefore know that I am a proponent of “Modern Monetary Theory” (MMT)—are a much smaller minority still. Moreover, that minority is likely to be biased in favour of people who also prefer fiat money to credit money.

Having hedged my bets in advance, in an outcome that would surprise neither Ford nor Edison, the majority thought that they were opposed to fiat money:

In fact, they were great supporters of fiat money, and outright critics of the gold standard. They wanted the hydro-electric scheme at Muscle Shoals on the Tennessee River to be financed by the Government issuing $40 million in US currency, without backing that currency by either bonds or gold.

When challenged that “in a sense, there would be no security behind this kind of money,” Ford replied that:

“There would be the best security in the world. Here you have a river capable of furnishing 1,000,000 horsepower… This energy is wealth in a productive form. Now, which is the more imperishable the more secure, this power site and its development, or the several barrels of gold necessary to make $40,000,000. This site, with its power possibilities, will be here long after the Treasury Building is a ruin.”

“When the Government needs money it will raise it by issuing currency against its imperishable natural wealth.” (Ford and Edison 1921)

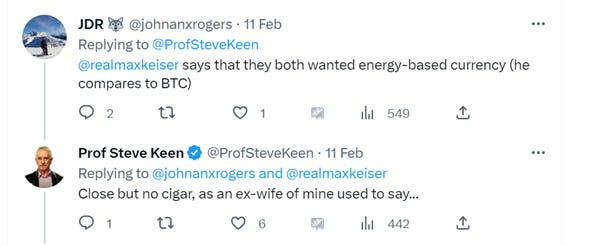

I’ve been informed that Max Keiser thought Ford and Edison were in favour of energy-based currency, and therefore that they’d support Bitcoin:

My reply shows my scepticism. Firstly, Bitcoin uses—and therefore “perishes”—energy, whereas Ford referred to fiat money being backed by the country’s “imperishable natural wealth”—energy and other resources that are still in the ground. Edison made a similar comment—that paper money is based on “Humanity and the soil”:

“What are bills and checks? Mere promises and orders. What are they based on? Principally on two sources—human energy and the productive earth. Humanity and the soil—they are the only real basis of money.”

Secondly, rather than talking about money being backed by some other specific commodity—whether energy or gold—what Ford and Edison were arguing was that a national currency is backed by the non-financial assets of that country: its physical wealth, manifest in its raw materials and its infrastructure, were what gave authority to the financial assets it issued.

Edison even described the use of a fiat currency—a paper currency (in his day), backed only by the power of the Government—as the mark of a civilised society:

“Now, as to paper money, so-called, everyone knows that paper money is the money of civilized people. The higher you go in civilization the less actual money you see. It is all bills and checks.”

When Edison was asked “would not Mr. Ford’s suggestion that Muscle Shoals be financed by a currency issue raise some objection?”, he replied:

“Certainly. There is a complete set of misleading slogans kept on hand for just such outbreaks of common sense among the people. The people are so ignorant of what they think are the intricacies of the money system that they are easily impressed by big words. There would be new shrieks of ‘fiat money’, and ‘paper money’, and ‘greenbackism’, and all the rest of it—the same old cries with which the people have been shouted down from the beginning.” (Ford and Edison 1921)

Those misleading slogans are alive and well today, as evidenced by our modern-day Henry Ford, Elon Musk:

And gold bugs like Peter Schiff:

And cryptocurrency enthusiasts like Max Keiser:

Ford and Edison would have none of that. They echoed Keynes’s description of the gold standard as a “barbarous relic”, and both wanted it abolished. Ford’s opposition to gold has tinges of his anti-semitism to it, in that he saw it as being controlled by bankers who then promoted war to make their control lucrative:

Gold as a metal is all right … But … through its scarcity It has acquired a fictitious value far beyond its value as a useful metal… The people of the world made a mistake which has cost them generations of financial slavery when they consented to making gold a basis for the issuance of currency… because gold is scarce … its total supply can be controlled… There is a group of international bankers who today control the bulk of the world’s gold supply…”

Edison concurred with Ford in being against the gold standard, and sounded just like David Graeber in his analysis:

“Gold is not money until the people of the United States and other nations put their stamp on it. It is not gold that makes the dollar. It is the dollar that makes the gold. Take the dollar out of the gold, and leave it merely [as] yellow metal, and it sinks in value. Gold is established by law. Just as silver was, and gold could be disestablished, demonetized by law, just as silver was. When silver was demonetized the former so-called silver dollar became worth about 50 cents.”

Edison also sounded very much like Stephanie Kelton in The Deficit Myth (Kelton 2020) when he described dollar bills and government bonds as just different forms of government money:

“Then you see no difference between currency and Government bonds?”, Mr Edison was asked.

“Yes, there is a difference, but it is neither the likeness nor the difference that will determine the matter: the attack will be directed against thinking of bonds and currency together and comparing them. If people ever get to thinking of bonds and bills at the same time, the game is up.”

He also made the MMT point that a fiat currency is backed by the authority of the Government which issues it:

“Look at it another way. If the Government issues bonds, the brokers will sell them. The bonds will be negotiable: they will be considered as gilt-edged paper. Why? Because the Government is behind them, but who is behind the Government? The people. Therefore, it is the people who constitute the basis of Government credit. Why then cannot the people have the benefit of their own gilt-edged credit by receiving non-interest bearing currency on Muscle Shoals, instead of the bankers receiving the benefit of the people’s credit in interest-bearing bonds?”

Unfortunately, Ford and Edison’s wisdom here didn’t change people’s minds a century ago, and a century later, we’re still having the same pointless debates. Given their cynicism about the capacity of the public to understand complex issues, I doubt that Ford and Edison would be surprised that the view they championed was still the minority view today. Ford is alleged to have said “It is well enough that people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning”. What he definitely did say, in a ghost-written autobiography, was that:

“The people are on the side of sound money. They are so unalterably on the side of sound money that it is a serious question how they would regard the system under which they live, if they once knew what the initiated can do with it.” (Ford, Crowther et al. 2013, p. 163)

In my next post, I’ll go back to first principles to show that Edison and Ford were right about money and government debt, and Elon Musk is wrong.

Thanks to many generous donors BRAVE NEW EUROPE will be able to continue its work for the rest of 2023 in a reduced form. What we need is a long term solution. So please consider making a monthly recurring donation. It need not be a vast amount as it accumulates in the course of the year. To donate please go to HERE

Be the first to comment