Evidence sharply contradicts PhRMA’s contention that its member companies need unregulated drug prices to generate profits that they then reinvest in drug innovation. This is a long read that goes on to question the practice of share buybacks and other short-term ways of creating “shareholder value”

William Lazonick is Professor Emeritus of Economics at University of Massachusetts and Öner Tulum is a Postdoctoral Research Associate at SOAS University of London

Cross-posted from Institute for New Economic Thinking

On August 16, 2022, the US Congress passed the Inflation Reduction Act, which, among other things, enables Medicare to negotiate the prices of certain high-cost prescription drugs, beginning in 2026.[1] Even though it is just one step forward in confronting US pharma’s financialized business model, this legislation was a long time coming.[2] A New York Times article published almost four decades ago reported accusations against pharmaceutical companies by then-US Rep. Henry Waxman (D-CA) of “outrageous price increases” and “greed on a massive scale.” In response to Waxman, drug-company executives asserted that “prices have climbed recently to cover accelerated investment in researching and developing new and better medications to protect Americans.”[3]

Over the decades, the argument that pharmaceutical companies need high drug prices to finance drug innovation has been a mainstay of the industry’s opposition to price regulation. Not surprisingly, with Medicare’s right to negotiate prescription drug prices as a key policy objective of the Biden administration’s Build Back Better agenda, the industry lobby association, Pharmaceutical Research and Manufacturers of America (PhRMA), spewed out a slew of blog posts, with data from commissioned “studies,” to argue that government regulation of drug prices would deprive its member companies of the profits needed to augment and accelerate investment in drug innovation.[4]

Included in PhRMA’s lobbying effort was a letter dated August 4, 2022, signed by PhRMA president Stephen Ubl and 31 senior pharmaceutical company executives (mostly CEOs) on PhRMA’s board of directors, in which they sounded the alarm on drug-price regulation under the Inflation Reduction Act:

While the bill saves the federal government $300 billion, it takes far more from the biopharmaceutical industry and will have significant consequences for innovation and patients’ hope for the future. Some economists estimate upwards of 100 new treatments may be sacrificed over the next two decades if this bill becomes law. This includes treatments for multiple chronic conditions, the annual $2.7 trillion medical and lost productivity costs of which far exceed the direct federal “savings” this bill would achieve.[5]

How US pharmaceutical companies actually allocate their profits

Underpinning PhRMA’s argument of the devastating impact of price regulation on drug innovation and patient access to medicines is the assumption that pharmaceutical companies systematically reinvest corporate profits in productive capabilities that improve the development, manufacture, and delivery of drugs. The corporate executives who signed the PhRMA letter contend that price regulation will reduce profits and stifle drug innovation. Negating this assumption, however, is abundant—and indeed overwhelming—evidence that most of these pharmaceutical executives allocate corporate profits to massive distributions to shareholders in the form of cash dividends and stock buybacks.[6] Rather than devoting the high profits from high drug prices to augmenting and accelerating investment in drug innovation, US pharmaceutical companies burden US patients and taxpayers with high drug prices so that, through massive distributions to shareholders, the senior executives who make these allocation decisions can boost the yields on the companies’ publicly traded shares.

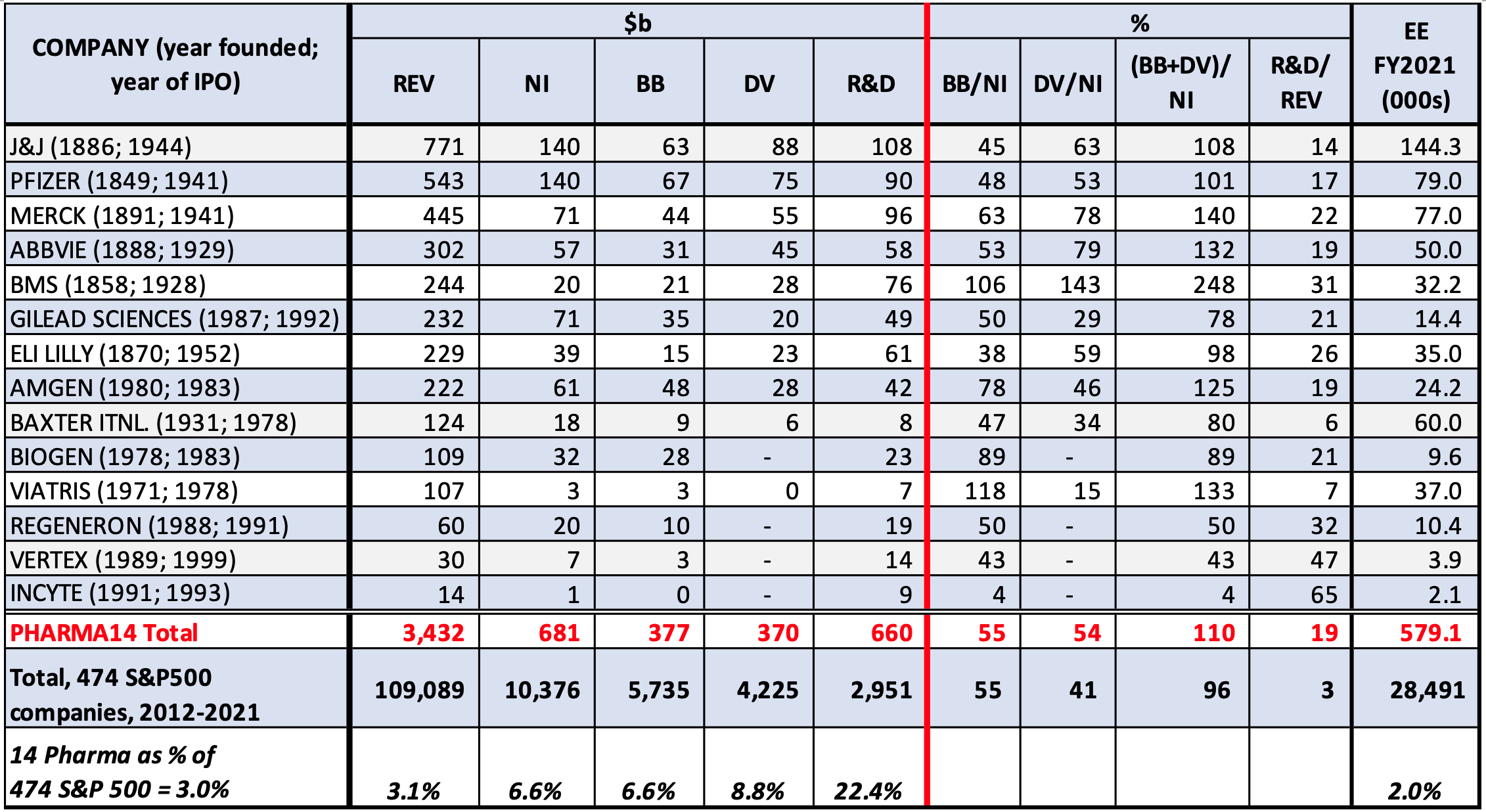

Data for the 474 corporations included in the S&P 500 Index in January 2022 and publicly traded from 2012 through 2021 reveal that these corporations distributed $5.7 trillion as share repurchases during the 2012-2021 fiscal years, representing 55 percent of net income, and $4.2 trillion as dividends, an additional 41 percent of net income (see Table 1). The vast majority (we estimate about 95 percent of the total) of the share repurchases were done as open-market repurchases (OMRs) of common shares, the purpose of which is to manipulate the company’s stock price.

Table 1. Financial data, 2012-2021, and 2021 employment for 474 corporations, including 14 pharmaceutical companies, in the S&P 500 Index in January 2022 that were publicly listed 2012-2021 (year founded; year of IPO for each pharmaceutical company)

Notes: IPO=initial public offering, REV=revenues, NI=net income, BB=stock buybacks, DV=dividends, R&D=research & development expenditures, EE=end-of-fiscal-year employment (in thousands). J&J is Johnson & Johnson; BMS is Bristol Myers Squibb; Baxter Intl is Baxter International. The founding and IPO years listed for Abbvie are those of its predecessor company Abbott Laboratories; for BMS, for the founding of Squibb and the IPO of Bristol-Myers; and for Viatris, for its predecessor company Mylan. Sources: Calculations from data in the S&P Compustat database and company 10-K reports

As shown in Table 1, for the decade 2012-2021, distributions to shareholders by the 14 pharmaceutical companies that were among the 474 S&P 500 companies in the database represented 110 percent of net income,[7] a larger proportion than the highly financialized 96 percent for all 474 companies. At 55 percent, the stock buybacks of the subset of pharmaceutical companies was the same proportion of net income as the 474 companies, but, at 54 percent versus 41 percent, pharmaceutical dividends as a proportion of net income far exceeded that of all the companies in the dataset. The 14 pharmaceutical companies accounted for 3.1 percent of the revenues of all 474 companies but 6.6 percent of the net income, 6.6 percent of the buybacks, and 8.8 percent of the dividends. The $747 billion that the pharmaceutical companies distributed to shareholders was 13 percent greater than the $660 billion that these corporations expended on research & development over the decade.

Note that, employing an analytical distinction that Lazonick elaborates in detail in his 2009 book, Sustainable Prosperity in the New Economy?,[8] among the 14 pharmaceutical companies in Table 1, seven—J&J, Pfizer, Merck, Abbvie, BMS, Lilly, and Baxter—have their historical roots in the “Old Economy” business model (OEBM) that dominated the US pharmaceutical industry coming into the 1980s, while the other seven—Gilead, Amgen, Biogen, Viatris, Regeneron, Vertex, and Incyte—all of which were founded in 1971 or later, have emerged and grown on the basis of the “New Economy” business model (NEBM). Under OEBM, the most successful companies, now known as “Big Pharma,” integrated the development, manufacture, and delivery of drugs and provided their employees with the expectation of a career with one company, manifested by decades of service with the company, company-funded nonportable defined-benefit pensions, and company-subsidized healthcare coverage in employment and retirement. Under NEBM, associated with the biotech revolution, companies specialize in drug development, typically outsourcing manufacturing to contract development and manufacturing organizations (CDMOs), and depend on a scientific labor force that is highly mobile from company to company and even across nations, with pensions in the form of portable defined-contribution 401(k) plans.

Of critical importance in the rise of NEBM have been the changing functions of the stock market. Under OEBM, as it existed in pharmaceuticals prior to the 1980s, the role of the stock market was to separate share ownership from managerial control. Precipitating this separation was not, as is commonly assumed, the need for these companies to raise cash from the stock market to fund their growth. Rather the function of public share issues was to enable the owner-entrepreneurs and their family members who had led the successful growth of their firms to monetize their investments, passing on strategic control of the companies to professional managers in what the business historian Alfred D. Chandler, Jr. called “the managerial revolution in American business.”[9]

Given the decades-long time lags between the years in which the OEBM companies in Table 1 were founded and the years in which they did their initial public offerings (IPOs), these companies were already highly profitable when they listed on the stock market—in each case the New York Stock Exchange (NYSE). These corporations did not rely on the stock market to issue treasury shares for cash to invest in the growth of the firm. Rather their source of investment finance for internal growth was earnings retained earnings out of profits, leveraged (if necessary) by bond issues, while striving to pay a steady dividend to shareholders.

With the rise of NEBM from the 1970s, an IPO continued to play a “control” function, enabling venture capitalists and owner-entrepreneurs to cash in their founder shares. In many cases, in the context of an IPO, professional managers assumed strategic control. With the very short time lags between the founding of a company and its IPO, however, as can be seen for the cases of the seven NEBM companies in Table 1, owner-entrepreneurs have often continued to exercise managerial control for a time after the IPO. The rapid transition from founding to IPO has been made possible by the existence of NASDAQ, the automated quotation system for “over-the-counter” stocks established in 1971. By enabling startups to go public without a profit or even a product, a NASDAQ IPO has provided venture capitalists with a quick “exit strategy” that was not possible on NYSE, with its stringent listing requirements. Thus, in the presence of the highly speculative NASDAQ, the stock market began to perform a “creation” function, inducing venture capital to invest in uncertain new firms because of the possibility of a relatively rapid exit from these investments via an IPO. Indeed, all seven firms identified as NEBM in Table 1 are listed on NASDAQ.

With the rise and expansion of NEBM in information-and-communication-technology (ICT) and biotechnology in the 1980s and 1990s, the stock market also began performing “combination” and “compensation” functions. A small company could grow large by using its stock as a combination currency in lieu of cash to acquire other companies.[10] In addition, and of profound importance, a startup company, which, given its uncertain future, could not hold out the expectation to employees of an OEBM-style career with one company, could use its stock as a compensation currency, typically in the form of stock options, to attract, retain, motivate, and reward a broad base of employees. During the 1980s and 1990s, with NASDAQ generally booming, the use of stock options by New Economy biopharma startups to lure scientific and managerial personnel from secure employment with established Old Economy companies eroded the organizational capabilities of Big Pharma’s corporate research labs, eventually compelling these Old Economy companies to use stock-based pay to compete with New Economy companies for personnel.

As already stated, prior to the 1980s Old Economy pharmaceutical companies did not make significant use of the stock market to raise cash for investment in the growth of the firm. Nor did they do significant amounts of share repurchases, which can be viewed as the “negative cash” function of the stock market. That changed from the mid-1980s as Big Pharma companies sought to compete for acquisitions and personnel using their stock as a currency, with stock buybacks as a tool for giving manipulative boosts to their own companies’ stock prices. Enabling large-scale stock buybacks as OMRs, which at Big Pharma companies were in addition to a steady stream of dividends, was Securities and Exchange Commission (SEC) Rule 10b-18, adopted in November 1982, which is aptly called “a license to loot” the corporate treasury.[11] Legitimizing this use of corporate cash from the late 1980s was the flawed ideology emanating from US business schools and board rooms that, for the sake of economic efficiency, a business corporation should be run to “maximize shareholder value.”[12]

Meanwhile, from the beginning of the 1980s New Economy biopharma startups found that, even without products or profits, they could raise substantial amounts of cash for internal investment through their IPOs and subsequent secondary stock issues on NASDAQ, as long as this highly speculative stock market was booming, and hence liquid, so that stock traders who absorbed these new share issues could look for the opportunity to sell their shares for a capital gain. As indicated in Table 1, however, once some of these New Economy biopharma companies generated profitable drugs, they also turned to stock buybacks as OMRs to give manipulative boosts to their stock prices.

Although President Joe Biden and Senate Majority leader Chuck Schumer, along with many elected Congressional Democrats, have been sharp critics of stock buybacks,[13] in 2021 a record $882 billion in share repurchases by companies in the S&P 500 Index easily outstripped the previous annual high—fueled by the Republican 2017 corporate tax cuts—of $806 billion in 2018.[14] In the first quarter of 2022, S&P 500 buybacks set an all-time record of over $260 billion, and, with second-quarter buybacks at $240 billion,[15] the 2022 total could surpass the obscene stock-market manipulations of 2021.

Senior executives pad their take-home pay by doing massive distributions to shareholders

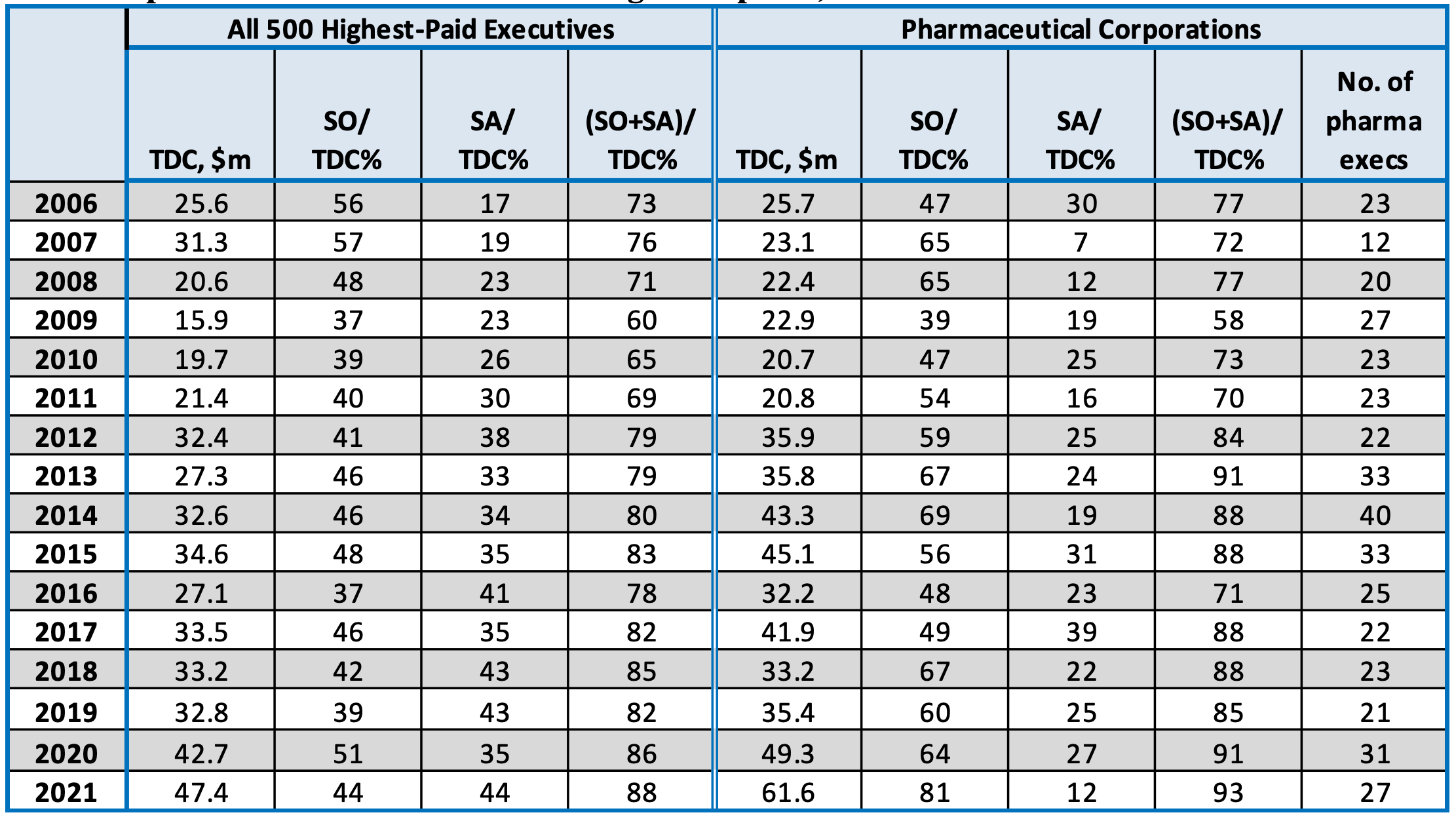

These data on distributions to shareholders sharply contradict PhRMA’s contention that its member companies need unregulated drug prices to generate profits that they then reinvest in drug innovation. At the same time, significant beneficiaries of these distributions to shareholders have been the very same senior executives who control the pharmaceutical companies’ resource-allocation decisions. Table 2 displays data on the compensation of the 500 highest-paid executives in the United States for each year from 2006 through 2021 and the subset of pharmaceutical executives among these 500 highest-paid.

Table 2. 500 highest-paid executives in each year, US corporations, with proportions of mean total direct compensation from stock options and stock awards, and representation of pharmaceutical executives among the top 500, 2006-2021

Notes: TDC=total direct compensation, SO=stock options, SA=stock awards Source: S&P ExecuComp database

From 2006 through 2021, the average total direct compensation (TDC) of the 500 highest-paid executives ranged from, with the stock market depressed, a low of $15.9 million in 2009, of which 60 percent were realized gains from stock-based pay, to, with the stock market booming, a high of $47.4 million in 2021, of which 88 percent were realized gains from stock-based pay.[16] In most years, the average TDC of the pharmaceutical executives was higher than for all 500 executives.

Distributions to shareholders in the form of dividends and buybacks inflate executives’ realized gains on stock-based pay. In the case of stock buybacks, not even the Securities and Exchange Commission (SEC), which purportedly regulates US financial markets, knows the precise days on which buybacks as OMRs are executed.[17] But the CEO and CFO of the repurchasing corporation possess this material insider information, and, moreover, they decide when to execute buybacks. Even with SEC Rule 10b5-1, adopted in 2000 to give corporate executives a safe harbor against insider-trading charges in stock sales by doing them according to a pre-announced plan, top executives can time their option exercises and stock sales to increase their pay.[18] OMRs will result in stock-price increases that can, if the senior executives correctly time their stock sales, augment their stock-based pay. The executives’ strategic control over resource-allocation decisions and insider information about the timing of buybacks can contribute to the gains that these executives realize in exercising stock options and the vesting of stock awards.[19]

The extraordinarily high TDC and percentages of it that were stock based in 2014 and 2015 were largely the result of the bonanza reaped by a number of executives at Gilead Sciences through the impacts on the company’s stock price of its soaring sales of the high-priced Sovaldi/Harvoni hepatitis-C drugs combined with its use of its inflated profits to do stock buybacks.[20] Also, when the average pay of the top 500 executives exploded to new heights in 2020 and 2021, the pay of the subset of pharmaceutical executives took off even more. As the pandemic raged, the average TDC of 27 pharmaceutical executives among the top 500 rose to an unprecedented $61.6 million, with 93 percent of it coming from realized gains on stock-based pay, the highest proportion since data on realized gains on stock awards as well as stock options became available in 2006.[21]

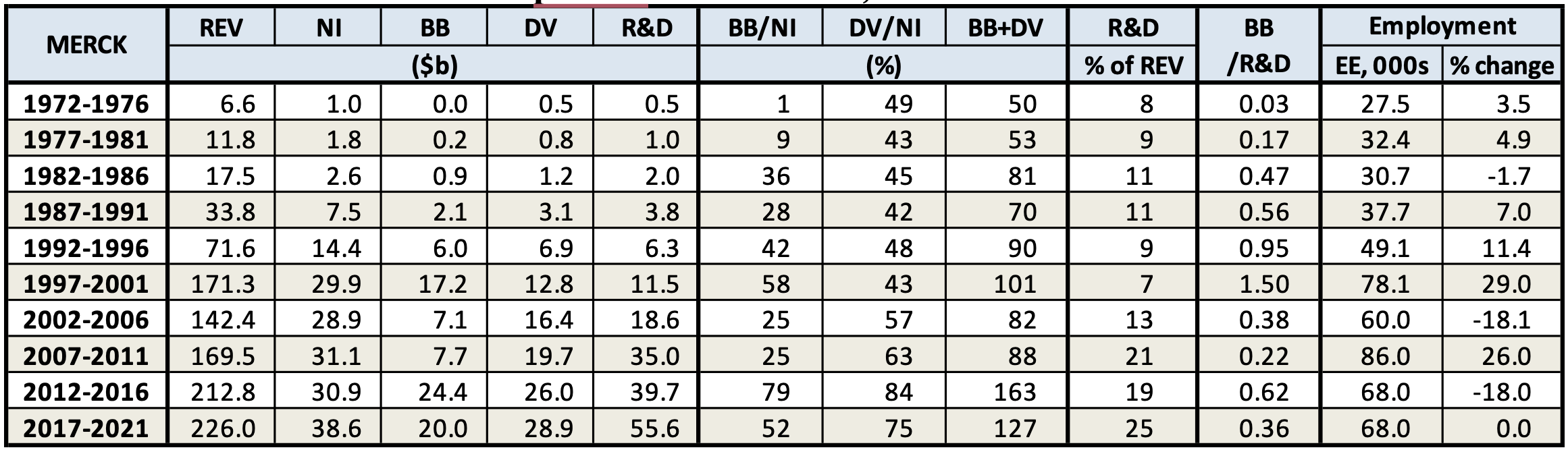

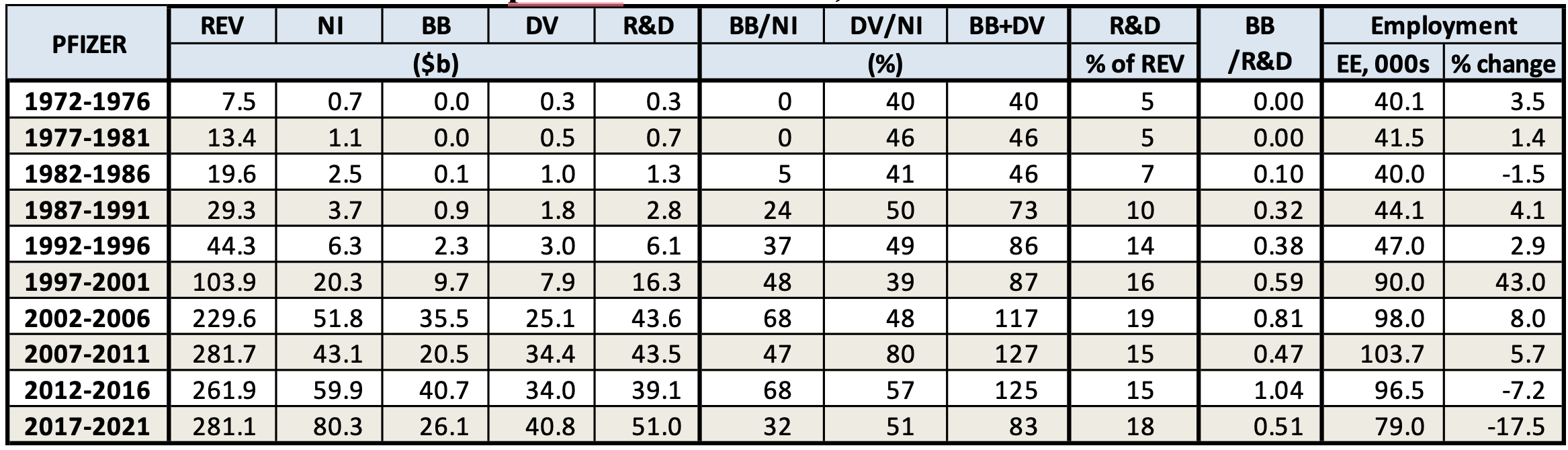

Tables 3a and 3b show distributions to shareholders by Merck and Pfizer, two US-based Big Pharma companies that for decades have been among the most financialized of all US corporations. Merck began doing large-scale buybacks in the second half of the 1980s, and Pfizer in the first half of the 1990s. Merck greatly increased its buybacks in the late 1990s and Pfizer even more so in the early 2000s. Over the 25-year period 1995-2019, Merck distributed an amount equal to 118 percent of net income to shareholders, with 54 percent as buybacks, while Pfizer paid out 114 percent of net income, with 58 percent as buybacks. As discussed below, Pfizer ceased doing buybacks from August 2019 through February 2022, while its net income soared in 2021 on profits from its Covid-19 medicines. As a result, its buybacks as a proportion of net income fell to 32 percent in 2017-2021, while Merck’s proportion was 52 percent.

Table 3a. Merck’s distributions to shareholders as stock buybacks and cash dividends, in billions of current dollars and as percent of net income, 1972-2021

Table 3b. Pfizer’s distributions to shareholders as stock buybacks and cash dividends, in billions of current dollars and as percent of net income, 1972-2021

Notes: REV=revenues, NI=net income, BB=stock buybacks, DV=dividends, R&D=research & development expenditures, EE=end-of-fiscal-year employment for last year in cell, %change=change in employment over the five-year period. Sources: Calculations from data in the S&P Compustat database and company 10-K reports.

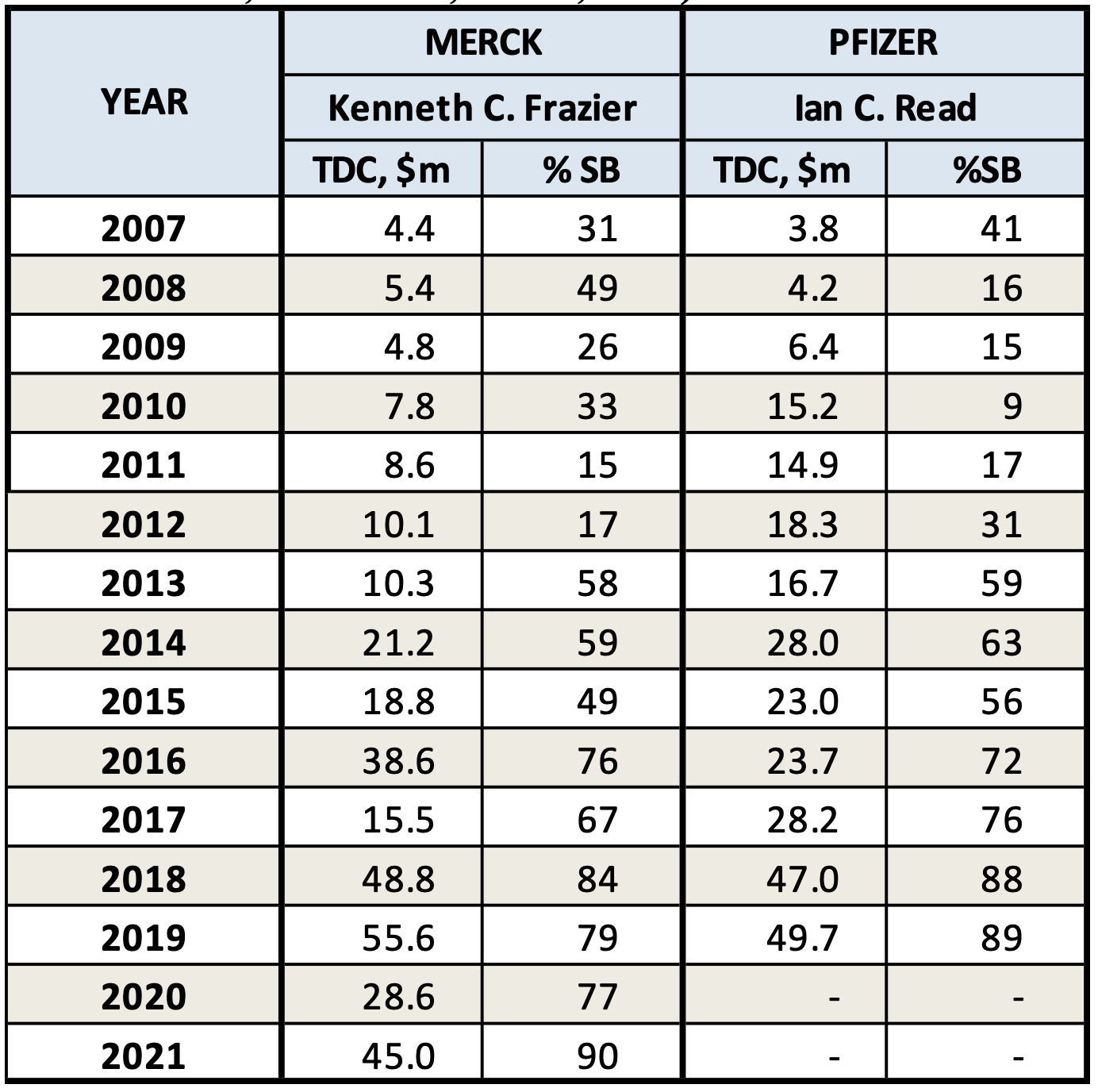

Table 4 shows the TDC for 2007-2021 of Kenneth Frazier, who was CEO of Merck from January 1, 2011, to June 30, 2021. Over the years of his CEO tenure, Frazier averaged $27.4 million per year in TDC, of which 72 percent was stock based. As also shown in Table 4, Ian Read was Pfizer CEO from December 5, 2010, to January 1, 2019. Over his tenure as CEO from 2011 through 2018, Read averaged $30.2 million per year in TDC, of which 64 percent was stock based. In addition, Read stayed on as Pfizer executive chairman in 2019, pocketing another $49.7 million (89 percent stock based) on his way to retirement.

Table 4. Total direct compensation (TDC) and percentage stock-based (%SB) 2007-2021, Kenneth Frazier (Merck CEO, 2011-2021) and Ian Read (Pfizer CEO, 2011-2018; Chair, 2019)[22]

Sources: S&P ExecuComp database and company proxy statements

The explosion of pay of “New Economy” biopharma executives

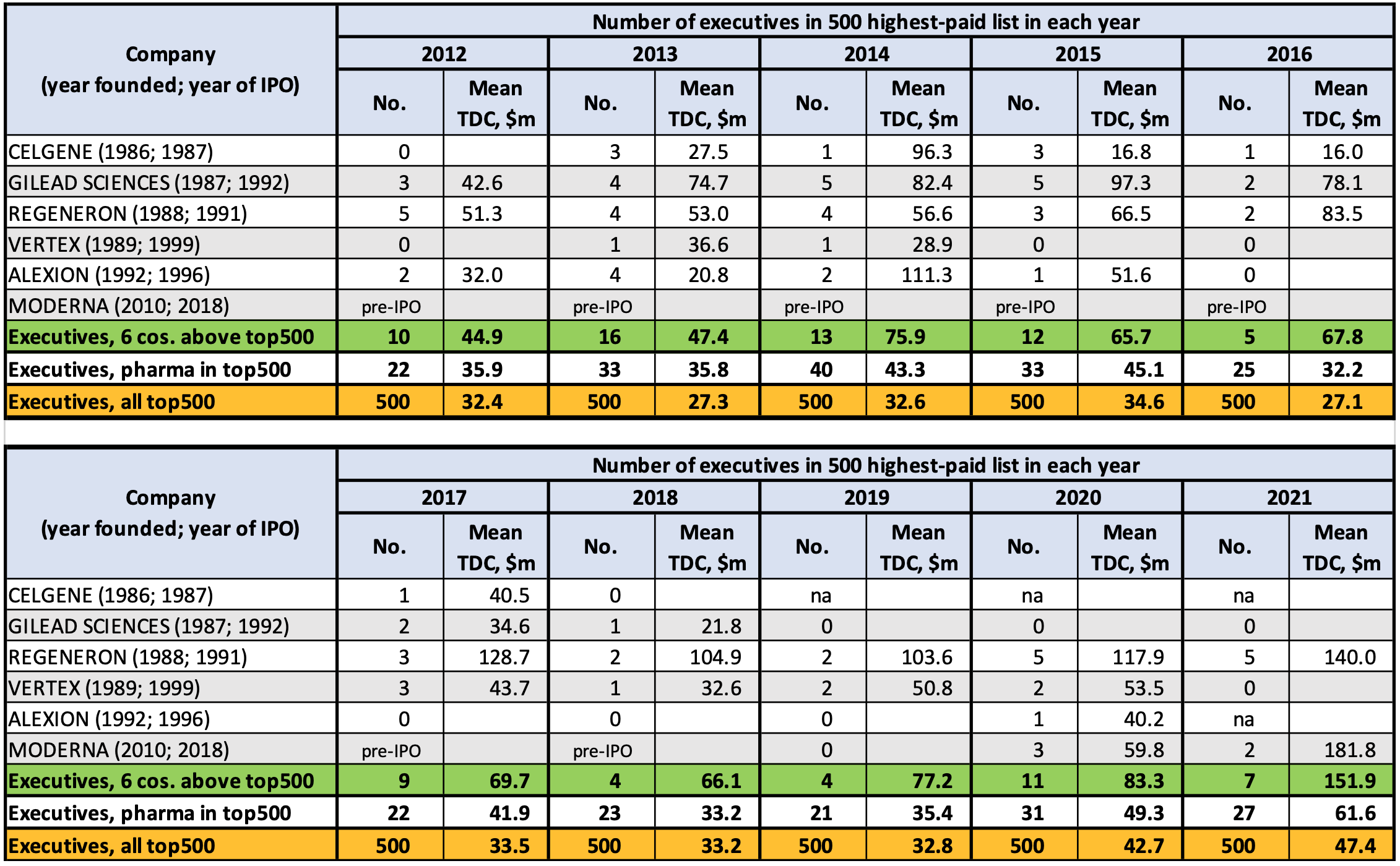

As displayed in Table 5, the top executives of younger “New Economy” companies such as Regeneron and Vertex, and most recently Moderna, have provided these enormous pay packages, partly supported by stock buybacks as OMRs. Their bonanzas are mainly the results of soaring stock prices, driven by a combination of innovation and speculation, and the abundant amounts of stock-based pay that their boards (of which they are often members) have lavished on these executives.[23] In the case of Regeneron, Schleifer and Yancopoulos are founders and board members as well as CEO and CSO, respectively, and their enormous TDC included in the data in Table 5 does not include their sales of founder shares. Nor does it include the fortunes made from founder shares by Moderna chairman Noubar Afeyan and CEO Stéphane Bancel.

Table 5 shows the data for six New Economy biopharma companies that in one or more years from 2012 through 2021 had one or more executives among the annual lists of 500 highest-paid US executives. In every year, the average TDC of the New Economy biopharma executives in the top 500 is far higher than the average TDC for all pharmaceutical executives and (except for 2018) even more so than for all top500 executives.

Table 5. Total direct compensation of leading New Economy biopharma companies with one or more executives in one or more annual list of highest-paid US corporate executives, 2012-2021

Notes: Celgene was acquired by Bristol Meyers Squibb in 2019; Alexion was acquired by AstraZeneca in 2021; Moderna did its IPO on December 6, 2018. Sources: S&P ExecuComp database and company proxy statements

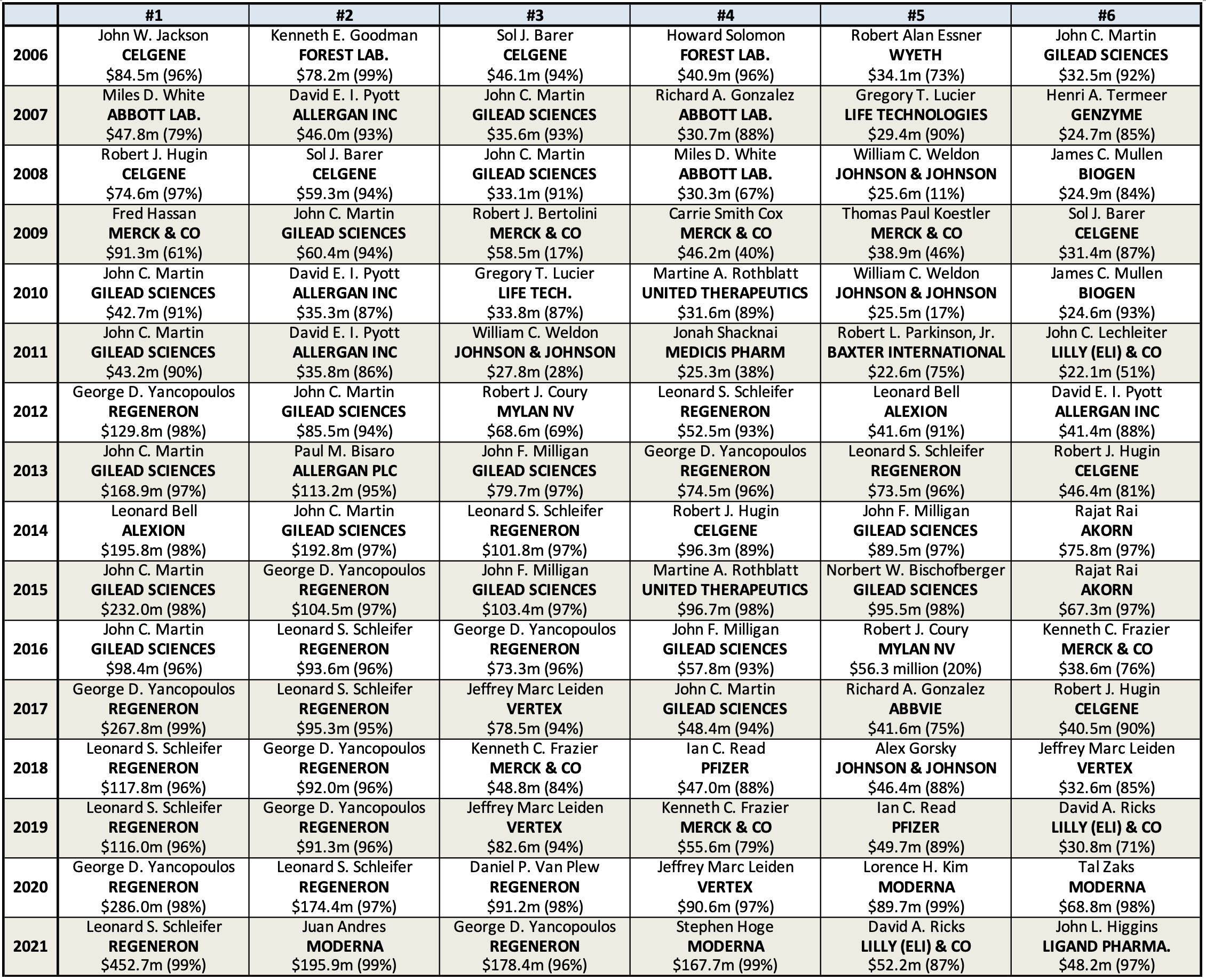

Table 6, which selects from all pharmaceutical executives in the S&P ExecuComp database (and not just from those companies in the S&P 500 Index), identifies the six highest-paid pharmaceutical executives for each year from 2006 through 2021. Note the prominence of executives from three of the New Economy biopharma companies in Table 5: Regeneron (19 of 96 cells, all during 2012-2021), Gilead Sciences (17 of 96 cells), and Celgene (8 of 96 cells). Also note the extent to which their pay is stock-based. Of the 96 cells in Table 6, the pay levels in 88 cells are 60 percent or more stock based, with 61 cells 90 percent or more, 17 between 80 and 90 percent, seven between 70 and 80 percent, and three between 60 and 70 percent.

Table 6. Six highest-paid pharmaceutical executives, 2006-2021, with total direct compensation (TDC) in millions of dollars (stock-based pay as percent of TDC)

Notes: Abbvie is a 2013 spinoff from Abbott Laboratories; Life Technologies was created by the merger of Invitrogen and Applied Biosystem in 2008, with Gregory T. Lucier as the CEO of both Invitrogen and, then, Life Technologies. Source: S&P ExecuComp database and company proxy statements

Of the highest-paid executives, founders of the companies include Leonard Schleifer and George Yancopoulos, Regeneron (founded in 1988; IPO in 1991); Leonard Bell, Alexion (1992; 1996); Martine Rothblatt, United Therapeutics (1996; 1999); Sol Barer, Celgene (1986; 1987); and Jonah Shacknai, Medicis Pharmaceutical (1988; 1990). As indicated, all these companies went public within a few years after their founding, a phenomenon encouraged by the creation of the highly speculative NASDAQ stock exchange in 1971 and its subsequent growth. The compensation of these individuals shown in Table 6 is as executive employees of the companies and does not include personal income received by selling founder shares.

A ten-time “medalist” in the highest-paid rankings is Gilead’s John C. Martin, who was the company’s CEO from 1996 to 2016 and executive chairman from 2016 to 2018. He appears on the top-six list in each of the first 12 years, 2006-2017, including five times in first place, three times in second, and twice in third. His average annual TDC of $197.9 million in 2013-2015 was more than double the $85.5 million he took home in 2012 and the $98.4 million in 2016. Propelling Martin’s megapay in 2013-2015 were surges of Gilead’s profits and stock price, based on massive revenues from its price-gouged Sovaldi/Harvoni drugs, aided by $15.3 billion in buybacks in 2014-2015 and Gilead’s first dividend ($1.9 billion) in 2015. From 2012 to 2015, Gilead’s revenues increased by 3.4 times, its profits by 7.0 times, and its stock price by 4.4 times (July 2012 to its all-time peak in 2015). In 2016, Gilead distributed $11.0 billion in buybacks and $2.5 billion in dividends—a combined 99.7 percent of net income—but its profits declined from $18.1 billion to $13.5 billion, and its stock price declined from $118 (July 2015) to $72 (December 2016). As a result, CEO Martin’s 2016 compensation fell to $98.4 million—a sum which nevertheless placed him at the top of the pharma executive-pay podium for that year.

The established “Old Economy” companies known as Big Pharma, including Wyeth (founded 1860; IPO in 1926), Abbott (1888: 1929), Johnson & Johnson (1886: 1944), and Merck (1891: 1941), were better represented among the top six in the earlier years, including four from Merck in 2009. Both 2018 and 2019 were bountiful years for Big Pharma executives, with Merck’s Frazier and Pfizer’s Read at, respectively, #3 and #4 in 2018 and #4 and #5 in 2019. Johnson & Johnson CEO Alex Gorsky was #5 in 2018, and Lilly CEO David Ricks #6 in 2019.

In 2020 and 2021, Regeneron’s Yancopoulos and Schleifer took turns at #1, with three Regeneron executives holding the top three positions in 2020. Looking back a decade to 2012, Yancopoulos was #1 and #2 three times each, #3 twice, and #4 once, while Schleifer was also #1 and #2 three times each as well as #3, #4 and #5 once each. Moderna’s massive stock-price explosion (see the discussion below), based on its involvement in the development, manufacture, and delivery of the Covid-19 vaccine, enabled two of its executives to enter the top six in 2020, and then two different executives in 2021. Not in the top six in 2020 or 2021 were Moderna’s Afeyan and Bancel, both of whom took home vast fortunes by selling founders’ shares at high stock prices.[24]

The mRNA Covid-19 bonanzas of Pfizer and Moderna

The Academic-Industry Research Network is currently engaged in an in-depth assessment of the tension between innovation and financialization at those pharmaceutical companies that participated in the development, manufacture, and delivery of the Covid-19 vaccines which received emergency use authorization (EUA) in the United States, United Kingdom, and the European Union.[25] With the riches garnered from Covid-19 medicines overspilling their corporate coffers, let us take a peek at how Pfizer and Moderna have managed the innovation-financialization tension during the pandemic.

The case of Pfizer clearly illustrates that, even within a business corporation that has become one of the leading repurchasers of its own stock, there is an ongoing tension between innovation and financialization, with specific sets of circumstances determining the outcome.[26] A highly financialized corporation from the late 1980s, Pfizer in early 2019 committed to doing $8.9 billion in buybacks, of which $6.8 billion was in the form of an “accelerated share repurchase” to be completed by August 1 of that year.[27] Thereafter, the company ceased doing buybacks as it turned its strategic attention to conserving a portion of its profits to finance investment in its drug pipeline. Previously, Pfizer’s strategy had been to acquire other companies with lucrative drugs on the market that had years of patent life left and to extract the profits from these drugs to fund its distributions to shareholders. By 2019, however, with Big Pharma acquisition targets disappearing and the patents on some of Pfizer’s major drugs expiring, its board recognized that Pfizer itself could be taken over by another Big Pharma company unless it could build a pipeline of internally developed drugs.

For the sake of internal drug development, Pfizer refrained from doing buybacks from August 2019 through February 2022. Indeed, in an almost unheard of move among US corporations, in January 2020 Pfizer publicly announced its commitment to forego buybacks that year, and it did so again in January 2021. The company did, however, increase its dividend in 2019, 2020, 2021 and the first nine months of 2022.

The implementation of the change in Pfizer’s investment strategy followed the end of Ian Read’s tenure as Pfizer CEO as of January 1, 2019, in favor of current CEO Albert Bourla. As CEO from 2011, Read had engaged in a resource-allocation strategy of “downsize-and-distribute”: Pfizer downsized its labor force and distributed corporate cash to shareholders.[28] In an earnings call with stock-market analysts in January 2020, Bourla made an extraordinary admission of the company’s financialized past, declaring that Pfizer had stopped doing buybacks so that the company could invest in innovation:

The reason why in our capital allocation, we are allocating right now money [is] to increase the dividend and also to invest in our business…all the CapEx to modernize our facilities. The reason why we don’t do right now share repurchases, it is because we want to make sure that we maintain very strong firepower to invest in the business. The past was a very different Pfizer. The past of the last decade had to deal with declining of revenues, constant declining of revenues. And we had to do what we had to do even if that was financial engineering, purchasing back ourselves. We couldn’t invest them and create higher value. Now it’s a very different situation. We are a very different company.[29]

Bourla did not explain why the “old” Pfizer—which, less than 12 months before, had done $8.9 billion in buybacks—“had to do what we had to do even if that was financial engineering, purchasing back ourselves.” But his rambling statement is a very rare recognition by a CEO of a major US corporation that stock buybacks are the enemy of investment in innovation.[30]

Shortly thereafter, SARS-CoV-2 was declared a pandemic, and Pfizer found itself in what turned out to be a very lucrative partnership with the German firm, BioNTech, to develop, manufacture, and deliver a Covid-19 mRNA vaccine. Even though Pfizer’s revenues almost doubled from $41.9 billion in 2020 to $81.3 billion in 2021, with profits soaring from $9.6 billion to $22.0 billion, the company refrained from doing buybacks, while the dividend payout ratio declined from 88 percent to 40 percent.

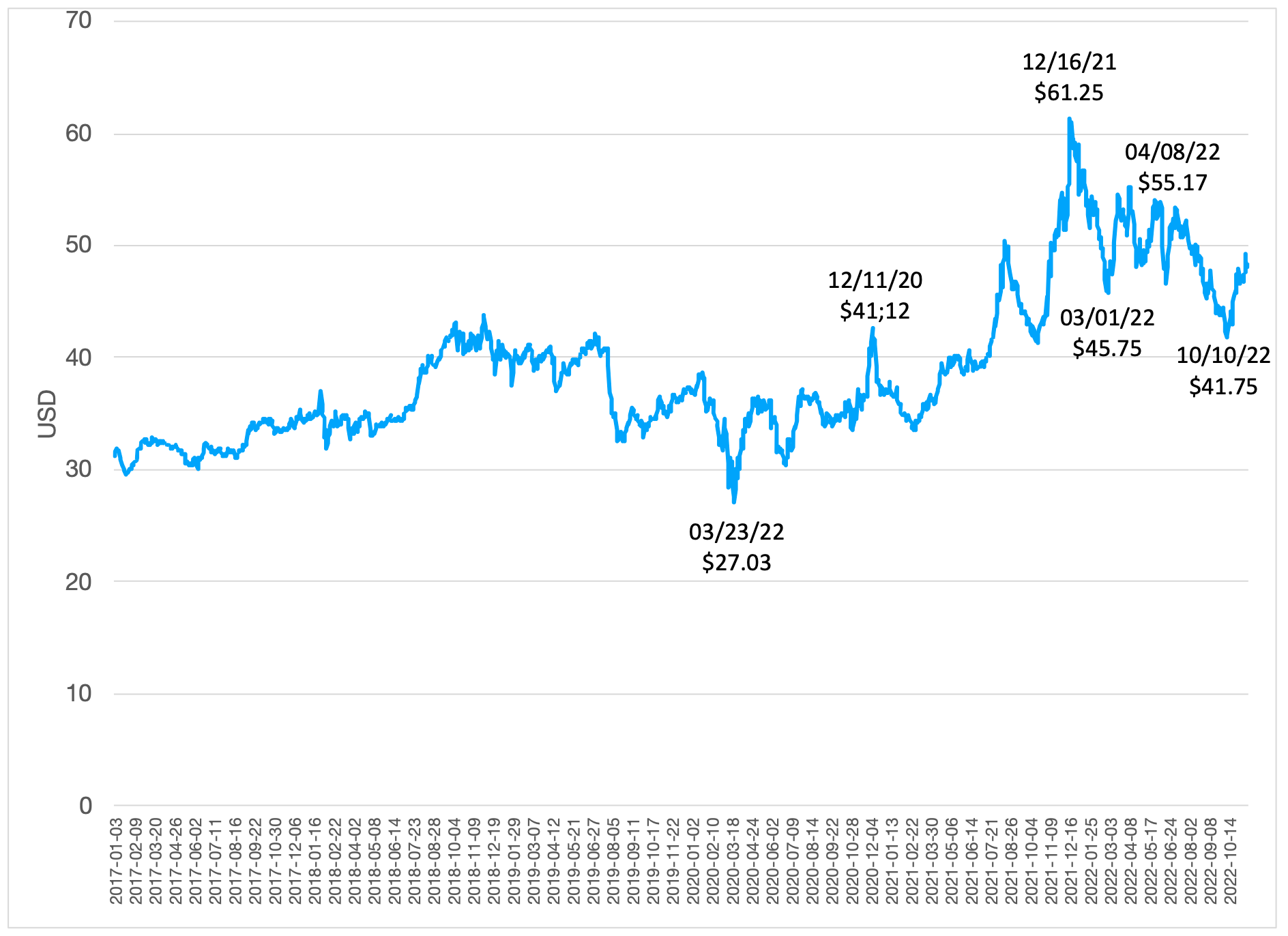

With revenues and profits continuing to explode in 2022, bolstered by sales of its Covid-19 antiviral pill Paxlovid—given EUA by the US Food and Drug Administration (FDA) on December 22, 2021—Pfizer did $2.0 billion in buybacks, all of them in March 2022, at an average price of $51.10. Why, for the first time since early 2019, did Pfizer decide to repurchase shares in March 2022? While Pfizer has not provided any explanation for this break in its no-buybacks policy, the graph of Pfizer’s daily stock price in Figure 1 suggests a straightforward answer: In March 2022, Pfizer’s CFO Frank D’Amelio (who would be retiring from that position on May 1, 2022) decided that the time was right to give a manipulative boost to Pfizer’s stock price.

On March 23, 2020, a week after the World Health Organization declared SARS-CoV-2 a pandemic, causing stock markets to plummet, Pfizer’s stock was at $27.03, its lowest price since October 22, 2014. Subsequently, as the stock markets recovered, and indeed boomed, during 2020 and 2021, the company’s stock price climbed to $41.12 on December 11, 2020, the date on which the BioNTech-Pfizer Covid-19 vaccine Comimaty secured EUA from the FDA. From that point, Pfizer’s stock price rose in fits and starts during 2021, as the revenues and profits from Comimaty rolled in, reaching an all-time high of $61.25 on December 16, 2021, in apparent anticipation of approval of Pfizer’s Covid-19 antiviral pill, Paxlovid, which secured EUA from the FDA on December 22.

Figure 1: Pfizer’s daily closing stock price, Jan. 3, 2017-Nov. 18, 2022

Source: Yahoo Finance daily stock prices

By March 1, 2022, however, the stock price had declined to $45.75. We can assume that Pfizer did the $2.0 billion in buybacks in March 2022 to give a manipulative boost to its sagging stock price. [31] If so, it apparently worked, with the stock hitting $55.17 on April 8, 2022. In the press releases of its results for the first, second and third quarters of 2022, Pfizer repeated that the company “does not anticipate any additional share repurchases in 2022.”[32] In the earnings press release of July 28, Pfizer’s new CFO, David Denton, declared: “We continue to prioritize high-value uses for our capital, with an emphasis on reinvesting in our business by funding both internally- and externally-developed science and innovation while also continuing to grow our dividend and buy back shares, when appropriate, to help offset dilution.”[33]

During the second and third quarters of 2022, Pfizer refrained from doing another round of buybacks, with the stock price gyrating in the $50 range until mid-August before declining to about $44 in the last week of September. Note, however, in Figure 1 the continuing price decline to $41.75 on October 10, and its subsequent recovery to $49.24 on November 14. Did Pfizer engage in more buybacks during October to “financial engineer” this turnaround? Maybe not, because unlike the decline of Pfizer’s stock price in the first two months of 2022, which occurred even though the NYSE Index was stable, the decline of Pfizer’s stock price during September and early October and then its rise through mid-November matched the movements of the NYSE Index. When Pfizer issues its 2022 10-K filing in February 2023, we will find out whether the company did any buybacks during the fourth quarter of 2022.

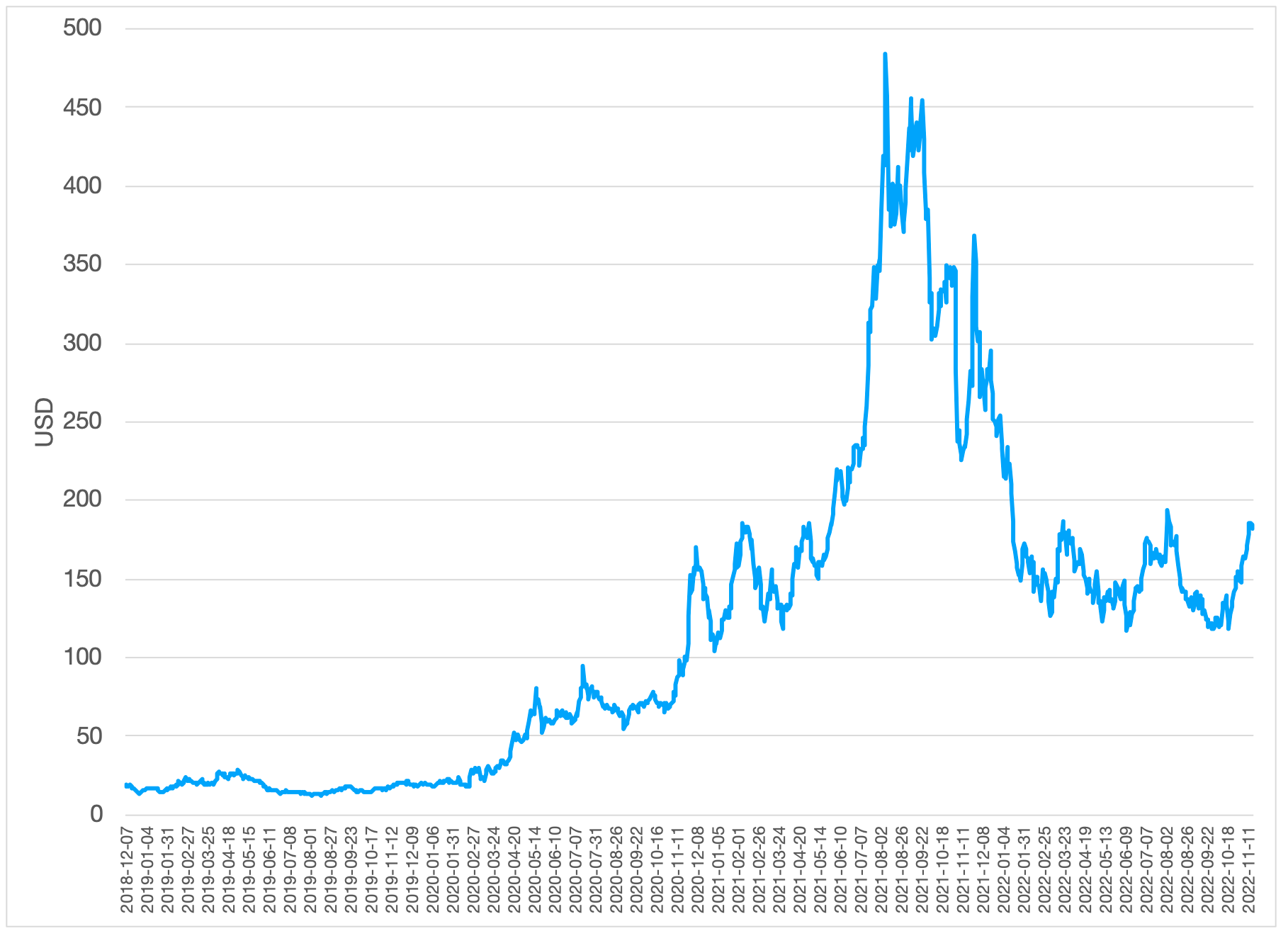

If Old Economy Pfizer seems to be concerned with using a portion of its pandemic profits to continue its strategy of investing in innovation, New Economy Moderna’s executives appear to be laser-focused on the company’s stock-price performance, in, as can be seen in Figure 2, a market that has placed highly fluctuating valuations on its shares. At $67.47 on October 30, 2020, the stock price almost tripled to $183.74 on February 12, 2021, before falling to $115.49 on March 30, and then more than quadrupling to a high of $484.47 on August 9. By March 7, 2022, the price had collapsed to $126.46, and it then fluctuated around $150 through mid-November 2022.

Figure 2: Moderna’s daily closing stock price, Dec. 7, 2018-Nov. 18, 2022

Source: Yahoo Finance daily stock prices

Founded in 2010 with its NASDAQ IPO in December 2018, Moderna, headquartered in Norwood MA, had 830 employees at the end of 2019. In seeking its first commercial product with the Covid-19 vaccine, Moderna collaborated with the US National Institutes of Health (NIH), whose team of researchers conducted most of the Covid-19 vaccine development effort, including clinical trials.[34] In May 2020, Moderna entered into a ten-year pact with Lonza, a long-established Switzerland-based CDMO, to mass produce the vaccines, initially at a plant in New Hampshire (which Lonza had acquired from a British company in 1993), a 90-minute drive from Moderna’s headquarters in Norwood, and subsequently on dedicated lines at Lonza plants in Switzerland.[35] While accepting substantial Covid-19 vaccine development and procurement funds from the Trump administration’s Operation Warp Speed, Moderna retained control of marketing the vaccine, enabling it to keep the lion’s share of the profits subsequent to EUA, notwithstanding the critical contributions of NIH and Lonza—not to mention decades of research by the wider scientific community—to the success of the vaccine.

Providing venture capital to Moderna was Flagship Pioneering, based in Cambridge MA, whose CEO, Noubar Afeyan, hired Stéphane Bancel as Moderna CEO in 2011, giving him a substantial quantity of co-founder shares in the startup. In 2014, Moderna was the first biopharma startup, not yet publicly listed, to gain “unicorn” status (a $1 billion valuation), even though it had no products in clinical trial. At the IPO in late 2018, Moderna had 21 drugs in development, with no expectation of a product launch for several years. Bancel was, however, a hyper-aggressive fundraiser, with Moderna securing $2 billion in private equity and another $600 million in the IPO.[36]

From May 2020, seven months before the Moderna vaccine received EUA, Flagship and Moderna senior executives began selling their shares. Over the course of about one month from late February to late March 2021, two Flagship funds sold a portion of their Moderna shareholdings for $1.4 billion, with Afeyan gaining from not only his 75-percent ownership of Flagship Pioneering but also venture-capital fees and the “carried interest” (typically 20 percent) of the funds’ profits.[37] It was reported in March 2022 that Bancel had sold shares valued at $408 million since January 2020.[38] The 2021 compensation of Moderna’s five highest-paid executives totaled $362 million. Indeed, Moderna CMO Tal Zaks sold stock to the tune of $1 million per week from May 2020, only to announce in February 2021 that he would leave the company (riches in hand) in September 2021, in advance of a possible EUA for the Moderna vaccine. As we have seen in Table 6 above, among the highest-paid pharmaceutical executives were, in 2020, Moderna CFO Lorence Kim ($89.7 million) and Zaks ($68.8 million) and, in 2021, CTO Juan Andres ($195.9 million) and president Stephen Hoge ($167.7 million). As we have also mentioned, Afeyan and Bancel were not among the highest “paid” executives because their stock sales were founders’ shares.

Moderna has not yet paid a dividend, but, with its stock price declining from its peak of $484 in August 2021, the company did $857 million in stock buybacks in the last quarter of the year at an average price of $245.76, including $540 million in November. Moderna did another $143 million in buybacks in January 2022 at an average price of $236.33. After its stock continued its free fall to $147.63 on January 27, the company did no buybacks in February as its fluctuating stock price appeared to stabilize. Nevertheless, it dropped to $126.46 on March 3, and from March through September Moderna did buybacks every month for a seven-month total of $2.8 billion (average price: $142.72), ranging from $222 million in July to $533 million in September. The $3.8 billion that Moderna spent on buybacks to manipulate its stock price in 2021 and the first nine months of 2022 represented 20.2 percent of its substantial pandemic profits over the 21 months. With its stock declining further to $119.32 on October 7 but then climbing to $175.25 on November 15, we expect that Moderna continued to do repurchases over these two months, and that the company will remain addicted to doing buybacks to manipulate its stock price in the years to come.

Given its 10-year contract with Lonza, Moderna is not investing in manufacturing capacity (beyond a plant it already had in Norwood prior to the pandemic designed for manufacture of doses for relatively small-scale clinical trials of cancer candidates). Additionally, as a potentially significant constraint on Moderna’s growth as a multiproduct firm, Flagship Pioneering, which exercises strategic control over Moderna, has a business model which favors the creation of new startups for the development of new drug candidates because of the stock-market gains that can be made from an IPO, even when, as is typically the case among biopharma startups, it is product-less, compared with the typically much smaller stock-market gains from the growth via new products of an already profitable firm from successful drug innovation that, in the highly financialized US environment, has already experienced its external fundraising and its most highly speculative stock-price runup early in its history as a publicly listed company (as displayed for the case of Moderna in Figure 2 above).

The incentive of a venture-capital firm such as Flagship to “maximize shareholder value” via a proliferation of startups is currently being tested, however, by the very weak biopharma IPO market, with Flagship cutting staff at some of its ventures.[39] With the NASDAQ stock exchange highly liquid, there were 77 biopharma IPOs in 2020 and 96 in 2021. But, in 2022, with stock prices falling, there have been only eight biopharma IPOs thus far.[40] Note, however, that an even more extreme biopharma IPO drought occurred in 2008-2010, yet the speculative phenomenon of what we call the “product-less IPO” (PLIPO) remerged even stronger in the subsequent decade. As the liquidity of NASDAQ was restored in the 2010s, stock traders became willing to absorb initial and secondary stock issues precisely because they had the expectation that they would be able to sell the shares for a gain without having to hold them until the issuing pharmaceutical company might generate product revenues, much less profits. Rather, the liquid market has enabled stock traders to try to time the buying and selling of shares to realize financial gains. It is ever-present speculation, not innovation, which has yet to occur, and which may never occur, that drives the stock-price movements of most publicly listed biopharma startups.[41]

Meanwhile, both Pfizer and Moderna are fighting to be sure that any benefit that the world gets from mRNA medicines means more money in their corporate treasuries. Given the novelty of mRNA technology, there are myriad patent claims, with Moderna challenging not only the intellectual property rights of Pfizer/BioNTech but also the NIH, whose scientists developed the “Moderna” Covid-19 vaccine.[42] Both Moderna and Pfizer are preventing the US government from providing expired doses of their Covid-19 vaccines to researchers who want to use them in experiments to develop next-generation applications such as nasal vaccines.[43] Both companies are determined to raise the prices of their Covid-19 vaccines—driven by so-called “normal market forces”[44]—well above the $20 per dose negotiated with the US government during the pandemic.

Augmented profits will then be available to flow out of the companies as distributions to shareholders, which executives will claim as “necessary” to support their stock prices. All the while, insofar as they invest internally in the drug pipeline or gain control over products through M&A deals, these companies will benefit from massive and persistent NIH spending on life sciences research. The NIH budget for 2022 is $45.2 billion, continuing government funding that, dating back to 1938, has now totaled more than $1.3 trillion in 2022 dollars of taxpayer money.[45] In addition, the US government grants companies like Pfizer and Moderna patent production, while these companies can avail themselves of various other types of federal, state, and local subsidies.[46] Yet, their grossly overpaid executives whine about price regulation.

US government regulation of drug prices is just a first step in policy reform for drug innovation

As noted at the outset of this article, PhRMA makes a valid point that, in principle, the earnings that a pharmaceutical company retains out of profits provide the financial foundation for corporate investment in drug innovation. The problem is that, in practice, as the evidence presented in this article makes abundantly clear, contrary to PhRMA’s claims, major US pharmaceutical companies typically distribute all their profits and even more to shareholders in the form of dividends and buybacks. In implementing price regulation, government agencies should possess the analytical capability to evaluate whether, in fact, price caps stifle drug innovation.[47]

Within the US context of corporate financialization, however, government policy that seeks to support the generation of safe, effective, accessible, and affordable medicines must go much further than “smart” price regulation. Adopting a policy agenda that AIRnet advises to foster innovation across all industrial sectors,[48] the US government should 1) ban open-market repurchases; 2) disconnect executive pay from a company’s stock-price performance; 3) place representatives of stakeholders, including employees, taxpayers, and consumers, on corporate boards; 4) reform the corporate tax code to reward innovation and penalize financialization; and 5) support the working population in gaining access to productive and remunerative employment on a sustained basis through “collective and cumulative” careers. These reforms are relevant to US industrial corporations in general, and not just to pharmaceutical companies. The shareholder-value sickness that afflicts the US pharmaceutical industry is, in fact, an American socioeconomic epidemic that was present for decades before the SARS-CoV-2 pandemic further exposed this chronic disease.

1) Ban stock buybacks:

Enabled since 1982 by the Reagan-era SEC Rule 10b-18, AIRnet’s research has shown that, to quote the subtitle of a well-known Harvard Business Review article, “stock buybacks manipulate the market and leave most Americans worse off.”[49] In 2018, US Sen. Tammy Baldwin (D-WI) proposed rescinding Rule 10b-18 as part of the Reward Work Act, reintroduced in the Senate by Baldwin with three co-sponsors in March 2019[50] and in the House by Reps. Jésus García (D-IL), Peter DeFazio (D-OR), and Ro Khanna (D-CA) in October 2022.[51]

Without the “safe harbor” against stock-price manipulation charges that Rule 10b-18 has provided for 40 years, the practice of OMRs would have to end. Shareholders who purchase shares of a company on the stock exchange would look to dividends to get a yield on that portfolio investment by holding shares. OMRs, in contrast, increase the gains of sharesellers who, as professional stock traders, are in the business of timing the buying and selling of shares, benefiting from access to nonpublic information on the precise days on which the company is executing buybacks. These privileged sharesellers include senior executives of the company doing the buybacks, Wall Street bankers, and hedge-fund managers.[52]

Indeed, stable shareholders who buy corporate stocks for dividend yields should be opposed to buybacks. Instead, they should want corporate management to reinvest in the productive capabilities of the company as a basis for creating the next round of competitive products that can generate the profits out of which a stream of dividends can continue to be paid. If the company is successful in making these investments in innovation, its shares should rise in value, giving shareholders a financial gain if and when they decide to sell some or all of their shares.

2) Disconnect executive pay from stock-price performance:

In its 2023 Budget, President Biden took aim at realized gains on executive pay as an incentive for senior management to do stock buybacks.

The President also supports legislation that would align executives’ interests with the long-term interests of shareholders, workers, and the economy by requiring executives to hold on to company shares that they receive for several years after receiving them, and prohibiting them from selling shares in the years after a stock buyback. This would discourage corporations from using profits to repurchase stock and enrich executives, rather than investing in long-term growth and innovation.[53]

If the Biden administration is intent on preventing corporate financialization from inflating executive pay, it should, as a first step, ask the SEC to institute the correct measurement of executives’ actual realized gains (ARG) on their stock-based compensation rather than the highly misleading estimated “fair value” (EFV) measures currently in use. As AIRnet has shown, EFV uses grant-date stock prices to value stock options and stock awards, thus understating—vastly when the company’s stock price is booming—the actual take-home compensation of these executives, based on their ARG from stock-based pay. The EFV use of grant-date stock prices to measure executive pay obscures the financial incentive for senior executives to boost the company’s stock price by any means possible—first and foremost buybacks—to inflate their own ARG from stock options and stock awards.[54]

When measured correctly, our analysis of the extraordinarily high stock-based pay of US executives strongly suggests that they are rewarded much more for stock prices that are inflated by speculation and manipulation, as distinct from innovation. Moreover, even when senior-executive ARG reward stock-price increases driven by innovation, the board’s focus on lavish stock-based pay for those at the top means that senior executives extract far more value in their remuneration packages than is warranted compared with other corporate employees whose skills and efforts have resulted in innovative products.[55] Indeed, in the presence of a “downsize-and-distribute” resource allocation strategy, it is often the case that senior executives lay off employees who have been key contributors in the innovation of products that have resulted in corporate profits, while at the same time padding their ARG by fomenting stock-price speculation and engaging in stock-price manipulation.[56]

The remedies are to disconnect executive pay from stock-price performance and to reward all corporate employees for the company’s success at innovation through a stable and equitable compensation plan that reflects all contributions to the organizational-learning processes that are the essence of innovation. As vice president and in his campaign for the nomination as Democratic presidential candidate, Joe Biden was a sharp critic of stock buybacks and their link to executive pay.[57] As he concluded in a Wall Street Journal op-ed, “How Short-Termism Saps the Economy,” published in September 2016:

The federal government can help foster private enterprise by providing worker training, building world-class infrastructure, and supporting research and innovation. But government should also take a look at regulations that promote share buybacks, tax laws that discourage long-term investment and corporate reporting standards that fail to account for long-run growth. The future of the economy depends on it.[58]

3) Place stakeholder representatives on corporate boards:

Households as workers and taxpayers are risk-takers who invest in the firm’s productive capabilities.[59] Hence, there is a clear rationale for extending to them the right to voting representation on corporate boards. In the US context, however, it is viewed as a radical proposition.[60] The extension of democratic rights in corporate governance to previously disenfranchised groups of people represents major social change, but radical change is urgently required given the damage that the prevailing system of US corporate governance is inflicting on the attainment of stable and equitable growth.

Shaped by the highly flawed ideology that public shareholding represents “ownership” of productive assets, the SEC-sanctioned proxy-voting system as it now exists undermines sustainable prosperity.[61] All board members should function as trustees who recognize the generation of innovative products as the purpose of the corporation, subject to the social norms of providing stable employment and an equitable distribution of income to the company’s employees. Board members should represent the participants in the corporation—including households as workers, taxpayers, and consumers—who bear the risk of value creation. By the same token, those whose interest in the corporation is predatory value extraction should be excluded from directorships.

In addition to rescinding SEC Rule 10b-18, the Reward Work Act, which, as we have noted, has been introduced in the Senate and the House, would have representatives of workers as one-third of board members of each publicly listed company in the United States.[62] In August 2018, Sen. Elizabeth Warren (D-MA) introduced the Accountable Capitalism Act, which, among other things, would require US corporations with $1 billion or more in annual revenues to have worker representatives as forty percent of board members.[63] In the case of the pharmaceutical industry there is a very strong case to be made to include board members who represent both taxpayers, who collectively fund life sciences research, and patients, for whom access to medicines is often a matter of life or death.

4) Reform the corporate tax system:

In the debate over the Republican-supported 2017 Tax Cuts and Jobs Act, both its advocates and critics recognized that the main corporate use of the extra income gained from lowering the corporate tax rates on domestic and repatriated profits would be increased distributions to shareholders in the form of cash dividends and stock buybacks.[64] Indeed, Senate Democrats called out the 2017 Act as #GOPTaxScam, emphasizing that the tax breaks were being used to fund stock buybacks.[65] As Senate Democratic Leader Chuck Schumer (D-NY) put it in a #GOPTaxScam report, issued in February 2018:

The record-setting pace of stock buybacks is proof that companies across the country are stuffing the savings from the Republican tax bill into their own pockets and the pockets of their wealthy investors, rather than workers. These numbers prove that the bulk of the savings from this bill aren’t trickling down into higher wages, but into bigger gains for giant corporations and the wealthy.[66]

Manifesting the heightened predatory value extraction that has characterized financialized corporate governance during the pandemic, buybacks have been, as noted above, far greater in 2021 and 2022, under the Biden administration, than in the three previous years, with the Republican corporate tax cut from 35 percent to 21 percent in place. The Biden administration has been unable, and perhaps unwilling, to raise the corporate rate, settling instead on a 15-percent minimum corporate tax.[67]

Meanwhile, in August 2022, Democrats were forced to include a one-percent tax on buybacks in the Inflation Reduction Act as a concession to secure the vote of US Senator Kyrsten Sinema (D-AZ), needed to pass the Act in the Senate. She declared that her vote for the Act could be had if the Democrats would drop from it a provision to put an end to the capital-gains tax treatment of “carried interest” income by hedge funds, replacing it with the one-percent buybacks tax with a view to raising $74 billion in tax revenue over ten years.[68]

In our view, this one-percent tax on buybacks only serves to legitimize a toxic practice that should be banned. Moreover, the revenue raised from the tax on buybacks will come nowhere near to offsetting the immense damage to the US economy and US households that buybacks cause.[69] If the Biden administration insists on taxing rather than banning buybacks, then it should set the surcharge at, say, 40 percent, with a mandatory warning banner on the corporate repurchaser’s website that reads: STOCK BUYBACKS DESTROY THE MIDDLE CLASS.

5) Support collective and cumulative careers:

In a world of rapid technological innovation and intense global competition, the value-creating economy depends on the continuous augmentation of the productive capabilities of the labor force. That means that both higher education and the work experience of the national labor force need constant upgrading as a necessary condition for producing innovative products. Achieving productive outcomes and returning a substantial portion of the profits from the productivity gains to productive workers are fundamental to achieving sustainable prosperity.[70]

The innovation process entails collective and cumulative learning: “collective” because individual employees rely on shared work experience to become more productive, and “cumulative” because what the “collectivite” learned yesterday determines what it can learn today. For individual employees to contribute their skill and efforts to innovation, they need access to collective and cumulative careers (CCCs) that provide them with opportunities to be productive over working lives that now span four decades or more.

Under the Old Economy business model that prevailed in the decades after World War II, companies provided CCCs through the “career-with-one-company” (CWOC) employment norm. With the rise to dominance of the New Economy business model in the 1980s and 1990s, however, the CWOC norm disappeared.[71] New Economy start-ups could not attract talent by offering a career with one company because a CWOC was not an inducement that start-ups with uncertain futures could promise to fulfill. Rather, implementing the process called “marketization,” New Economy start-ups could induce talent to leave or eschew CWOC employment with Old Economy companies for the sake of stock options that could become very valuable if and when the company did an IPO on NASDAQ.[72]

This New Economy practice of using stock options to attract and retain a broad base of employees remained intact even after some start-ups became going concerns with employees in the tens of thousands. Over the course of the 1980s and 1990s, this marketization process corroded the CWOC norm at Old Economy companies, with IBM’s deliberate downsizing of its labor force from 374,000 in 1990 to 220,000 in 1994 representing a pivotal case.[73] With the growth of the startup biopharma sector, Big Pharma companies also had to compete for employees on “New Economy” terms, while the rise to dominance of the destructive ideology that a company should be run to “maximize shareholder value” provided senior pharmaceutical executives, as in other industries, with a self-serving rationale for downsizing the labor force and distributing corporate cash to shareholders.[74]

In the 21st century, the globalization of the labor force, particularly in advanced-technology fields, has completed the erosion of the CWOC norm in the United States, as key jobs are offshored to lower-wage areas of the world and as key employees are recruited from globalized labor supplies, often on temporary nonimmigrant visas, to fill high-end technology jobs in the United States.[75] Meanwhile, the human capabilities of older workers, accumulated through many years of education and decades of work experience, atrophy at a time when the application of those capabilities to confront new economic and social challenges is what a value-creating economy needs.

In a globalized economy with rapid technological change, the CWOC norm will not be restored. This dramatic erosion and devaluation of CWOC in the now-dominant business model has created enormous challenges for members of the US labor force to construct for themselves, through interorganizational mobility, the CCCs that a middle-class existence requires. CCCs have become increasingly necessary for individuals to maintain a good standard of living over an expected forty to fifty years of their working lives, with sufficient savings from employment income to sustain them for twenty years or more in retirement. Without CCCs, people who were deemed to be highly productive in their forties may become obsolete in their fifties, or they may find that educated and experienced workers in lower-wage areas of the world have become equally or even better qualified to do their jobs.

For the sake of sustainable prosperity, social institutions must be restructured to support CCCs across business corporations and government agencies as well as civil-society organizations. There are many different paths by which individuals can structure their CCCs. Over the course of their careers, people may develop skills through a series of jobs with different employers in an interlinked network of business corporations, government agencies, and civil-society organizations. In addition, a CCC may be followed across national borders, often with employment by one multinational corporation, agency, or organization or through a more individualized search for a globalized career path.[76]

As they have been doing since the late 1980s, many of the most talented and ambitious young people embarking on careers may look for a quick hit on Wall Street or a venture-backed IPO that can provide them with enough income for a lifetime without pursuing a CCC. The problem is especially acute when the large corporations that used to be the bedrocks of CCCs—including the Big Pharma companies—support the dominance of the “financial economy” over the “productive economy” by distributing almost all, if not more, of their profits to shareholders in the form of stock buybacks and cash dividends. If the SARS-CoV-2 pandemic has taught us anything, it is that in pharmaceuticals, as in the US economy more generally, the policy cure for the shareholder-value sickness must begin right now.

Be the first to comment