Stock buybacks come at the cost of technological innovation

William Lazonick, professor emeritus of economics at University of Massachusetts

Matt Hopkins, PhD candidate at SOAS University of London

Cross-posted from the website of the Institute for New Economic Thinking

For a half-century after the invention of the integrated circuit at Texas Instruments (TI) and Fairchild Semiconductor in the late 1950s, the United States was a leader in global semiconductor fabrication. Until 1991, TI and Motorola were the world’s leading integrated device manufacturers (IDMs), selling chips they fabricated, at which point they were surpassed by Intel, with its microprocessor having become the standard hardware in personal computers.

Meanwhile, from the early 1980s, “fabless” semiconductor companies – firms that designed, but did not fabricate chips themselves – proliferated, creating products for varied segments of the memory and logic markets. Initially, these design companies turned to IDMs for wafer fabrication. Responding to the opportunity to manufacture chips for fabless firms, in 1987 Morris Chang, a Taiwanese native with electrical engineering degrees from MIT and Stanford and 25 years of work experience at TI, launched Taiwan Semiconductor Manufacturing Corporation (TSMC) as the world’s first “pure play” foundry. In 1985, the Taiwanese government had lured Chang back home to head its Industrial Technology Research Institute (ITRI), from which TSMC was spun off with financial backing from a state development fund and the Dutch electronics company Philips.

In 1980, ITRI had created United Microelectronics Corporation (UMC) as Taiwan’s first IDM. In 1995 UMC divested its chip-design business as MediaTek and became a pure-play foundry. In 2020, TSMC’s revenues were $46.9b., 7.4 times UMC’s. Close in sales to UMC was GlobalFoundries (GF), a 2009 spin-off from U.S.-based Advanced Micro Devices (AMD). GF subsequently acquired fabs of Chartered Semiconductor (Singapore) and IBM. Now wholly owned by an Abu Dhabi sovereign wealth fund, GF’s global headquarters are in New York State. In fourth place among the dedicated foundries is China-based Semiconductor Manufacturing International Corporation (SMIC), with 2020 revenues of $3.8b.

Larger, however, than UMC, GF, and SMIC as a semiconductor fabricator is Samsung Electronics Corporation (SEC), the flagship company of the Korean Samsung chaebol, with estimated 2020 foundry revenues of $14.7b., more than twice those of UMC and GF. In 2020, SEC generated $200.6b. in total revenues across all product segments, of which semiconductors contributed $121.0b. Besides the $14.7b. in foundry revenues, SEC’s fab output consisted of $59.3b. in chips used in SEC products such as smartphones and computers as well as $47.0b. in SEC-designed chips sold externally. As an IDM, SEC was second globally to Intel, which had $77.9b. in 2020 semiconductor revenues. Among the fabless firms competing with Intel at the high end of the processor market are U.S.-based Nvidia (2020 revenues: $16.7b.) and AMD ($9.8b.).

The most advanced chips are produced for smartphones as “system-on-a-chip” (SOC). The leading designers of SOCs are Apple (USA), Qualcomm (USA), SEC (South Korea), and MediaTek (Taiwan). HiSilicon, a wholly-owned subsidiary of Huawei Technologies (China), was also a SOC leader until U.S. trade sanctions, implemented from August 2020, terminated its access to TSMC’s fab output. TSMC and SEC use 7nm and 5nm process technology to manufacture many of these mobile processors along with the most advanced AMD computer and Nvidia gaming SOCs. According to TSMC, compared with 7nm, 5nm offers 15% faster speed, 30% less power consumption, and 1.8 times the logic density.

TSMC’s most important advanced-fabrication customer is Apple, accounting for 22% of net revenues in 2018, 23% in 2019, and 25% in 2020. From the iPhone’s launch in 2007, Apple relied on SEC for chip fabrication, for which the Korean company built a state-of-the-art plant in Texas. But SEC subsequently emerged as Apple’s leading competitor in smartphones. In early 2011, Apple filed a smartphone-patent infringement suit against SEC. As an alternative to SEC, Apple contracted with TSMC for foundry services but needed more than five years to shift iPhone chip fabrication entirely from SEC to TSMC.

With its Apple contract, TSMC now leads the race in advanced process technology, with SEC close behind. In 2020, both TSMC and SEC transitioned from 7nm to 5nm process, and in 2021 both are making investments to commercialize 3nm. TSMC went from zero 5nm revenues in 2Q20 to 8% in Q320 and 20% in Q420. SEC is intent on closing the technology gap with TSMC by allocating $28b. to capital expenditures in 2021, about the level of its 2020 plant and equipment (P&E) investments.

For its part, TSMC has announced plans to spend $100b. in total on P&E and R&D over the next three years, including $30b. in 2021, up from $17.2b. in 2020. TSMC will construct a $12b. 5nm facility in Arizona and is also considering the state as the site for a $25b. 3nm fab. Most of this new capacity is slated to fabricate Apple’s M-series processors.

Intel still leads the global semiconductor industry in total revenues. But, as an IDM, Intel manufactures almost all its CPUs at 14nm, and its 10nm capacity has been stuck, with limited output, since 2018. Meanwhile, Apple is abandoning Intel processors for its Mac computers, turning instead to TSMC to fabricate Apple’s own designs. Intel itself already contracts with TSMC and UMC to produce 15-20% of its non-CPU chips. Moreover, later this year, TSMC will commence production of intel’s Core i3 processors, inside advanced laptops, at 5nm.

Even as it has fallen behind in advanced chip fabrication, Intel has remained a very profitable company, averaging $21.0b. in annual net income in 2018-2020, with average annual P&E expenditures of $15.2b. In 2021, Intel expects to produce its first 7nm CPU, while increasing P&E spending to $20b.

As part of its IDM 2.0 strategy for manufacturing, innovation, and product leadership, announced in March by the company’s new CEO, Pat Gelsinger, Intel plans to build two fabs in Arizona. Included in IDM 2.0 is the launch of Intel Foundry Services “with plans to become a major provider of foundry capacity in the U.S. and Europe to serve customers globally.” Yet even if Intel should achieve 7nm on a significant scale in 2021, it will fall further behind TSMC and SEC as this decade unfolds. At some point, Intel could even find itself trailing SMIC, especially if China responds to U.S. trade restrictions by developing a semiconductor equipment supply chain that is not dependent on U.S. vendors.

Intel’s external and internal competitors

Why has Intel fallen behind TSMC and SEC in semiconductor fabrication, and why is it unlikely to catch up? The problem is that Intel is engaged in two types of competition, one with companies like TSMC and SEC in cutting-edge fabrication technology and the other within Intel itself between innovation and financialization. The Asian companies have governance structures that vaccinate them from an economic virus known as “maximizing shareholder value” (MSV). Intel caught the virus over two decades ago. As we shall see, with the sudden appointment of Gelsinger as CEO this past winter, Intel sent out a weak signal that it recognizes that it has the disease.

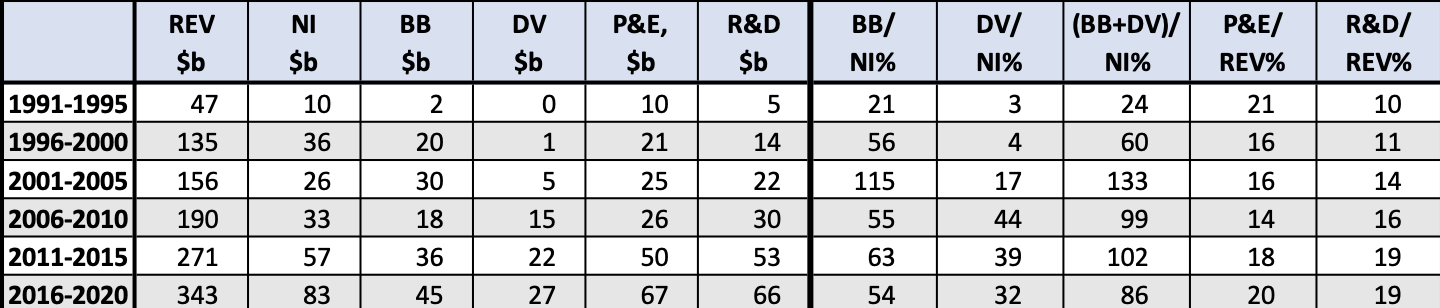

In the years 2011-2015, Intel was in the running, along with TSMC and SEC, to be the fabricator of the iPhone, iPad, and iPod chips that Apple designed. While Intel spent $50b. on P&E and $53b. on R&D over those five years, it also lavished shareholders with $36b. in stock buybacks and $22b. in cash dividends, which together absorbed 102% of Intel’s net income (see Table 1). From 2016 through 2020, Intel spent $67b. on P&E and $66b. on R&D, but also distributed almost $27b. as dividends and another $45b. as buybacks. Intel’s ample dividends have provided an income yield to shareholders for, as the name says, holding Intel shares. In contrast, the funds spent on buybacks have rewarded sharesellers, including senior Intel executives with their stock-based pay, for executing well-timed sales of their Intel shares to realize gains from buyback-manipulated stock prices.

Table 1: Intel: stock buybacks (BB), cash dividends (DV), plant and equipment expenditures (P&E), and research and development expenditures (R&D), with ratios to net income (NI) and revenues (REV), 1991-2020 Source: Intel 10-K filings.

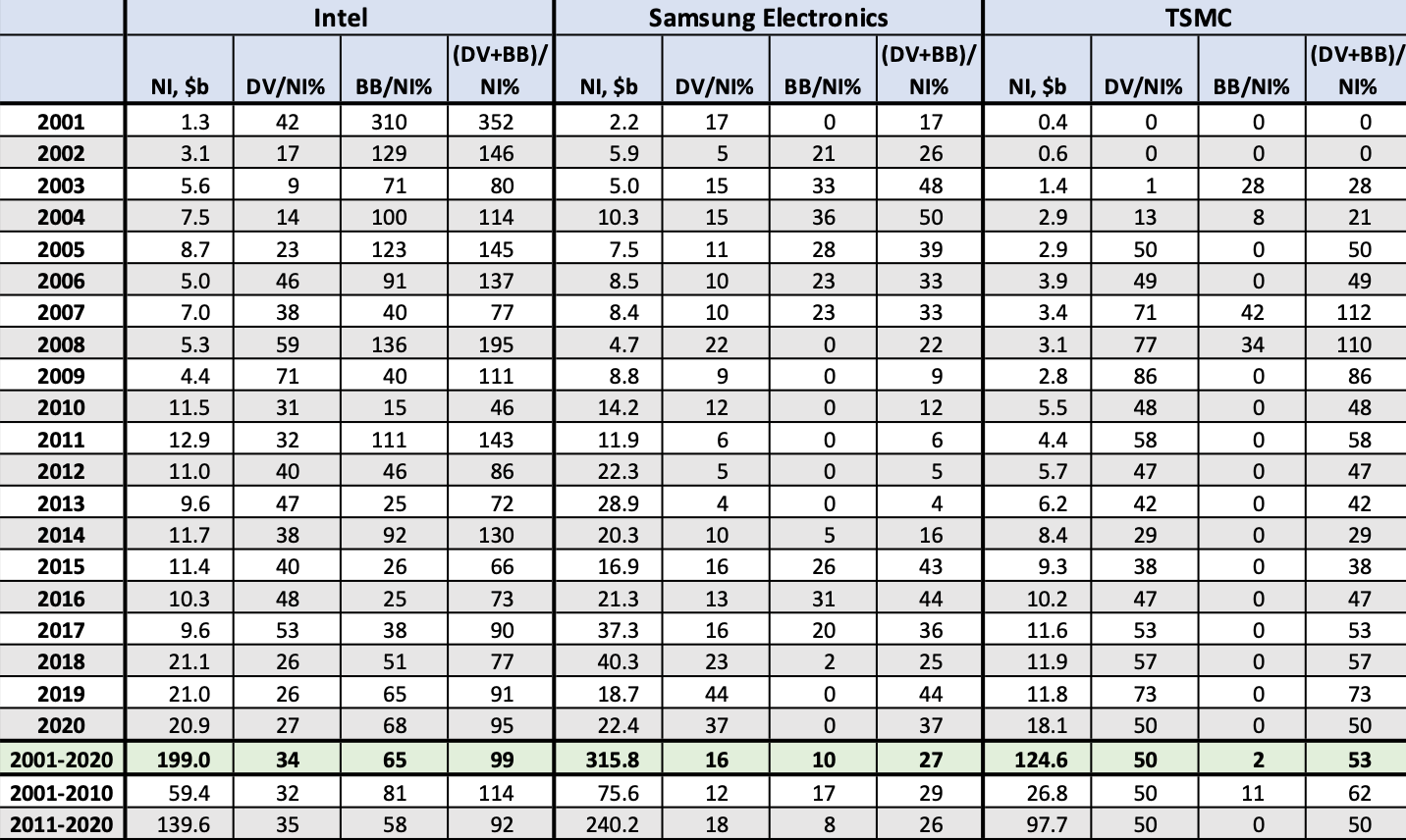

As Table 2 shows, Intel’s distributions to shareholders have been far greater than those made by either SEC or TSMC.

Table 2: Stock buybacks (BB) and cash dividends (DV) as percentages of net income (NI) at Intel, SEC, and TSMC, 2001-2020 Sources: Intel, Form 10-K filings; TSMC and SEC, Form 20-F filings.

The purpose of SEC’s stock buybacks in 2002-2007 and 2014-2018 was to increase the voting power of the founding Lee family, thereby consolidating its strategic control over resource allocation against the threat of corporate raiders. It is clear from SEC’s remarkable history that the Lee family has used its strategic control to allocate profits to investments in world-class productive capabilities. So too at TSMC under the leadership of Morris Chang. At 50% of net income over the past decade, TSMC’s dividend payout ratio was 2.8 times that of SEC and 1.4 times that of Intel. The sole purpose of TSMC’s stock repurchases between 2003 and 2008 was to buy out the ownership stake of Philips.

Innovation requires a social condition we call financial commitment to sustain technological transformation and market access until the generation of a higher-quality, lower-cost product can result in financial returns. The foundation of financial commitment is retained earnings. In the case of Intel, as shown in Table 1 above, in recent years the company has made substantial allocations to P&E and R&D, even as it has distributed almost all its profits to shareholders. But Intel has been able to tap other cash flows to make, simultaneously, large-scale productive investments and shareholder payouts. For the decade, 2011-2020, these other cash flows included depreciation charges of $87b., long-term debt issues of $45b., and stock sales (mainly to employees in stock-based compensation plans) of $12b.

Given the availability of these sources of funds, the vast sums that Intel has wasted on buybacks have not thus far imposed a cash constraint on its investments in semiconductor fabrication. Rather, it has been a deficiency in organizational learning—the essence of the innovation process—that has hampered Intel’s implementation of process technology. The generation of high levels of productivity from P&E and R&D expenditures requires, as a second social condition of innovative enterprise, organizational integration, working in combination with financial commitment. Organizational integration mobilizes the skills and efforts of large numbers of people in a hierarchical and functional division of labour into the collective and cumulative learning processes required to transform technologies to generate a higher-quality product and, then, access markets to attain economies of scale.

The root of Intel’s failure in organizational integration lies in the financialized character of a third social condition of innovative enterprise, strategic control. Accepting stock yield as the measure of enterprise performance, in recent years Intel’s senior executives who exercise strategic control have lacked both the incentive and, increasingly we would argue, the ability, to implement innovative investment strategies through organizational integration.

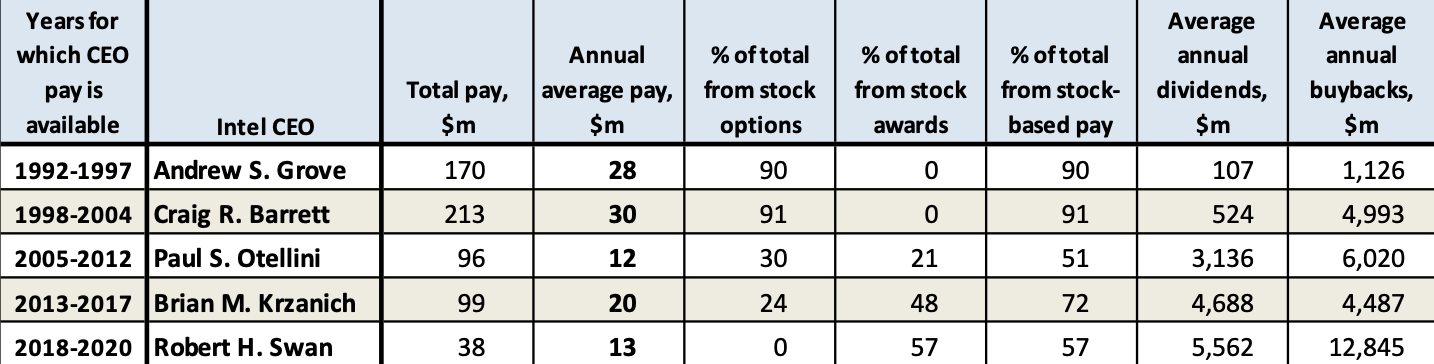

Executive stock-based pay, in the form of stock options and stock awards, has created incentives for Intel’s CEOs to do large-scale buybacks to give manipulative boosts to the company’s stock price. Table 3 documents the total compensation, including realized gains from stock options and stock awards, of Intel’s CEOs over the past three decades.

Of the $170m. in total compensation that Grove took home over six years as CEO, 90% was realized gains from stock-based pay, with 89% of the $170m. flowing into his bank account in 1996 and 1997 as the Internet stock-market boom took off. Aided by the boom and a doubling of Intel’s buybacks to $6.8b. in 1998, Barrett’s total compensation in his first year as CEO was $117m., with 98% of it realized gains from exercising stock options.

Table 3: Total and stock-based remuneration of Intel CEOs, 1992-2020 Source: Intel DEF 14A proxy filings. Note: Stock-based pay is measured as the actual realized gains from the exercise of stock options and vesting of stock awards.

Intel’s buybacks reached $10.6b. in 2005, the year in which Otellini, Intel’s first non-engineer CEO, took over. Buybacks declined to an average of $1.7b. in 2008 and 2009 in reaction to the financial crisis, but then were jacked up to as high as $14.3b. in 2011. The following year, buybacks were $5.1b. as Otellini departed as CEO with $40m. in total compensation, 82% of it stock-based.

With Krzanich as CEO, buybacks peaked at $10.8b. in 2014. He raked in $40 million in total pay (79% stock-based) in 2017 but was ousted in mid-2018 for having a “consensual relationship” with an Intel employee. In early 2018, news outlets alleged that Krzanich engaged in insider trading, based on non-public information of security flaws in Intel’s CPUs, as he sold all his Intel shares except for the minimum 250,000 he was required by contract to hold.

With Krzanich’s exit, the new CEO was Robert Swan, an MBA who had spent his career in finance at a number of companies, including GE, TRW, Northrup Grumman, eBay, and General Atlantic, before joining Intel as CFO in 2016. From 2018 through 2020, Swan averaged just under $13m. in total remuneration, of which 57% was stock-based. In the Swan years, annual dividends were 19% higher and annual buybacks 186% higher than in the Krzanich years.

The pressure on a U.S. publicly listed company such as Intel to do buybacks comes not only from senior executives as “value-extracting insiders” but also from the threat of attack by hedge-fund activists as “value-extracting outsiders.” The activists purchase a small fraction of a company’s shares on the stock market and then, to encourage the insiders to do buybacks, line up the proxy votes of asset managers, who function as “value-extracting enablers.” The U.S Securities and Exchange Commission provides “regulatory” support for this predatory value extraction with its Rule 10b-18, which since its adoption in 1982 has given a company that does massive buybacks a “safe harbor” from stock-price manipulation charges

Will Intel’s new CEO turn the company from financialization to innovation?

Those who exercise strategic control at Intel need to ask themselves why, in doing buybacks, they are showering cash on public shareholders who are merely stock traders looking for the most lucrative opportunity to rid themselves of the company’s shares. Part of the problem, as we have seen, is that those who exercise strategic control at Intel have been increasingly incentivized to focus on precisely this type of value-extracting behavior.

On January 13, 2021, Intel suddenly announced that Swan’s stint as CEO would end on February 15, with industry veteran Pat Gelsinger taking over. Gelsinger had joined Intel in 1979 at the age of 18, subsequently earning a bachelor’s degree from Santa Clara University and a master’s from Stanford, both in electrical engineering. He was central to the design of Intel’s microprocessors in the last half of the 1980s, when the company was rising to dominance in the field. He became Intel’s first chief technology officer in 2001 and senior vice president of the company’s Digital Enterprise Group in 2005. From 2009 to 2012, Gelsinger was president and chief operating officer of EMC, the leading computer storage company, and then became CEO of VMware, a publicly listed company controlled by EMC and then, from 2016, by Dell Technologies after the merger of Dell and EMC.

Is Gelsinger a CEO who understands that Intel cannot hope to regain global technological leadership in semiconductor fabrication unless it stops doing buybacks to manipulate its stock price so that it can be wholly focused on investing in innovation? In an interview broadcast by CBS’s Sixty Minutes on May 2, Gelsinger complained that the U.S. share of world semiconductor manufacturing had declined from 37% to 12% in the past 25 years and told interviewer Lesley Stahl that “Intel has been lobbying the U.S. government to help revive chip manufacturing at home—with incentives, subsidies, and-or tax breaks, the way the governments of Taiwan, Singapore, and Israel have done. The White House is responding, proposing $50 billion for the semiconductor industry in the U.S. as part of President Biden’s infrastructure plan.”

Stahl asked Gelsinger why, given its profitability, Intel needed U.S. government support, to which the CEO invoked U.S. national interest: “This is a big, critical industry and we want more of it on American soil: the jobs that we want in America, the control of our long term technology future, and as we’ve also said, the disruptions in the supply chain.”

Stahl countered: “You have spent much more in stock buybacks than you have in research and development. A lot more” (for the record, in 2019-2020, Intel spent $27.8b. on buybacks and $26.9b. on R&D). Gelsinger replied: “We will not be anywhere near as focused on buybacks going forward as we have in the past. And that’s been reviewed as part of my coming into the company, agreed upon with the board of directors.”

Gelsinger’s response is a rare instance of a sitting CEO of a major U.S.-based company even implying that buybacks may have undermined its ability to compete in its industry. As for his deal with the board that “we will not be anywhere near as focused on buybacks going forward,” Intel’s financial report for Q121 shows that between February 22 and March 27, with Gelsinger at the top, Intel executed $1.5b. in buybacks. Perhaps the new CEO was focused on other things during his first month and a half in office. For Intel as for other major U.S. corporations, the addiction to buybacks is hard to kick.

The 19 publicly listed corporate members of the U.S. Semiconductor Industry Association that signed a letter to President Biden in February, asking the government for financial support for their industry, did buybacks of $540b. (2020 dollars) from 2001 through 2020, with IBM, Intel, Qualcomm, and TI accounting for 84% of these repurchases. In 2016-2020 alone, these 19 companies squandered $148b. (nominal) on buybacks—almost three times the $50b. in financial aid that the Biden administration has offered the SIA.

Our policy recommendation for the Bden administration is simple: As a condition for giving the U.S. semiconductor industry $50 billion in infrastructure assistance, put a ban on SIA members doing stock buybacks as open-market repurchases. That legislation can then be a first step in Congress rescinding the Securities and Exchange Commission’s Rule 10b-18—corporate America’s license to loot. With a critically important company like Intel focused on innovation rather than financialization, the United States can get back to the business of building a world-class semiconductor-fabrication industry – one that leads rather than lags advances in technology.

Be the first to comment