An independent Scotland would likely start life with a substantial public deficit so adopting the EU’s fiscal rules would mean austerity.

William Thomson is a political economist and has worked for almost a decade in the financial services sector in London, holding positions at the British Bankers’ Association and the Council of Mortgage Lenders. William has an MA (Hons.), MSC The Green Economy, and an MEcon Economics of Sustainability. Based in Dunblane, William writes articles on economics in various publications, including The National, Brave New Europe, and the Scottish Left Review. He hosts the Scotonomics Podcast and curates Scotland’s Economics Festival.

Dirk H. Ehnts is a German heterodox economist and is currently an accredited parliamentary assistant at the European Parliament in Brussels for Fabio de Masi (MEP). This report was written before his most recent appointment. Dr. Ehnts has written several academic papers and books on Monetary Operations. Dr Ehnts has held academic positions on three continents. Dirk is a representative of Modern Monetary Theory (MMT) and spokesman of the board of Pufendorf-Gesellschaft e. V. Berlin.

In February 2025, Scotland’s First Minister John Swinney said, “I believe that rejoining the EU should be our clearly stated goal, and a national mission.” Mr. Swinney is part of an exceptionally pro-EU Scottish Government administration. Despite differences on other issues, this administration is as Eurocentric as those that came before.

Since Scotland voted to remain part of the UK in 2014 (partly because this was supposed to mean staying in the EU), there has been an end destination for Scottish independence. For both the Scottish government and a large part of the population, the desire is to rejoin the European Union.

This position was solidified when, two years later, Scotland voted 62% to 38% in the Brexit referendum.

The feeling is mutual, according to polling in July 2025 by YouGov, European nations would hang out the tartan dishcloths if Scotland were to rejoin the European Union.

This consensus has allowed us to ask a straightforward question: What does economic convergence look like for Scotland’s economy as it transitions away from life as a currency user as part of the UK and towards membership of the EU?

A simple and essential question, but one that is incredibly difficult to answer. It’s as meaty as a Scotch pie dropped in a beef bourguignon. We have but taken a nibble in our discussion paper that concentrates on the impact of the EU’s fiscal rules.

We hope this sparks an academic process that will encourage others to question the details of the economic plan as well as excite researchers beyond the economic sphere. It is a fascinating topic for everyone in the social sciences.

How will Scotland cope and adapt with a sharp focus away from the English border towards and across the English Channel? How European is a nation stuck on the periphery of Europe? What cultural renaissance beckons? Will it drift towards the Nordic countries or towards France and Germany? What about its stepping stone role between the US and Europe? How easy is it to end a 300-odd-year union and jump into bed with one that is only 50 years old? What impact will it have on other ‘separatist’ movements in Europe?

But let’s leave those head scratchers for later and for others to address.

The Stability and Growth Pact

The discussion paper, Undermining Economic Resilience – The Economic Impact of Adopting the European Union’s Stability and Growth Pact in an Independent Scotland addressed one aspect of that convergence. The desire of an SNP administration (should it still be in power after a yes vote) to unilaterally follow the European Union’s fiscal rules, known as the Stability and Growth Pact.

To the impartial observer, it appears peculiar that, as soon as Scotland leaves the economic union of the United Kingdom, it would volunteer to accept a very similar framework of fiscal rules for an independent Scotland. While not being a member of the bloc.

Many policymakers, as well as a few mainstream economists and policy institutes, such as the IPPR, are aware that rigidly adhering to fiscal rules in the UK is harming the economy. But that is only half the story.

The recent neo-fascist demonstrations across the UK show that as austerity bites, the right-wing’s stock rises.

How easily we have forgotten – or ignored – that over 300,000 premature deaths were caused by austerity in the UK during Osborne’s austerity years in 2010 – 2015.

First introduced in Europe in the early 1990s, debt and deficit targets changed the ‘rules of the game’. They are designed to ensure that governments control their day-to-day spending—a fancy way of saying fiscal austerity.

In a recent study, Swiss researchers Brändle and Elsener found that “fiscal rules have the strongest limiting impact on social spending,” mainly because that is what they are designed to do.

The Instability and No Growth Pact

Fiscal targets lead to increased unemployment and below-target inflation, as the 2010s have shown in the Eurozone. Mass unemployment and rising inequality have led to political instability, which is now playing out in many eurozone member states. Hence, the somewhat tongue-in-cheek but more appropriate renaming of the Stability and Growth Pact as the Instability and No Growth Pact.

There is not much dissension from the statement that ‘austerity doesn’t work’. Even the IMF’s World Economic Outlook in 2023 found that austerity doesn’t reduce the level of government debt, which, remember, is the main reason for fiscal rules.

We advise you to take a step back. If you were in charge of a newly independent nation that was exiting from the UK – easily the state that has most deeply embraced fiscal austerity – how high up your list would it be to undergo even harsher austerity? Because even harsher austerity would happen in Scotland if it tried to align with a 3% GDP fiscal target quickly.

Scotland’s historical public deficit

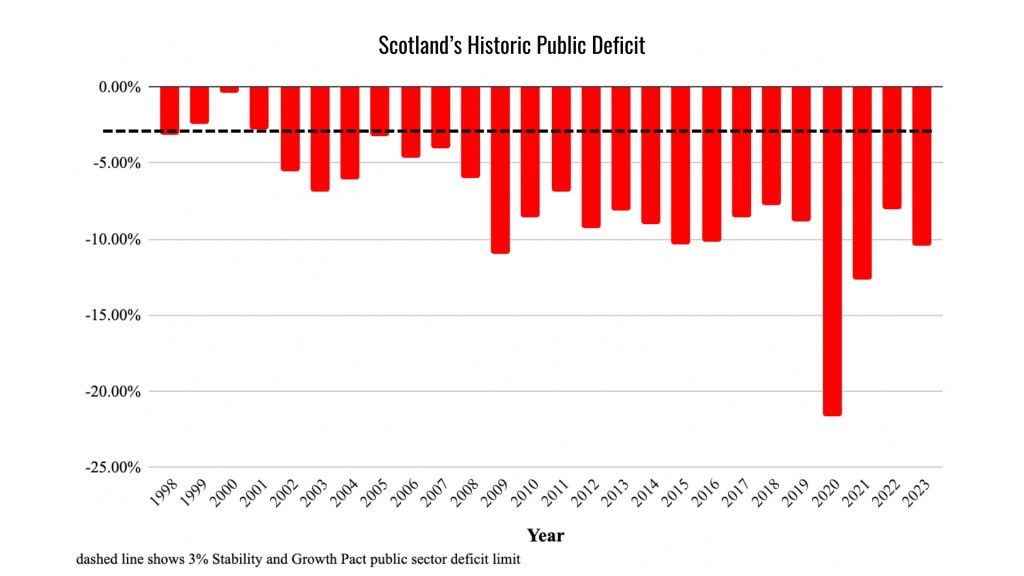

Below is Scotland’s historic public deficit. It is important to note that this includes all three levels of government: local, sub-national (Holyrood), and national (Westminster). The level of public deficit also reflects Scotland’s position as part of the United Kingdom; however, we argue that economic fundamentals are unlikely to change substantially over the first decade of independence, so we suggest that these figures are the best we have.

The dotted line marks the SGP level of 3%.

The Scottish public deficit, on average, since 2018, is around 12%. Now, as Modern Monetary Theory economists, both Dirk and I will make a very separate argument that this level of public deficit is not an issue (but that really isn’t the point of this article – or our report). We are dealing exclusively with the impact of moving from circa 12% to below 3%.

Fiscal rules would lead to crushing austerity in an independent Scotland

So, using a relatively simple macroeconomic model, but basing all variables on real data with realistic parameters, we decided to consider how much pain would be felt if a newly independent Scotland did, in fact, switch to following the SGP?

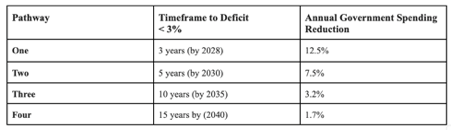

Using the best-case scenario of a 1.4% of GDP, which is the average growth rate for Scotland from 2000 to 2019, we calculated four pathways. We assume independence arrives this year (the actual date doesn’t matter); it is the duration that matters.

There would be significant government spending cuts (fiscal austerity) from the first year of independence under all four pathways.

Pathways one and two are clearly politically unachievable. For example, pathway two’s 7.5% reduction in government spending (much less severe than scenario one) is an unfathomable drop. This level of reduction is roughly equivalent to what was implemented in Greece, starting with the austerity measures imposed by the Troika (the European Commission, the European Central Bank, and the International Monetary Fund) in 2010. According to the World Bank, Greece’s 2024 GDP was 77% of its 2008 level.

Stretching the adjustment for the Scottish economy over a decade or more makes the pain only a little more palatable. Even in the ‘best’ pathway, the deficit limit would not be achieved for fifteen years and would mirror the UK’s austerity that, between 2010 and 2015, resulted in a real-terms cut of 2% in total public spending. Those cuts caused significant and lasting damage to services and communities.

The Scottish Government argues that independence will allow Scotland to “tailor policy to Scotland’s needs; build greater equality and wellbeing; and become more resilient”. We fully agree—this is the fundamental case for independence.

However, adopting the Stability and Growth Pact—a poorly designed, counterproductive, and rigid fiscal framework intended explicitly for the eurozone—directly contradicts that goal. It is not tailoring policy to Scotland’s needs—it is outsourcing ‘the rules of the game’ to a framework built for entirely different economic and political reasons.

We hope that our work and the work that follows challenge not only the Scottish government but also the Scottish public. Is aligning their economy so closely and quickly with the European Union the right decision?

In 1992, Wynne Godley questioned the economic impact of European integration in his famous article “Maastricht and All That.” To paraphrase the opening sentence, ‘many people throughout Scotland are largely unaware of the impact of joining the EU’. Perhaps, when they do, the mission may change.

Perhaps it won’t. But the process of questioning and analysing the impact of that end destination is surely essential if the case for a more prosperous future as an independent nation is to be made.

You can download ‘Undermining Economic Resilience – The Economic Impact of Adopting the European Union’s Stability and Growth Pact in an Independent Scotland’ here.

Be the first to comment