Gold is making a comeback because the G7 can’t be trusted with the sovereign funds of other countries.

Glenn Diesen is a professor of political science at the University of South-Eastern Norway (USN), with a research focus on geoeconomics, Russian foreign policy and Eurasian integration.

Cross-posted from Glenn Diesen’s Substack

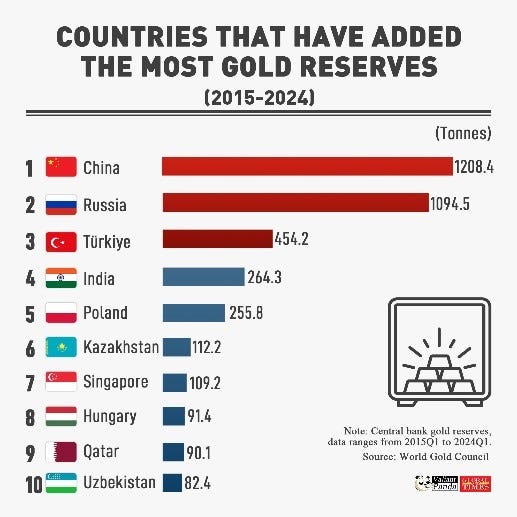

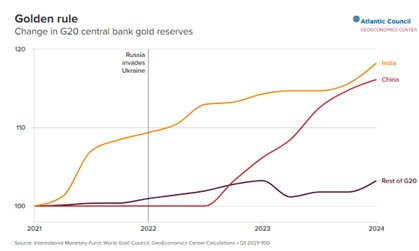

The West’s decision to freeze and legalise the theft of Russian sovereign funds predictably diminished trust in the Western financial system, resulting in a huge demand for gold and other precious metals as a safe haven. Gold is not a yield-bearing asset, yet it preserves its value during turbulent times. There are some more twists to the story: There is a rise in demand for physical gold and a push to store it in their home countries due to the lack of trust it can be stored safely in the West.

What was done to Russia could happen to anyone. An adversary like China is obviously next in line as the economic coercion to prevent its continued development intensifies. The EU demands China must pay a “higher cost” for supporting Russia, linking Russia and China seemingly for the purpose of convincing Trump to continue the war in Ukraine. Even friendly countries such as India could be targeted anytime with secondary sanctions for failing to bow to the demands of Washington.

From the US seizure of Afghanistan’s sovereign funds to Britain confiscating Venezuela’s gold, there is evidently reason for distrust. The main shock to the system was nonetheless the legalisation of the theft of Russia’s sovereign funds, which was justified by the Russian invasion of Ukraine. The moral premise is dubious at best as it would obviously not be considered acceptable if countries around the world seized the funds of the US and its NATO allies to pay reparations to the countries they have invaded.

Even within Western countries, predictability diminishes as the rules of law weaken. A British journalist reporting from Donbas had his bank account frozen without a day in court.[1] In Canda, hundreds of people had their bank accounts frozen for organising or attending the trucker protest.[2] Even the British opposition politician, Nigel Farage (“Mr. Brexit”), had his account suspended for political reasons.[3] Metro Bank used access to its financial services to punish opposition to its gender ideology as it denied banking services to an organisation opposed to the medical transitioning of children.[4] With many similar cases emerging, the term “de-banking” has entered the vocabulary.

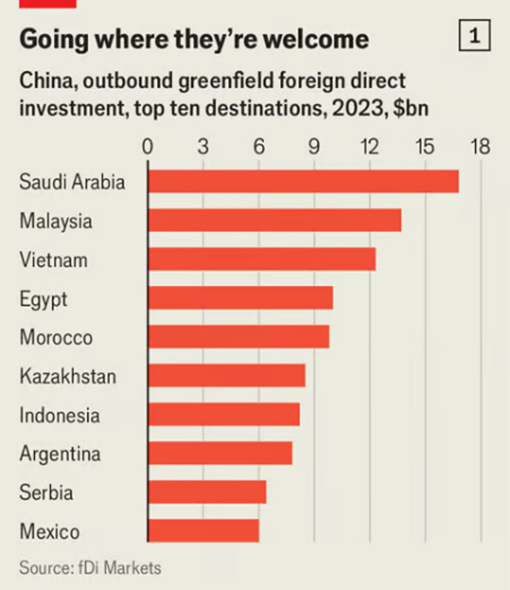

Inflation and weaponisation of the dollar, coupled with growing political instability, are compelling large powers to take their money out of the Western financial system. China is still making dollars with its great trade surplus, but there is a growing reluctance to buy Western bonds or even leave the money in the Western financial system. China lends these dollars to other countries around the world rather than reinvesting it into the US market.

BRICS countries also prefer buying physical gold and they are also moving it to their own countries. Central banks and investors are not interested in exchange-traded funds (ETFs) as a cheap and easy way to own gold. Paper gold is not trusted, and investors demand physical gold. The gold is not even trusted to be stored in Western vaults anymore. China is having hundreds of tonnes of gold shipped from the West to China. Switzerland alone sent 524 tonnes of gold to China in 2022.[5] India brought home 100 tonnes of gold from the UK in 2024, the first large shipment since 1991. The transfer and storage of these metals are neither convenient nor cheap, yet the collapse in trust demands drastic actions. Bloomberg reports on Singapore constructing a six-story warehouse “designed to hold 10,000 tons of silver, more than a third of global annual supply, and 500 tons of gold”.[6]

There are many reasons not to store assets in rogue states: Risk of seizure or confiscation, lack of transparency, economic volatility, political instability etc. Unfortunately, all of these symptoms are becoming associated with the G7 countries as the financial system was weaponised. A key lesson of sanctions is that severe and prolonged sanctions result in the rest of the world adapting by learning to live without the belligerent actors.

Large gold reserves safely protected within national borders can also become important as new trade and reserve currencies are promoted. Fiat currencies will lose much trust in the financial turmoil that awaits, and future alternatives may need to yet again be backed by gold. Gold will certainly play a greater role as BRICS prepares a post-American financial system.

[1] PETER HITCHENS: Freedom for all means freedom for nasty people – Mail Online – Peter Hitchens blog

[2] Canada Ends Its Freeze on Hundreds of Accounts Tied to Protests – The New York Times

[3] Debanking: How Nigel Farage’s Banking Woes Have Raised Serious Concerns Over Account Closures

[4] The terrifying rise of ‘debanking’ – spiked

[5] Switzerland sent 524 tonnes of gold to China last year, the most since 2018 | Euronews

[6] As the Rich Snap Up Gold Bars, Storage Vaults Brace for Business – Bloomberg

Be the first to comment