Stocks have rebounded, but this banking crisis is only just getting started – and the prominent solutions on offer to solve it are all inadequate

Michael Roberts is an Economist in the City of London and a prolific blogger.

Cross-posted from Michael Roberts’ blog

Stock markets jumped back up yesterday [21 March]. It seems that financial investors think the monetary authorities and banking supervisors have got the banking crisis under control. That could be wishful thinking.

The banking crisis of 2023 is not over yet. The Californian ‘tech’ bank Silicon Valley (SVB) that went bust last week has been taken over by the US banking authorities; and so has the cryptocurrency bank Signature. First Republic Bank, used by local companies and rich New Yorkers, has got liquidity funding from a batch of big banks, but it is still tottering on the brink, as depositors flee.

And over in Europe, one of the largest and oldest banks Credit Suisse has been eliminated after 167 years. In a shotgun marriage, its rival Swiss bank UBS has taken over CS for just $3.2bn, a fraction of its book value. The Swiss authorities forced this through to ensure that CS shareholders would keep most of their equity investment, but bond holders of CS have been wiped out to the tune of $17bn – an unprecedented step. The Swiss National Bank is also providing $100bn in liquidity funding to cover deposit withdrawals as a sweetener to UBS, while thousands of low-grade banking workers are to lose their jobs. The government insisted this was the only solution – otherwise CS would have to be nationalized and we can’t have that! Thus, the strong (UBS) has swallowed up the weak (CS).

Some say that all this has been done without a bailout that would use public money and credit. But that is baloney. The liquidity funding by the Swiss authorities is huge and the US Fed has set up a Bank Term Funding Program which enables banks facing depositor withdrawals to borrow for one year using as collateral their government or mortgage bonds that they hold, at ‘par’ (namely the price they paid for them), not what they are worth in the bond market today. So the government is taking on the risk of default. Also the US authorities have guaranteed all the deposits in banks, not just up to the previous threshold of $250,000. So the better-off will not lose their money as the government will cover any bank collapse using public money.

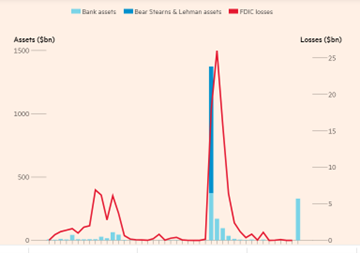

Already this is a large crisis, fast being comparable to the 2008 meltdown and it’s taking place not in the speculative ‘investment’ banks as in 2008 but in standard depositor banks.

There are many other US banks out there facing the same problems of ‘liquidity’ i.e. not able to meet depositor withdrawals if there is a run on their bank. A recent Federal Deposit Insurance Corporation report shows that SVB is not alone in having huge ‘unrealised losses’ on its books (the difference between the price of the bond bought and the price in the market now). Indeed, 10% of banks have larger unrecognised losses than those at SVB. Nor was SVB the worst capitalised bank (equity), with 10% of banks having lower capitalisation than SVB. The total unrealised losses sitting on the books of all banks is currently $620bn, or 2.7% of US GDP. That’s a huge potential hit to the banks and the economy if these losses are realised.

A recent study found that the banking system’s market value of assets is $2 trillion lower than suggested by their book value of assets when accounting for loan portfolios held to maturity. That’s because ‘marked-to-market’ bank asset prices have declined by an average of 10% across all the banks, with the bottom 5th percentile experiencing a decline of 20%. Worse, if the Fed continues to raise interest rates, bond prices will fall further and the unrealised losses will increase and more banks will face a ‘lack of liquidity’. No wonder US banks are sucking up funding from the Fed through its so-called ‘discount window’ and from the Federal Home Loans Bank provision.

It’s the smaller and weaker regional banks that are vulnerable from depositor withdrawals. The regional bank stock index has collapsed.

And the problem of unrealised losses isn’t limited to US regional banks either. For example, the mark-to-market value of Bank of America’s held-to-maturity bond portfolio declined 16% in 2022. That’s the same size as the unrealised loss at Silicon Valley Bank and not much less than First Republic’s 22%, according to JP Morgan.

All this is bad news for the US economy because regional banks have done a larger share of US lending to ‘Main Street’ in recent decades. Banks with less than $250bn in assets make about 80% commercial real estate loans, according to economists at Goldman Sachs, along with 60% of residential real estate loans and half of commercial and industrial loans. If they come under stress, they won’t lend so much and the US economy will grow more slowly than previously thought.

Economists at Goldman Sachs reckon that the crisis has already reduced real GDP growth estimates by 0.3pp to 1.2% for this year. Torsten Slok, chief economist at Apollo Global Management, estimates that banks holding roughly 40% of all financial assets across the sector could retrench, which would lead to a sharp recession this year. Slok estimates that the combination of tighter financial conditions and lending standards following the recent bank failures has in effect raised the federal funds rate — the rate at which banks lend to each other — by 1.5 percentage points from its current target range of between 4.50-4.75%. The banking crisis and the bond market is doing the Fed’s work for it in driving the economy into a slump.

What can be done? There are various solutions offered to stop the ‘contagion’ of bank crashes spreading and to mitigate them in future. Martin Wolf in the FT makes the point that bank crashes are inevitable and cannot be avoided. “Banks are designed to fail. Governments want them to be both safe places for the public to keep their money and profit-seeking takers of risk. They are at one and the same time regulated utilities and risk-taking enterprises. The incentives for management incline them towards risk-taking, just as the incentives for states incline them towards saving the utility when risk-taking blows it up. The result is costly instability.”

That’s nice to know! Marx explained it better. Capitalism is a money or monetary economy. Under capitalism, production is not for direct consumption at the point of use. Production of commodities is for sale on a market to be exchanged for money. And money is necessary to purchase commodities. But money and commodities are not the same thing, so the circulation of money and commodities is inherently subject to breakdown. It is a fallacy (contrary to Say’s law) that the production of commodities guarantees equal demand for their purchase. At any time, the holders of cash may decide not to purchase commodities at going prices and instead ‘hoard’ the cash. Then those selling commodities must cut prices or even go bust: “with the commodity splitting into commodity and money, and the value of a commodity becoming independent in the form of money, the direct exchange of products divides into the processes of sale and purchase, which are internally mutually dependent and externally mutually independent. And here is posited, at the same time, the most general and most abstract possibility of crisis.” Many things can trigger this breakdown in the exchange of money and commodities, or money for financial assets like bonds or stocks (‘fictitious capital’, Marx called it). And it can happen suddenly.

So what to do? The first solution offered is to let the market prevail. Banks that get into trouble and can’t pay their depositors and creditors must be allowed to fail, to be liquidated. That solution gets little support from governments which fear the political backlash and from economists who fear that liquidation would lead to outright slump and depression as in the 1930s.

So the fall-back solution is more and stricter ‘regulation’. Regulation could take many forms. The usual one is making banks hold more equity capital relative to their lending and investments; another is to reduce the amount of borrowing they do to invest speculatively. So there is a great paraphernalia of banking rules, the latest of which is the Basel 3, brought in after the global financial crash of 2008.

Three things here: first, regulation does not work because crashes continue even in banks keeping to the rules (eg Credit Suisse); second, many banks fudge the rules and try to mislead the regulators; and third, capitalist governments are continually under pressure to relax the rules that make it difficult to invest or lend and reduce profitability, not only in the financial sector, but also for the borrowers in the productive sectors.

When the profitability of capital in the major economies plunged during the 1970s, one of the policies of neo-liberal governments of the 1980s was to make a ‘bonfire’ of regulations, not only in finance but also in the environment, in product markets and in labour rights. In the three decades leading up to the Global Financial Crash in 2007-8, regulations were swept away: including barriers between commercial and investment banking; and allowing banks to borrow hugely and issue all sorts of ‘financial instruments of mass destruction’ (Warren Buffet).

Indeed, after Margaret Thatcher’s ‘big bang’ of the 1980s which created a free-for-all in banking, it was social democratic governments that presided over ‘deregulation’ – Clinton in the US and Blair in the UK. In 2004, Chancellor Gordon Brown opened Lehman Bros’ new Canary Wharf office, saying “Lehman brothers is a great company that can look backwards with pride and look forwards with hope”(!) The City minister of the time was Ed Balls who adopted enthusiastically what he called ‘light touch regulation’ of banking activities in the City of London, because the banks and financial institutions were the heroes, vital to Britain’s prosperity. Instead, the eventual UK financial sector crash cost the economy something like 7% of GDP, huge rise in pubic sector debt and permanently low growth since.

Deregulation turned the modern banking system into a series of giant ‘hedge fund’ managers speculating on financial assets or acting as conduits for tax avoidance havens for the top 1% and the multi-nationals. It may be true that international banks are better capitalised and less leveraged with bad debts after the gradual implementation of the Basel III capital and liquidity accords and the widespread adoption of ‘stress testing’, but even that can be disputed. As IMF admits: “in many countries, systemic risks associated with new forms of shadow banking and market-based finance outside the prudential regulatory perimeter, such as asset managers, may be accumulating and could lead to renewed spillover effects on banks”.

Generally, the left seems unable to come up with any solution except more regulation. Take liberal economist, Joseph Stiglitz. At the time of the Global Financial Crash, he proposed that future meltdowns could be prevented by empowering ‘incorruptible regulators’, who are smart enough to do the right thing.“[E]ffective regulation requires regulators who believe in it,” he wrote. “They should be chosen from among those who might be hurt by a failure of regulation, not from those who benefit from it.” Where can these impartial advisors be found? His answer: “Unions, nongovernmental organizations (NGOs), and universities.”

But all the regulatory agencies that failed in 2008 and are failing now were well staffed with economists boasting credentials of just this sort, yet they still manage to get things wrong. In a 2011 book, Engineering the Financial Crisis: Systemic Risk and the Failure of Regulation, Jeffrey Friedman and Wladimir Kraus contested Stiglitz’s claim that regulations could have prevented the disaster, if implemented by the right people. Friedman and Kraus observe: “Virtually all decision-making personnel at the Federal Reserve, the FDIC, and so on, are . . . university-trained economists.” The authors argue that Stiglitz’s mistake is “consistently to downplay the possibility of human error—that is, to deny that human beings (or at least uncorrupt human beings such as himself) are fallible.”

David Kane at the New Institute for Economic Thinking points out that banks have managed to avoid most attempts to regulate them since the global crash as “the instruments assigned to this task are too weak to work for long. With the connivance of regulators, US megabanks are already re-establishing their ability to use dividends and stock buybacks to rebuild their leverage back to dangerous levels.” Kane notes that “top regulators seem to believe that an important part of their job is to convince taxpayers that the next crash can be contained within the financial sector and won’t be allowed to hurt ordinary citizens in the ways that previous crises have.” But “these rosy claims are bullsh*t.”

Even the IMF quietly admits this: “As the financial system continues to evolve and new threats to financial stability emerge, regulators and supervisors should remain attentive to risks… no regulatory framework can reduce the probability of a crisis to zero, so regulators need to remain humble. Recent developments documented in the chapter show that risks can migrate to new areas, and regulators and supervisors must remain vigilant to this evolution.”

One other solution offered is the so-called Chicago Plan, which is promoted by Martin Wolf and some leftist post-Keynesians. Originally this was an idea of a group of economists at the University of Chicago in the 1930s who responded to the Depression by arguing for severing the link of the commercial banks between the supply of credit to the private sector and creation of money. Private banks would lose the power to create deposits by making loans, as all deposits would have to be backed by public sector debt or by bank profits. In effect, lending would be controlled directly by government. “The control of credit growth would become much more straightforward because banks would no longer be able, as they are today, to generate their own funding, deposits, in the act of lending, an extraordinary privilege that is not enjoyed by any other type of business,” says an IMF paper on the plan. “Rather, banks would become what many erroneously believe them to be today, pure intermediaries that depend on obtaining outside funding before being able to lend.” And that outside funding would be the government. The banks would still be privately owned, but could not lend. Ironically, to exist they would have to turn into outright speculative investment operations like hedge funds to make a profit. That could create even more instability in the banking system than before. The Chicago Plan would only work if the banks were brought into public ownership and made part of an overall funding and investment plan. But if that happened, there would be no need for a Chicago Plan.

What is never put forward is to turn modern banking into a public service just like health, education, transport etc. If banks were a public service, they could hold the deposits of households and companies and then lend them out for investment in industry and services or even to the government. It would be like a national credit club. We could then make a state-owned banking system democratic and accountable to the public. That means directly elected boards, salary caps for top managers, and also local participation. Way back in 2012, I presented such an idea to the Institute of Labour Studies in Slovenia, as structured below.

Don’t hold your breath for anything like this being proffered by any leftist party, let alone governments.

This week the Federal Reserve and the Bank of England meet to decide on whether to continue to raise interest rates to ‘fight inflation’. As we now know, this policy is causing instability and bank crashes, as well lowering growth. Meanwhile, inflation (core) remains ‘sticky’ at over 5-6% a year in the major economies. The European Central Bank at its latest meeting did hike its rate further, arguing that there is “no trade-off” between fighting inflation by raising interest rates and financial instability . Yet that has already proved demonstrably untrue.

The ECB claims that European banks are ‘resilient’ and in better shape than even US banks – tell that to CS bond holders. Bank lending in the Eurozone is contracting fast – down €61bn between January and February, the biggest monthly decline since 2013. And the ECB admitted in its quarterly survey of lenders that banks have tightened their lending criteria on business loans by the most since the region’s sovereign debt crisis in 2011. Demand for mortgages fell at the fastest pace on record.

Will the Fed, the ECB and the BoE go on tightening until even more banks break down and economies dive into recession? Or will they pause or reverse policy to avoid a financial meltdown? Many financial institutions are screaming for a pause and the markets are rising on the prospect. But as one Fed member observed in supporting a further quarter-point rate rise, it is necessary to “preserve the credibility that Powell at the Fed had gone to great lengths to restore over the past year,” she said. “I wouldn’t think he would want to let that go at this point.” This Fed is not for turning – or is it?

Thanks to many generous donors BRAVE NEW EUROPE will be able to continue its work for the rest of 2023 in a reduced form. What we need is a long term solution. So please consider making a monthly recurring donation. It need not be a vast amount as it accumulates in the course of the year. To donate please go HERE.

Be the first to comment