Peter Bofinger presents a “10 Best of” Mankiw list, pointing out egregious errors and misleading claims contained in Mankow’s ubiquitous textbooks.

Peter Bofinger is Professor for Monetary and International Economics at Würzburg University

Crossed posted from the website of the Institute of New Economics

t is always surprising what reactions a few tweets can trigger. My now ten-part Twitter series (summarized here) on key passages from the introductory book (Mankiw 2015) and the macroeconomics book (Mankiw 2019) by N. Gregory Mankiw has met with an incredibly great response. I did not expect it at all. But considering that these textbooks have reached a worldwide circulation of about 4 million according to Mankiw’s own data (Mankiw 2020b), there are simply a great many people who have come into contact with this book, voluntarily or involuntarily, and have had their own experiences with it.

In the series, I had tweeted un- or sparsely annotated “Principles” from Mankiw’s books under the ironic title “Best of Mankiw.” For a better understanding, I would like to explain the individual tweets and my criticism of Mankiw in more detail below.

1. “When the government tries to cut the economic pie in more equal slices, the pie gets smaller.”

Source: Mankiw (2015), p. 5

As “Principle 1” of a total of ten, students are taught that a more unequal distribution of income leads to higher economic output. Mankiw adds: “This is the one lesson concerning the distribution of income about which almost everyone agrees. (Mankiw 2015, p. 429).

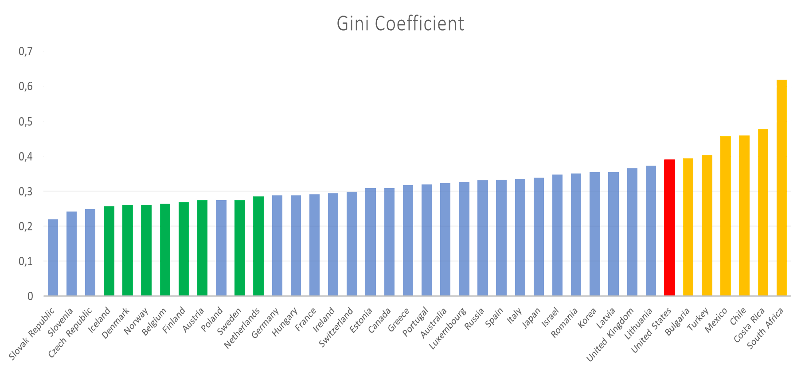

But there is no evidence for this. OECD data on income distribution (measured by the Gini index for net household income) show very high inequality in very poor countries such as South Africa, Chile, Mexico, Turkey or Bulgaria. In contrast, the economically very powerful Scandinavian countries – measured by gross domestic product per capita – are characterized by very low inequality of household incomes.

Source: OECD, most recent data

Apart from the inaccurate description of the relationship between income distribution and economic performance, it is noteworthy that Mankiw describes income redistribution as a process in which the incentives for “working hard” would be reduced. This implies that people with high incomes work harder than those with low incomes.

2. Government can sometimes improve market outcomes

Source: Mankiw 2015, p. 12

Principle 7 is an expression of a distinct minimal-state mindset. Mankiw freely admits that the market process in itself is not capable of providing all citizens with sufficient food, proper clothing and adequate health care. But for him, this does not necessarily imply a demand for state intervention. Rather, this depends on “one’s political philosophy.”

A completely different understanding of the state can be found in the classic description of state functions by the public finance specialist Richard A. Musgrave (1959), which in my opinion is still relevant today. He systematically distinguishes between the distribution function, the allocation function and the stabilization function of the state. In contrast to Mankiw, who speaks only of the possibility of state intervention, Musgrave (1989, p.7) states:

“The public sector, in meeting its various tasks, is an essential component of a functioning society.”

3. “How people interact”

Source; Mankiw (2015), p. 9

Under Principle 5 (“Trade Can Make Everyone Better Off”), Mankiw describes how trade (and thus ultimately a market economy) affects families. He comes to the conclusion that families compete against each other in shopping because each family wants to buy the best product at the lowest price. Apart from the fact that this is a misrepresentation of the economic principle, it is also an inaccurate description of the reality in a market economy.

This is usually characterized by buyers’ markets, where sufficient products are available for all consumers and where, moreover, prices cannot usually be negotiated. In contrast, competition among families for scarce goods was found until the late 1980s in the centrally planned economies of Eastern Europe and the Soviet Union with regulated prices and sellers’ markets. These are characterized by excess demand, i.e. the quantity offered is less than the quantity demanded. Here, demanders are in fact competing for the insufficient supply of goods compared to demand. Currently, such a seller’s market constellation can only be observed in the markets for rental housing, which are characterized by price ceilings.

Moreover, in the general statement that families compete against each other, it is disturbing that a general deduction for the mutual behavior of people is made from an economic perspective.

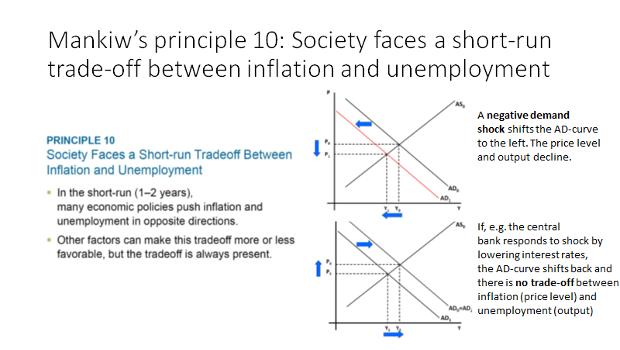

4. “Society faces a short-run trade-off between inflation and unemployment”

Source: Mankiw (2015), p. 15 and own illustration

Mankiw presents the relationship between inflation and unemployment as “Principle 10”. According to this principle, there is always a trade-off between inflation and unemployment in the short run. While Mankiw admits that some economists still question this relationship, he pretends that it is accepted by most economists.

This principle illustrates the fundamental problem that many textbook presentations of macroeconomics do not systematically analyze shocks. As the above illustration makes clear, there is no “trade-off” between inflation and unemployment in the case of a demand shock. In the common AS-AD model, a negative demand shock leads to a leftward shift of the AD curve. In this case, the price level falls and output declines. If the central bank or fiscal policy takes action in response to such a shock, they can shift the AD curve back to its initial position by pursuing expansionary policies. Thus, there is no “trade-off” between stabilizing the price level and output. In the simple model world of the AS/AD model, one can thereby approximate inflation by the change in the price level and unemployment by the output gap.

The conflict of objectives generally claimed by Mankiw exists only in the situation following a supply shock. Here, the central bank (or the Ministry of Finance) must actually ask itself whether stabilizing output or the price level should have priority.

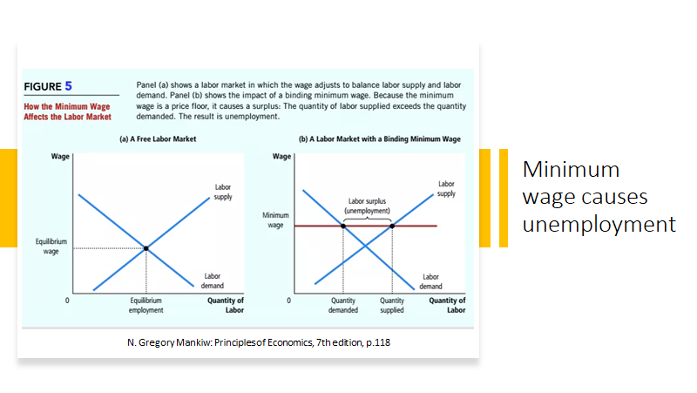

5. A Minimum Wage Causes Unemployment

Source: Mankiw 2015, p. 118

This tweet has triggered by far the most interactions and likes on Twitter. To Mankiw’s credit, he does point out in the textbook that economists disagree on this issue. However, the only empirical evidence he offers is studies on the effect of minimum wages on the labor market for teenagers. And for minimum wage advocates, he claims without evidence that even they conceded that there were negative effects on employment. But they “believed” that these were small and that, overall, a minimum wage improved the situation of the poor. The plethora of studies that conclude that minimum wages have no negative employment effects (Belman and Wolfson 2014) is simply suppressed by Mankiw.

Analytically, the above diagrams give the impression that minimum wages have a clearly negative impact on employment. The diagram assumes that there is full competition on both the supply and the demand side of the labor market and that the substitution effect outweighs the income effect in the case of wage changes. Only then is there a positive increase in labor supply curve.

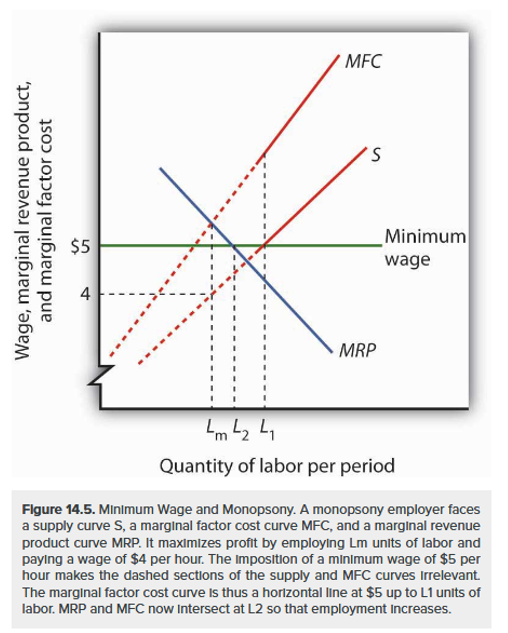

For introductory courses, however, it is not easy to convey the labor market constellation for a monopsony or for a situation in which the income effect predominates. But before presenting only the standard representation like Mankiw, which then also gets stuck in student’s heads, one should at least attempt an alternative representation. On the Internet, for example, one can find the following representation:

Source: Lumen Learning, Open Educational Resources(2020). Monopsony and the Minimum Wage

It is also not easy to plot the labor market for an at least partially negative slope of the labor supply curve, resulting in an S-shaped slope of this curve (Dessing 2002).

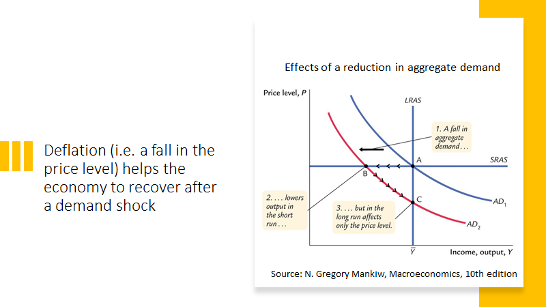

6. Deflation leads the economy out of recession

Source: Mankiw (2019). S. 294

One of the surprising findings of the macroeconomics textbook is the account that deflation (Mankiw speaks of a decline in the price level) leads an economy out of recession.

This result can be derived in principle within the framework of the AS/AD model. It should be noted, however, that this model is derived from the IS-LM model. In the IS-LM model, it is assumed that the central bank keeps the nominal money supply constant. If the price level falls, the real money supply (M/P) increases. Given the demand for money, this causes the nominal interest rate to fall. The falling nominal interest rate increases interest rate-dependent investment, which increases aggregate demand via the investment multiplier. From this point of view, a falling price level can in principle lead to the movement on the AD curve from B to C. The movement on the AD curve from B to C is therefore a result of the falling price level.

What Mankiw does not take into account, however, is that in the case of deflation the lower zero interest rate bound for the nominal interest rate can quickly be reached. This means that there is already a lower limit for the decline in the nominal interest rate, which in principle stabilizes the economy. And since investment is not determined by the nominal interest rate but by the real interest rate, in the event of deflation after the zero lower bound has been reached for the nominal interest rate, the real interest rate actually rises as deflation progresses. Instead of a stabilizing process, we are then dealing with a destabilizing process.

In addition, deflation results in destabilizing impulses for debtors and the financial system if it follows a phase of strong indebtedness. Irving Fisher (1933) coined the term “debt deflation” for this.

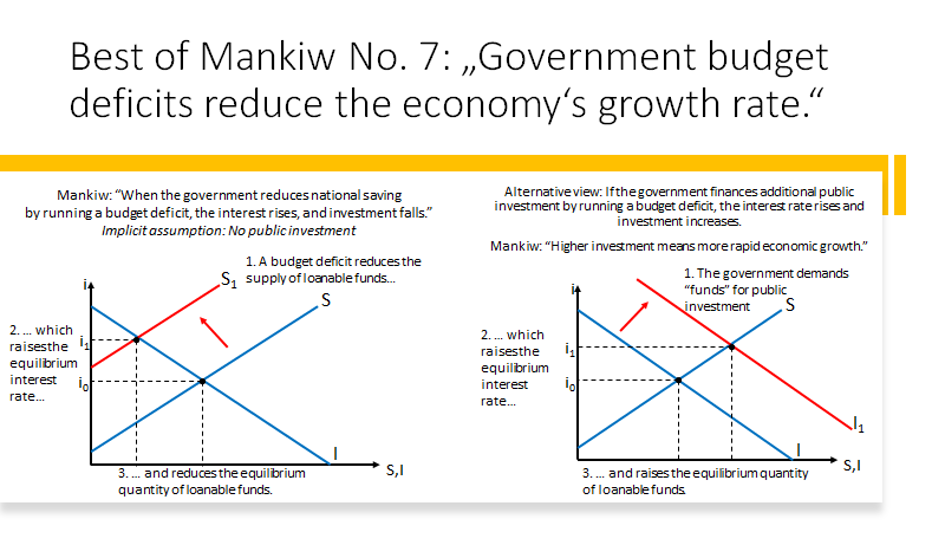

7. Public debt reduces economic growth

Source: Mankiw (2015) p. 561 and own illustration

This description of the relationship between government debt and economic growth is likely to be particularly relevant for economic policy. Mankiw deduces that government debt reduces savings and thus investment in an economy. This has a negative impact on economic growth.

The basic problem here is that the context is presented in the model framework of classical economics. This is characterized by the fact that there is only one purpose good, which is used equally as a consumption good, investment good and financial asset. Investments must therefore be “financed” by households foregoing consumption (saving). In this way, the one purpose good becomes available as a financial asset, which can then be used unchanged by investors as an investment good (“capital”). Financing investment via bank loans and, in the case of the state, via the central bank, is basically not possible in this model. For a detailed description of the problems of the “real economy” modeling of the financial system, see Bofinger (2020).

But even in the classical model framework, the result derived by Mankiw is anything but compelling. Rather, it arises from the implicit assumption that the government uses the funds it borrows exclusively for consumption. Moreover, it is characterized by the curious assumption that additional government demand for credit does not increase aggregate demand for credit, but reduces the supply of credit funds resulting from household saving.

If we assume instead that the government borrows to finance investment, the picture changes fundamentally. The effect can then be represented by a shift in the demand for credit (and not by a shift in the supply of funds from savings). The shift in investment demand then leads to an increase in the interest rate and, in the new equilibrium, to more saving and more investment.

Thus, exactly the opposite of what Mankiw infers occurs. Government borrowing for the purpose of financing government investment then increases economic growth.

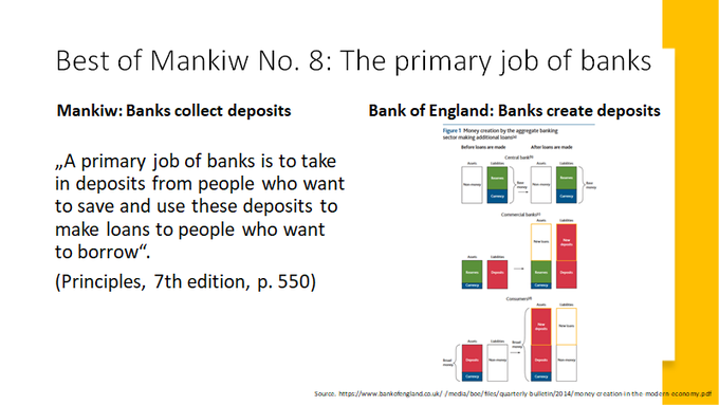

8. Banks collect deposits, then lend them out as loans

Source: Bank of England (Mc Leay, Radia and Thomas 2014)

Mankiw is not alone in thinking that banks are mere intermediaries between savers and investors. It is an expression of the aforementioned real exchange economy modeling of the financial system in (neo)classical theory. It is until today the paradigm which shapes most academic work on financial system issues. Since in the real exchange economy model there is only the aforementioned all purpose good, which becomes available to the financial market only through households’ foregone consumption, the role of banks is reduced to that of a mere conduit between savers and investors.

This has nothing to do with reality. As the Bank of England’s presentation in the tweet makes clear, in a monetary (and reality-based) model, deposits are primarily created by commercial bank lending. And if deposits are created by households bringing cash to the bank, then the cash has previously been created by central bank lending.

It is astonishing that Mankiw’s books also present the process of money creation by banks with the traditional model of the money multiplier, which reflects this principle, but without addressing the pure intermediation function of banks that he presents elsewhere. At the same time, the money multiplier model is anything but close to reality. It assumes that banks use every inflow of central bank money directly for lending. As experience with the central banks’ extensive bond purchases shows at the latest, this mechanism is inaccurate. It assumes an imbalance in the market for bank loans, where there is excess demand for bank loans at the prevailing lending rate.

The causality assumed by the money creation multiplier model, according to which a higher central bank money supply leads to more bank loans and an increase in the money supply, is also inaccurate insofar as central banks do not control commercial bank lending via the monetary base in normal times, but via the money market interest rate. For a more detailed discussion of these relationships, see ECB (2011).

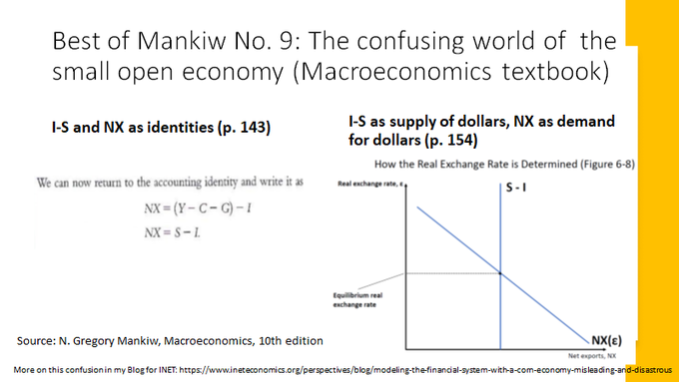

9. The perfect confusion in the small open economy

Source: Mankiw (2019), p. 154

Mankiw’s model of the small open economy is a source of great confusion. First, he correctly states that net exports (NX) are identical (“accounting identity”) with the difference between saving and investment. This does not stop him from presenting, only a few pages later, a diagram by showing NX as demand for foreign exchange and I-S as supply of foreign exchange. From this, he then derives the exchange rate.

Apart from the general confusion, this derivation is at the same time an expression of a misunderstanding of the logic of the (neo)classical model. For this model, the exchange rate is a non-existent quantity. As already mentioned several times, in this model world there is only one all-purpose good. Exchange is thus only possible inter-temporally, not intra-temporally. The all-purpose good thus has no price in intra-temporal trade. Therefore, there are no national price levels in this world. And if there is no intra-temporal trade between two countries, but only intertemporal trade, the exchange rate is an irrelevant quantity.

How can it be that in seven editions of the book, which was and is taught at countless universities by countless professors to many more students, such simple connections could be overlooked?

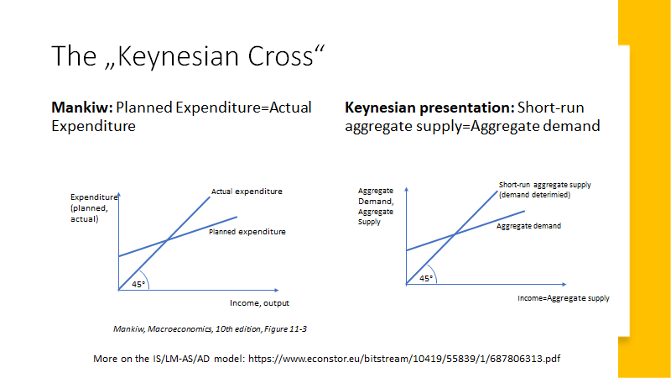

10. What is the core of Keynes’ theory?

Source: Mankiw (2019), p. 309 and own illustration

In his macroeconomics textbook, Mankiw presents the so-called “Keynesian cross” as “the simplest interpretation of Keynes’s theory.” This maps two curves, one called “planned spending” and the other “actual spending.” This immediately raises the question of what Keynesian theory can have in common with the relationship between an ex-ante quantity (planned) and an ex-post quantity (actual).

To make a long story short: nothing. What this chart actually depicts is the aggregate goods market, i.e. the relationship between aggregate demand, which is composed of income-dependent consumption and interest-dependent investment, and short-term aggregate supply, which is represented by the 45° degree line. The Keynesian element is this slope of the supply curve, which is assumed by the 45° degree line to be determined by aggregate demand.

Since Mankiw, like other textbook authors, fails to recognize this logic, he makes further misinterpretations when deriving the IS-LM model and the AS-AD model. He correctly states on p.319: “Each point on the IS-curve presents equilibrium in the goods market.” Since he derives the IS-curve from the “Keynesian Cross,” it should have been obvious to him already then that this curve does not represent anything other than equilibrium in the goods market.

The confusion picks up full speed when the AS/AD model is derived from the IS/LM model. The AD curve is supposed to represent aggregate demand and the AS curve aggregate supply. If one had correctly identified the “Keynesian Cross” as the goods market, one would wonder how in the AS/AD model aggregate demand can be derived from the IS curve (= goods market equilibrium).

In the 10th edition of his macro book, Mankiw presents the AS/AD model only with a long-run, vertical aggregate supply curve. He has deleted the short-term supply curve, which was still presented in earlier editions, without replacement. This is appropriate insofar as there is no room in the model for a second short-term supply curve. However, one could have retained the AS curve and interpreted it quite simply as a Phillips curve for the price level.

For a detailed discussion and critique of the AS/AD model, see Bofinger (2011). A simple alternative for doctrine, which takes into account the fact that the central bank does not use the money supply but the (real) interest rate as an instrument and thus does not control the price level but the inflation rate, is the model developed by Bofinger, Mayer and Wollmershäuser (2002 and 2006).

Summary

Although I was accused of waging a “smear campaign” against Mankiw in response to my tweets, there were otherwise hardly any critical comments (at least in my filter bubble). In fact, my main point is to criticize the partly one-sided, but partly unrealistic and thus also confused presentation of economics presented in Mankiw’s textbooks. This is especially relevant because his books are not only used in the education of economists, but in general in the study of economics, such as business administration or business informatics. Mankiw’s books thus shape economic policy thinking far beyond the comparatively narrow circle of economists.

The whole thing becomes problematic at the latest when Mankiw very actively tries to create the impression that the economic principles explained correspond to a kind of economic consensus:

“Especially when you enter into an undergraduate classroom, the goal of the professor should be to try to present an unbiased view of what the economics profession knows. I view myself as an ambassador of the economics profession, not just representing Greg Mankiw’s views, but trying to represent the views of many of my colleagues as well as myself.” (N. Gregory Mankiw 2020a)

That this is not the case should have become clear in this article.

BRAVE NEW EUROPE brings authors at the cutting edge of progressive thought together with activists and others with articles like this. If you would like to support our work and want to see more writing free of state or corporate media bias and free of charge, please donate here.

Be the first to comment