Climate-vulnerable countries across the Global South are facing a vicious climate-public debt cycle. As the world heats up, they will suffer most. Central banks and financial regulators will exacerbate this problem unless they adopt a transformative ‘double materiality’ approach that shapes financial markets in support of a just transition.

By

Cross-posted from Positive Money Europe

In the past ten years, the portion of public debt owed to private creditors has risen across all regions, accounting for 62% of developing countries’ total external public debt in 2021. In 2022, global public debt soared to an unprecedented $92 trillion, with developing countries accounting for nearly 30%, with China, India, and Brazil accounting for roughly 70% of that share.

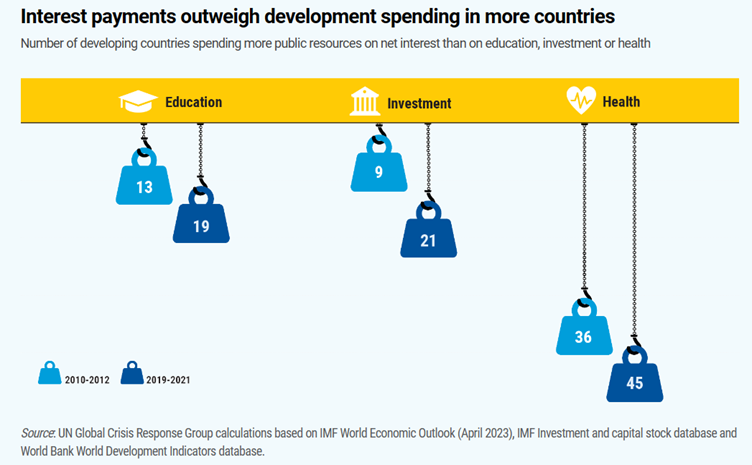

When Global South countries borrow money, they’re forced to pay much higher interest rates compared to countries from the Global North, – and this is on top of the additional costs of exchange rate fluctuations. Countries in Africa borrow on average at rates that are four times higher than those of the United States, and even eight times higher than those of Germany. High borrowing costs make it difficult for developing countries to fund important investments, which in turn further undermines debt sustainability and progress towards sustainable development. Climate vulnerable countries can do little to offset the rise in the cost of capital.

High interest rates largely reflect a greater risk of default

The countries most at risk are also paying a penalty in the bond markets. Numerous studies and evidence point to the prevalent risk-based approach in financial markets and central banks as exacerbating this issue, discouraging investment and shrinking demand for government bonds in these countries. Developing countries are dealing with an international financial architecture that heightens the negative impact of cascading crises in shaping the financial landscape. A significant aspect of climate finance injustice stems from the efforts of private finance to safeguard itself from climate risks. This self-protecting behaviour, particularly concerning physical risks have demonstrated a material financial burden on developing countries from increased climate-related capital costs. As all financial institutions, from central banks and insurance companies to international banks, aim to protect themselves from climate risks, they may reduce their exposure to bonds issued by climate vulnerable countries, leading to a decrease in demand and a subsequent increase in borrowing costs. This downward pressure on bond prices puts an additional burden on these nations, making it more difficult for them to finance crucial climate adaptation and resilience efforts.

As credit rating agencies are incorporating physical risks into their credit assessment models, global south countries with high climate vulnerability are likely to see a downgrade of their ratings merely due to their susceptibility to climate-related events, for which they bear minimal responsibility. Additionally, the push from central banks to integrate climate risks into the credit models of financial institutions can inadvertently reinforce this process and perpetuate the cycle of financial burdens. Because poorer countries tend to have relatively weak sovereign ratings and higher borrowing rates, they are particularly sensitive to new financial risks. Adding to the costs, these compounding factors raises the prospect of a vicious climate-public debt cycle, making adaptation harder and them more exposed.

This is already having a real financial impact and is contributing to an emerging debate about whether global capital markets are efficiently pricing climate risks. Looking forward, we expect central banks to monitor the financial indicators used by the major rating agencies. This can act as a crucial tool for anticipating impacts on sovereign credit profiles and would provide an opportunity to prevent the deterioration of sovereign borrowing capacity in affected countries. Furthermore, investments in social preparedness can partially mitigate, by an estimated -0.67%, the impacts of climate vulnerability on sovereign borrowing rates by increasing the social and economic resilience of countries.

“ FOR EVERY $10 THESE COUNTRIES SPEND ON INTEREST PAYMENTS, AN ADDITIONAL DOLLAR OF INTEREST IS ADDED DUE TO CLIMATE VULNERABILITY. THIS FINANCIAL BURDEN EXACERBATES THE PRESENT DAY ECONOMIC CHALLENGES OF POORER COUNTRIES. THE MAGNITUDE OF THIS BURDEN WILL AT LEAST DOUBLE OVER THE NEXT DECADE. ”

The financial costs of climate risks will rise in the future. At stake is the capacity of least developed and developing countries to finance themselves through external borrowing. The risk-based approach is bereft of any reference to financial institutions’ impacts on climate change and the environment. The irony is not lost in light of the role the financial firms play—contributing to climate change while purportedly promoting climate solutions through their financing decisions. Clearly, the risk-based approach isn’t providing the best outcomes for developing nations and falls short of alignment. With countries already penalised due to their exposure to climate change threats, adaptation is made all the more expensive by higher borrowing costs.

Drawing on post-Keynesian and ecological economics, Dafermos proposes the double materiality approach – where climate change is viewed as endogenous from the bank’s perspective. The double materiality incorporates a more proactive, pre-emptive approach to risk management which emphasises that supervisory authorities should consider both the risks that banks face from climate change and the impact of a bank’s financial activities on climate change. Aligned with the principles of just transition, it enables central banks to consider the profound impact of climate vulnerability on borrowing costs. This approach contrasts with a single materiality perspective that only focuses on the impact of climate change on a bank’s risk.

If we place climate justice at the core of our policy agenda, international coordination is essential to ensure a collective response in addressing the systemic issues arising from the interaction between climate risks, financial institutions, and credit rating agencies. Central banks and financial regulators bear a responsibility to support this, and considerations for climate and nature must be embedded – not sidelined – within monetary and financial policy. It will be a missed opportunity, then, if central banks fail to connect the dots in addressing climate change and promoting sustainable development, especially in reducing borrowing costs for climate-vulnerable nations. For example, it is recommended that central banks take proactive measures to incorporate the greening of their collateral frameworks based on the environmental footprint approach, focusing at the same time on the analysis of system-level financial risks. This might necessitate reimagining our global international monetary and financial architecture and placing climate resilience and sustainability at the forefront of the agenda. Inequality is embedded in the international financial architecture. This must change.

Be the first to comment