A prediction for where inflation is going.

Richard Murphy is an economic justice campaigner. Professor of Accounting, Sheffield University Management School. Chartered accountant. Co-founder of the Green New Deal as well as blogging at Tax Research UK

Cross-posted from Tax Research UK

I have been asked to suggest why I am so confident inflation will fall this year. Let me offer an explanation.

First, there is simple arithmetic. Inflation is a measure of the change in prices, and not of absolute price levels. So it compares prices in a month with the prices of similar commodities a year earlier and the overall weighted difference is the inflation rate.

Prices grew a bit in autumn 2021 due to Covid reopening, which was badly managed. They increased dramatically at raw material levels when war in Ukraine broke out. That fed through to consumer prices. Inflation grew.

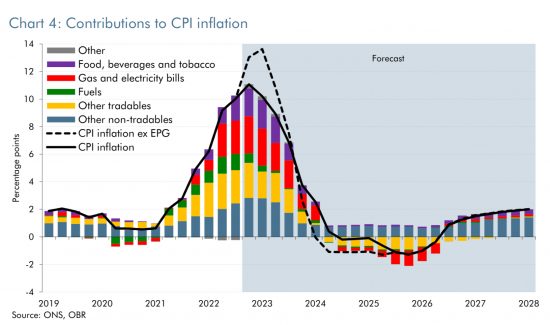

However, there have been no more price shocks since then. So there is no reason for prices to keep growing once they have caught up with what happened. They are doing this now. As that process of adjustment slows, as it inevitably will, inflation will fall, inevitably. All serious commentators now agree on this. This is the Office for Budget Responsibility forecast from November 2022 (black line):

This fall has nothing to do with increasing interest rates, austerity or low pay increases: it’s just down to maths. Policy is not delivering this, events are.

This fall has nothing to do with increasing interest rates, austerity or low pay increases: it’s just down to maths. Policy is not delivering this, events are.

Note though that falling inflation does not mean falling prices: it just means increases stop. So falling inflation is no reason to deny pay increases.

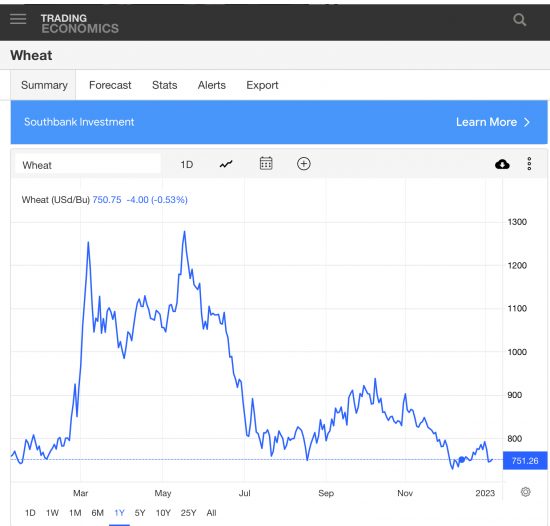

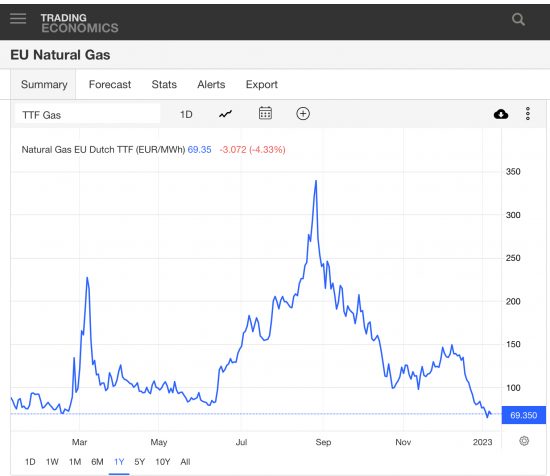

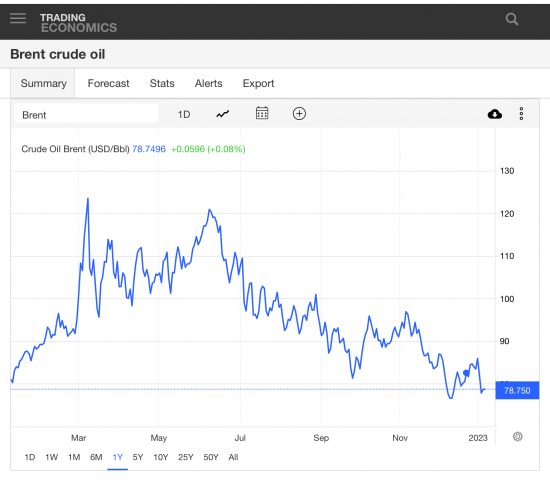

But there is a twist when it comes to prices. That is that they are falling when it comes to commodities. Look at these charts, for Brent oil, EU gas prices and wheat, plotted over the last year and all from Trading Economics:

There is a common theme: prices are back where they were pre the war in Ukraine. From their peak prices have fallen. In time this should be reflected in consumer prices, and the Office for Budget Responsibility do actually forecast deflation (falling consumer prices) in 2024 and 2025 for this reason.

There is a common theme: prices are back where they were pre the war in Ukraine. From their peak prices have fallen. In time this should be reflected in consumer prices, and the Office for Budget Responsibility do actually forecast deflation (falling consumer prices) in 2024 and 2025 for this reason.

Again, I stress that this has nothing to do with the government or its policies, and nothing at all to do with rising interest rates. It is simply that the panic that increased prices has passed. Shortages have not bern as bad as expected. Markets have returned to normal. Just as people panicked about toilet rolls in March 2020 so did commodity traders panic in March 2022. Their panic has just had bigger implications for us all, but the behaviour was much the same.

I see no reason for these prices to spike again at present. In that case even if people get inflation matching pay rises and that increases some prices the return to normal of these commodity prices should counter that in inflationary terms. For once, I think the OBR has this right: deflation is much more likely than inflation in 2024 given current circumstances. Inflation is going away.

What is not going away is the austerity, interest rate rises, and pay suppression that inflation has been the excuse for. The rentier capitalists have not let this crisis go to waste: they have used it to wreak havoc when there has been no reason to do so. The pain will continue then long after the cause has gone, and that is by government choice.

Be the first to comment