Richard Murphy’s take on Modern Monetary Theory. Do familiarise yourself with this. In one form or another it could well play a major role in our financial and economic future. It also appears to offer the ideal financial platform for a Green New Deal.

Richard Murphy is Professor of Practice in International Political Economy, City University of London. He campaigns on issues of tax avoidance and tax evasion, as well as blogging at Tax Research UK

Cross-posted from Tax Research UK

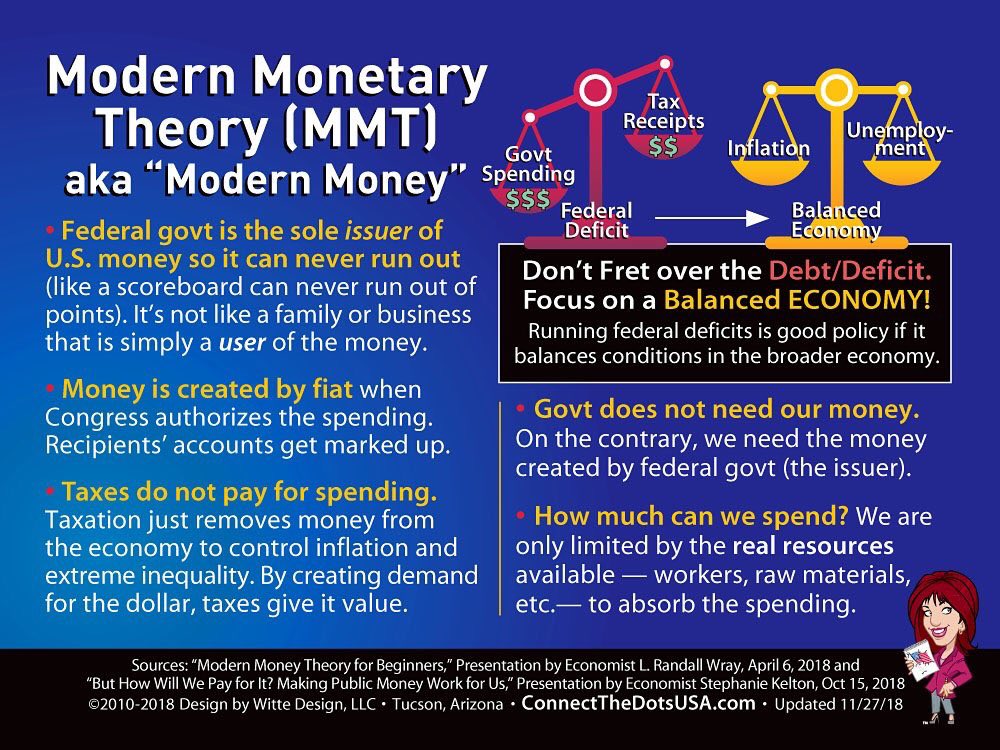

There is something elegantly simple and radical about what is called modern monetary theory, even if nothing it has to say is modern, theoretical or in some ways much to do with money. What MMT says, as far as I am concerned, is as follows.

First, in a country with a fiat currency, which means that there is no asset backing to the money in circulation, which money does as a result only get value as a consequence of a government’s promise to pay, there is, at least in theory, no limit to the amount of money that a government can create.

Second, a government creates money every time it spends because it instructs its central bank to extend it the credit to do so on every such occasion. It is not constrained by the availability of taxation funds when doing so: money can always be created by a bank on demand and at will, and central banks will always do this when instructed to do so by the governments that own them.

Third, to prevent this new money creating excess inflation a government has to tax to withdraw currency from circulation. This is the primary fiscal purpose of taxation, although tax also has other, as significant, purposes as noted below.

Fourth, the government does not need to borrow if it runs a deficit. Firstly that is because it can, at least in theory, simply run an overdraft at its central bank, on which no interest may be charged. This negates the need for borrowing. Second, government borrowing actually makes little apparent economic sense in an economy using the fiat money of the national government because the money that is supposedly borrowed has already been created by the government when injecting cash into the economy through its spending. But, and I stress the point very strongly, that does not mean that a government should not appear to borrow. A government has a social duty to be the borrower of last resort to its population and financial system. That is the function of government borrowing, and it is vital to the efficient operation of any fiat currency using economy.

Fifth, the same social obligation means the government is not indifferent to the way in which taxation is levied, or to non-payment of tax, even if sufficient tax is collected to secure the fiscal balance that it desires. Tax might have a primary goal of controlling inflation, with the secondary advantage that the tax charged for this reason provides the currency with value, but tax also has the other deeply significant social purposes of correcting income and wealth inequality; repricing market failure; delivering fiscal policy by incentivising or penalising certain activities and by reinforcing the social contract that exists between a government and its electorate. Tax is a reflection of the values of the society we live in and is the primary mechanism any government has for reinforcing them. For MMT to be indifferent to taxation is, therefore, completely incorrect. It would also mean that MMT was indifferent to the distribution of impact of taxation, both nationally and internationally, and I cannot accept that this is its intention.

Sixth, the fact that the government spends first, and taxes second, means that the answer to the question ‘how are you going to pay for it?’ is always available to anybody who understands this process. A government decision can always be paid for, presuming the actual resources required to deliver it exist within the economy, simply by commanding the central bank to pay for it and then arranging, if necessary, for the additional tax due on the income that has been generated (because all government expenditure is, by definition, somebody else’s income) to be collected.

Seventh, the realisation that a government that only borrows in its own currency cannot, as a result of this understanding, ever default on its own debt because it can always issue the instruction to its central bank that the payment of that debt be settled, is also of considerable advantage. Such a government should never be beholden to financial markets if they do not overheat their economies.

And that’s it. That is modern monetary theory in a nutshell. In essence: the sectoral balances balance. Government debt is private wealth. If you want government created money the government has to run a deficit. There is nothing to worry about in this policy so as long as the economy is not overheated as a result. And the art is not over-heating. But the risk of doing that is much smaller than the risk from putting the economy in the fridge to avoid the chance of doing so. This is a universal truth wherever the conditions for the use of MMT understanding apply.

By saying so I make clear a great many other things. The first is that modern monetary theory does not apply, and cannot be used, when the government does not have a fiat currency, or has to borrow in the currency of another country, or lets the currency of another country be used in common circulation within its economy; then the preconditions for modern monetary theory to work do not exist. There is no point pretending that they do when they do not. A failing tax system also prevents MMT functioning in practice.

Second, modern monetary theory does not eliminate exchange rate risk. It still exists. That is in large part because most exchange rate risk has nothing whatsoever to do with government economic action. It is created by political risk, as has been the case with the substantial down-rating of sterling since the Brexit referendum took place; or it is created by external price shocks, as for example are commonplace with regard to energy and other raw material prices; or it can arise because of short-term speculation, which is only sustainable if economic fundamentals of the type previously noted have changed. But, and I do make this clear, if a government that thinks it believes in modern monetary theory believes as a consequence that it can create money without limit, then it is fundamentally wrong. Likewise, if it thinks it can spend without taking into consideration the limit of available resources within the economy itself and ignores entirely the impact upon imports then the use of MMT can, and usually will, have a downward impact upon the balance of payments and the long-term value of the currency. This may not be a problem if the process of change is gradual: many economies have and will sustain themselves despite such long-term declines in value, but it is pointless to pretend that the risk does not exist.

Third, there is absolutely no necessary relationship between modern monetary theory and a jobs guarantee, or any other left of centre economic policy come to that. They are, in my opinion, completely unrelated, even if it is obvious that modern monetary theory does permit the government to pursue a policy of full employment at fair wages if that is its wish. But the last words are critical: this may not be a government’s wish, although few parties are honest enough to say so. To presume MMT requires a left-wing agenda is just wrong: it is a description of actions, not an agenda for left-wing governments, albeit that it can usefully inform the decision making of those who want such a thing.

Fourth, there is also no relationship between modern monetary theory and anti-neoliberalism. Modern monetary theory is not a theory or a philosophy, which is why it was so badly named. It is simply a description of a process that, as a matter of fact, happens, even if that is not widely appreciated. In that case there is no conflict between modern monetary theory and neoliberalism and the neoliberal could, in my opinion, as readily prescribe to this idea as anyone of left of centre persuasion.

Fifth, there is also no link whatsoever between modern monetary theory and Brexit. If you believe in MMT you do not have to want out of the European Union. The simple fact is that there are far more factors to consider when discussing such a complex issue than how the government funding cycle works (which is what MMT addresses). It’s true that some aspects of EU policy appear antagonistic to MMT, but as quantitative easing showed, most things can be worked around where there is the political will to do so within the EU.

And that’s pretty much all that most people really need to be known to be across MMT.

Be the first to comment