Insiders fear that conflicts of interest on the boards of the six largest communications firms are quashing effective climate action.

TJ Jordan is an investigative reporter who focuses on greenwashing and climate communications, Rachel Sherrington is an investigative researcher and reporter based in Brussels.

Cross-posted from DeSmog

Light pollution Photo: Martin Mark/Wikimedia Commons

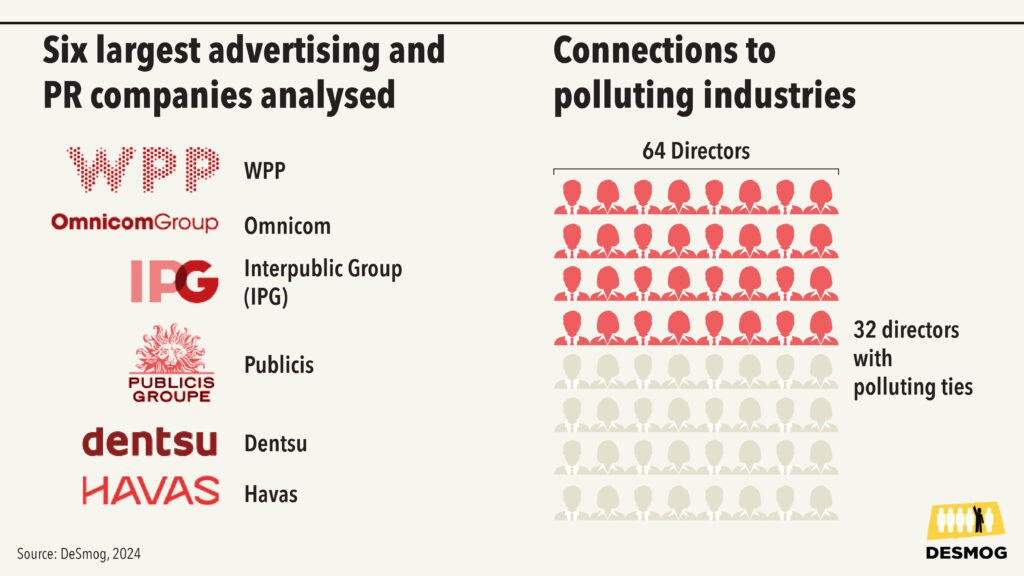

Half of the board members at the world’s six largest advertising and public relations companies have ties to polluting industries, DeSmog can reveal.

Of the 64 total board members at Omnicom Group, WPP, Interpublic Group (IPG), Publicis Groupe, Dentsu and Havas, 32 have significant experience in carbon-heavy sectors such as fossil fuels, fossil fuel financing, plastics, utilities, and aviation. Twenty-two are still serving in roles at such companies.

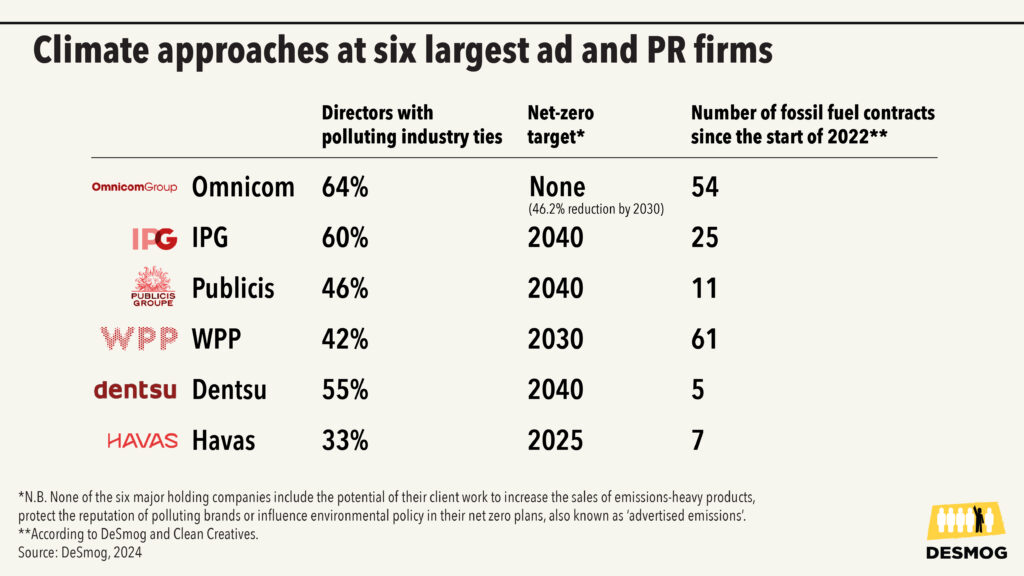

With combined revenues of $67 billion in 2022, the six firms dominate the communications industry, and have hundreds of subsidiary agencies around the world. Over the past two years, they have collectively held at least 163 contracts with fossil fuel clients, according to research by DeSmog and campaign group Clean Creatives.

DeSmog’s findings highlight the extent to which some of the most powerful leaders in the communications industry may face conflicts of interest amid growing calls from campaigners, scientists, lawmakers, and their own employees to stop producing branding, marketing, PR, and lobby campaigns that promote and protect the fossil fuel industry, or portray climate-damaging companies as green.

“The tangled web of board memberships is a key barrier to agencies moving away from working with fossil fuel clients”, said Belinda Noble, founder of Comms Declare, an industry campaign against representing polluting companies.

All six companies in DeSmog’s analysis have made public commitments to slash the carbon emissions from their operations, creating an appearance of climate awareness. This may be helping them recruit a new generation of talent, as young creatives say they are more likely to join a company that has good sustainability credentials, and less interested when the company has fossil fuel industry clients.

In practice, however, the six do not seem to be giving up pursuit of lucrative contracts with oil and gas companies or related industries, and employees who raise issues around representing polluting brands have told DeSmog that they are meeting opposition at the highest levels of these companies.

“It makes me very ashamed to be in this industry”, said a WPP employee, who asked not to be named for fear of professional repercussions. “There are people in it who do genuinely want to use their skills and knowledge for positive change — lots actually — but unfortunately none of us hold positions of power and there’s only so much we can do.”

Omnicom’s board stood out as the most climate-conflicted, with seven of its 11 directors having direct affiliations with polluting industries.

DeSmog sent requests for comment to the six holding groups and the directors named in this story via both company media teams and their personal company email addresses, as well as to the other companies named in this story. WPP declined to comment. None of the directors, other holding groups, or other companies responded.

Among them, Valerie Williams holds a non-executive directorship at the Devon Energy Corporation and Leonard S. Coleman Jr. holds a non-executive directorship at Hess Corporation, both major U.S. oil and gas companies. Chevron is currently in the process of acquiring Hess in a $53 billion deal.

Ronnie S. Hawkins, a non-executive director at Omnicom, is currently a partner at Global Infrastructure Partners, which he joined from EIG Global Energy Partners. Both are fund managers that invest heavily in fossil fuel infrastructure, such as pipeline and refinery projects. DeSmog found that many of these projects are owned by current or recent Omnicom clients, including Shell, BP, ExxonMobil, and Repsol.

Hawkins spent 19 years as a senior member of the energy investment divisions at Citigroup and Credit Suisse, respectively the 2nd and 20th largest private financers of fossil fuel projects from 2016 to 2022, according to BankTrack. BankTrack’s research also shows that both banks have a history of funding oil and gas majors that also employ Omnicom agencies. Hawkins also did a stint as managing director of Harbour Energy, a London-listed oil and gas company with interests in the UK, Indonesia, Vietnam, Mexico, and Norway.

Omnicom has held 54 fossil fuel contracts since the beginning of 2022, including three with Exxon, the third-largest oil and gas company in the world by revenue.

A series of videos published on Exxon’s YouTube page in 2023 promoted carbon capture and storage as a way to reduce carbon emissions from fossil fuel production — even though the technology largely has a two-decade record of failure at curbing CO2 pollution, and is mostly used by the oil industry to extract more oil. Scientists continue to cast doubt on whether carbon capture will ever function at the huge scale required to make a dent in climate change.

In another 2023 campaign, Mobil (Exxon’s automotive car fuel brand) launched an advert positioning petrol-powered cars as a way of “disconnecting”, in an apparent swipe at electric vehicles.

“When you’re in a position like I am, trying to make change at an agency to make it more climate-minded, and you see this research, it makes you wonder whether it’s all a bit of a waste of time”, said an Omnicom employee who is involved in staff-led climate groups. “It helps you understand why we’re continuing to see agencies and holding companies like Omnicom take on fossil fuel briefs. It’s pretty disheartening.”

In its 2022 annual report, Omnicom stated that 2 percent of its revenues — around $286 million — came from the oil, gas, and utilities sectors.

Nadeem Khan, who leads the graduate program in Board Practice and Directorship at the University of Reading, said that accelerating climate action at a company such as Omnicom will require bold decisions.

“Currently, a director’s reputation is mainly judged on delivering short-term financial successes, rather than social and environmental wins”, Khan told DeSmog. “You need a board and CEO that are accepting of an organisation’s needs to adapt as renewed, evolved forms in the long-run, otherwise eventually it may not compete as markets themselves evolve.”

No Appetite for Change

New York-based IPG followed closely behind Omnicom in DeSmog’s analysis, with six of its 10 board members having experience in polluting industries such as natural gas, shipping, and plastics.

In 2022, IPG published a policy directly addressing the issue of working for fossil fuel clients — something the other five companies have yet to do. The policy has a number of requirements, including that clients must set specific emission reduction goals that are aligned with net-zero emissions by 2050.

However, IPG employees have previously told DeSmog that some elements of the policy mean it is weaker than it appears, such as the fact that it only applies to new clients. “You could drive an oil tanker through some of the loopholes in it”, said one IPG insider.

Another employee, who recently left one of IPG’s subsidiary agencies, told DeSmog that it was clear to staff engaging with leadership on polluting clients that “behind closed doors”, there was no genuine appetite for change at the top of the company.

Both employees asked not to be named for fear of professional repercussions.

In November, DeSmog reported that McCann, an IPG advertising agency, will pitch to retain its relationship with Saudi Aramco when the current contract runs out this year.

With 2022 revenues of $604 billion, Saudi Aramco is the largest oil and gas company in the world.

At WPP, board chair Roberto Quarta has seven current and past ties to polluting industries, the highest in DeSmog’s analysis, including two current partnerships at Gulf Capital and Clayton, Dubilier & Rice, fund management companies that have significant stakes in fossil fuel infrastructure and logistics companies. Many of those companies work closely with Exxon,TotalEnergies, Sabic, PTT Oil, Shell, BP, and Chevron. All are current or past clients of at least 10 WPP agencies, DeSmog found.

Another WPP board member, Simon Dingeman, is the former head of UK investment banking at Goldman Sachs. Since the establishment of the 2015 Paris Agreement, Goldman Sachs has provided $143 billion in fossil fuel finance, according to BankTrack, putting it in the top 15 private funders of the sector.

Dingeman is currently a senior advisor at the investment firm Carlyle Group, which has been criticised by campaigners for making claims about its climate leadership whilst doubling the emissions related to its investments between 2011 and 2021, according to research group Private Equity Climate Risks.

At Paris-based Havas, three out of nine board members have ties to polluting industries. They include Havas chairman-CEO Yannick Bolloré and board member Marie Bolloré, his sister, who have ties to the oil logistics division of the family-run Bolloré Group — which also owns Havas parent company Vivendi.

In 2023, Havas won a major contract with Shell to manage the company’s worldwide advertising spots. With $386 billion in revenue in 2022, Shell is the world’s fourth-largest oil company.

A DeSmog investigation, published in January, revealed growing discontent amongst Havas employees who saw the move as undermining Yannick Bolloré’s numerous public statements of concern about climate change. The investigation also documented a number of current or recent fossil fuel clients among Havas subsidiaries, as well as deep ties between the Bolloré Group and fossil fuel projects in Africa and Canada.

Five out of Dentsu’s nine directors have ties to polluting companies or sectors. Just under half of the 13 directors at Publicis and 12 directors at WPP have similar ties.

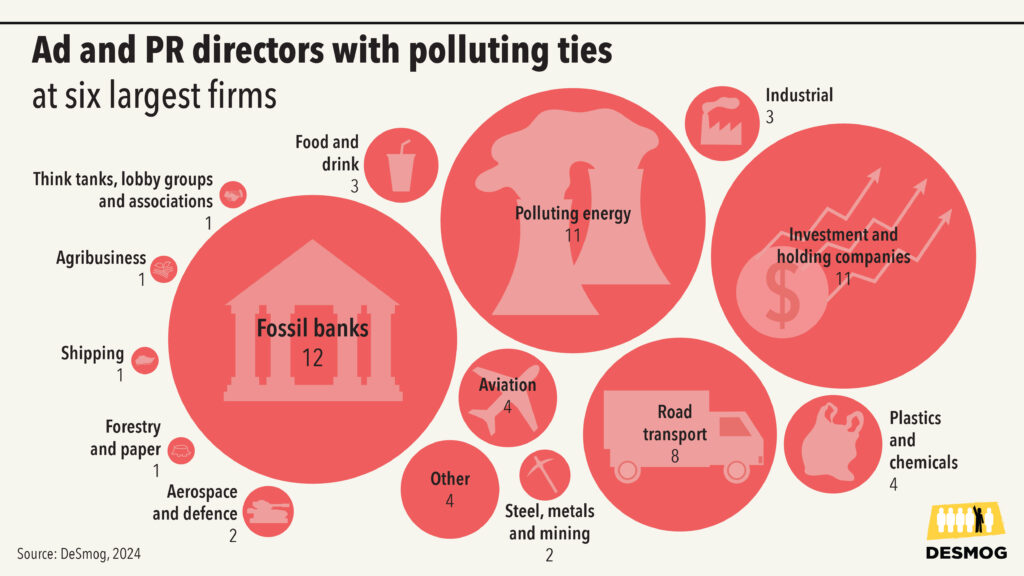

Board members at these companies have experiences at a range of companies with fossil fuel interests.

Dentsu’s board chairman, Tim Andree, was previously chief communications officer of BASF, the biggest chemical producer in the world and a major supplier of petrochemicals and services for the oil and mining industries. The German company has a history of lobbying against EU regulations on polluting chemicals.

At Publicis, board member André Kudelski was previously vice-chair of the Geneva Airport and a director at Swiss International Airlines. A number of Publicis agencies have produced campaigns supporting the aviation industry in recent years, including Publicis Sapient’s adverts for Swiss International Airlines’ premium economy class.

The aviation industry accounted for 2 percent of global carbon emissions in 2022, according to the International Energy Agency, with emissions in the sector growing faster than in road, rail, and shipping.

DeSmog’s analysis did not include similar examples below the parent company level. For example, John Dawkins is co-chair of GRACosway, one of Omnicom’s leading political lobbying agencies in Australia, whilst also holding chair and non-executive director roles at mining companies Precious Metal Resources Ltd and Tiaro Coal Ltd, respectively.

GRACosway and Dawkins did not respond to DeSmog’s requests for comment.

Low-Hanging Climate Commitments

Agencies and industry bodies have been slow to acknowledge the true climate impact of the industry, campaigners say. While five of the six holding companies have now set net-zero goals, these plans only account for emissions generated by their own business operations, such as employee travel, energy used to power office buildings, and the production of advertising campaigns.

All six are members of Ad Net Zero, a voluntary industry initiative whose members pledge to voluntarily reduce these sorts of in-house greenhouse gas emissions. Ad Net Zero’s five-step action plan does not ask members to consider the potential wider climate impacts of their work, such as the risk that producing campaigns that enhance the images of heavily-polluting clients could deflect pressure to cut emissions.

The polluting industry ties among the relevant 32 board members are concentrated in three sectors: banks that finance fossil fuel development, polluting energy production, and investment and holding companies. Credit: DeSmog

Purpose Disruptors, a campaign group focused on the ad and PR industry, defines the carbon pollution associated with an advertising-generated uplift in sales of heavily polluting products and services, such as SUVs or air travel, as “advertised emissions.” The concept has been recognised by the United Nations-led Race to Zero campaign, which focuses on getting businesses, universities, cities, and others to eliminate their carbon emissions no later than 2050.

A 2023 report by Dentsu estimated that the company’s 2022 advertised emissions were 32 times the size of its own operational carbon footprint.

“Board directors have been adamant publicly about their dedication to climate action and their companies’ pivot towards net zero”, said Sarah Chow, an investment analyst at the Sydney-based ethical pension fund Future Super. The fund has been trying to engage with Publicis and WPP on their work for high-carbon-emitting clients. “But behind closed doors and after public [annual general meetings], our relations with these directors have gone cold.”

Some experts argue that the pace of change in the industry is also constrained by the parent company structure of these six firms, which limits the power of subsidiary agencies to make their own decisions on issues such as climate strategy.

“You have to remember, these few leading directors are setting the tone and agenda not just for the overarching company, but multiple chains of companies”, said the University of Reading’s Khan.

Andreas von Angerer, head of impact investing at Zurich-based Inyova, led a group of investors in raising the issue of advertised emissions with the Publicis board at its annual general meeting in May 2023.

The group, which also includes French asset-manager Ecofi and Australia’s Future Super, collectively manages assets worth more than 16 billion euros.

Publicis’ board “told us that all of their clients are reducing emissions, even though their oil clients such as Saudi Aramco and ADNOC” — the Abu Dhabi National Oil Company — “are clearly not”, von Angerer told DeSmog.

“Currently these boards don’t have the progressive mindset needed to really set up a company for the future”, he said. “We really need new faces, new ideas and new minds on boards to make sure these old, established companies keep up with the transition [to net zero].”

Transitioning With the Times?

In a report released in April 2022, the United Nations Intergovernmental Panel on Climate Change referenced the communication industry’s role in protecting polluters.

Several months later, UN Secretary-General António Guterres told the General Assembly that “we need to hold fossil fuel companies and their enablers to account [including] the massive public relations machine raking in billions to shield the fossil fuel industry from scrutiny.”

For the better part of two decades, advertising regulators in the UK, France, Australia, and some other jurisdictions have taken stands on greenwashing. In June 2023, the UK’s Advertising Standards Authority banned adverts by Shell, Repsol, and Petrobras that made misleading claims about their investments in renewable energy. Shell’s adverts had been created by WPP’s Wunderman Thompson (now VML), and Repsol’s by DDB Spain, an Omnicom agency.

In November, for the first time, the Advertising Standards Authority banned two ads for promoting driving that harms the environment. The adverts for the Toyota Hilux SUV were made by WPP agency The&Partnership, according to industry publication The Drum.

Experts say that these sorts of greenwashing complaints and regulatory bans pose legal risks to individual board members, because they have the potential to inflict reputational damage that could trigger financial losses.

“Directors of advertising agencies must have sufficiently robust governance structures to mitigate and respond to these [reputational and financial] risks”, said barrister Margherita Cornaglia of Doughty Street Chambers, a group of barristers focused on human rights and civil liberties. “Failure to identify or address risks as a result of their links with fossil fuel and other polluting companies could place them in breach of their fiduciary obligations.”

Communications companies may be taking note. In its 2022 annual report, WPP mentioned the “increased reputational risk associated with working on client briefs perceived to be environmentally detrimental.” Dentsu has also mentioned these risks in public documents.

Experts say they expect action on issues such as climate change to increase as younger generations join these boards of directors.

“Boards tend to transition in decennial cycles”, the University of Reading’s Khan said. “There emerges a generational shift, a new way of thinking. You can see the difference of mindsets through faster evolving changes — for example at Google, Nvidia, or Microsoft in the tech industry — where boards are made up of more entrepreneurial attitudes and comparatively younger directors.”

But Sarah Chow of Future Super believes these changes need to happen now. “Board directors are often removed from the actual problems their employees face”, she said. “They need fresh blood that understands the pulse of a company’s workforce, and what the workforce wants.” Chow would also like to see union or other employee representatives on the agencies’ boards.

A former WPP employee shared Chow’s vision: “Why isn’t a creative holding company saving a board seat for a junior creative? They are the future of the industry.”

Be the first to comment